2023 – Outlook For Sustainable Energy

This is a marketing communication. Please refer to the prospectus and KID/KIID for the Fund, which contain detailed information on its characteristics and objectives, before making any final investment decisions.

2023 OUTLOOK FOR SUSTAINABLE ENERGY

JANUARY 2023

Executive Summary

Energy security replaced decarbonisation at the top of government policy agendas in 2022. The energy transition accelerated as activity in solar, wind, electric vehicles and energy efficiency were all well ahead of expectations. Improved relative economics of sustainable energy generation versus fossil fuels, despite raw material and energy inflation, was critical to this inflection. Significant investment plans from the EU and US were announced, giving greater clarity around a higher long-term growth opportunity for the sector and sustainable energy equities reacted positively to the news. Our portfolio continues to offer broad exposure to companies that are well placed to benefit from an energy transition that will gather pace through the remainder of this decade.

In 2022, energy security has become arguably the most important catalyst driving the energy transition, reflecting governments’ desire to reduce reliance on fossil fuels, whose prices spiked due to Russia’s invasion of Ukraine. This energy crisis is accelerating the transition towards sustainable energy sources that help to reduce energy-importing nations’ reliance on fossil fuel imports.

Much of the key policy support for the energy transition in 2022 was enacted with a focus on improved energy security, including:

- The REPowerEU deal which was passed as a direct response to the invasion of Ukraine. The EU intends to invest EUR210bn between 2022-27 and a total of EUR300bn by 2030 with a particular focus on renewable energy generation (EUR86bn) and energy efficiency (EUR97bn).

- The Inflation Reduction Act (IRA) which included $369bn of direct funding and simplified, extended 10-year tax credits that target climate and energy security across electricity generation, transport, industrial manufacturing, buildings, and agriculture. The incentives may help increase US utility-scale annual solar installations by 5x and US wind installations by 2x over the next three or four years compared to 2020 levels.

Supporting these two significant policy steps were the Chinese 14th renewable energy plan and the COP27 climate conference. The Chinese plan targets a 50% increase in renewable energy generation in 2025 (versus 2020) while the COP27 conference kept the higher end of the ambition of the Paris Agreement (a 1.5degC temperature increase target) although was short on specific new targets.

Supporting these two significant policy steps were the Chinese 14th renewable energy plan and the COP27 climate conference. The Chinese plan targets a 50% increase in renewable energy generation in 2025 (versus 2020) while the COP27 conference kept the higher end of the ambition of the Paris Agreement (a 1.5degC temperature increase target) although was short on specific new targets.

While energy transition growth plans were ratchetted higher, the actual pace of the transition in 2022 also accelerated. We saw around 380 GW of new renewable generation capacity installed, 90 GW higher than the record installations seen in 2021 and around double the 194 GW installed in 2019. Solar represented nearly two-thirds of the new capacity additions, with wind installations at around 25% and hydro in third place. Renewable electricity generation increased by around 7% to over 8,500 TWh, outpacing global electricity demand growth (estimated at 3% in 2022).

Electric vehicle sales surged, reaching around 13% of global light auto sales, up from just over 3% in 2020 driven by China (60% of the market) with Europe now a distant second.

High energy prices catalysed the need for efficiency and the IEA estimates that global energy intensity improved by 2% in 2022. This is meaningfully higher than the 0.5-0.6% levels seen in the pandemic years but still not enough to hit net zero by 2050, according to the IEA. Investment into energy efficiency reached $560bn in 2022 (versus $400bn pa from 2015-2020).

The disruption to energy markets in 2022 brought sharp energy price inflation to the world economy. Companies involved in the manufacturing of sustainable energy equipment were not immune to these inflationary pressures, with energy inflation eclipsing the post-COVID raw material cost inflation and supply chain issues that have started to abate. While inflation was acute in the key battery metals of lithium and nickel, battery companies were able to adjust their cathode chemistries and deliver economies of scale, helping to contain battery price increases at 7% in 2022, leading to prices being broadly flat versus 2020.

Whilst inflationary pressures increased the cost of installing and generating renewable power in 2022, we observe that renewable energy generation continued to become relatively more economic than fossil fuels as the year progressed. Improved relative economics as well as security of supply considerations will help to sustain strong demand for sustainable energy activities during any potential global recession.

Against this backdrop, the Guinness Sustainable Energy Fund delivered a total return (USD) of -12.5%, outperforming the MSCI World Index (net return) at -18.1%. Solar equipment manufacturers were the strongest performing subsector, whilst our electrification sub sector (including electric vehicle-oriented companies) was the weakest. Eight of our top ten performing stocks were US listed companies, reflecting a strong positive swing in sentiment after the passage of the IRA. Three of the eight weakest performers were Chinese (Hong Kong) listed entities, reflecting the negative economic momentum and poor sentiment in that market.

Looking ahead to 2023 and beyond, we expect further acceleration of the transition:

- On the supply side of the energy transition, the IEA is forecasting that renewable power additions over the coming five years will be just over 2,400 GW; a 30+% increase on its previous five-year forecast and their largest upward revision. The world is set to add as much renewable capacity in the next five years as it did in the past 20 years, equivalent to the entire current power capacity of China.

- The IEA has described solar power as “the cheapest electricity in history” and large-scale solar remains at the bottom end of the cost curve. Globally, we expect solar installations to grow in 2023 by 50 GW to around 310 GW, with all key regions seeing higher installations across a broader spread of countries. Polysilicon prices have peaked, bringing cost relief for cell and module manufacturers, supporting consumer demand.

- Global wind installations are expected to grow in 2023 to a record level of 113 GW, driven by global policy support in China, Europe and the US. The raw material and supply chain issues of 2021 and 2022 will increasingly turn into tailwinds, helping to keep installations at the current high levels and give us confidence to increase our long-term installation rate estimates. We believe that global wind capacity should nearly triple by 2030 (20%pa growth from 2021) with offshore wind growing nearly five times.

- EV sales should reach 12-13 million in 2023, representing around 15% of total passenger vehicle sales, taking the global EV stock to nearly 30 million vehicles. Improved economics, better range and quicker charging times are the key drivers of improved EV sales. The end of Chinese EV subsidies in January 2023 could well affect demand this year.

- Battery demand for use in EVs and energy storage will accelerate further in 2023 despite battery metal prices remaining at elevated levels. Moderation of commodity prices, improvements to cell chemistry and efficiency improvements in battery pack design and manufacturing will help in achieving the $100/kWh level at which mass market EVs become affordable. This tipping point is likely delayed to 2027.

The outlook we summarise here is broadly consistent with current government activity and observable investment plans. To be clear, however, the growth described falls well short of the energy transition activity needed to achieve a net zero / 1.5 degree scenario in 2050, as targeted by the IPCC and reiterated at COP27. In a net zero scenario, the deployment of renewable generation capacity, penetration of EVs and battery storage, use of alternative fuels and implementation of energy efficiency measures will need to accelerate markedly.

RISK: The Guinness Sustainable Energy Fund is an equity fund. Investors should be willing and able to assume the risks of equity investing. The value of an investment and the income from it can fall as well as rise as a result of market and currency movement, and you may not get back the amount originally invested. Further details on the risk factors are included in the Fund’s documentation, available on our website. The Guinness Sustainable Energy Fund is managed for capital growth and invests in companies involved in the generation, storage, efficiency and consumption of sustainable energy sources (such as solar, wind, hydro, geothermal, biofuels and biomass). The Fund is actively managed with the MSCI World Index used as a comparator benchmark only.

At 31 December 2022, the Guinness Sustainable Energy Fund traded on a 2023 P/E ratio of 19.1x and 2023 EV/EBITDA multiple of 11.6x (around 10-20% lower than the same one year forward metrics published in our last annual outlook). The fund trades at a premium to the MSCI World, reflecting greater expectation for growth from sustainable energy companies relative to the index. As a sense check, we see that consensus EPS growth (2021-2024E) of the portfolio (at 18.8%pa) is well ahead of the MSCI World (at 7.2%pa).

This document details how the growth outlook for the sector has improved in 2022 and the growth premium of the fund versus the MSCI World (11.6%pa) is markedly higher than the 7.8%pa that we published in our prior annual outlook. Looking over the next five years, we believe that the portfolio is likely to deliver normalised earnings growth of around 14%pa, well ahead of growth in the MSCI World Index, that will bring the fund P/E ratio down from the current 19.1x for 2023E to around 13x in 2026E.

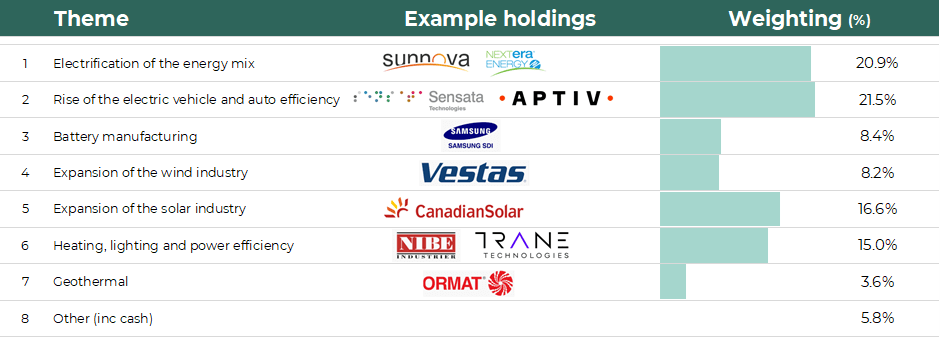

Our current portfolio is summarised below by investment theme:

Key themes in the Guinness Sustainable Energy Fund

Source: Guinness Global Investors (31 Dec 2022)

Our report covers the sustainable energy sector and fund in 2022 and provides an outlook for 2023 and beyond. We have split the document into three sections:

- Developments in sustainable energy policy and ‘macro’

- Analysis of the four key sustainable energy subsectors: energy displacement, electrification, generation and installation/equipment

- Performance, positioning and valuation of the Guinness Sustainable Energy Fund

To read the full report, please click HERE.

The Managers

Will Riley – Portfolio Manager

Will joined Guinness in 2007 and has been managing energy funds since 2010.

Johnathon Waghorn – Portfolio Manager

Jonathan joined Guinness in 2013 and has been managing energy funds since 2008.

The value of this investment and any income arising from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested. Past performance does not predict future returns.

This is a marketing communication. Please refer to the prospectus and KID/KIID for the Fund, which contain detailed information on its characteristics and objectives, before making any final investment decisions.

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we can access the funds mentioned in this article on the various offshore investment platforms we offer. We do NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investments costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards