Fundsmith Equity – have investors been rewarded for holding on..??

Today, we re-visit the Fundsmith Equity Fund, a long term holding of ours, where six months ago we reviewed our position due to our concerns over the recent underperformance….. we retained our holdings in the fund….. but did we do the right thing..??

Back in January, I published an article on the Fundsmith Equity Fund and whether we as investors should be concerned with the recent underperformance compared to that of other Global Equity funds and that of the IA Global Index.

That article can be found here

To recap about this fund, now with a size of £ 27.3 billion (as at 26th July 2021) is the largest fund domiciled in the UK and has been a very popular choice among retail investors in the UK, as well as around the world. The fund has been run by Terry Smith (pictured) since its launch back on 1st November 2010

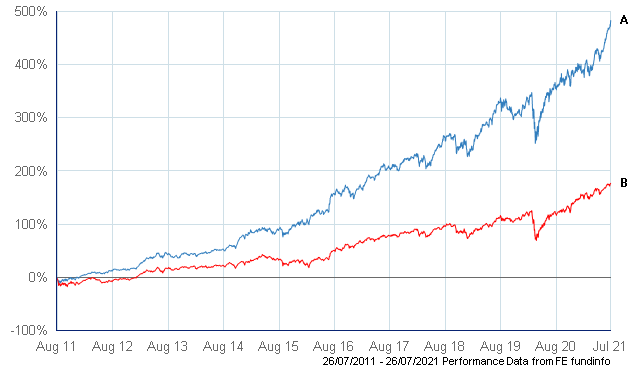

Investors have been very well rewarded by holding this fund with an average annualised return of 19.3%pa over the past 10 years…… significantly outperforming the 10.7%pa from the benchmark IA Global Index.

The fund has an investment objective of investing in equities on a global basis.

The Company’s approach is to be a long-term investor in its chosen stocks. It will not adopt short term trading strategies. The company has stringent investment criteria which Fundsmith Investment Services Ltd (as investment manager) adheres to in selecting securities for the Company’s investment portfolio. These criteria aim to ensure that the Company invests in:

- high quality businesses that can sustain a high return on operating capital employed;

- businesses whose advantages are difficult to replicate;

- businesses which do not require significant leverage to generate returns;

- businesses with a high degree of certainty of growth from reinvestment of their cash flows at high rates of return;

- businesses that are resilient to change, particularly technological innovation;

- businesses whose valuation is considered by the Company to be attractive.

Actually, their investment moto is:

- Buy Good Companies

- Don’t Overpay

- Do Nothing

So once again, why was the fund under review back in January 2021..?

As many of our clients, myself included, hold this fund as part of a diversified portfolio, there was concerns that the recent underperformance the fund was experiencing was going to be the ‘new normal’ for this type of fund management. There were concerns over the size of the fund, the buy & hold strategy and the concentrated asset holdings that Fundsmith undertake.

I must stress that the fund was still providing a positive performance for investors, but for the 6-month period to 25th January, performance was approx. 10% below that of its benchmark IA Global index.

At the time, I wrote “while we may be a little concerned (& disappointed) in the short-term performance, we take a good deal of confidence in that the strategy that has worked so well for investors over the past 10 years, will continue. At the moment, it still meets our requirements as a long term, low turnover equity holding for a diversified portfolio”.

So what has happened since..??

Well, it has been good news for investors that stuck with the fund. As the following graph shows, the 6-month period since the article & our review of the fund for it to be retained, it has delivered a net 18.7% return which is a significant outperformance against the benchmark IA Global Index which was +8.9% over the same period.

6 month performance – 26 January 2021 to 26 July 2021

- Fundsmith Equity T Acc

- IA Global Index

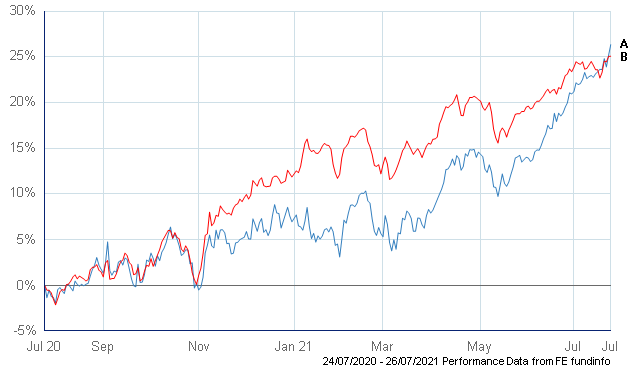

If we now look at the past 12 months of performance, the fund has now outperformed the IA Global Index……

12 month performance – 24 July 2020 to 26 July 2021

- Fundsmith Equity T Acc

- IA Global Index

So what has changed at Fundsmith that has resulted in this improvement in performance..??

From what I can see, nothing..!!

They have maintained their investment philosophy of investing in high quality, resilient type companies, don’t overpay…… and do nothing..!!

In other words, the same strategy that they have employed over the past 10 years which has generated a 482.7% return (or an average of 19.3%pa) for investors.

- Fundsmith Equity T Acc

- IA Global Index

What I would like to highlight to any investor, and this does not just apply to the Fundsmith Equity Fund, is that no matter how good the management and performance is of a particular fund, investors should not rely solely on just one investment for their wealth creation, and to embrace the importance of quality diversification. We strongly advocate the need for quality diversification which includes not only asset types and geographical regions…… but also diversification of the the Fund Manager investment styles. By combining & blending fund managers with different management styles, this will potentially result in a more consistent overall portfolio performance.

An example of the benefits of quality diversification can be seen with our Sustainable Ethical Allocation Portfolios.

The Fundsmith Equity continues to be a quality global equity fund that we are comfortable proposing for investors to hold as part of a medium to longer term, diversified portfolio.

The Fundsmith Equity Fund can be accessed on most of the Offshore Investment Platforms and Offshore Life Company policies. When placed via Ethical Offshore, there will be no upfront / entry fee or commission charged and we will place the trade for the lowest charging version of the fund available on the relevant platform.

If you would like to get further information on the Fundsmith Equity Fund or the other high quality global equity funds that we believe investments into would complement the Fundsmith fund, please click on More Information at the bottom of the page.