2022…. What Happened..??

Let’s not mince words here…… 2022 was a shocker for financial markets.

While others may disagree, my personal opinion was that 2022 was a more stressful year for financial managers than what was encountered during the Global Financial Crisis of 2007 & 2008, the European Debt Crisis and the more recent turmoil caused by the Covid19.

When it came to market performance and investment returns in 2022 there was one clear, dominant force driving the markets: inflation.

Inflation’s surge to 40-year highs led the Fed to an unprecedented series of interest-rate increases, cratering the bond market and sending stocks into a bear market that continued into the end of the year.

As the dust settles on 2022, it’s been an all-around brutal year for mutual fund investors. The average U.S. stock fund finished the year down roughly 17%, with the average large-growth funds down an average of nearly 30%.

S&P 500 Index – down 19.4% Nasdaq – down 33.1%

For U.S. bond, mutual fund and exchange-traded fund performance, the story in many ways is much worse, where in many cases, losses were the biggest in history.

Other regions didn’t fair much better with the Hang Seng Index in Hong Kong falling 16% and the Shanghai Shenzhen CSI Index dropping by more than 20%.

Europe faired a little better (in local currency terms) with the Euro Stoxx 600 and the German DAX down 13% and the French CAC down over 9%. The UK FTSE 100 index actually bucked the trend with a positive 1% return for the year in local currency term, helped due to the high exposure to financial companies and global energy companies. However, the FTSE 250 index, which represents more companies of the local UK economy, suffered with a loss of nearly 20%.

How did the Sustainable Ethical Allocation Portfolios hold up in 2022…??

Unfortunately, our portfolios suffered negative returns for the year, with some of our high conviction equity funds suffering significant losses. We did make some allocation changes at the start of quarter 2, especially with our fixed interest and bond exposure (significantly reducing exposure due to forecast of higher interest rates & inflation) but it still didn’t stop the portfolio losses.

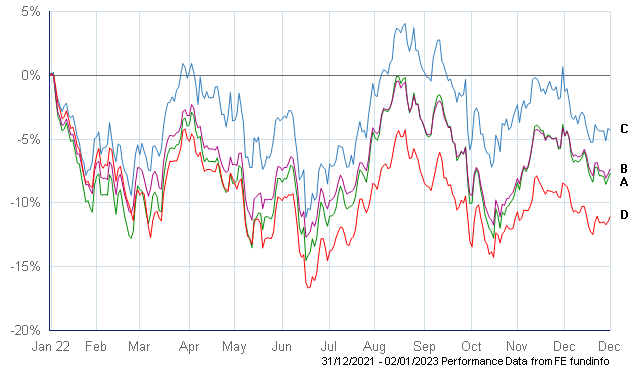

Both the Balanced Allocation and the Growth Allocation ended the year down 8% and the new Index ETF Allocation portfolio down just under 5% for the year.

- Sustainable Ethical Growth Allocation

- Sustainable Ethical Balanced Allocation

- Sustainable ETF Index Allocation

- IA Global Index

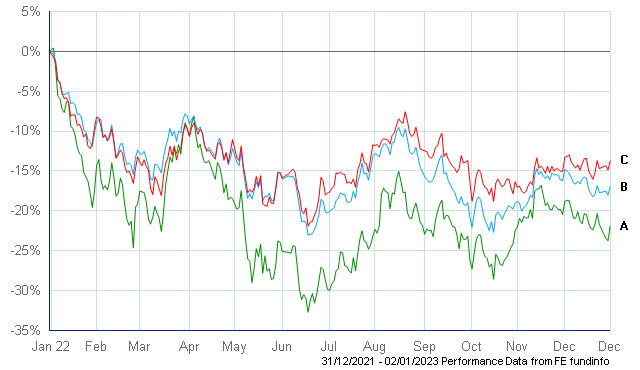

As mentioned above, some of our high conviction ESG / Sustainable type funds suffered in 2022, experiencing much higher levels of short term volatility. Our long term favourite Baillie Gifford Positive Change fund ended the year down 23% (was down near 35% during June) while the more diversified Royal London Sustainable World Trust ended the year down 17%.

- Baillie Gifford Positive Change

- Royal London Sustainable World Trust

- Fundsmith Equity

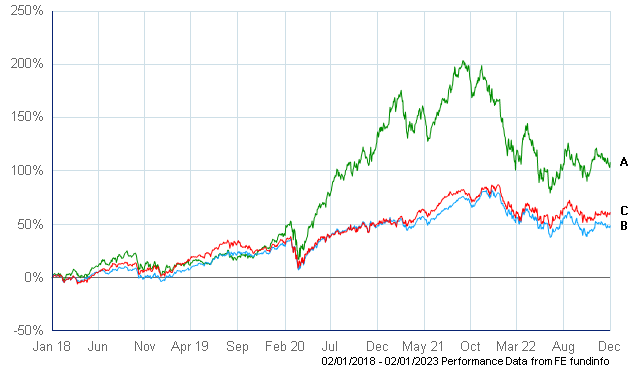

However, as we continually state, these funds should be considered long term holdings and investors need to be aware, and accept that there will be periods of underperformance, which will include negative periods. Even with the disappointing performance of 2022, the above 3 funds have still generated above market returns over the past 5 years, with Baillie Gifford at 15.8%pa, Fundsmith Equity at 10.0%pa and Royal London Sustainable World Trust at 8.3%pa.

- Baillie Gifford Positive Change

- Royal London Sustainable World Trust

- Fundsmith Equity

Looking Ahead…..

Our longer-term view has not changed, in that we continue to expect that high quality companies with strong balance sheets (low levels of debt), and that have a consistent, recurring and increasing revenue streams to provide the greater upside potential over the longer term. With rising interest rates, monitoring company debt levels will be important as higher interest costs, will have a negative impact on future company earnings and profits.

Higher inflation will also have a negative impact on earnings, so once again, it will be important that we are investing in high quality companies that have the pricing power to absorb the higher operating costs, or better still, be able to pass on these additional costs to the end consumer.

We did make some allocation changes to our Sustainable Allocation portfolios at the end of Quarter 1, increasing our exposure to value, income generating equities by reducing our exposure to high growth companies, which may struggle in the short term due to higher borrowing costs and inflation. We have maintained a bias towards companies involved in sustainable and renewable energy as well as healthcare and disruptive technology.

For the Balanced Allocation, we re-allocated our Bond and Fixed Interest exposure to funds that take a diversified approach to cautious assets, which includes inflation protected bonds, infrastructure as well as precious metals. With the current rising interest rate and inflationary environment, we will continue with this diversified approach.

Ethical Offshore Investments provides guidance on portfolios that have an ESG (Environmental & Social Governance) bias and an SRI (Socially Responsible Investing) focus. By avoiding high charging, commission paying funds, this results in lower portfolio costs, so more of the growth staying in the pockets of our clients.

If you would like to get more information on the Sustainable Ethical Allocation portfolios, or enquire on the vast array of Sustainable and Ethical style funds available, please click on More Information.

If you have an existing portfolio and would like to compare the holdings against the Sustainable Ethical portfolios, once again, please click the more information button at the bottom of this screen and we will provide a clear & easy to understand, comparison report.