Revealed: How much you need to make to recover from 2022’s worst-hit funds

As investors look forward to 2023, Trustnet finds out what returns are needed for them to recoup the falls in their funds last year.

By Gary Jackson,

Head of editorial, FE fundinfo

Investors in 2022’s worst-performing fund won’t get back to where they started last year until they have made a return of more than 275%, research by Trustnet shows.

Markets endured a rocky ride in 2022 as stocks and bonds fell at the same time in response to interest rate hikes, the war in Ukraine and worries about the health of the global economy. Few assets were able to rise in this environment, leaving many investors keen to recoup last year’s losses.

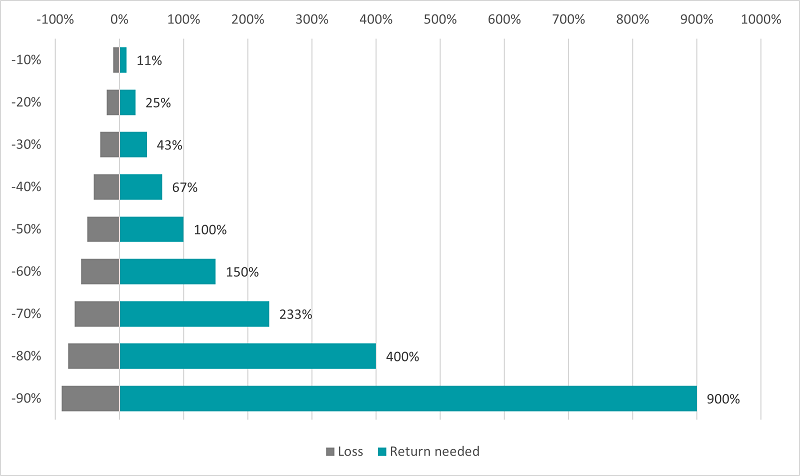

As the chart below suggests, one of the keys to long-term investing success is avoiding heavy losses in the first place. For example, an investor who is down 10% has to make 11% to get back to where they started.

At the other end of the spectrum, a return of 900% is needed to recover from an initial loss of 90%. And if an investor is down 99%, they are stuck in loss-making territory until they have made 9,990%.

Source: Trustnet

So how does this apply to 2022 and the heavy falls that hit many funds?

FE fundinfo data shows 85% of the funds in the Investment Association universe made a loss in 2022; some 45% of the 5,020 funds in this universe dropped by more than 10%.

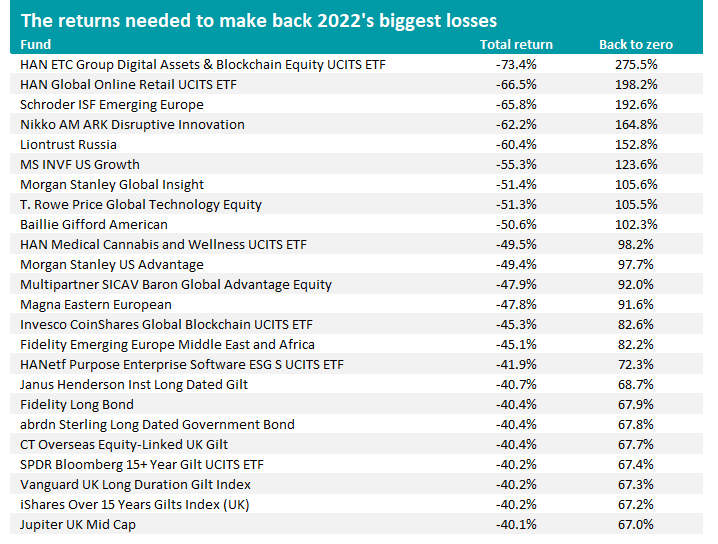

The table below shows the 25 funds that suffered the biggest falls last year, along with the return needed to get their investors back to where they started 2022. This is based on a sole investment made on 1 January; obviously the exact circumstances of investors will differ on if they already had a position in a fund, the date they invested, any follow-up or regular investments, etc.

Source: Trustnet

HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF – which invests in the blockchain technology that underpins cryptocurrencies – lost the most, dropping 73.4% as investors soured on all things related to the speculative asset class.

An investor who put their money into the ETF at the start of 2022 needs to make 275.5% from here to get back to a 0% return.

This might not apply to that many investors, however, as the fund is only £1.3m in size. Thankfully, this point applies to several of 2022’s biggest losers – 15 of the 25 highlighted above run less than £250m with eight of those being smaller than £25m.

That said, there are some relatively large funds on the list as well.

Nikko AM ARK Disruptive Innovation, which invests in the highest conviction ideas of Cathie Wood’s Ark Invest, has assets under management (AUM) of £1.7bn and investors are looking at a 164.8% return to get back to where they started 2022.

Other large funds include Baillie Gifford American (AUM £2.6bn, back to zero return of 102.3%), MS INVF US Growth (AUM £2bn, back to zero return of 123.6%) and Jupiter UK Mid Cap (AUM £1.1bn, back to zero return of 67%).

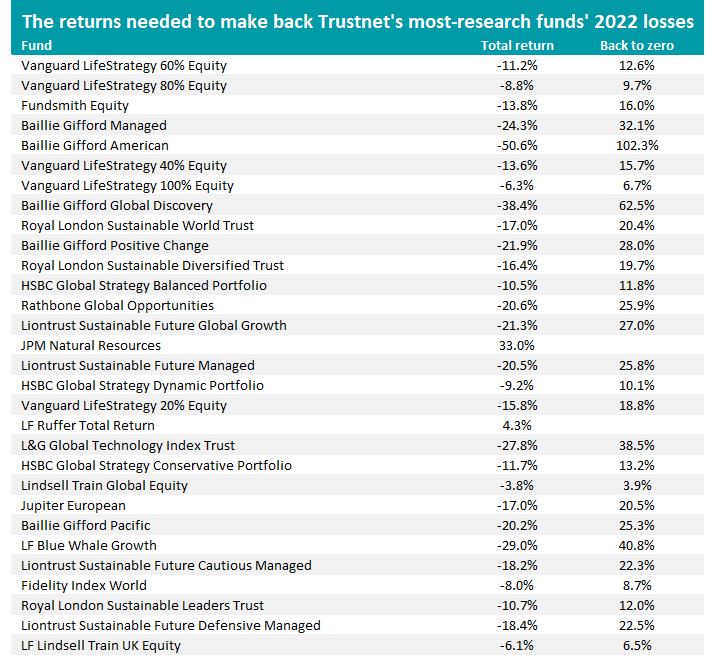

Below is a list of more familiar funds and the returns that are needed to get recoup all of 2022’s falls. These are the 30 most researched funds among Trustnet readers.

Source: Trustnet

Only two of them are in the enviable position of making a positive return in 2022: JPM Natural Resources with its 33% total return and LF Ruffer Total Return, which was up 4.3%. The rest incurred some degree of loss.

Investors in the popular Vanguard LifeStrategy strategies have to make returns ranging from 6.7% from the pure-equity Vanguard LifeStrategy 100% Equity fund through to 18.8% from the bond-heavy Vanguard LifeStrategy 20% Equity fund to recover from 2022.

Fundsmith Equity investors are looking at a 16% gain to recoup an investment made on 1 January, those in Rathbone Global Opportunities have to make 25.9% and backers of LF Blue Whale Growth are looking for a 40.8% return. This is down to the funds’ preference for growth stocks, which were hit hard by rising interest rates.

Lindsell Train holders are in a better placing, needing 3.9% from Lindsell Train Global Equity and 6.5% from LF Lindsell Train UK Equity. Exposure to Japanese and UK stocks, which were among the best places to be last year, helped these funds.

But those in some popular Baillie Gifford funds are looking for much steeper climbs: 102.3% for Baillie Gifford American, 62.5% for Baillie Gifford Global Discovery and 32.1% for Baillie Gifford Managed. The firm has enjoyed great success over the past decade with a focus on high-growth stocks, especially in the tech space, but this has suffered a knock-back more recently as higher interest rates put investors off their lofty valuations.

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please note the above article was first published by Trust Net and should not be regarded as individual investment advice on whether to buy, sell or hold any of the funds mentioned. Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we can access the funds mentioned in this article on the various offshore investment platforms we offer. We do NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investments costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards