Nuts about Brazil: Latin America’s largest economy is having its moment in the sun

Brazil’s inflation, monetary policy and fiscal discipline are the envy of the developed world.

23 January 2024

By Alison Savas

By Alison Savas

Falling inflation, falling rates and fiscal repair. It’s the backdrop the developed world is aspiring towards.

But the economy we’re referring to is Brazil – and there’s a lot to like, with both cyclical and longer-term structural opportunities.

While we’re excited about today’s improving fundamentals and attractive valuations, the environment hasn’t always been as prospective. In early 2022, Brazil was suffering from very high inflation driven by high food and power prices owing to drought from La Nina.

The target policy rate set by the central bank (the Selic rate) rose from 2% to 13.75% over an 18-month period which, amongst other things, put a lot of pressure on highly geared corporates.

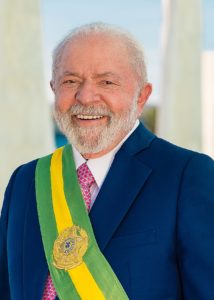

Meanwhile, the election of the left-leaning President Luiz Inácio Lula da Silva added uncertainty around uncontrolled fiscal spending.

But today, Brazil is poised for recovery, providing an attractive window of opportunity for stock market investors.

An evolving cyclical setting

As a result of policy makers moving with such purpose, inflation has fallen back to mid-single digits and the central bank has embarked on a rate cutting cycle. Our analysis suggests inflation is on track to remain around 4% in 2024, leaving plenty of room for further rate cuts. The market has priced the Selic falling to 9.75% by mid next year.

Fears around unconstrained fiscal spending have not come to fruition. The Lula government is targeting a primary fiscal surplus in 2025 (government revenue less spending but excluding interest payments), which will be the first primary surplus since 2013.

This fiscal discipline comes at a time when nominal GDP growth has been resilient and government revenue has been supported by strong commodity prices. Government debt has fallen from 90% of GDP at the peak of Covid to 75% (Biden and co. could take note).

While the political backdrop looks relatively stable today, politics and regulation have not always been supportive, so a healthy dose of scepticism should remain around whether Lula can achieve his fiscal goals. Brazil has a large public sector and generous social security programs which are hard to reform, but the point remains that the government is taking a sensible approach to spending and the trajectory is promising.

Structural strength

Brazil’s structural opportunity may not be as well understood – or priced – by the market. Brazil, and Latin America more broadly, have the resources to feed the world and can be a key enabler of the energy transition.

When it comes to agriculture, it is Brazil’s key export sector.

The country is one of the largest exporters of soybeans and meat globally, as well as exporting corn and sugar (and let’s not forget coffee beans, the lifeblood of this investment team).

The global population is growing and with the middle class expected to reach 6 billion people by 2050, demand for Brazil’s soft commodities can remain strong. And while a large chunk of these exports find their way to China, demand for food staples should remain relatively resilient even with a slower-growth China.

Then there’s Latin America’s role in energy transition. Low carbon technologies require meaningfully more minerals. For example, electric vehicles require up to four times more copper than an internal combustion engine vehicle to electrify the power train. Latin America is a large and low-cost producer of many of these commodities. Brazil has exposure via graphite and nickel, key materials for batteries.

Brazil is also a large producer of crude oil, which may feel at odds with the energy transition.

Brazil exports crude but imports refined products, which washes out to oil accounting for a marginal share of the country’s net exports. This means Brazil has a greater degree of energy independence than many other emerging economies (for example, India) but arguably it isn’t dependent on continual pumping. That said, taxes paid on profits from oil and gas certainly support the government’s coffers.

In this context it may surprise many that Brazil generates two-thirds of its own energy from hydropower, so a pathway to cleaner generation is firmly in place.

An undervalued stock market?

Despite these cyclical and structural tailwinds, Brazilian equities are priced on just 8x forward earnings.

But this alone should not be reason to allocate capital. Investors must be selective.

Three examples of how we’re providing clients exposure to this turning point for Brazilian equities are Itau Unibanco (NYSE: ITUB), Sendas Distribuidora (NYSE: ASAI) and Nu Holdings (NYSE: NU).

Itau Unibanco is one of the leading private sector banks in Brazil with around 12% share of total loans. The Brazilian banking system is relatively consolidated – the top four banks account for almost half of system loans – and the private sector banks are taking share from the state-owned incumbents.

Household debt is still only 35% of GDP, which is low relative to other developing economies.

One-quarter of Brazil’s population still remains unbanked. We see an opportunity for loans to grow and credit penetration to increase in a more benign macro backdrop. We like Itau’s exposure to a wealthier customer base which can be a competitive advantage for profitable lending, e.g. cross selling products and managing non-performing loans through the cycle.

We see Itau’s earnings growing around 20% p.a. as loan growth accelerates in a stronger macro backdrop. The bank is well capitalised, has a dividend yield of c. 6.5%, is priced at just 1.3x book and has consistently delivered an ROE of circa 20%.

Alison Savas is an investment director at Antipodes Partners. The views expressed above should not be taken as investment advice.

Please Note:

This article was first published by Trustnet and is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

Socially Responsible Investing – Ethical Business Standards