I’d rather stocks pulled back than power higher regardless, says decade’s best multi-asset manager

Stock markets are going through another strong year, but Royal London Asset Management’s Mike Fox wishes they would calm down.

PUBLISHED 10 August 2021 (Trustnet)

By Gary Jackson,

Head of editorial, FE fundinfo

Royal London Asset Management’s Mike Fox would rather see a “pull back” in stock markets than for equities to continue surging ahead regardless of fundamentals.

The re-opening from the coronavirus lockdown and the ongoing effects of massive stimulus means that equities have put in a robust showing in 2021 so far.

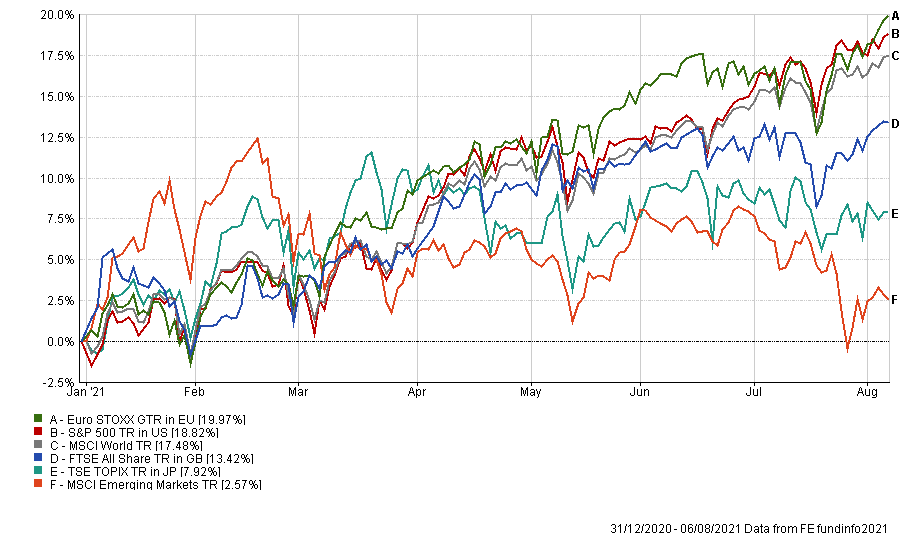

As can be seen in the below chart, European equities lead the pack with a total return of just under 20% (in local currency) while the US isn’t too far behind. The UK is up more than 13%.

That said, Japan and emerging markets – which have made less progress that the above in their Covid vaccination programmes – are further behind.

Performance of stocks markets over 2021

Source: FE Analytics

Source: FE Analytics

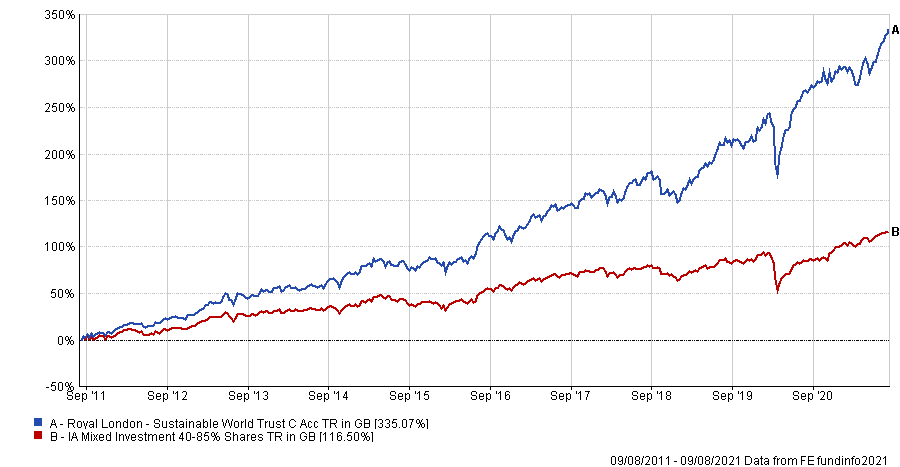

Mike Fox, whose Royal London Sustainable World Trust is the highest returning member of the IA Mixed Investment 40-85% Shares sector over the past decade, said: “This is turning out to be another strong year for equity markets. Is this justified?

“We think largely yes, but the risk of a rapid melt up (much like we saw in the late 1990s) is increasing, something that we would have mixed feelings about.”

The earnings of the S&P 500 in 2020 and 2021 illustrate Fox’s point. Last year, the index rose 15% while earnings fell 13%; in 2021, it is up more than 18% and earnings are forecast to rise 43%.

Looking at the entire period, the S&P has risen around 35% since the start of 2020 and earnings have grown just 24%.

“So there has been a rerating of equities in the United States, but nothing too stretched, hence why we think the move in that market (and others, which have a similar dynamic) is largely justified,” the manager added.

“The big question is what happens next. We would much prefer a period of market consolidation, even pull back, to keep valuations and earnings connected. We are not convinced we are going to get it.”

Fox conceded that it is “counterintuitive” for an investor to want their holdings to go up less rather than more. However, he argued that a melt-up in stock markets isn’t necessarily a good thing for investors.

He noted that the latter stages of equity bull markets are usually when the highest returns are made, as share prices move away from earnings and rerate significantly. However, this is then frequently followed by a bust.

Examining the current market backdrop, Fox said a continued rise in equities was more likely than “a healthy consolidation” as low bond yields, strong economic growth and accommodative central banks have created “near perfect conditions” for risk assets.

“For long-term investors who believe investment returns are created in the holding – rather than the buying and selling – of shares, high levels of market optimism can be very inconvenient if what we own becomes overvalued as it creates dilemmas as to how to respond,” Fox said.

“To be clear, this is not the situation we are in now, but we would much prefer the share prices of the companies we invest in move up in line with increases in their value, not because of excess optimism in markets.”

Performance of fund vs sector over 10yrs

Source: FE Analytics

Source: FE Analytics

Fox is head of sustainable investments at Royal London Asset Management and co-manages several funds alongside George Crowdy and Sebastien Beguelin.

These include the £3.3bn Royal London Sustainable Diversified Trust, £3bn Royal London Sustainable Leaders Trust and the £2.8bn Royal London Sustainable World Trust, of which all three are currently top decile in their respective sectors over three, five and 10 years.

Royal London Sustainable Diversified Trust and Royal London Sustainable World Trust are the highest returning members of the IA Mixed Investment 20-60% Shares and IA Mixed Investment 40-85% Shares sectors over 10 years respectively, while Royal London Sustainable Leaders Trust is ranked ninth in the IA UK All Companies sector.

The above article is for informational purposes only and was originally published by Trustnet.

With the Sustainable Ethical Allocation Portfolios, we have had an exposure to the Royal London Sustainable World Trust across all 3 of the portfolios, and has been a component since the portfolios inception in November 2018.

Investments made via Ethical Offshore Investments will result in no additional entry fees and we will place the investment into the lowest cost version of the fund available on the relevant platform.

For information on the Sustainable Ethical Allocation Portfolios or the underlying investment funds that are used, please click on the More Information button below.