Trade the Tape – Will the Bond Vigilantes Strike Back

Please find below the latest update from Adrian Tout from his regular newsletter, “Trade the Tape”.

Please note that this is for general information only and should not be considered personal financial advice.

The purpose of publishing these newsletters on the Ethical Offshore website is to provide investors some simple, easy to understand technical details on why the US markets are behaving the way they are at the moment, what has occurred to get them where they are, and what actions may influence where they end up in the near future.

The way Adrian Tout explains all this, in simple terms, I believe is good reading for any investor to get a better understanding of what is happening within the financial markets, what risks to be aware of and how to take advantage of these market conditions for your medium to longer term investment journey.

February 8, 2024 – Adrian Tout

Will the Bond Vigilantes Strike Back..??

-

US Government’s insatiable appetite for even more debt

-

Record Treasury auction this week – $42B in 10-Year Notes

-

Building the case for higher yields in the years ahead

Today the US federal government sold a record $42B of 10-year notes:

This was a closely watched bond auction – with the potential to push bond yields higher if there was a lack of demand.

But this wasn’t the case… it was well bid… fetching a yield of 4.093%

Markets exhaled.

Of particular note – international demand was at 71% versus a six-month average of 66.4%.

Makes sense…

The US is arguably one of the safer (or economically stronger) markets to put money to work.

For example, China is in the midst of debt-deflation spiral – with ratings agencies putting them on notice (following the imminent collapse of Evergrande – with the debts in excess of ~$300B)

Europe is in and out of recession – with the UK not much better.

From that lens, the US looks like a decent alternative.

The US Treasury said last week that it plans to continue gradually raising coupon auction sizes through April.

A $54 billion sale of three-year notes saw solid demand on Tuesday. The Treasury will also sell $25 billion in 30-year bonds on Thursday.

Why record debt issuance you ask?

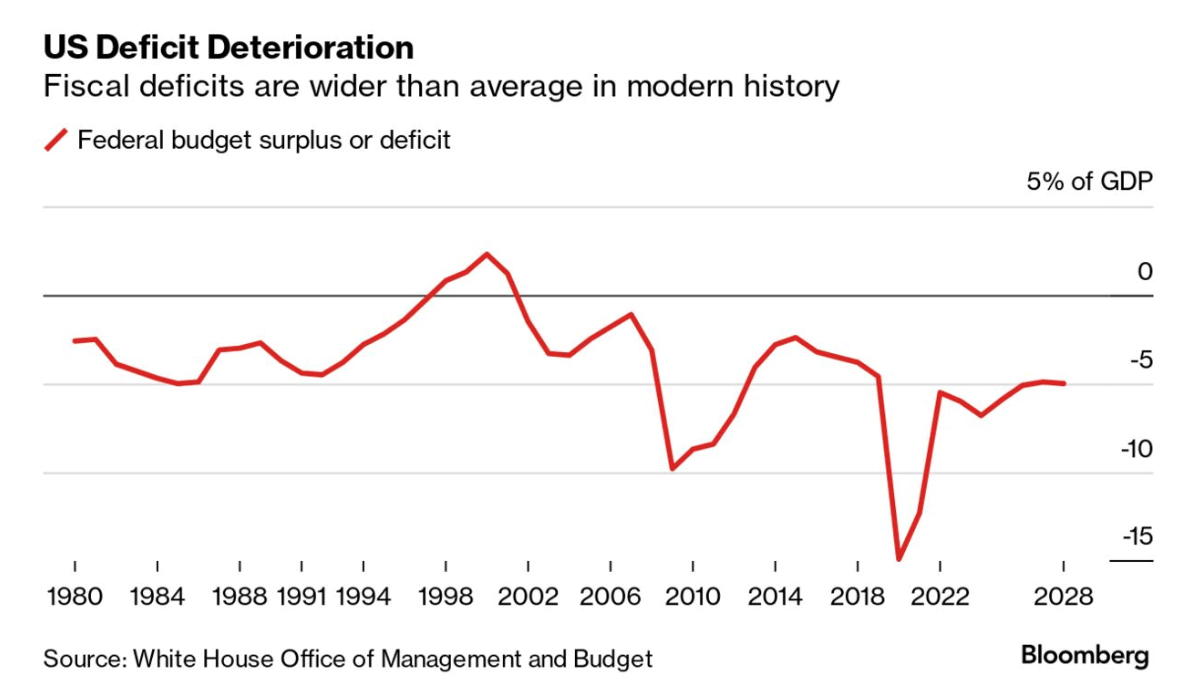

Simple: widening budget deficits.

And that’s a problem.

Powell’s Warning

Last weekend Fed Chair Jay Powell gave a rare interview with 60 Minutes.

Not only did Powell tell people to expect rates higher for longer – he also sent less than subtle warnings to Congress. I quote:

|

“It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path” |

Amen.

But good luck with that Jay.

When asked if this was an urgent problem – Powell said “…sooner is better than later. You could say that it was urgent, yes.”

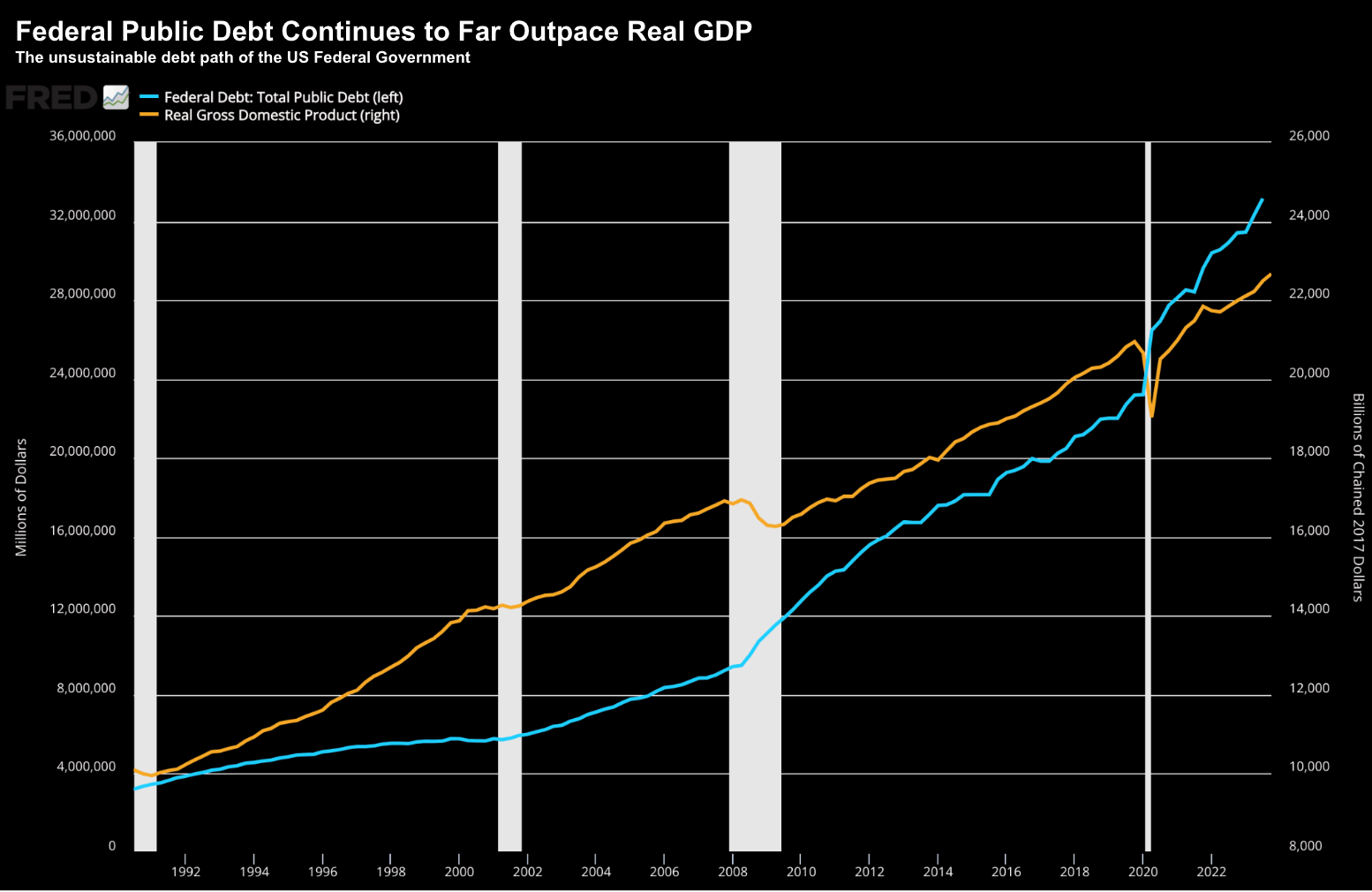

I might be wrong – however I suspect the Chairmen is looking at this chart – where federal debt continues to outpace real GDP (i.e. output).

Another way to interpret this chart: it’s costing greater amounts of debt (at higher rates) to maintain the same rate of growth.

This is not a sustainable path.

Bloomberg reported that former Fed Chair – Janet Yellen – since taking the position in Treasury – has consistently said that the right metric to look at is real net interest as a share of GDP — in other words, the inflation-adjusted interest rate that the government is paying for its total debt, compared with the size of the economy.

However, this week she highlighted that the Biden Administration’s budget proposal last year would have kept that rate at around 1%, an “historically normal” rate, in coming years.

Originally the budget was said to include $2.5 trillion of proposed deficit reduction – however Congress failed to act.

There were no cuts… just increased borrowing and spending.

Efforts to reduce spending were blocked.

This has put Yellen in a bind.

When pressed on the ‘urgent issue’ of widening deficits (and increased debt) she said recently: “I don’t want to express a view – the jury’s still out”

This was in stark contrast to a year ago.

Powell explained the basic math to 60 Minutes (echoing my chart).

He said… “federal debt is growing faster than the economy. So, it is unsustainable.”

This isn’t rocket science.

As an aside, renowned investor Paul Tudor Jones, told CNBC this week that he agreed with Powell in thinking that the federal government is on an unsustainable fiscal path.

Someone want to tell Congress?

The Case for Higher Rates

With inflation coming down and the prospects of maybe two or three central bank rate cuts later this year – bond yields have retreated from their recent highs.

For example, the 10-year peaked just above 5.0% to trade almost 100 basis lower this month.

And from mine, this has been a large catalyst for the massive equity rally the past few months – especially longer-duration assets (e.g. tech)

But here’s the thing:

Given the troubling fiscal situation – there’s no guarantee the bond vigilantes won’t return with vigor.

In other words, they will demand higher compensation for buying US debt.

On this subject, I caught this CNBC interview with billionaire investor and hedge fund manager Leon Cooperman.

Cooperman is Chairman and CEO of Omega Advisors, a New York-based investment advisory firm managing over $3.3 billion AUM – the majority consisting of his personal wealth.

He echoes much of my sentiment:

|

As a complete aside, when I find too many people who agree with my thesis, I start to ask what I could be missing?

Here’s Cooperman:

|

“Everybody came into 2023 with a very negative view, and the market went up quite a bit. Everybody is now positive, and so my guess is that by the end of the year, maybe we will go down” |

Too rich for me too Leon!

On the subject of unsustainable deficits and debt – he said this is a reason we could see much higher rates.

The U.S. government ran up another half a trillion dollars in red ink in the first quarter of its fiscal year.

The jump in the deficit pushed total government debt past $34 trillion for the first time (see my earlier chart)

|

“Given the amount of debt that we’re creating in the system, I wouldn’t be a buyer of government bonds at these levels” |

Put another way, Cooperman does not feel a 10-year note yielding around 4.0% is adequate compensation.

If he (and Tudor Jones) are right – it could spell trouble for equities should bond vigilantes wake up.

Putting it All Together

From mine, this is a potential blind spot for equity investors.

They are paying a very high multiple to own stocks (e.g. 21x forward) and are pricing in as many as six rate cuts.

As Cooperman says – this is a risky bet.

Powell essentially ruled out a rate cut in March (as part of this 60 Minutes interview) – whilst stressing the urgency of the worsening US fiscal situation.

And from mine, Yellen’s unwillingness to answer the question of fiscal responsibility this week spoke volumes.

What happened to the $2.5 Trillion in planned spending cuts?

From mine, it’s unlikely Congress is going to find any agreement to aggressively cut spending.

However it needs to be done…

Which raises a question: who is going to vote for austerity measures?

Cutting spending is never popular.

But at some point, you don’t get a choice. Your hand will be forced.

Keep an eye on bond yields.

Regards

Adrian Tout

The above article is for information only. The views of the author or any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy, sell or hold any specific investment or to adopt a particular investment strategy. However, the knowledge that professional analysts provide can be a valuable additional filter for anyone looking to make their own investment decisions.

Ethical Offshore Investments provides guidance on portfolios that have an ESG (Environmental & Social Governance) bias and an SRI (Socially Responsible Investing) focus. By avoiding high charging, commission paying funds, this results in lower portfolio costs, so more of the growth staying in the pockets of our clients.

Ethical Offshore Investments can also assist clients in getting exposure to the investment markets such as the broad S&P 500 index through very low cost Exchange Traded Funds (ETF’s) as well as investing directly into the individual stocks.

If you would like to get more information on the Sustainable Ethical Allocation portfolios, or enquire on the vast array of Sustainable and Ethical style funds available, please click on More Information.