A top performing fund manager explains why innovation alone is not enough

5 May 2021 – Innovation isn’t just about investing in speculative companies without earnings, explains Matthew Page, co-manager of the top quartile Guinness Global Innovators fund.

By Abraham Darwyne,

Senior reporter, Trustnet

As global economic growth looks poised for an acceleration, markets seem to have shunned the fast-growing companies that dominated financial markets last year and many of the highest performing growth focused funds of 2020 have suffered from lagging year-to-date performance.

However, the $661m Guinness Global Innovators fund, managed by Ian Mortimer and Matthew Page (pictured), was one of the few top-performing growth-orientated global equity funds that has managed to keep up its performance in 2021 so far.

However, the $661m Guinness Global Innovators fund, managed by Ian Mortimer and Matthew Page (pictured), was one of the few top-performing growth-orientated global equity funds that has managed to keep up its performance in 2021 so far.

One of the reasons it has performed well is due to its exposure to semiconductor stocks, which rallied strongly in the first quarter of 2021 amidst a semiconductor shortage that emerged after coronavirus.

Its positions in Applied Materials, KLA Corporation and LAM research were its three largest contributors to performance in the first quarter, which were up 55.1 per cent, 28 and 26.3 per cent respectively.

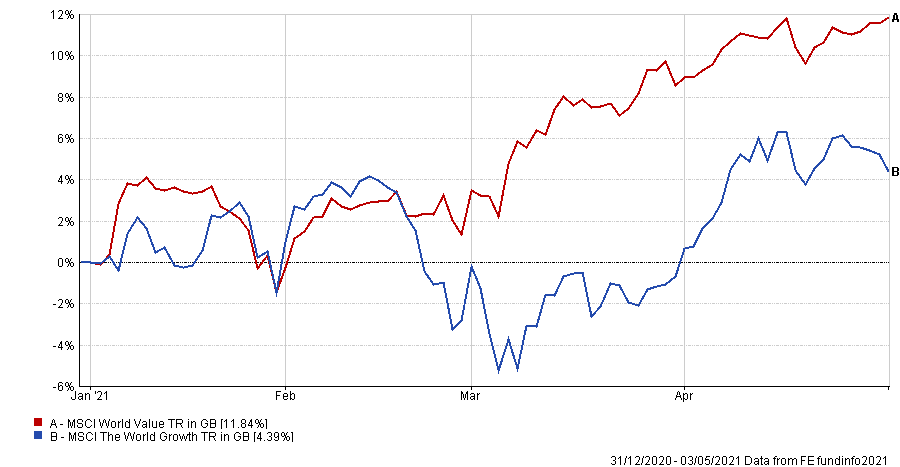

Yet despite the recent surge in value stocks that has occurred alongside semiconductor names, co-manager Page dismissed hype around the value-focused rally seen in the last few months.

“I think if you drill into it, it didn’t last all that long,” he said. “It’s captured half of that back already just in the space of the last two or three weeks.

“I think we’ve seen quite sort of clear leadership in terms of the market over the last 12 months.”

Indeed, in the MSCI World Growth index accelerated in performance in late March and early April, catching up to roughly half the outperformance from the MSCI World Value index.

Performance of MSCI World Value vs MSCI World Growth year-to-date

Source: FE Analytics

Page is instead focused on innovation, which – as the name of the fund gives away – forms a core part of the investment philosophy for the strategy.

The fund invests in companies benefiting from innovations in technology, communication and globalisation as well as innovative management strategies. However, it is not as simple as finding companies that are innovating, because Page said he also places a great emphasis on companies’ competitive strengths – or quality.

“Yes, we’re trying to invest in innovative companies, but we don’t believe that is sufficient in order to generate decent returns,” he explained. “Quality is very much an important overlay on top of this.

“We think innovative companies can outperform over time because they are potentially growing faster – but also because they’ve got wider profit margins.”

More importantly perhaps, Page said quality companies will have less of a sensitivity to the economic cycle – as seen by the earnings of many companies which grew despite the coronavirus pandemic in 2020.

One way the managers find innovative companies is by looking at the research & development (R&D) expense of the business, relative to what it is spending on capital expenditure.

However, Page pointed out that this is not enough of a measure on its own: “Any company could just spend a tonne of money on R&D, if that is not translating into a company that is generating revenues, margins, profits and growth – it’s sort of irrelevant.”

He continued: “We are not investing in highly speculative companies that haven’t got earnings or revenues today but could be do something incredibly transformative and disruptive in the future. That is not our strength, that’s not what we’re trying to do.

“We try to look at companies that are innovating today, and that in itself is translating into these high levels of profitability and their ability to reinvest in that business to grow it going forward.”

Whilst there is an abundance of equity funds that run concentrated portfolios, Guinness Global Innovators has a somewhat unique approach in the way it limits stock specific risk. It runs an equally weighted portfolio where each of its 30 positions in the portfolio make up roughly 3.33 per cent and the managers then only rebalance only a few times a year.

“The entire purpose of a portfolio is to try to diversify away stock specific risk,” Page explained. “If you take the simplest portfolio of two companies equally weighted, your stock specific risk is 50 per cent on each of those.

“If you go to 10 holdings you’ve got 10 per cent – so if one of those companies went completely bust, you could lose 10 per cent of the value of your portfolio.

“As you increase the number of holdings in that portfolio, the reduction in risk when you get into 30 to 40 names is really minimal.

“So you’re adding more and more complexity, more bandwidth you’re going need to look at those additional companies – but it’s not really helping to reduce the stock specific risk.”

When rebalancing, any excess gets put back into positions that the managers still favour but the market is not rewarding them at that point in time.

Page continued: “Yes we’re investing in quality-growth companies and yes we want to run our winners, but at the same time we think it’s quite important to think about that position size.

“We don’t want to be having 6, 7, 8 or 9 per cent positions in our portfolio because we’re dealing in quite dynamic areas where exogenous shocks can occur and that can have quite a significant impact.”

By looking back at data over the last 12 years, Page found that it is best to let positions just run most of the time.

“For the majority of the time we’re letting our positions run and letting the momentum in the market take them in whatever direction they’re going,” he said. However at a certain point, he believes it is important look at the distribution of position sizes and potentially rebalance the portfolio.

There are also certain periods when there are high levels of volatility in the market where it is better to rebalance more frequently. Page cited 2009 as an example, when the market was down hard in the first quarter after the crash caused by the global financial crisis, followed by a straight line up for the rest of the year.

“Within that there was quite a lot of volatility, and rotation of names, and volatility from month to month,” Page said. “Actually in that sort of environment rebalancing more frequently just across the portfolio makes sense.”

However despite the recent rotation and volatility seen in the last few months, Page doesn’t see the fund rebalancing any more often than usual this time around.

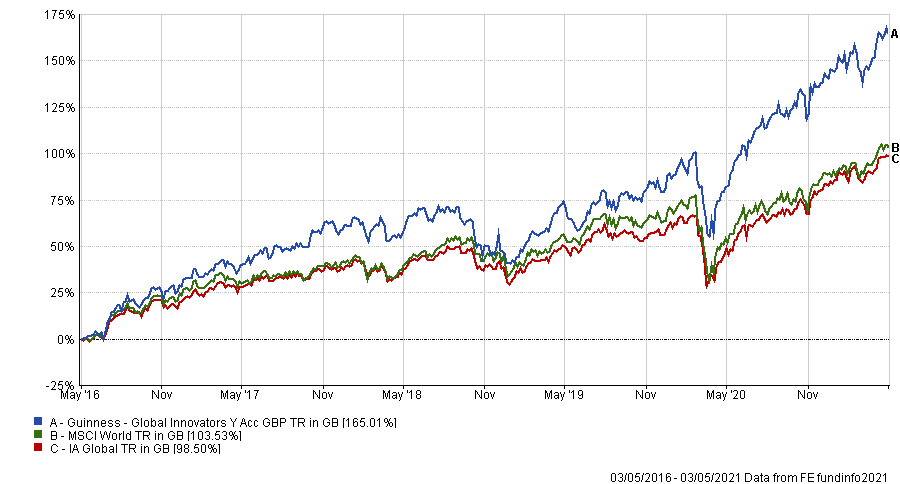

Guinness Global Innovators has delivered a 165.01 per cent return over the last five years, compared to 103.53 per cent from the MSCI World benchmark and 98.5 per cent from the average IA Global fund.

Performance of the fund over the last 5yrs

Source: FE Analytics

Clients of Ethical Offshore Investments can get access to this highly rated Guinness Fund, where we will allocate to the Y share class version of the fund. This will ensure that there is a Nil entry fee and that investors will access the version of the fund that has a lower annual management charge (0.86%pa as opposed to 1.95%a for the general C class version).

Please click below for more information on how to get access to this highly rated fund.