Fundsmith Equity – Should investors holding this fund be concerned …..

Today, we look at the Fundsmith Equity Fund, a well known, highly rated Global Equity fund that has been run by Terry Smith (pictured) since its launch back on 1st November 2010.

So why are we looking at this fund..??

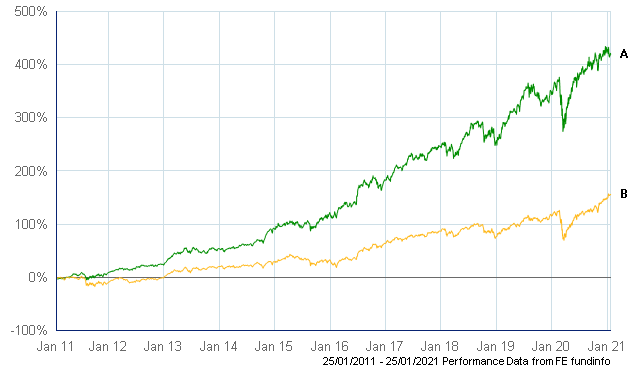

With a size of £ 23.2 billion (as at 31st December 2020) it is the largest fund domiciled in the UK and is a very popular choice among retail investors in the UK, as well as around the world. Investors have been very well rewarded by holding this fund with an average annualised return of 17.9%pa over the past 10 years…… significantly outperforming the 9.86%pa from the benchmark IA Global Index.

- A. Fundsmith Equity T +419.9%

- B. IA Global Index + 155.0%

So once again…… why are we looking into this fund..??

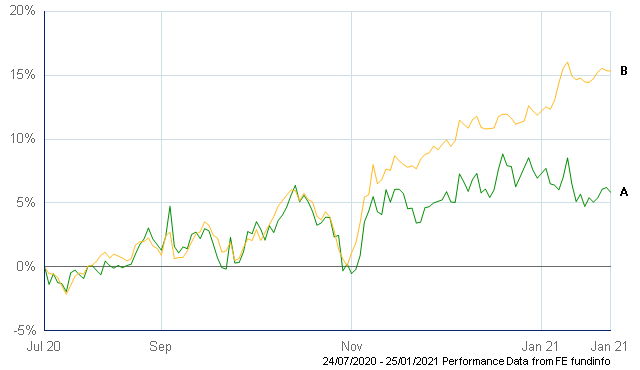

As many of our clients hold this fund (including myself) as part of their diversified portfolios, the recent performance over the past 6 months has been rather disappointing compared to that of other global equity funds and the benchmark IA Global Index.

I must stress that the performance of the fund was still positive over the past 6 months, just not at the same outperformance level as what many longer-term investors have been used to seeing.

- A. Fundsmith Equity T + 6.4%

- B. IA Global Index + 15.2%

As part of our ongoing monitoring of the funds that we propose for clients, when we see a fund underperforming over a period of time, we need to investigate further.

The fund has an investment objective of investing in equities on a global basis. The Company’s approach is to be a long-term investor in its chosen stocks. It will not adopt short term trading strategies. The company has stringent investment criteria which Fundsmith Investment Services Ltd (as investment manager) adheres to in selecting securities for the Company’s investment portfolio. These criteria aim to ensure that the Company invests in:

- high quality businesses that can sustain a high return on operating capital employed;

- businesses whose advantages are difficult to replicate;

- businesses which do not require significant leverage to generate returns;

- businesses with a high degree of certainty of growth from reinvestment of their cash flows at high rates of return;

- businesses that are resilient to change, particularly technological innovation;

- businesses whose valuation is considered by the Company to be attractive.

Actually, their investment moto is:

- Buy Good Companies

- Don’t Overpay

- Do Nothing

And it is sticking to the above strategy, ignoring all of the short-term market & media noise, that has resulted in the superior performance every year for the past 10 years.

So should investors be concerned now with the recent underperformance…..??

My view is that it is way too early to make a call on that. I have gone back through the quarterly performance of this fund for the past 10 years, reviewing how the performance stacked up against the IA Global Index (the funds benchmark).

Over the past 40 quarters of performance (10 years), the fund underperformed in 12 quarters, so 30% of the time. However, the fund outperformed over the calendar year each & every year over the past 10 years…… and that includes for 2020.

So short term underperformance is NOT uncommon for this fund, and due to the concentrated nature of their underlying holdings (they currently are holding only 30 different companies), it can occur when markets are experiencing a certain trend or sentiment that may not be viewed in the same way or shared by Fundsmith. As per their investment objectives, they do not adopt Short-Term Trading Strategies just because something is trendy in the market place at the present time.

While no one likes to see an investment underperforming like we are seeing with Fundsmith, investors have to realise that even the best investment managers do not get every decision correct, 100% of the time. To be honest, I would be more concerned with an investment that always was the best performer, month in month out, as that just screams ponzi scheme to me……. If it seems too good to be true, then it generally is.

As can be seen on the Fund Fact sheet for the Fundsmith Equity Fund, the concentrated holdings include Paypal, Microsoft, Idexx Laboratories, Facebook, Estee Lauder, Intuit, Phillip Morris, L’Oreal, Stryker and Novo Nordisk as their top 10 holdings……. These are quality types of companies that Fundsmith has consistently been investing in since inception.

What I think that this all highlights is that investors need to ensure that they don’t solely rely on just one investment for their wealth creation, and the importance of diversification. We strongly advocate the need for quality diversification which includes not only asset types and geographical regions…… but also diversification of Fund Manager styles. By combining fund managers with different investment styles potentially results in a more consistent overall portfolio performance.

For examples of the benefits of quality diversification, please read about our Sustainable Ethical Allocation Portfolios https://ethicaloffshoreinvestments.com/services/#portfolio-management

Whether it was good management or just pure luck on our part, but through our portfolio management service throughout 2020, we did rebalance clients portfolios which did result in a slight reduction in allocations to Fundsmith….. I must stress that this was not because of our concerns with the fund, but to ensure that a single holding within a portfolio doesn’t become too overweight and the portfolio performance not being reliant on just 1 or 2 individual funds.

We will continue to monitor the performance of the Fundsmith fund (obviously) and while we may be a little concerned (& disappointed) in the short-term performance, we take a good deal of confidence in that the strategy that has worked so well for investors over the past 10 years, will continue. At the moment, it still meets our requirements as a long term, low turnover equity holding for a diversified portfolio.

If the situation does not improve for Fundsmith and underperformance becomes the norm, being a liquid & daily traded fund, we simply sell the remaining units in the fund and allocate elsewhere.

If you are an investor that has the Fundsmith Equity Fund or a query on any managed fund investment, please use the ‘More Information’ and provide some brief details and we will respond.