Guinness Sustainable Energy Report – March 2023

This is a marketing communication. Please refer to the prospectus and KID/KIID for the Fund, which contain detailed information on its characteristics and objectives, before making any final investment decisions.

An improving outlook for the wind industry

March 2023

Executive Summary

Wind is the second most significant renewable power generation source. In recent years, the industry has faced headwinds as it has wrestled with COVID-related disruptions and various regulatory “air pockets”. Recent policy announcements as well as the slowing of raw material and energy cost inflation means that sentiment towards wind appears to be turning more positive in recent months.

Recent policy support for the wind industry

Recent policy announcements in the US, Europe and China have been positive for the wind industry, benefitting in particular the onshore wind sector, which had started to lag the growth outlook of the offshore sector.

In early 2022, Europe announced its REPowerEU plan which committed a further EUR 86bn in incremental renewables investment out to 2030. While the scale of investment is significant, the Act particularly benefits onshore wind because it seeks to remove Europe’s permitting bottlenecks and to streamline the permitting process from an average of 6 years to an average of 2 years. Streamlining this process is critical, we believe, because onshore wind farms typically face higher levels of local opposition. If achieved, we would expect the onshore industry will see a big step up in demand: the backlog of projects awaiting permitting in Europe is around five times the level of annual installations.

Subsequently, the US announced its Inflation Reduction Act which outlined a $369bn package targeting climate and energy security, focusing on reducing emissions from (amongst other things) electricity generation and transport. The Act changes the investment outlook for onshore wind because it extends current tax credits (the Investment Tax Credit (ITC) and the Production Tax Credit (PTC)) to 2033. For a longer cycle investment activity such as wind, this provides much needed visibility around project economics. Historically, the PTC has been made available for much short periods, providing visibility for perhaps one or two years at certain points – a period that is not helpful for wind projects that typically takes at least three years for development. According to Princeton University, the combined incentives may help increase US wind installations by 2x over the next three years compared to 2020 levels.

To remain competitive with the IRA, the EU proposed an EU industrial strategy in early February 2023. We expect to hear more details at the 23rd-24th March EU Council meeting but initial plans suggest the introduction of a “European IRA”, designed to increase significantly the manufacturing of clean energy equipment and the installation of clean energy products. One of three key attributes of the plan is better regulation and the removal of bottlenecks which would require each member state to speed up the permitting of renewable facilities via a single “approval entity”, so removing the current multi-step approval process that exists in many countries. The introduction of a time limit for the process (that would allow delayed projects to be approved centrally by the EU) as well as further administrative capacity would help to speed up project development timelines. In response, Germany have already announced plans to speed up its own permitting process including proposed legislation that will scrap the environmental impact assessment for wind generation projects. Onshore wind will also benefit from the other areas of increased financial support for clean energy projects and the proposal of a Critical Raw Materials Act that would allow for the diversified sourcing and recycling of raw materials critical to the energy transition.

The scale of the task ahead for the EU was highlighted by Vestas in its recent full year 2022 results commentary as follows “the EU Green Deal Industrial Plan aims to accelerate renewables with EU funding to be stepped up but also easing state aid approvals. 2022 installations were 50 percent below climate target and 2022 orders were down 47 percent year-on-year due to slow permitting”.

Less talked about has been the Chinese 14th 5-year renewable energy plan which aims to double the installed capacity of both wind and solar by 2030. This has led to China’s major state-owned power companies setting goals to increase total wind and solar capacity by 600 GW by 2025 (5 years ahead of schedule). This could potentially provide significant opportunity for many of the wind developers and wind power generators that we track in our universe, although it is unlikely that European and US wind turbine manufacturers will be able to benefit since the Chinese market is essentially closed to them.

Improving price and margin outlook for turbine manufacturers

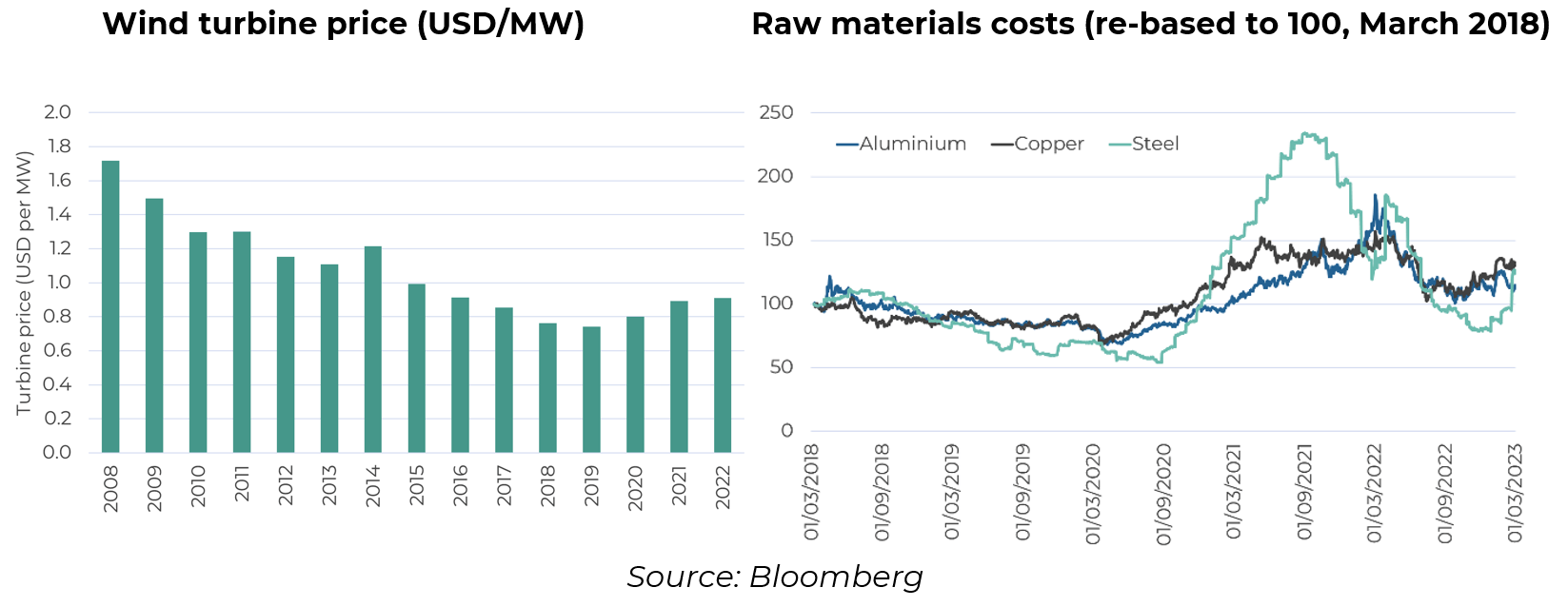

Recent policy support actions coincide with signs that wind turbine pricing is starting to improve and raw material costs are starting to fall.

There has been delay in turbine manufacturers passing on cost inflation, reflecting the fact that wind turbine manufacturing is a reasonably long cycle activity with around three years between order and delivery for a wind development.

However, in its latest update, Vestas indicated that the average selling price of its wind turbine order intake was Eur1.15m per MW in Q4 2022, up nearly 34% from the Q4 2021 level of Eur0.86m per MW. Broader industry data from Bloomberg indicates that average per MW wind turbine order prices are up 23% in 2022 versus 2019. We expect the inflationary pricing trend to continue as wind turbine manufacturers sign new contracts, providing an opportunity to pass on raw material, energy and wage increases to their customers.

To the benefit of turbine manufacturers, we note that some of the key raw materials (for example steel, copper and aluminium) appear to be past their periods of highest price rises. Indeed, the current picture suggests that the manufacturers may now start to enjoy a period of turbine price inflation coupled with raw material cost deflation.

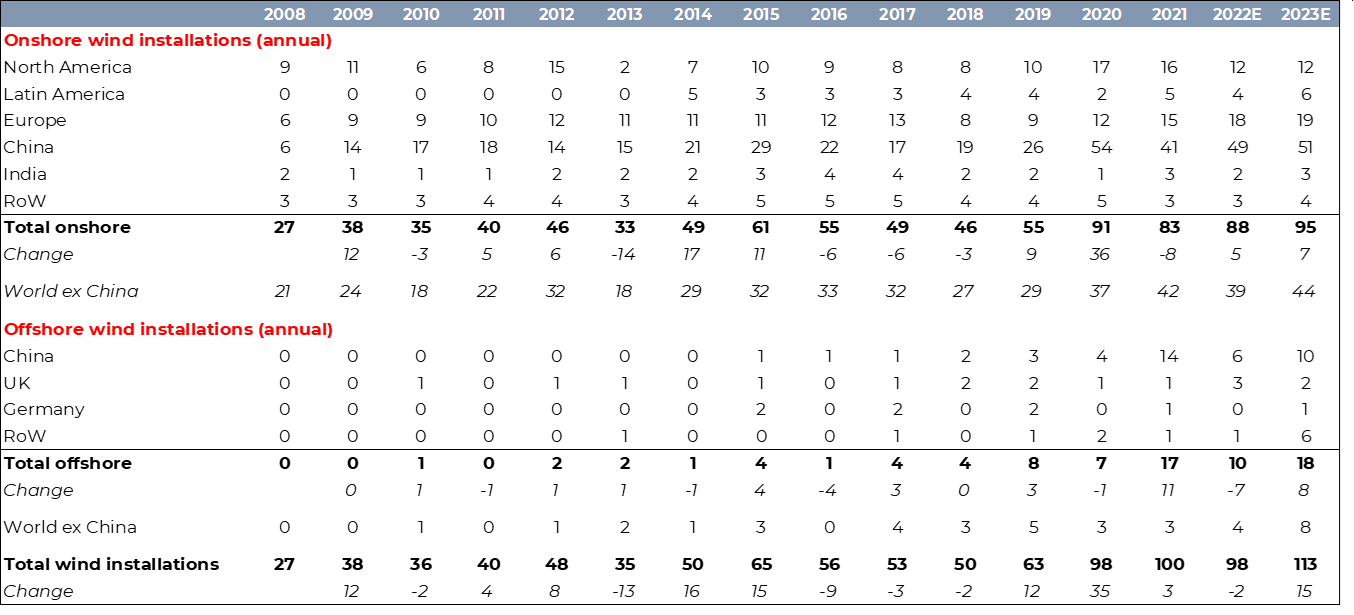

The result of the policy initiatives and the raw material and product price movements mentioned above is that we expect onshore installation growth to triple from our prior 2022-2030 growth rate estimate of 5-6%pa, allowing global onshore wind generation capacity to nearly triple by 2030.

Complementing the improved picture for onshore wind is a positive outlook for the offshore wind industry, which still represents only 7% of global wind capacity. We expect offshore capacity to grow nearly five times by the end of the decade, driven by broader geographic penetration, improving economics and supportive policy. These dynamics have seen us increase our 2030 capacity outlook for offshore wind to close to 300 GW, implying 20%pa growth versus 2021. By then, we expect Europe and China to account for the majority of installations, with the US still accounting for less than 10% (even if President Biden’s target 30GW plan is enacted).

Annual onshore and offshore wind installations (GW)

source: BP, IEA, BNEF, Guinness Global Investors estimates

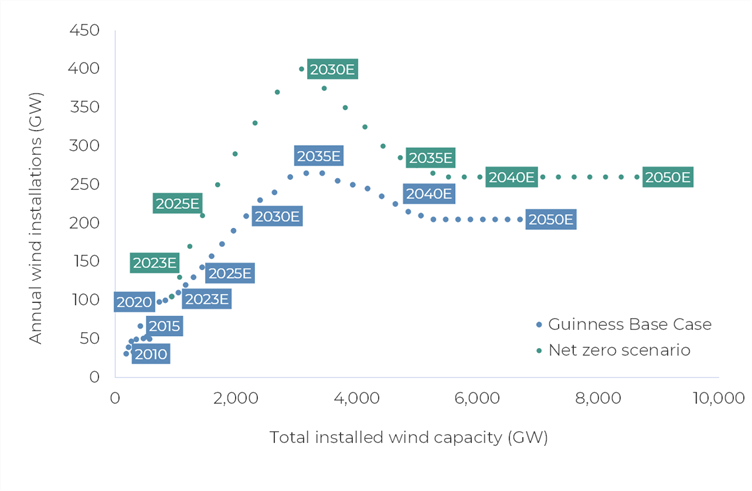

The long-term outlook for the wind industry remains very positive as the sector plays a critical role in global decarbonisation and the energy transition. We are increasingly confident that these issues will inflect positively over the next few years as a result of policy as well as price increase and a slowdown in raw material cost inflation, leading to a sustained ramp in global wind installations out to 2030 which will bring total installed capacity to around 2.2 TW in 2030.

However, this base case outlook is not sufficient for a net zero outlook. The Guinness net zero scenario indicates that total installed capacity would need to be 3.1 TW in 2030 (a compound growth rate of 16%pa from 2021) and that reaching this level of installed capacity would require annual installations to reach as much as 400 GW pa. While there appears to be significant policy support to grow the wind industry, we note that it has a very significant way to go in order to be fully aligned.

Global wind annual installations, base case and NZE scenario

source: IEA, IPCC, Guinness Global Investors

To read the full report, please click HERE.

The Managers

Will Riley – Portfolio Manager

Will joined Guinness in 2007 and has been managing energy funds since 2010.

Johnathon Waghorn – Portfolio Manager

Jonathan joined Guinness in 2013 and has been managing energy funds since 2008.

The value of this investment and any income arising from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested. Past performance does not predict future returns.

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we can access the fund mentioned in this article on the various offshore investment platforms we offer. We do NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investments costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards