Developed market equities to deliver 8.3%pa return over the next decade

Why is now a good time to invest..??

14 March 2023

The next 10 years will be more positive for both stock markets and fixed income investors, digital wealth management firm Moneyfarm has predicted.

They have predicted that developed equity markets is likely to be the best performing asset class, with annual return of 8.3%pa over the next 10 years, with emerging market equity and emerging government bonds set to be the next two best performing asset classes, with annual returns of respectively 6.6% and 6.4%.

More broadly, fixed income should experience a revival, with the different categories of bonds delivering returns of at least 3% each year.

Last year was generally not a good year for investors, with most equity indices significantly lower. And investments in Fixed Interest and Bond assets also experienced losses with some bond sectors suffering even more than the riskier equities. At time of writing, we are now seeing an increase in volatility due to the small regional bank collapses in the US. And just to add to the current negative sentiment, there appears to be some serious concerns with Credit Suisse which is pushing equity markets further into negative territory.

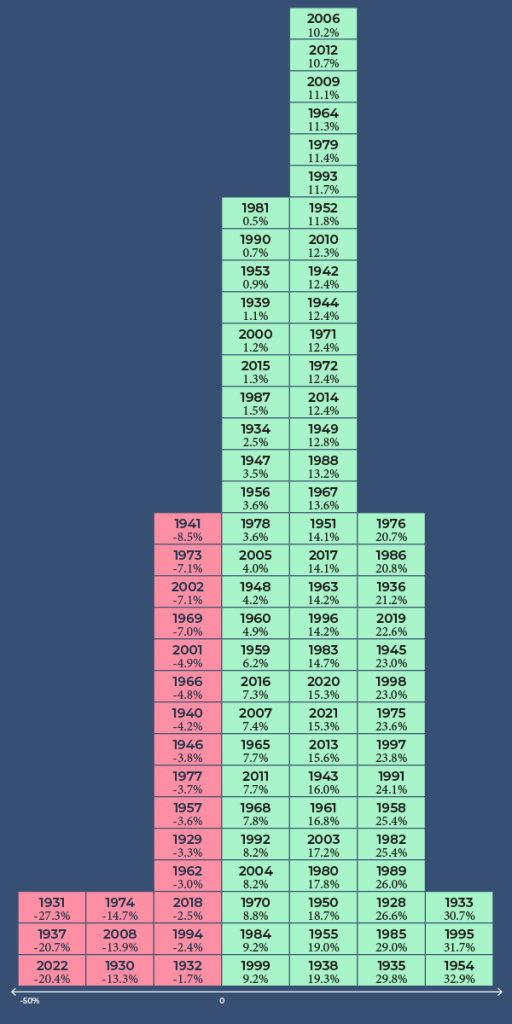

Moneyfarm warned, however, that parking money in cash has not historically been the best course of action. From 1930 to 2022, there were a total of 71 positive and 21 negative years for stock markets, which have typically outperformed.

Chris Rudden, head of investment consultants at Moneyfarm, said: “A market downturn should not be seen in a negative light entirely. There is, after all, an opportunity to capitalise on lower valuations.”

Rudden added: “Cash investments have their place for short term needs and can be useful for those ‘raining day’ events, however, history has shown that investing in stocks and shares portfolios tends to provide investors with a better outcome on longer term savings.”

The wealth management firm does not expect cash investments to offer similar annual returns over the next 10 years as stocks or bonds.

Commodities and real estate were the only asset classes that they have forecast to offer returns below the Bank of England’s inflation target of 2%, with annual returns of 0.3%.

Source: Moneyfarm

During a downturn or a bear market, it can be tempting to panic and sell off your investments.

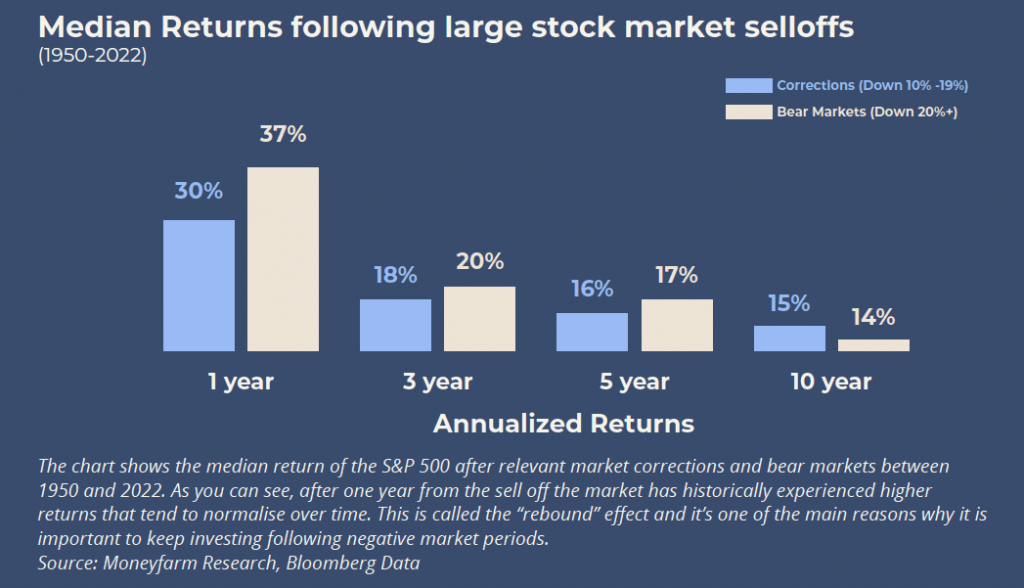

However, historical data from 1950–2022 shows that this is unlikely to be the best course of action.

In fact, after a market correction, the median one-year performance is 30%, while after a bear market, it is a median of 37%. This performance then normalises in three years to a median of 18% and 20%, respectively. History also shows us that there are generally more positive years than negative ones (see second chart below). That’s why it’s crucial not to miss out on the rebound.

You could beat inflation through compounding…

The real value of £100,000 left in an account could fall to £75,000 in 10 years with the current trajectory of inflation. The firm forecasted levels of inflation for 2023 and 2024 of 6.7% and 2.4% respectively. Inflation should then return to 2% from 2025 onward.

With current levels of inflation, your capital could lose over 10% of its purchasing power within the next year. Even if you assume a 2% inflation rate, which is the Bank of England’s target, your capital could still lose a further 15% (or more) of its purchasing power in the next 10 years. For example, if you have £100,000 in the bank, its real value could decrease to less than £75,000 in a decade if just kept in a cash account. With the right investment strategy and by taking advantage of compounding you can potentially earn returns that outpace inflation and help secure your financial future.

There’s been a lot of talk about a recession. But fear of a recession shouldn’t keep you out of the market.

While market downturns can sometimes come before recessions, it’s also true that market rallies can happen during economic downturns in anticipation of a recovery. Avoiding the market during these times can have a negative impact on your financial outcomes for many years to come, so investing now can be hugely beneficial.

Please note the information for the above article was obtained from Trustnet as well as from Moneyfarm. This article is for general information only. The views of Moneyfarm and any people quoted are their own and do not constitute financial advice.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, our clients can access a wide range of high quality managed funds, low cost ETF’s and direct shares and not be subject to additional entry or exit fees. As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to see how you can save on your investments costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards