Trade the Tape – What Banking Crisis..??

Please find below the latest update from Adrian Tout from his regular newsletter, “Trade the Tape”.

Please note that this is for general information only and should not be considered personal financial advice.

The purpose of publishing these newsletters on the Ethical Offshore website is to provide investors some simple, easy to understand technical details on why the US markets are behaving the way they are at the moment, what has occurred to get them where they are, and what actions may influence where they end up in the near future.

The way Adrian Tout explains all this, in simple terms, I believe is good reading for any investor to get a better understanding of what is happening within the financial markets, what risks to be aware of and how to take advantage of these market conditions for your medium to longer term investment journey.

July 17, 2023 – Adrian Tout

What Banking Crisis..??

-

S&P 500 now up ~ 30% from the October 2022 low

-

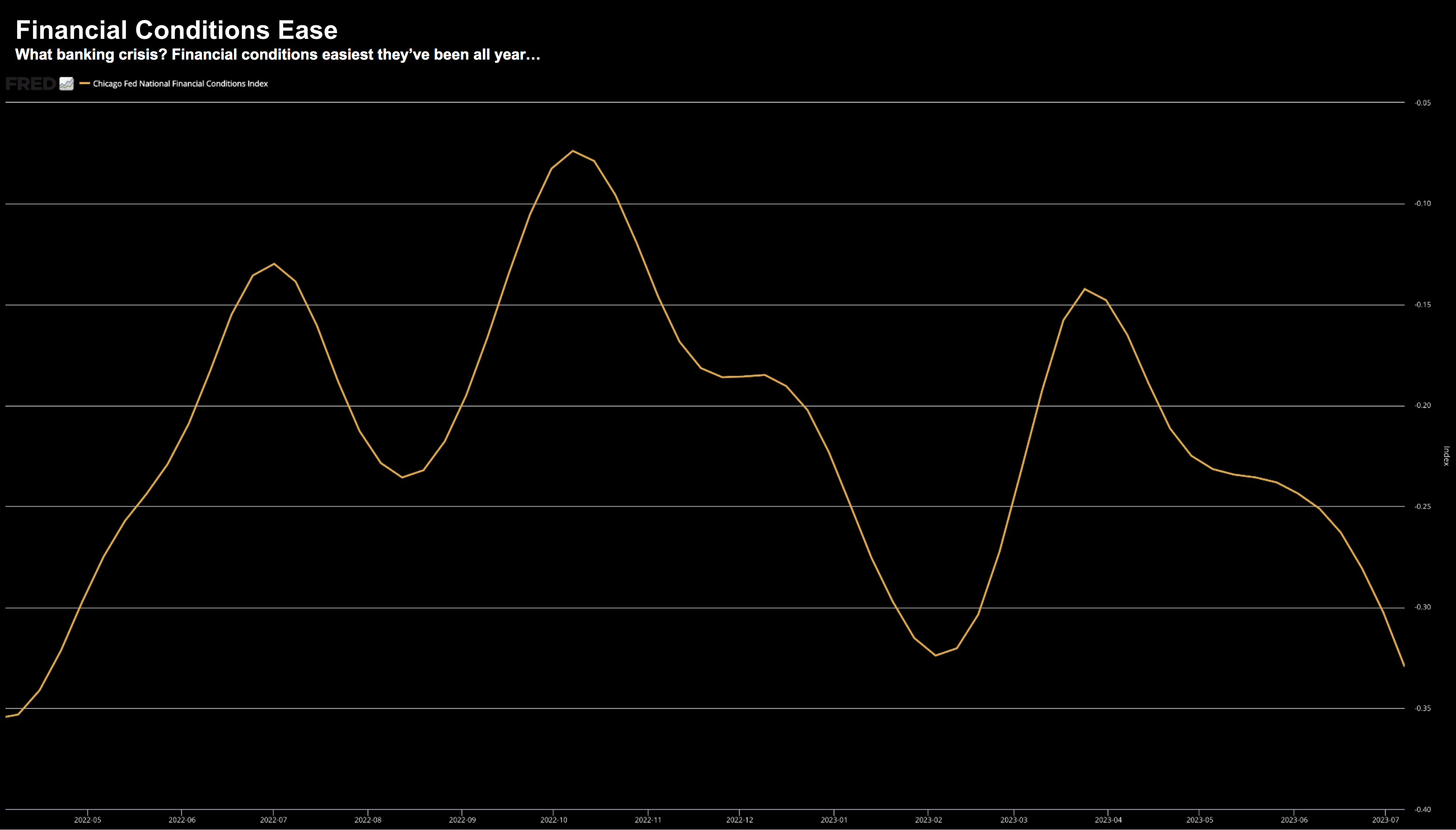

Financial conditions continue to ease; and

-

Will the Fed remove their ‘liquidity put‘ with the banking crisis over..?

Are things actually looking up?

If your measure is the equity market… you would say absolutely.

Stocks continue to charge higher on the back of lower inflation and optimism the Fed is closer to the end of its hiking cycle.

What’s not to like?

However, there’s something else giving markets a boost.

Easy money!

Financial conditions are as easy as they’ve been all year.

For example, it was only 4 months ago and we had a mini banking crisis… where funding was a lot tighter.

That’s now a distant memory.

Take a look at the Chicago Fed’s Financial Conditions Index:

Jul 17 2023

The spike higher in financial conditions happened in March (when SVB went belly up) – coupled with a distinct loss of risk appetite.

That’s mostly now rear-view mirror…

However, what it led to deserves comment.

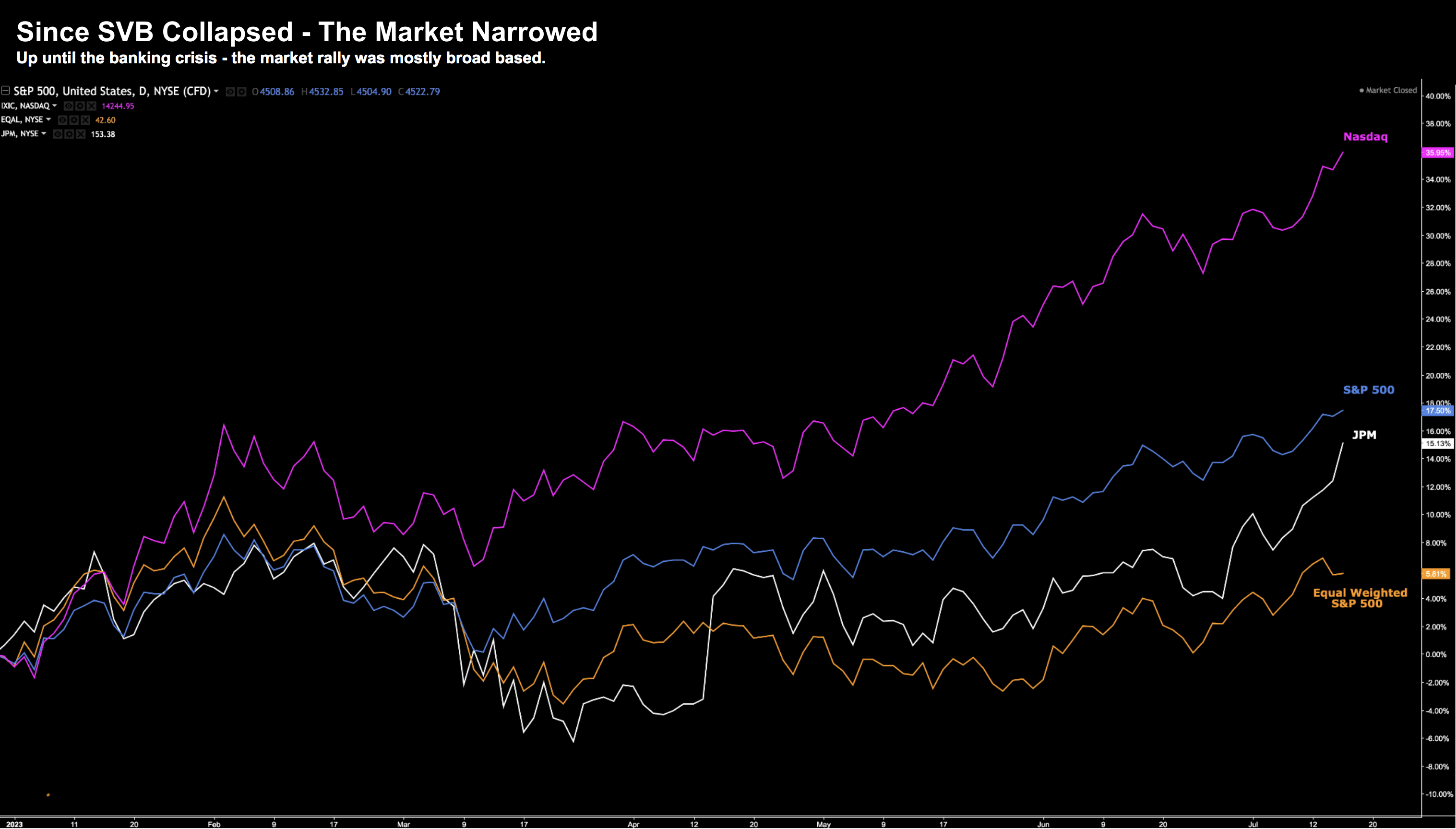

Banking ‘Crisis’ Led to a Narrow Market

Last Friday marked the unofficial start to the Q2 earnings season.

We heard from the US’ largest bank by assets (and stock I own) – JP Morgan Chase (JPM).

Revenue rose 34% as JPM took advantage of higher rates and solid loan growth.

It was an incredibly strong quarter.

Wells Fargo and Citi also beat expectations… commenting that consumers remain in good shape.

We will hear from Bank of America tomorrow (which I also own) and other key regionals.

Now March 10 this year – Silicon Valley Bank (SVB) collapsed.

The sentiment was very different… it was ‘risk off’.

I had some readers (who unsubscribed at the time) telling me I was totally wrong – and this was a repeat of 2008.

I wished them well with the short bets on banks (and the market).

As it turns out, it was not the end of the US banking sector (as they predicted) – and it was the start of a very narrow rally:

July 17 2023

From mine, this tells an interesting story.

What we saw was money finding its way to whatever offered the best return opposite the lowest risk.

Stocks like Apple, Amazon, Google, Meta, Microsoft, NVIDIA, Tesla, Netflix all ticked that box.

Strong predictable cash flows with great balance sheets.

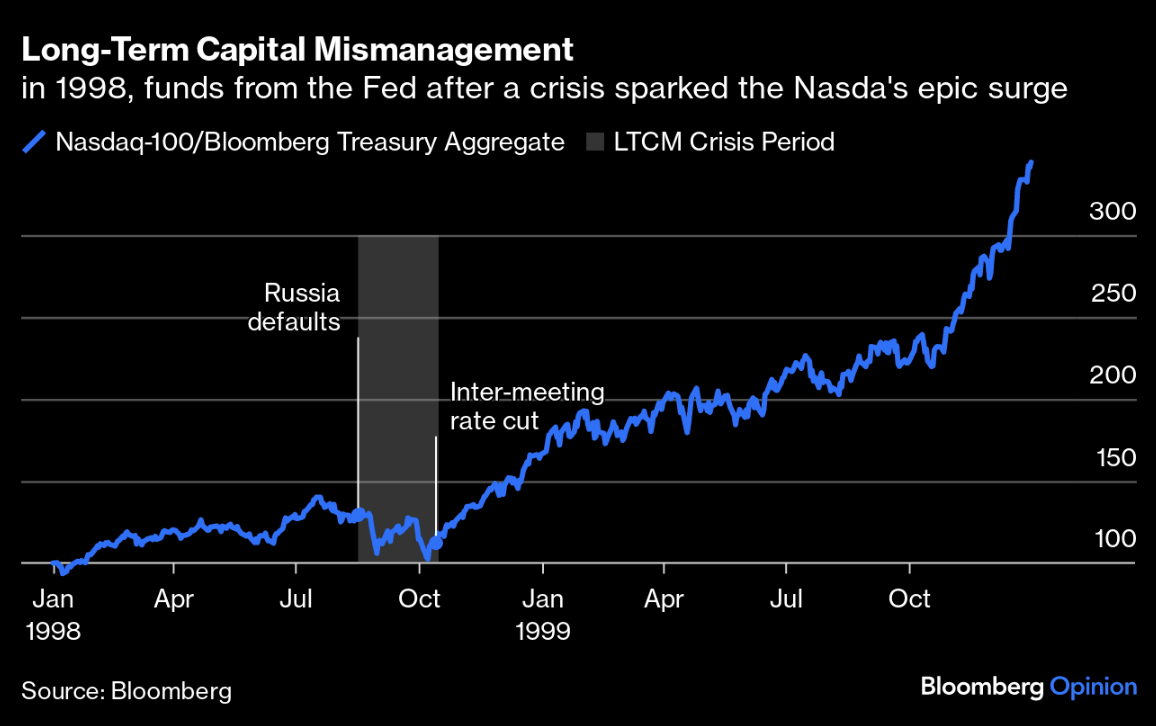

But this behaviour isn’t new…

In fact this is a pattern we have seen many decades ago.

For example, almost 30 years ago a hedge fund known as Long-Term Capital Management collapsed – which saw the Fed rush in to ensure there was liquidity.

The Fed – under Alan Greenspan – also announced an intra-meeting cut in the fed funds rate and the effect was immediate.

Here’s Bloomberg:

Rinse and repeat in 2023.

Now the events which caused the collapse of LTCM were nothing like what we saw with SVB and First Republic.

But the (central bank) remedy and subsequent market impact were similar.

For example, whilst effective Fed funds rates continued to rise, the extra liquidity offered from the Fed acted like a “put” in the market.

I talked about effect on May 20 – with a post titled “The One Thing Driving the Market”

But here’s the thing:

It’s unlikely the Fed has any motivation in creating a new asset bubble.

But that’s what we might have (in tech at least) – where forward PEs (in many cases) are now above 30x for popular stocks.

From Matt Maley of Miller Tabak framed it this way (bold emphasis my own):

A big part of the reason for the very positive action in the stock market (and other asset classes) since March has been the return of the “Fed put”; there is little question in our minds that this has been the case.

The very large injection of liquidity that they engaged in during the regional bank crisis in March (which can be seen by the BIG jump in their balance sheet at that time) shows that the Fed took a page from their emergency playbook from the pandemic-induced crisis in 2020.

The question now… is whether the banking crisis has calmed down enough to allow the Fed to remove their “Fed put” once again (or to at least push it to a level that is more “out of the money” than it has been in recent months)… or if the situation is still more precarious than anybody is letting on.

Listening to most of the “Fedspeak” recently, it sure looks like they want to be much less accommodative with their “Fed put” than they have been over the past few months.

And therein lies the rub…

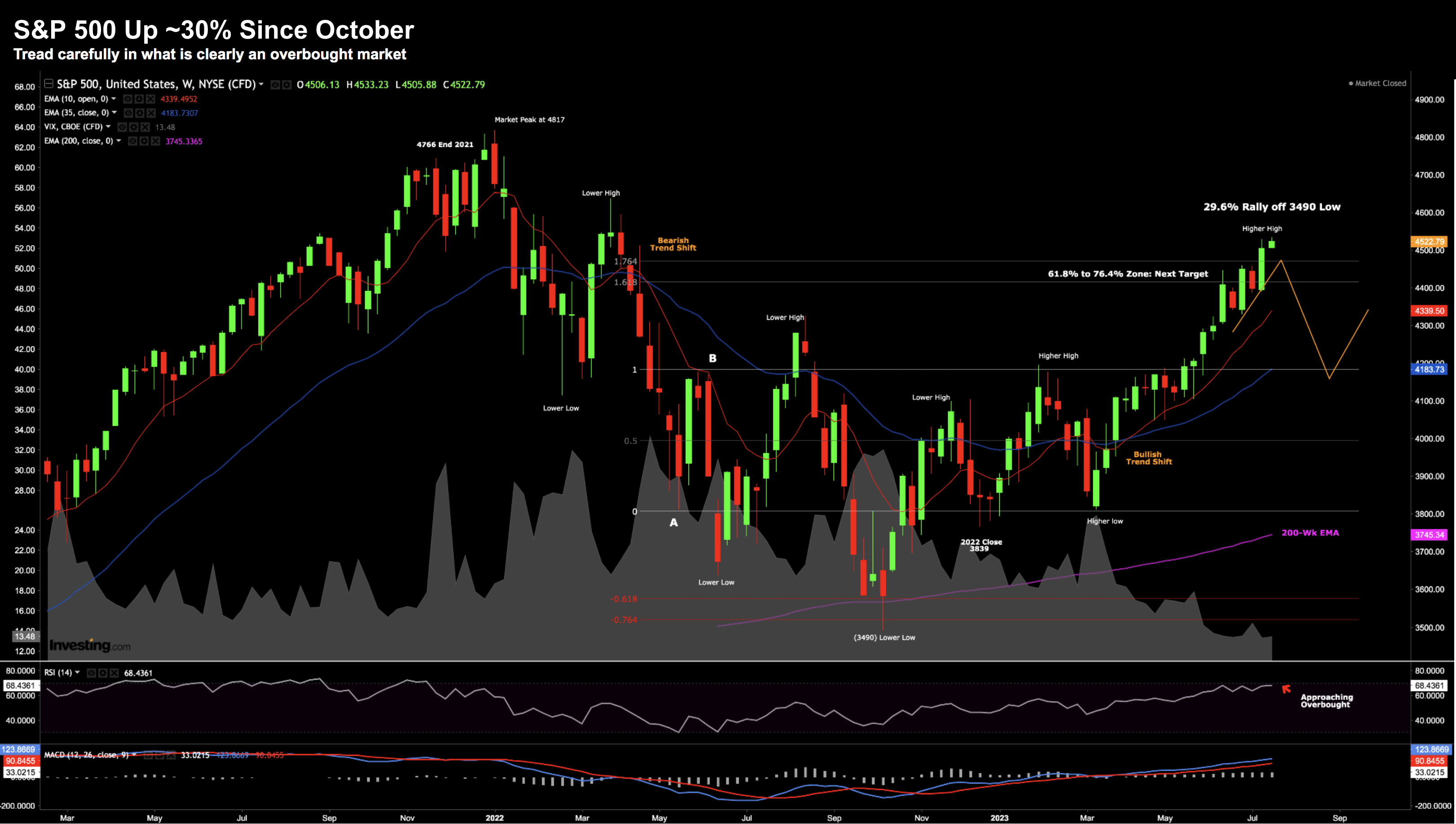

S&P 500 Optimism

Below is the ‘straight up‘ price action we have seen the past few months.

July 17 2023

If we look back to October – we are up a staggering 30%

But for me, what makes this rally even more curious is its been without any increase in earnings.

In fact, according to Factset, we are about to see the third consecutive contraction in earnings.

In other words, what we have is meaningful multiple expansion.

Most of that has been less than 10 tech stocks – however more recently – we have seen other sectors catch a bid

For example, banks, energy and industrials are now participating.

Irrespective, the market clearly thinks that conditions are only going to get better.

What’s more, they believe the Fed is not about to take away the punchbowl.

For me, stocks are too expensive given 2-year bond yields are trading close to 5%

That’s the equivalent of a forward PE of 20x (where 1/5 = 20) – where it’s risk free.

Now by comparison…

With the S&P 500 trading 4522 and earnings expected to be ~$220 (which feels optimistic) – that’s a forward PE of 20.6x

That’s an earnings yield of 4.9%

From mine, that is not a compelling risk / reward opposite the risk-free rate.

Putting it All Together

I do think that Matt Maley is asking the right question:

Whether the banking crisis has calmed down enough to allow the Fed to remove their “Fed put” once again (or to at least push it to a level that is more “out of the money” than it has been in recent months)… or if the situation is still more precarious than anybody is letting on.

With respect to the latter – banks are in the process of telling how precarious things remain.

So far so good… but most of the uncertainly sits with smaller regionals.

The big banks will be fine (as I wrote at the time).

But in terms of the former – should the Fed remove their liquidity “put” – it will be interesting to see whether this continues to buoy markets.

More on that July 28/29 when the Fed gives their most recent update on monetary policy.

Until then, the focus will be earnings and whether current prices justify the frothy valuations.

Regards

Adrian Tout

The above article is for information only. The views of the author or any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy, sell or hold any specific investment or to adopt a particular investment strategy. However, the knowledge that professional analysts provide can be a valuable additional filter for anyone looking to make their own investment decisions.

Ethical Offshore Investments provides guidance on portfolios that have an ESG (Environmental & Social Governance) bias and an SRI (Socially Responsible Investing) focus. By avoiding high charging, commission paying funds, this results in lower portfolio costs, so more of the growth staying in the pockets of our clients.

Ethical Offshore Investments can also assist clients in getting exposure to the investment markets such as the broad S&P 500 index through very low cost Exchange Traded Funds (ETF’s) as well as investing directly into the individual stocks.

If you would like to get more information on the Sustainable Ethical Allocation portfolios, or enquire on the vast array of Sustainable and Ethical style funds available, please click on More Information.