Turmoil hits the markets again…. Will this provide another opportunity for longer term investors..??

After yesterday’s global market falls, is this the start of the end for investors..?? Or once again, an opportunity to take advantage of a bad situation.

Equity investors are enduring a tough time at the moment, as shares in technology and growth type businesses are getting hammered on inflation fears.

To be honest, I would rather NOT be writing this post, because by doing so, there obviously has been some significantly negative market movement that has occurred. And as a result, investors have seen the value of their portfolios fall.

Yesterday, it seemed that every equity market was deeply in the red, with losses across the board of circa 2%. Growth type companies involved in Technology have been the hardest hit with many companies down well over 5% for the day……. Yet these types of businesses were predominately the better performers of 2020.

There is a lot of market commentary across various forms of media with so called ‘financial experts’ rambling on as to why this has happened, with differing view as to what will happen next. Once again, it only seems to be the ‘media financial experts’ yelling & screaming their opinions. Where as the major Fund Managers have maintained their low profiles, ignoring the market noise that accompanies market conditions like we are seeing now, continuing to monitor their underlying holdings and (hopefully) using this as an opportunity to re-balance and/or add to their favourite positions at a discounted level. Which in turn, generates additional positive results for investors.

Now back to the question, will this current sell off situation provide an opportunity for investors……..

2020 was a very unique year, and on a personal level, I hope that we never have to endure a covid19 type situation ever again.

Investment market wise, it was probably the most unpredictable and volatile situation that I have encountered in 30 years of being in the financial markets…… and that includes the Global Financial Crisis in 2008.

I published an article on 25th June https://ethicaloffshoreinvestments.com/features/turmoil-and-opportunity/ as a follow up to an earlier article on 6th April https://ethicaloffshoreinvestments.com/news/within-this-turmoil-is-there-opportunity/

in regards to previous investment opportunities, by taking advantage during negative, and sometimes very volatile market conditions.

In these articles, I highlighted a personal long-term favourite of mine, the Baillie Gifford Global Discovery Fund which last year, had once again fallen by over 30% in the space of a few months…… only to recover those losses and provide investors a very good return (the fund ended 2020 with a +76.8% return).

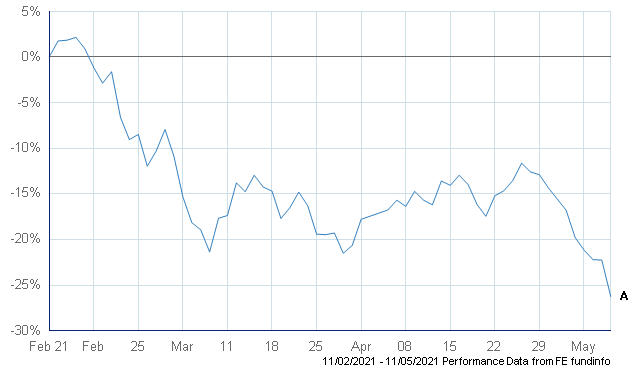

Unfortunately, after the significant market falls of yesterday (the fund was down 5.13% for the day), investors are once again looking at a drop of near on 30% for this fund from its all-time high levels seen back in February this year….

- A. Baillie Gifford Global Discovery B

So does this significant fall now provide an opportunity for investors..??

First off, I have to provide the standard disclaimer that Past Performance is no Guarantee of Future Performance……..

I will also provide the famous Mark Twain quote that does seem to re-appear during times like this that “History does not repeat itself….. But it does rhyme”.

Let’s re-cap previous situations where this fund has suffered significant losses in the past.

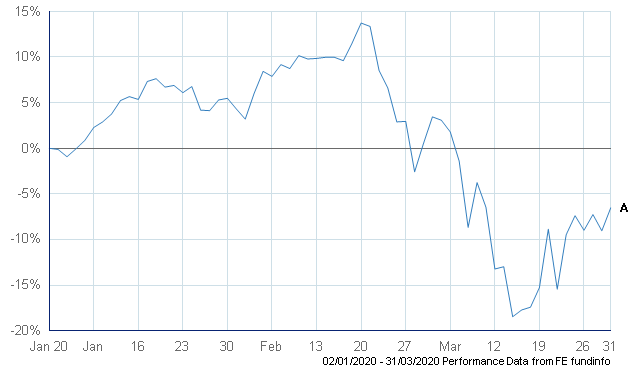

- A. Baillie Gifford Global Discovery B

Last year, from its peak on the 20th February to the low for the year on 16th March, the fund had fallen by a staggering 28.2%

So what happened to our clients that maintained their position in this fund..??

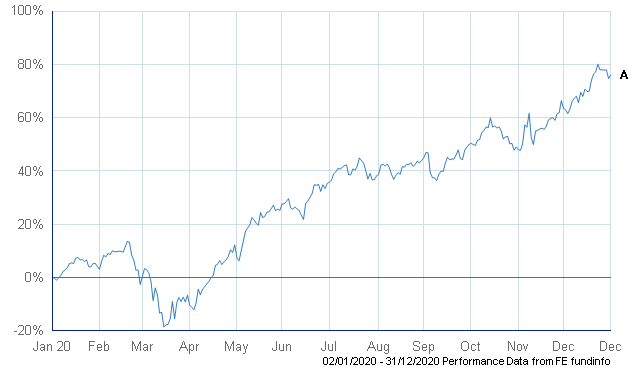

- A. Baillie Gifford Global Discovery B

Well, if you happened to have timed your investment at the absolute worst possible time on 20th February 2020 (the then all-time highest point), after seeing your investment dropping in value by nearly 30% in less than a month………. you ended the year up +54.8%

I have also provided performance information on how this fund performed during the Global Financial Crisis in 2007 & 08 as well as its performance during the aftermath of the 9/11 terror attacks and the SARS outbreak during 2002 & 2003 in the following article https://ethicaloffshoreinvestments.com/news/within-this-turmoil-is-there-opportunity/

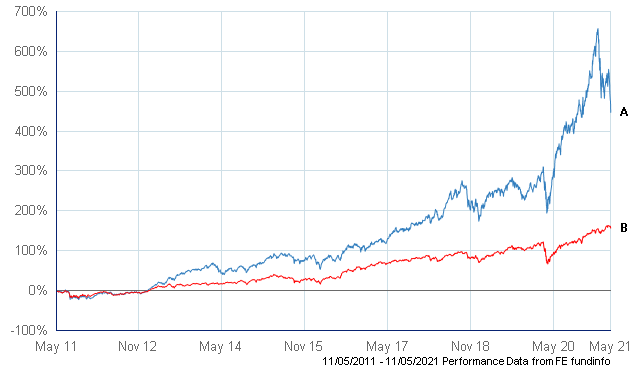

Looking back at another recent occasion when the fund dropped by near on 30% or more:

The last few month of 2018 was also not a good time for investors in this Baillie Gifford fund, as they witnessed their investment value falling by 27%.

- A. Baillie Gifford Global Discovery B

After witnessing that fall in value in late 2018, then followed by the covid19 inspired market panic sell off in March 2020, plus this latest market pullback, investors have still been rewarded with positive performance.

So even if once again, you had invested at the then worst possible time (3rd September 2018), even what has happened in the past few weeks, your investment is still up +46%

Over the past 10 years, the average annual return of the Baillie Gifford Global Discovery fund is 18.5%pa, significantly outperforming the IA Global Index (9.9%pa) over that same period.

- A. Baillie Gifford Global Discovery B

- B. IA Global Index

Now, I must stress that I am not professing that this is the bottom of the current market sell-off and anyone that says that they can predict this (in my opinion) are actually just guessing. But what I would like to point is that during periods of extreme market pressure & volatility, can provide significant upside IF you have the patience, timeframe and acceptance of short-term volatility.

This is in no way me trying to convince clients and prospective clients to pile their money into this specific Baillie Gifford fund, and even when markets are acting in a normal manner, it would be absolutely negligent to suggest such a thing. As I have stated many times before, portfolios needs to be well diversified which includes diversification of Fund Managers, no matter how good an individual manager is.

The purpose of this article is to demonstrate that during periods of high volatility and lack of confidence in investment markets, investors with the appropriate timeframe can significantly benefit from these situations through an exposure to good quality fund managers…… even though at first it may look like a losing situation.

Any investors that have any queries with the funds that they hold or wish to obtain additional information on the wide range of high quality Managed Funds available through Ethical Offshore Investments (plus how we can potentially reduce your current charges), please click on the Request Information button at the bottom of this page.

So what has triggered this latest sell off..??

My take on the current market situation is that with the vaccine rollout across many countries in full swing, there is the hope that we may be able to get back to some form of normal day-to-day life sooner rather than later. This means small local businesses opening up, the flexibility to travel and the ability to go out with a group of friends and spend some of that money that you have been unable to spend in lockdown.

On a personal level, that sounds absolutely fantastic and the sooner that occurs, the better. However, on an economic level, as we have all been in some form of lockdown and unable to spend our money on discretionary items, this pent-up demand will (potentially) result in an inflation of prices, due to the increased demand over initially limited supply.

And before you think that inflation is bad, actually the opposite is true in that controlled inflation does benefit businesses with higher prices (& theoretically, greater margins), increased wages growth which in turn increases discretionary spending…… and Governments benefit from an increase in taxation receipts, either through sales tax and/or tax on earnings and profits.

The perceived fear at the moment seems to be that as inflation rises, Central Banks around the world will implement measures to control it, which generally means a raising of official interest rates. This is being looked at by many market participants as a significant negative to certain growth type businesses as this increase in borrowing costs (higher interest charged on loans) will have a negative impact on future earnings and growth potential of the business.

I do agree with that……. But……. The good quality businesses that have the pricing power over their competitors, can pass on some or all of any inflation related costs to their customers. This is nothing new…!! And that is why it is so important that we at Ethical Offshore Investing research the Fund Managers that take a bias investment approach to quality, sustainable companies that can maintain their pricing power through the various market conditions.

It is therefore so important that investors maintain a well-diversified portfolio of good quality, sustainable assets that not only results in diversification of asset class, but geographical regions, business sectors and Fund Manager investment style. It is also very important that investors also have an appropriate investment timeframe, as market situations like what we have just witnessed (& more so, the covid19 sell off last year) is why investors in growth style assets should be looking at a 5 year timeframe so as to ‘wait out’ the short term negative movements.

It is therefore so important that investors maintain a well-diversified portfolio of good quality, sustainable assets that not only results in diversification of asset class, but geographical regions, business sectors and Fund Manager investment style. It is also very important that investors also have an appropriate investment timeframe, as market situations like what we have just witnessed (& more so, the covid19 sell off last year) is why investors in growth style assets should be looking at a 5 year timeframe so as to ‘wait out’ the short term negative movements.

And finally, this also emphasises the importance of ensuring that short term income and/or capital requirements are maintained in cash or very low risk money market type investments so as not to be affected during volatile and periods of market falls.

By following this strategy for income clients, results in peace of mind knowing that the income component that they are drawing out, is coming from a secure asset class. So during volatile periods like we are seeing at the moment with general equity markets suffering losses, the cash component will maintain a stable value. It therefore gives time for the growth component of the portfolio to recover the short term losses.