Why more investors should consider Asia

Asia is a fascinating place in which to invest. It’s home to hundreds of outstanding companies in some of the world’s fastest-growing countries.

Chris Salih – published by FundCalibre

This means an impressive investment horizon of stocks in countries such as China, Korea, Singapore, India, Australia, Thailand, and the Philippines.

The region is also home to a dizzying array of technology companies, car manufacturers, retailers, health care businesses, and financial services companies.

Here, we look at the main reasons why investors should be exposed to this area of the world.

Reasons to invest in Asia

Asia is home to 60% of the world’s population (4.5 billion people)* and, with more and more people being lifted out of poverty, income levels across Asia are increasing and the middle class is growing and spending more.

The region is also at the forefront of the digital revolution and, according to Tahsin Saadi Sedik, senior economist in the International Monetary Fund’s Asia and Pacific Department, its companies “are exploiting recent advances in artificial intelligence (AI), robotics, cryptography and Big Data that promise to reshape the global economy and fundamentally alter the way we live and work, in the same way that the steam engine and electricity did in centuries past.”

Intra-regional trade is accelerating

According to Fidelity, COVID-19 has also accelerated trends already developing across supply chains. “In the short term, as trade and economic activity in the region recovers from its nadir earlier in the year, intra-Asian trade – which for most economies in Asia already represents most of their exports and imports – is accelerating,” it said.

“As industries and governments factor in the learnings of the pandemic, proximity will increasingly feature as a factor to overcome the friction of travel and transport in supply chains.

“Over the long term, we believe the disruption of supply chains during the COVID-19 pandemic, along with geopolitical tensions, will drive a more regional approach to trade. We expect to see the rise of regional economic centres where growing demand from large economies such as China or India fuel growth in other developing countries nearby. This shift in supply chains will benefit countries in Asia with large domestic economies, large neighbouring economies and rising middle classes.

So why is Asia unpopular with investors?

Despite their superior growth potential, Asian assets remain under-represented in investor portfolios.

While there is currently £36bn invested in funds within the IA Asia Pacific excluding Japan sector**, it is only the 12th most popular out of almost 50 sectors. And the sums invested pale into comparison to the IA Global sector which has £169.3bn and the £161.5bn in IA UK All Companies sector.

Asian companies are also under-represented in global equity indices. In the MSCI AC Asia (ex-Japan) Index, Asian stocks (excluding Japan) make up just 10.3% of the index***.

“When you consider that indices like this are used as benchmarks, many investors can expect to be underweight in their allocation to Asian equities,” said Fidelity.

Five funds to consider

For those not wanting to miss out on the opportunities available in Asia, here are five Elite Rated fund options.

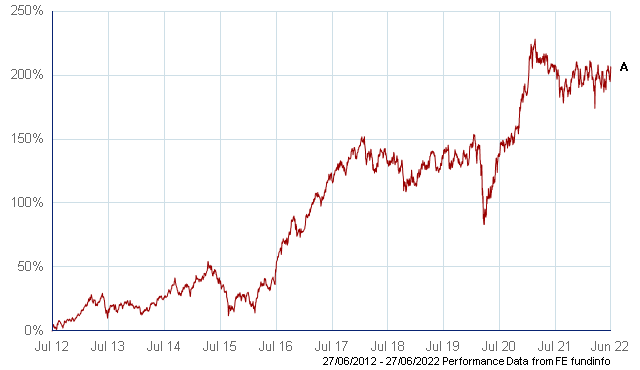

Invesco Asian

This fund’s manager, William Lam, seeks companies whose share prices are substantially below Invesco’s estimate of fair value. “Our search for undervaluation leads us to look for new ideas in unloved areas of the market,” he said. William also has a clear preference for cash-generative companies with strong balance sheets, as these attributes suggest sustainable business models and conservative management.

A. Invesco Asia – 10 year performance 206.6% (11.9%pa)

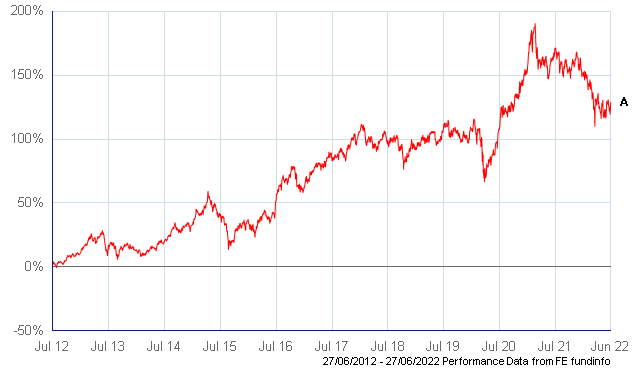

JPM Asia Growth

Hong Kong-based Joanna Kwok and Mark Davids have been running this fund together since its revamp in 2015.

They will invest in the shares of up to 60 companies of any size, primarily focusing on quality, growing businesses to generate superior capital gains than their peers and the wider market. “Despite all the noise in markets, the story around growth in Asia continues to centre around 4.5 billion people who live, work and consume in this fast-moving, exciting region,” said Joanna.

A. JPM Asia Growth – 10 year performance 179.3% (10.8%pa)

Matthews Pacific Tiger

Managers Sharat Shroff and Inbok Song favour holdings that are capable of sustainable growth, based on a number of key fundamental characteristics.

These include balance sheet information, number of employees, size and stability of cash flow, management’s depth, adaptability and integrity, and product lines. The managers currently believe the outlook is encouraging despite the challenges testing consumers and companies, such as higher energy prices.

A. Matthews Asia Pacific Tiger – 10 year performance 128.7% (8.6%pa)

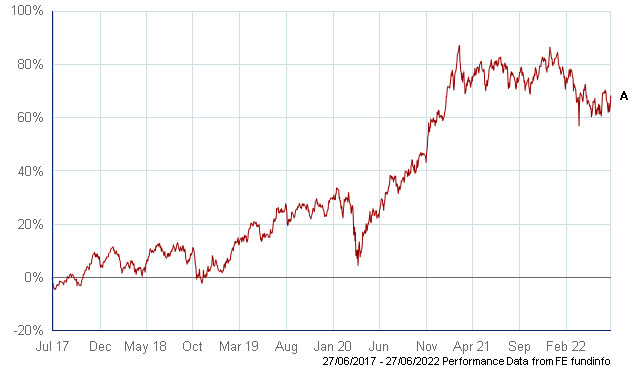

Fidelity Asia Pacific Opportunities

Anthony Srom takes a high conviction approach to his management of this fund, with the intention of ensuring each stock contributes to performance in a meaningful way.

While the portfolio’s style is broadly neutral, fresh portfolio ideas can provide a contrarian view. Company fundamentals, market sentiment and current valuations are the three key factors for portfolio construction.

A. Fidelity Asia Pacific Opportunity – 5 year return 68.3% (11.0%pa)

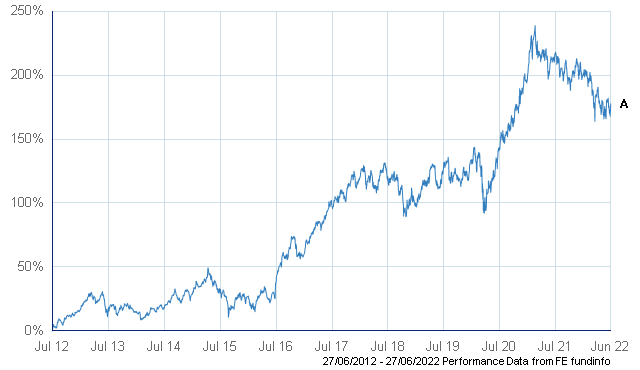

Schroder Asian Alpha Plus

Managed by Richard Sennitt and assistant Abbas Barkhordar, this fund adopts a flexible approach as it looks to exploit stock market inefficiencies.

According to the most recent commentary, Richard prefers to take a diversified stance when it comes to portfolio construction, particularly given China’s recent struggles with Covid-19. “We retain exposure to select financials, while we have also been very gradually increasing exposure to some of the better-quality growth stocks in the region,” he wrote^.

A. Schroder Asian Alpha Plus – 10 year performance 177.7% (10.8%pa)

*Source: Investment Association, April 2022

**Source: Fidelity, March 2022, worldometers.info/population/countries-in-asia-by-population

***Source: Fidelity, MSCI All Worlds Index, 29 January 2021

^Source: Schroders, April 2022

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice. Whilst FundCalibre provides product information, guidance and fund research we cannot know which of these products or funds, if any, are suitable for your particular circumstances and must leave that judgement to you. Before you make any investment decision, make sure you’re comfortable and fully understand the risks.

Please note the above article was first published by Fund Calibre and should not be regarded as individual investment advice on whether to buy, sell or hold any of the funds mentioned. Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we can access the funds mentioned in this article on the various offshore investment platforms we offer. We do NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investments costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards