Investment News

-

Core and satellite investing explained

There are many ways to build an investment portfolio.

FundCalibre explains the Core Satellite method of portfolio construction

January 13, 2023 -

2023 – Outlook For Sustainable Energy

Energy security replaced decarbonisation at the top of government policy agendas in 2022.

Read the 2023 outlook report from the managers of the Guinness Sustainable Energy Fund.

January 10, 2023 -

Revealed: How much you need to make to recover from 2022’s worst-hit funds

As investors look forward to 2023, Trustnet finds out what returns are needed for them to recoup the falls in their funds last year.

January 9, 2023 -

Everything you need to know about death benefits and SIPPs

In the past, death benefits on UK pensions were often seen as complex and associated with punitive tax charges.

However, since 2015 a lot has changed…… and for the better too.

January 5, 2023 -

Better times ahead for China?

With valuations for many companies now at historical lows, Dale Nicholls, portfolio manager of Fidelity China Special Situations PLC, outlines why he believes China offers compelling investment opportunities over the coming year.

January 5, 2023 -

Five funds for income investors to consider in 2023

With many looking to income this year, Trustnet finds out which funds the experts are backing.

January 5, 2023 -

Five funds for aggressive investors looking to make the most of the turmoil

Experts give five options for investors who are willing to stomach short-term losses for the potential future rewards.

January 5, 2023 -

Why more investors should consider Asia

Asia is a fascinating place in which to invest.

It’s home to hundreds of outstanding companies in some of the world’s fastest-growing countries.

June 28, 2022 -

Moody’s downgrades Laos deeper into junk territory on debt woes’

The emerging economy is the latest Asian nation after Sri Lanka to be hit hard by spiralling inflation and currency weakness.

Should expats living in Laos be concerned with their local investments…??

June 17, 2022 -

Trillions lost and lives ruined: inside crypto’s ‘Lehman Brothers’

More than a $1 trillion was wiped off the value of cryptocurrency markets in the last six months, ruining countless lives and prompting insiders to speculate that the Bitcoin bubble may finally have burst.

May 23, 2022 -

Stocks: Should investors sell in May?

Its that time of the year again when investors wonder: “Should I sell in May and go away…??”

May 9, 2022 -

Some tech stocks are down 75% from their highs of last year

High-growth tech stocks were already getting pummeled before Russian’s invasion of the Ukraine. The skid has only gotten worse.

This CNBC article highlights some of the biggest losers…

March 8, 2022 -

Funds at risk of lockout following Russian block on foreign stock sales

A handful of funds with large exposures to Russian stocks now have large portions of their portfolios deemed illiquid following the Russian central bank’s block on the sale of local stocks by foreigners.

March 2, 2022 -

Market volatility is soaring. Here’s what Warren Buffett says to do

Volatile markets can be challenging.

With that in mind, here are five pieces of advice from Berkshire Hathaway Chairman Warren Buffett.

March 2, 2022 -

Outlook for 2022 – Royal London Asset Management

Comments on the 2022 outlook for Sustainable Investing from Royal London Asset Management’s Mike Fox.

February 18, 2022 -

The Ratings Radar Show: Mike Fox – King of ESG investing

The Royal London Asset Management has been walking the walk in ESG for longer than most others – and providing investors with great returns along the way

Citywire Ratings Radar discuss what makes him the King of ESG investing.

February 16, 2022 -

Structured Notes for the Income Investor

New Income Structured Notes available – up to 10%pa paid quarterly

Options for the income investor during this period of low interest rates and higher volatility.

February 16, 2022 -

Scottish Mortgage: Long-term investing for transformative change

Investing in Innovative Companies…

Lawrence Burns, deputy manager at Scottish Mortgage Investment Trust, sat down for a webinar with Citywire to discuss growth stocks, volatility, and why the progress of Moore’s Law remains a positive for innovative companies.

February 14, 2022 -

Bank of England raises interest rates to 0.5%

The Bank of England has raised interest rates from 0.25% to 0.5% in its first back-to-back hike since 2004.

February 3, 2022 -

Nurobots: delivering a good life with autonomous vehicles.

Claire Shaw, Investment Specialist at Scottish Mortgage, explains how the autonomous vehicle company Nuro, through its self-driving vehicles, hopes to transform local commerce and help deliver a better everyday life for everyone.

February 1, 2022 -

Federal Reserve points to interest rate hike coming in March

The Federal Reserve on Wednesday provided the clearest hint yet that it could start raising interest rates as soon as March.

January 27, 2022 -

Terry Smith: We are probably in for an ‘uncomfortably bumpy ride’ if inflation takes hold

The Fundsmith Equity manager gives his views on the impact of inflation and how it could affect the profitability of different types of companies.

January 13, 2022 -

US solar soars to new heights as sun sets on COP26

In the past decade alone, US solar energy installations have grown at an average annual rate of 42% in America.

Ethical Offshore can provide guidance on ways to get exposure to this exciting alternative energy sector.

January 13, 2022 -

Warning: These are the 3 most common crypto scams

Cryptocurrencies have now hit mainstream investing, but it’s still a wild world out there and everyone needs to be careful.

January 13, 2022 -

Older investors embrace more investment risk…

Almost half of over-55s have bought cryptocurrencies in the past two years, according to the Schroders Global Investor Study – suggesting the appetite for high-risk investments is not limited to the young.

January 13, 2022 -

Why might ESG factors increase returns?

We focus on three ESG measures – R&D, carbon intensity and worker safety – to see to what extent they can add to investment returns, and why.

In association with Schroders…

November 19, 2021 -

Huge improvements need to be made before cryptocurrencies are ethical

Cryptocurrencies hit record highs but can they survive ethical scrutiny?

Trustnet asks experts to find out.November 18, 2021 -

Disrupting Disease with Artificial Intelligence

Cancer, heart failure and Alzheimer’s are among the last lethal hold-outs. But medical technologies using artificial intelligence could speed up breakthroughs, as Tom Slater, joint manager of Scottish Mortgage Investment Trust explains

November 17, 2021 -

Uncertainty and disruption – why the strong will get stronger

Businesses can take market share away from competitors with strong supply chain relationships.

David Beggs of Sanford DeLand Asset Management explains…..

November 16, 2021 -

Up in smoke? The highs (and lows) of cannabis’ investment case

The decline in related cannabis stocks comes following a wave of positivity for the sector. So, has the industry already burnt out or will it find a new spark?

November 1, 2021 -

Blockchain and NFTs: How to make sense of crypto terminology

The language to describe cryptocurrency trading is often cloaked in jargons.

This recent article may assist in getting an understanding of the common terms used……

October 12, 2021 -

Fund managers facing identity crisis amid rising ESG sophistication

Investment firms need to clearly define their ethical investing proposition as investors develop stronger preferences.

Speak with us to learn more about ESG & Social Responsible Investment funds

October 7, 2021 -

The global growth funds hit hardest by the recent sell-off

Global growth, small-caps and sustainable growth funds have been hit the hardest by the recent sell-off in equities amidst rising interest rate fears.

Speak with us to learn more on the short & longer term performance of these types of funds.

October 6, 2021 -

Why investors should care about cybersecurity

Here’s why investors should consider cyber preparedness in their investment decisions and how Schroders has engaged on the topic.

Ask about the range of regulated specialist funds and ETF’s that investors can access to invest in companies protecting others from Cyber Crime.

October 6, 2021 -

Ashworth-Lord: If Cristiano Ronaldo were a fund, he’d be Buffettology

The founding manager of CFP SDL UK Buffettology tells Trustnet about the most exciting investment in the fund, and his plan of action if it ever becomes too big.

October 1, 2021 -

Terry Smith: Why some CEOs are better investors than most fund managers

The Fundsmith Equity manager says that as a long-term investor, he is in effect sub-contracting to the CEOs of the companies he invests in.

September 30, 2021 -

Innovation is unlocking new potential in health care

Biotech and telehealth are among the key areas shaping the future of health care, particularly in emerging markets.

An information marketing communication issued by Capital Group provides 10 trends that they see emerging.

September 29, 2021 -

Evergrande’s equity is worthless – but its failure is not a systemic risk

As it emerges that Chinese property developer Evergrande may default on $300bn of debt, Aubrey Capital Management’s Rob Brewis says he is not worried about contagion.

September 21, 2021 -

Three Disruptive Trends Set to Transform the Auto Industry

Over the next 10 years, the global automotive industry is expected to face one of the most significant changes in its history – the replacement of internal combustion engine (ICE) vehicles with electric vehicles (EVs).

Article originally published by PIMCO.

September 15, 2021 -

Britain’s economy is already seeing a rapid shift due to climate change

Climate change could spark major shifts in British produce in the coming decades as the country attempts to avoid a “catastrophic” environmental fallout, experts have said.

August 31, 2021 -

Vanguard calls for fund fee transparency….. and we fully agree..!!

Asset manager says product costs should be as clear to the public as calorie counts on food labels

At Ethical Offshore Investments, we could not agree more..!!

August 17, 2021 -

Does a focus on sustainability genuinely boost the bottom line?

Brown Advisory’s Karina Funk has first-hand experience of how a focus on sustainability can boost profits – but her definition of sustainability may differ from the consensus.

August 12, 2021 -

Terry Smith: ‘No amount of recovery or low valuation will turn a poor business into a good one’

Fundsmith equity manager Terry Smith, who was under media scrutiny earlier in the year for outflows, showed that his fund is still as consistent as ever.

August 11, 2021 -

I’d rather stocks pulled back than power higher regardless, says decade’s best multi-asset manager

Read what the manager of one of our long term, sustainable fund holdings has to say about the current & future direction of markets.

August 11, 2021 -

What will follow China’s crackdowns..?

IBOSS Asset Management’s Chris Metcalfe explains what the recent tech and education regulatory crackdowns in China could mean for those invested in the world’s second largest economy.

August 3, 2021 -

Chinese stocks are now among Asia’s worst-performing as Beijing crackdown spooks investors??

Days of heavy selling in Chinese stocks have left two major indexes in the country as the worst-performing markets of Asia-Pacific.

July 28, 2021 -

Fundsmith Equity – have investors been rewarded for holding on..??

A strong, top quartile 18.7% return over the past 6 months may have justified our decision to maintain holding the Fundsmith Equity Fund…

July 27, 2021 -

GAM, Baillie Gifford, Morgan Stanley: The high-octane global funds that were worth taking the risk on

To find a fund that delivers returns far above the sector average, investors often must be willing to endure high volatility

Trustnet looks at the global equity funds with high volatility and top-ranked returns over the past five years.

July 26, 2021 -

What has happened to Asia’s once top performing currency..??

Once Asia’s top performer, the Thai baht is now becoming the region’s worst-hit currency

July 26, 2021 -

2020’s winning funds fall down the rankings – but how far?

Halfway through the year, Trustnet finds out how the funds that made 2020’s highest returns are holding up in a very different market…

July 19, 2021 -

How to spot… & avoid… cryptocurrency scams

Many people have been duped out of millions of dollars from Crypto Currency scammers….

A recent article published on Yahoo UK Finance may help to inform how to spot, and more importantly avoid Crypto Currency Scams.

July 19, 2021 -

Ardan International Platform awarded a ‘Strong Rating’ by AKG

Low cost & easy to understand fee structure with No Lock-in periods, access over 80,000 different investment assets plus 11 different currencies… Ardan Platform provides flexible investment opportunities for the expat investor…

July 15, 2021 -

Is Bitcoin worth Zero..?? Black Swan author Nassim Taleb thinks so

‘Black Swan’ author Nassim Taleb says bitcoin is worth zero and fails as a currency and a hedge

July 15, 2021 -

The ‘B’ word……….. Should investors still worry about Brexit after five years?

On the five-year anniversary of the Brexit referendum, Trustnet asks market commentators and fund managers about the impact it has had on the UK market and what it means for investors looking ahead.

June 23, 2021 -

Scottish Mortgage Investment Trust Betting on Long Term Growth

Baillie Gifford’s James Anderson, Tom Slater and Lawrence Burns discuss three areas where they are heavily investing into for long-term growth in the Scottish Mortgage Investment Trust.

June 21, 2021 -

“Investment management is irretrievably broken” – Scottish Mortgage Investment Trust

James Anderson shares his blunt views on the investment management industry in his final review as manager of the Scottish Mortgage Investment Trust.

May 13, 2021 -

Turmoil hits the markets again…. Will this provide another opportunity for longer term investors..??

After yesterday’s global market falls, is this the start of the end for investors..?? Or once again, an opportunity to take advantage of a bad situation.

May 12, 2021 -

Baillie Gifford’s McCombie: “If you want to outperform every quarter, don’t invest with us”

Baillie Gifford’s Iain McCombie says even if value does have “its day in the sun”, he will still be sticking to finding the few exceptional companies with strong fundamentals that drive stock market returns.

May 11, 2021 -

A top performing fund manager explains why innovation alone is not enough

Innovation isn’t just about investing in speculative companies without earnings, explains Matthew Page, co-manager of the top quartile Guinness Global Innovators fund.

May 5, 2021 -

Back to life, back to normality: Why there’s still some way to go for undervalued shares

Saracen Fund Managers’ Graham Campbell explains why value stocks could continue to outperform, even after some strong recent gains.

May 5, 2021 -

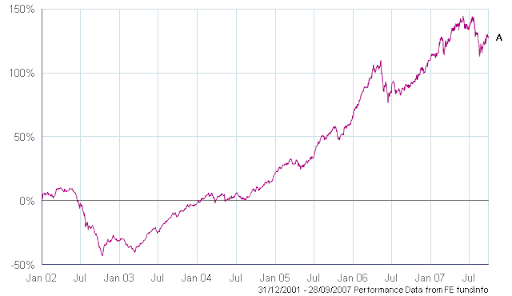

The Importance of Investment Timeframe

Time in the Market…… not timing the market.

It is so important that investors understand the importance of having the appropriate timeframe for achieving their financial goals & investment objectives.

April 20, 2021 -

Fundsmith Equity – Should investors holding this fund be concerned …..

Is it time to exit…?? The highly rated Fundsmith Equity has underperformed over the past 6 months, so should investors be concerned & head to the exit.

January 27, 2021 -

2020 – A year to forget….. or a year to remember..?

2020 was a challenging year for all….. we review the performance of the Sustainable Ethical Allocation Portfolios and how they compared to their peers

January 14, 2021 -

2nd Year Anniversary – Sustainable Ethical Allocation portfolios

November marks our 2 year anniversary for our Sustainable Ethical Allocation Portfolios……. so how have these portfolios held up against other multi-asset, diversified strategies…..

November 6, 2020 -

How to reduce paying tax on your investments if you are returning to Australia…

Pay Less Tax on your investments… Take advantage of Global Investment Products to reduce, or even eliminate Australian tax on your investment portfolio. All this while still having full control of your invested assets.

July 1, 2020 -

Turmoil and Opportunity

With all of this turmoil & negativity this year, Global Discovery is up 35% for 2020…… read how the earlier turmoil resulted in opportunity.

June 25, 2020 -

A Regular Savings Plan… or A Savings Trap

Read this article before you commit yourself to locking into what could be a very expensive, inflexible savings product…

Know the facts and your options BEFORE you sign up for a Contractual Savings Plan policy.June 19, 2020 -

Top 5 reasons to use an International Investment Platform

Read the Top 5 reasons to use our preferred International Investment Platform: Low Cost & Transparency, Investment Range, Multiple Currencies, Safety & Security and Financial Strength.

June 19, 2020 -

No upfront or establishment costs… But are you being charged more elsewhere??

The obvious question that needs to be asked is if there are no fees or charges, how then are advisers, consultants, brokers getting paid?

April 6, 2020 -

Transparency… What is the real cost of investing?

As part of our Ethical approach in doing business, we ensure that potential clients are fully informed of the charges that they will be subject to……. We advocate Full Transparency.

April 6, 2020 -

The Importance of Investment Timeframe

A situation that we work very closely with clients is that of their investment timeframe. When investing in growth funds and portfolios such as the Sustainable Ethical Allocations, investors need to make sure that they have a suitable timeframe.

April 6, 2020 -

Within this turmoil, is there opportunity??

While our Sustainable Ethical Allocation Portfolios have been able to perform better than the general markets, this first quarter of 2020 has seen portfolio values reduce. But does this now present itself as an opportunity to take advantage of the current market situation?

April 6, 2020 -

What is Environmental, Social and Governance (ESG)?

ESG – Environmental, Social and Governance refers to the three central factors in measuring the sustainability and societal impact of an investment in a company or business.

April 3, 2020 -

What is Socially Responsible Investing (SRI)?

SRI or social investment is any investment strategy which seeks to consider both financial return and social/environmental good to bring about social change regarded as positive by proponents.

April 2, 2020 -

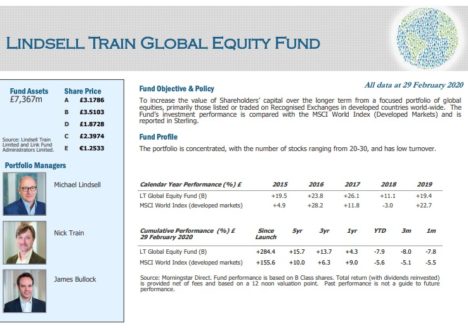

Lindsell Train Global Equity Fund – Manager’s Report

The report includes basic facts on the fund, some portfolio characteristics, recent and historic performance as well as some commentary from the portfolio manager.

March 12, 2020 -

The Bank of England’s emergency rate cut and what it means for investors

As the Bank of England steps in to support the UK economy amid the coronavirus outbreak, investment experts explain how it might affect markets and what investors should expect.

March 12, 2020 -

Three positive reasons for investors to think positively about climate investing

Investec Asset Management’s Deirdre Cooper explains why investors shouldn’t be too despondent about the huge challenges in tackling climate change and why there are reasons for optimism.

March 6, 2020 -

The funds hit hardest by the violent stock market sell-off

Hundreds of funds have slumped to double-digit weekly losses as stock markets have tumbled amid fears over the spread of the coronavirus.

March 3, 2020 -

Terry Smith ‘relaxed’ over coronavirus impact on Fundsmith

Star fund manager Terry Smith is ‘pretty relaxed’ over the impact of the coronavirus on Fundsmith Equity and confident his £19.3bn fund will rebound more quickly than the stock market in a crash.

March 3, 2020 -

‘Do nothing’ Train buys Fevertree after six-year wait

One of the UK’s few remaining star fund managers has scooped up a stake in battered tonic maker Fevertree (FEVR) and declared himself uninterested in the stock market turmoil caused by the coronavirus.

March 3, 2020 -

The funds hit by the coronavirus sell-off

Almost all sectors in the Investment Association (IA) universe suffered heavy losses last week as equity markets sold off amid increasing coronavirus concerns, data from FE fundinfo shows.

March 3, 2020 -

When Warren Buffet speaks, people from all over the world listen

Probably the most famous, successful investor has recently released his Chairman’s letter to shareholders of Berkshire Hatthaway. Probably the most anticipated annual shareholder letter for investors globally.

February 27, 2020 -

Well, I did it. I bought shares today by Scott Phillips

Today, Scott Phillips narrowed his search down to a few companies that are attractively priced, compared to their long term future earning potential. So he bought them. Investing doesn’t need to be any harder than that.

February 26, 2020 -

What Are Environmental, Social, and Governance (ESG) Criteria?

Environmental, social and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments.

February 2, 2020 -

Why BlackRock Is ‘Going Green’

BlackRock, the world’s largest money manager, just announced that it would exit investments with “high sustainability” risks. BlackRock Is ‘Going Green’.

February 1, 2020 -

Morningstar European sustainable fund flows reach record levels in 2019

Morningstar’s sustainable funds universe attracted record inflows of €120bn last year, with almost 40% of these coming in during the final quarter alone.

January 31, 2020 -

Surge in eco-awareness driving ‘most significant’ period of ESG inflows

High-profile eco campaigns among factors behind spike in returns.

January 30, 2020 -

Four French AM heavyweights seek to outsource new ESG initiative

Four Paris-based asset management companies plan to approach ESG measuring tools from a fresh perspective, with the help of an external partner.

January 28, 2020 -

BlackRock shuffles top ESG roles amid full sustainability push

BlackRock has made several senior personnel changes in an effort to strengthen its sustainable investing platform.

January 27, 2020 -

Still pursuing green: The rise of ESG in the US

The rise of ESG in the US Responsible investment making waves across the pond

January 14, 2020 -

Spotlight firmly focused on ESG space in 2020

A bumper year of events ahead promoting sustainable investment

January 14, 2020 -

Five Trends Shaping Markets In 2020 and How to Respond

Asset allocation ideas to help position your portfolio for the challenges and opportunities ahead. Effective strategies to navigate this environment may include diversifying risk, going long duration, and overweighting emerging markets.

December 13, 2019 -

Data Availability Drives ESG Investing Surge

The widespread availability of data has also emerged as a source for good. Investors and research analysts have increasingly found inventive ways to capitalize on newly available information.

June 25, 2019

News

- What the Iran conflict means for oil, markets and portfolios

- Can China’s momentum last in the year of the horse?

- The AI alternative staring us all in the face

- The Magnificent Seven aren’t at risk of a rerating: Here’s what is

- Complaint Resolution Service

- Complaint Resolution Service

- Which Taxes Will Rise in Rachel Reeves’ Autumn Budget?

- Does the gold price crash signal full reversal or short-term correction?

- The Structured Note Portfolio….. no set up costs – wide range of Note options

- A Global Investment Exposure for a Fraction of the Cost…..