Gold could hit record high of $2,500, says WisdomTree

In a best-case scenario the asset class would soar, but there are also reasons to be bearish.

18 July 2023

By Jonathan Jones,

Editor, Trustnet

Gold is on track to hit a new record high of $2,225 per ounce by this time next year, according to Nitesh Shah, head of commodities and macroeconomic research at WisdomTree. However, if things go right, the precious metal may shoot even higher to $2,500 per ounce.

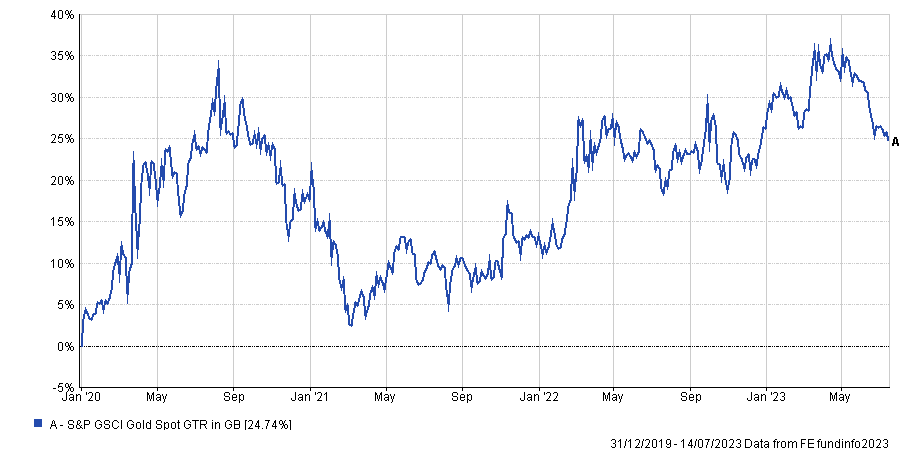

Investors in the yellow metal have had a rollercoaster over the past few years. In 2020, when the pandemic caused investors to duck for cover, it held up as a safe haven, with prices rising 17.2%. In 2021, with expectations of a recovery, it softened 3.4%.

Last year was another upswing as markets were shook by rising interest rates and inflation, war in Ukraine and the prolonged lockdown measures in China. As a result, gold surged another 11.8%.

This year, with investors taking a sanguine view on markets, it has nudged 1.4% lower. Overall, it leaves investors that bought the metal at the start of 2020 up a glistering 24.7%, with the spot price at $1,955 at the time of writing.

Gold spot price since start of 2020

Source: FE Analytics

Shah said much relies on macroeconomic data, specifically from the US. Consensus expectations are “for inflation to continue to decline (although above the Federal Reserve target), the US dollar to depreciate, and bond yields to continue to fall”.

Theoretically, rising rates is poor for gold, as the better yield on offer from low-risk bonds means investors move from the speculative gains from the precious metal to the certainty of yield.

However, rising rates this time around brings the world closer to recession – an environment where its safe haven status should prop up the price.

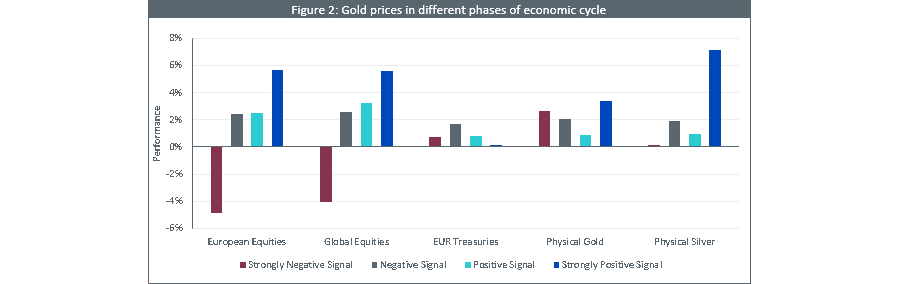

“Gold tends to perform well in times of economic stress. As the chart below shows, when composite leading indicators turn strongly negative, gold performs positively while equities tend to be negative. Gold also outperforms Treasuries, which are seen as competing defensive assets,” said Shah.

Source: WisdomTree

As such, in the consensus case scenario, gold could reach $2,225 per ounce by the second quarter of 2024, clearing the previous all-time nominal highs of $2,061 per ounce set in August 2020.

Invesco’s Paul Syms, head of EMEA ETF fixed income and commodity product management, was also bullish on the precious metal.

Last month he wrote: “We believe gold remains an asset worth holding especially given uncertainties around the US debt ceiling, any further banking crisis, a correction in stock markets, escalation in the war or countless other geopolitical concerns.”

But things could get even better, said Shah, if we get a scenario where the Federal Reserve “pays heed to the recession warning signs and pivots its monetary policy to cutting rates faster” before inflation is below the target level.

“If the Fed begins monetary expansion by autumn 2023, bond yields will be falling and, assuming it moves before the European Central Bank and other major central banks, we could see the US dollar depreciate at a faster rate.

“We assume inflation will be stronger than in the consensus scenario as a result of the Fed loosening monetary conditions. Assuming that the recession fears that the Fed is responding to are real, we expect positioning in gold futures to remain elevated.”

In this scenario, gold could reach $2,490 per ounce, 22% higher than the all-time high.

The bearish view, which is that inflation falls below the Fed target meaning the central bank overdoes its monetary tightening, would cause the US dollar to appreciate and bond yields to rise.

While this increases recession risk and could be positive for gold as a hedge, it does pose the most risk to the yellow metal.

In this scenario, gold would reach $1,710 per ounce, bringing prices back to November 2022 levels.

This article is provided for information only and was first published by Trust Net. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, clients can access very low cost Exchange Traded Funds that are backed by Physical Gold Bullion holdings, that track the spot price of Gold.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investments costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards