Sustainable investing services for now… and for the future.

We provide Ethical Offshore Investment Services in a cost effective manner.

Ethical Offshore Investment Services

Portfolio Management Services

Our approach to portfolio management is proposing a portfolio structure that is personalised to meet your individual needs and investment objectives. This will include (but not limited to) your risk / volatility tolerances, investment timeframe, requirements to capital or income.

Our approach to portfolio management is proposing a portfolio structure that is personalised to meet your individual needs and investment objectives. This will include (but not limited to) your risk / volatility tolerances, investment timeframe, requirements to capital or income.

We will only use Fund Managers that are strictly regulated in jurisdictions such as the UK, Luxembourg and Singapore and offer full transparancy into their investment holdings, are liquid and can trade on a daily basis.

As we are NOT affiliated with any of the Fund Managers, we can offer an un-biased approach to which funds we would propose to investors. As our revenue is generated from the client management service, we therefore have a vested interest in using in what we believe are the best funds for the clients personal investment strategy. This will also ensure that we use the lowest charging structure available. As we are not loyal to a specific fund or fund manager, if we are not satisfied that a particular fund is appropriate going forward, we will provide our reasoning to our clients and switch out of that specific fund and reallocate to an alternative fund.

We try to avoid funds that have entry or exit fees.

Speak with us today!

Utilising quality fund managers and lower costs, we can help you grow your savings and investments.

Sustainable Ethical Allocation Portfolios

As part of our Portfolio Management Service, we offer guidance on the management of 2 different risk controlled, diversified model portfolios (Balanced and High Growth) as well as a low cost, Index ETF model portfolio.

The diversified model portfolios are designed to achieve greater than general market returns while doing so with a lower risk profile and lower short term volatility. All of the underlying assets are transparent, liquid and can be traded on a daily basis.

We will use the lowest charging version of the fund available to ensure that more of the returns are retained by the investor. This has resulted in a combined total Annual Management Charge of:

- 0.32% pa Index ETF

- 0.72% pa Balanced

- 0.65% pa High Growth

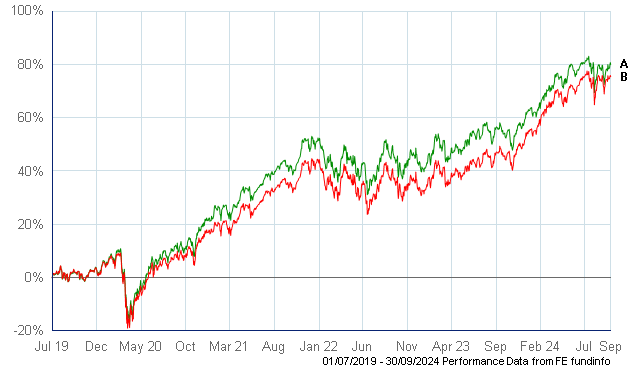

The Index ETF Allocation Portfolio will invest across a range of index funds and ETF's (Exchange Traded Funds) to provide a significantly diversified global investment opportunity, but with lower costs.

The objective of this allocation is to achieve a net return above that of the FTSE World Index.

A. Index ETF Allocation

B. FTSE World Index

Top 3 holdings:

- iShares Dow Jones Global Sustainability Screened UCITS ETF

- Vanguard LifeStrategy 100% Equity

- L&G Global Equity UCITS ETF

Fund managers allocated within this portfolio include:

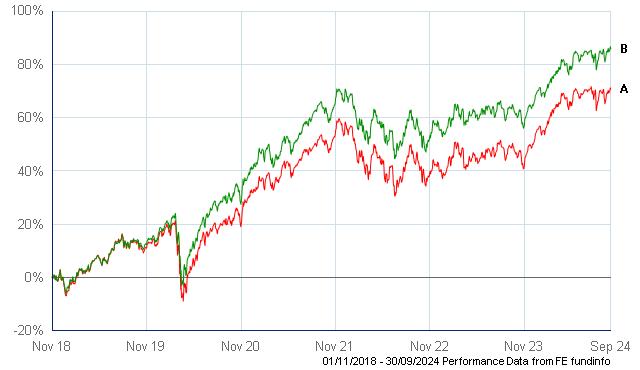

The Sustainable Ethical Balanced Allocation Portfolio will have approx. 65% of the allocation invested in growth type assets such as equities and infrastructure with the remaining allocated to more cautious type assets such bonds, fixed interest and cash type assets.

The objective of this portfolio is to achieve similar type returns associated with direct equity investing, while experiencing lower levels of short term volatility, especially during negative market periods.

A. Sustainable Ethical Balanced Allocation

B. IA Global Index

Top 3 holdings:

- iShares Dow Jones Global Sustainability Screened UCITS ETF

- Troy AM Trojan Ethical

- Royal London Sustainable World Trust

Fund managers allocated within this portfolio include:

![]()

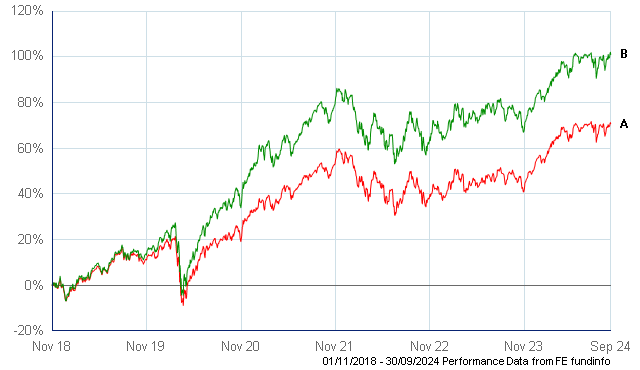

The Sustainable Ethical High Growth Allocation Portfolio will invest predominately in a range of equity and high growth style funds, designed for the longer term investor that can accept higher levels of short term volatility.

The objective of this allocation is to achieve a net annual return of 10% - 12%pa but clients need to be aware and accept that there will be higher levels of short term volatility, with periods of negative returns.

A. Sustainable Ethical Growth Allocation

B. IA Global Index

Top 3 holdings:

- iShares Dow Jones Global Sustainability Screened UCITS ETF

- Baillie Gifford Positive Change

- Fidelity Global Sustainable Equity Income

Fund managers allocated within this portfolio include:

![]()

![]()

If you appoint us to manage your portfolios, we place the trades to the lowest fee charging version available of that particular fund.

We do NOT take any upfront commission from placing these trades.

Financial Planning Services

Through our association with OIBME our qualified consultants can provide solutions for such issues as:

- Offshore Portfolio Management

- International / Offshore Bank Accounts

- Retirement Planning

- Estate Planning

- Asset Protection

- Expat Relocation / Repatriation

Through Offshore Investment Brokers, we have Terms of Business with various offshore product providers, which allows us to propose products and provide specialist services to meet your specific Financial Planning requirements.

This includes (but not limited to):

![]()

![]()

![]()

![]()

Estate Planning Services

We can help you with all your estate planning requirements.

The main reason for Estate Planning is to ensure that you provide for your family, ensuring a quick and smooth transfer of assets, to the people that you wish to benefit, in the event of your passing.

Death is not a subject that is easy to talk about for many people, but unfortunately it is going to happen to us all (the only guarantees in life being death & taxes…….) However, through Estate Planning arrangements, you can ensure that your invested money is paid to the beneficiaries of your choice, and paid in accordance to your wishes.

For example, you may prefer that instead of the full amount being paid as a one off lump sum, the money is held in a trust structure and paid to the beneficiaries in instalments. In some jurisdictions, this can be a very tax effective way of distributing a deceased estates assets.

Also, good Estate Planning via Offshore Portfolio Bonds can potentially quicken the process by paying directly to beneficiaries prior to the granting of Probate. Please note that the rules do vary for different nationalities and residence locations.

Estate Planning can also provide significant benefits while alive through the protection of assets from third parties.

We have arrangements with a range of Trust providers who can guide clients through the sometimes complex nature of Estate Planning, providing a solution that not only benefits investors now, but will also ensure that it provides your wishes for your family too.

To confidentially discuss your personal estate planning requirements, please click on Request Information

Retirement Strategies

- Pre & Post Retirement Strategies

- Australian Superannuation & Allocated Pensions

- UK Pensions

- Pension Transfers to offshore jurisdictions

- Tax Effective Income Streams

When you have made the decision to retire in a country as an Expat, this does throw up many opportunities for how to fund your retirement income. But it also results in many questions as what to do.

- Should I transfer all my assets to the country I am retiring in..??

- Should I consolidate all of my investments..??

- What currency should I be investing in..??

The answer to the above is……………

Each person is unique and as such, there is no standard answer to the above.

As part of our service, we would gather the information on your current situation, determine what you financial needs & objectives are for your future situation, and would then provide the viable options to you that we believe that will best serve you in meeting your ongoing personal financial needs and retirement objectives.

When we do report back to a client on a retirement strategy, we will provide full disclosure on why certain strategies have been proposed and what the financial cost / benefit will be.

I will state that in many situations, especially when it comes to Australian Superannuation, we will propose that it is in the best interest to maintain those proceeds in the structure that they currently are**. What we then look at is an offshore strategy that can complement the Superannuation assets and therefore provide the benefit of the flexibility & tax effectiveness of the offshore product with the tax effectiveness & robust compliance structure of Superannuation.

It is a similar situation with UK Personal Pensions.

We will only propose a transfer out of a scheme if we can demonstrate that it is going to be in your best interest in doing so.

** just a further comment/warning on Australian Superannuation – if you are under the age of 55 and approached by someone offering a service to transfer your superannuation out of the system, be very skeptical & cautious as in most cases, it is illegal to do so if you have not met a condition of release

(1. reached your preservation age & retired, 2. Reached your preservation age & commence a transition to retirement income stream & 3. You are 65 years old even if you have not yet retired).

There are significant fines & penalties imposed by the Australian Tax Office if caught, which could see you paying back well over 50% of the amount to the ATO in penalties…….

If you have been approached and are still unsure, please click on Request Information

Expat Relocation Strategies

The life of an expat can be an exciting one….. moving from country to country and the experiences that go with it.

However, a change of location can also result in a change in how you are taxed on income and on your investments.

As part of our ongoing management service, we will provide guidance on strategies on how to legally reduce any tax liability on your offshore investments. It is therefore important that any proposed structure of investment is flexible and can change in-line with the requirements of the individual clients’ personal situation.

Returning Home – if the decision to return home is made, strategies implemented while offshore using certain offshore structures can become very beneficial on your return….. There are some significant tax benefits, especially for Australians and Brits that return home after a period as non-residents.

If you would like to speak with us about the potential benefits of the Expat Relocation Strategies, please click here…

Complaint Resolution Service

Have you suffered a financial loss due to mismanagement of your Offshore portfolio or policy?

Our Complaints Resolution Service may be able to assist you in gaining financial compensation

No win = No cost

No win = No cost

Our Complaints Resolution Service has been successful in obtaining financial compensation for clients that have suffered financial losses due to the actions of Offshore Life Companies, Investment Platform providers, Pension Trustees, Discretionary Fund Managers and regulated Financial Adviser firms.

I would like to think that the majority of people involved in the financial and wealth management industry are honest, trustworthy people that are trying to help their individual clients reach their financial goals and objectives.

However, I am not that naïve to dismiss the fact that, all be it a small percentage of industry participants, that there are some with different motives for being in the industry with the sole purpose of making as much money as they can, as quickly as the can, with no care of the consequences of their actions on their clients…….. I am not that naïve as unfortunately I have witnessed this first hand and this was one of the driving forces for me in setting up Ethical Offshore Investments.

While a lot of the negative issues experienced by investors in the offshore industry is the result of those so called ‘cowboys’, there will be occasions where a client has been financially disadvantaged due to negligence or incompetence from the actions of a corporate entity, such as a Life Company, Pension Trustee, Discretionary Fund Manager or a financial advising firm.

This could be for example:

- Incorrect or lack of disclosure of fees, charges and potential exit penalties

- Inappropriate investments (too risky, lack of liquidity, lock in periods, lack of diversification)

- Processing errors resulting in delays for payments

- Unauthorised transactions

A lot of clients that have invested in Offshore type investment structures and investment schemes are not aware of their rights to lodge an official complaint and depending on the complaint (& the participants), lodging an application with a regulator for financial compensation.

So how does Ethical Offshore Investments assist with this…?

First off, we obviously listen to the complainant about what has occurred & how they believe that the actions that were taken resulted in a financial loss.

We will then request relevant information from the product provider(s) involved (with clients consent of course) and will review the actions or transactions that took place. Taking into consideration the location (where the advice/service was provided as well as country of residence of the client) as well as the location of where the responsible entity is, we can then provide guidance on what course of action the client can take.

Just because a client may be living in Thailand for example and received advice/services from an unregulated firm, doesn’t mean that there isn’t anything that can be done…….. if the product that the complaint is referring to is from a recognised offshore Life Company (without naming names, but they generally are the ones based in the Isle of Man, Guernsey, Jersey, Mauritius or the Cayman Islands) then there is an official complaints procedure that these companies must all adhere to, as directed by the local regulatory body to maintain their relevant licensing and registrations.

First step is to approach the relevant company with full details of the complaint & documented proof of how the actions caused the client to be financially disadvantaged. In many situations, where it is a clear-cut case of where the actions of the Life Company / Product Provider did result in a financial loss, the Life Company will deal with it internally & offer a compensation pay out directly to the client.

If the Life Company / Product Provider disputes the allegations made and does not agree to compensation, the next step is approaching the relevant Financial Regulator for that particular provider.

- United Kingdom – Financial Conduct Authority (FCA) UK

- Isle of Man – Isle of Man Financial Services Authority

- Guernsey – Guernsey Financial Services Commission

- Cayman Islands – Cayman Islands Monetary Authority

- Mauritius – The Financial Services Commission Mauritius

- Labuan – Labuan Financial Services Authority

We then provide the regulator all of the relevant information for them to asses and determine an appropriate financial outcome for the client. As part of our service, we continue to liaise with the Regulator & the client on the progress, as well as providing additional information as requested by the regulator.

Recent Compensation Success

Over the past few years, we have been able to achieve the following compensation results for clients:

- GBP 15,000 – incorrect processing of a withdrawal by an Isle of Man Life Company issued savings plan

- GBP 12,000 – incorrect processing of an asset transfer by an Isle of Man Life Company offshore portfolio bond

- GBP 10,031 – inappropriate investments made by a Malta Pension Trustee Company

- GBP 3,871 – incorrect processing of a surrender request by a Guernsey Life Company savings plan

- US $ 8,000 – incorrect processing of an asset transfer by a UK regulated Discretionary Fund Manager

There have been many other successful smaller claims where fees have been waived and or reimbursed.

How much does this service cost..?

First off, this is a No Win = No Pay service. If after we have reviewed your complaint situation and agree that there is a case to be made, we will prepare all of the documentation required and lodge it with the relevant Life Company and following that, with the regulator. At this stage, the client pays Ethical Offshore Investments nothing..!!

First off, this is a No Win = No Pay service. If after we have reviewed your complaint situation and agree that there is a case to be made, we will prepare all of the documentation required and lodge it with the relevant Life Company and following that, with the regulator. At this stage, the client pays Ethical Offshore Investments nothing..!!

If the complaint comes back unsuccessful (after appeals made to the regulator or tribunal), there is no cost to the client. So in other words, if we take on the case, we must strongly believe that there is a good chance of success…….

The cost to the client for when a compensation case is successful is dependent on a few different factors. The absolute maximum cost would be 20% of the net compensation amount received. And this is only payable once the compensation amount has been received.

However, this cost may in fact be lower depending on the actual amount of work we provided for the compensation as well as what business relationship that we have with the client. In some cases, the complaints resolution service can be part of the on-going client management service we are already providing and as such, there is no further costs to pay…… irrespective of the compensation amount awarded.

If you feel that due to the actions of a previous advising firm, product provider or investment manager has resulted in you being financially disadvantaged, please click on the Request Information button below and provide some details, including how we can contact you, and we can confidentially discuss what is an appropriate course of action for you take.

Sustainable Offshore Investing using Ethical Business Standards.