Within this turmoil, is there opportunity??

It’s very hard at the moment to turn on any media outlet and not be bombarded with news on Covid-19 and all the negativity surrounding it…… then there is the financial news and how share markets around the world have tumbled, putting a serious dent into people’s wealth.

Our clients have not been immune to this and while our Sustainable Ethical Allocation Portfolios have been able to perform better than the general markets, this first quarter of 2020 has seen portfolio values reduce.

But does this now present itself as an opportunity to take advantage of the current market situation..??

Now, I must stress that I am not professing that this is the bottom of the market and anyone that says that they can predict this (in my opinion) are actually just guessing. But what I would like to point is that during periods of extreme market pressure, can provide significant upside IF you have the patience, timeframe and acceptance of short term volatility.

Baillie Gifford Global Discovery Fund – this is an aggressive styled fund that I have used as part of a diversified equity portfolio for some time now, which has provided an average annual return of 11.8% since launch. While it is still a very highly rated fund with high quality management, performance has suffered recently. From its peak on 20th February to 16th March 2020, the value dropped by 30% (it is currently -10.25% YTD).

I will provide 2 examples of this fund when it suffered a 30% drop in value and how investors that invested at that time would have fared.

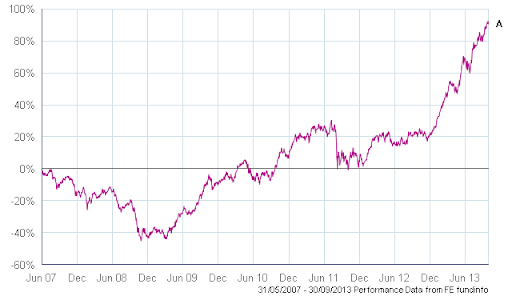

The Impact of the Global Financial Crisis

A. Baillie Gifford Global Discovery B Acc

From its peak price on 31st May 2007, the value had dropped 30% by the 29th September 2008. Investors that were brave enough to buy into the fund at that time, witnessed further losses of 20% until it did bottom out on the 6th March 2009. Anyone that had invested on 31st May 2007, being the then peak of its value, were now looking at paper losses of 44% of the value of their investment.

So how would those investors have faired then..??

- + 29.9% (1 year performance from 29th September 2008)

- + 46.2% (2 years performance)

- + 47.7% (3 years performance)

- + 73.1% (4 years performance)

- + 171.8% (5 years performance)

And don’t forget, those investors initially would have seen losses of 20% before the fund had bottomed out with the market.

During the Global Financial Crisis, all you were hearing was the Doom & Gloom and that it was the end of the financial world as we knew it…………. Sound familiar..??

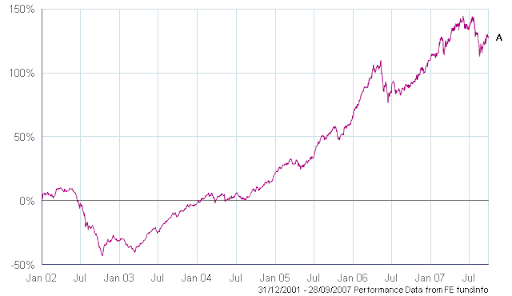

9/11 Terror Attacks and the SARS outbreak

A. Baillie Gifford Global Discovery B Acc

So once again, using the then highest point on the 2nd April 2002, by 4th September the value had dropped by 30%. As per the previous example, if investors had used that point to invest in the fund, they would have experienced a loss of value of 24.3% as at 10th October 2002. So from peak to trough, the drop was over 48%.

So how would those investors have faired then..??

- + 19.1% (1 year performance from 4th September 2002)

- + 39.3% (2 years performance)

- + 101.5% (3 years performance)

- + 151.2% (4 years performance)

- + 198.4% (5 years performance)

I have to make the obvious disclosure that past performance is NO guarantee of future performance.

I will also provide the famous Mark Twain quote that does seem to re-appear during times like this that “History does not repeat itself….. But it does rhyme”.

This is in no way me trying to convince clients and prospective clients to pile your money into this specific Baillie Gifford fund, and even when markets are acting in a normal manner, it would be absolutely negligent to suggest such a thing. As my clients are well aware, portfolios needs to be well diversified which includes diversification of Fund Managers, no matter how good an individual manager is.

The purpose of this article is to demonstrate that during periods of high volatility and lack of confidence in investment markets, investors with the appropriate timeframe can significantly benefit from these situations through an exposure to good quality fund managers…… even though at first it may look like a losing situation.

Any investors that have any queries with the funds that they hold or wish to see how those funds would have performed during the same periods, there is a ‘request information’ button at the bottom of this page.