2021 Quarter 3 Update – Sustainable Ethical Allocation Portfolios

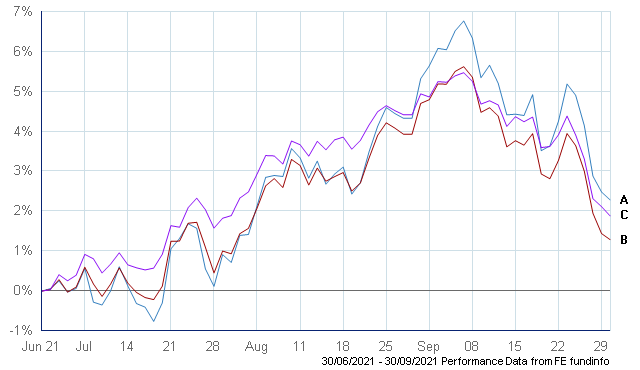

The Investment Rollercoaster that is 2021 continued its theme again with the quarter 3 performance of the Sustainable Ethical Allocation portfolios.

There was good momentum going from early July right up to mid-September……. But the last week of the quarter was not a pretty one to watch for investors.

While saying that, all 3 portfolios did end the quarter in positive territory…… was just a little disappointing (& frustrating) with the market reactions in late September.

- A – Sustainable Ethical GROWTH Allocation

- B – Sustainable Ethical BALANCED Allocation

- C – Sustainable Ethical CAUTIOUS Allocation

The Baillie Gifford Positive Change fund, which I seem to comment on a regular basis with my updates, was one of the better performers again for the quarter, up around 6.2% for the period……… and this is after being one of the hardest hit global funds in the last week of September.

The global growth funds hit hardest by the recent sell-off

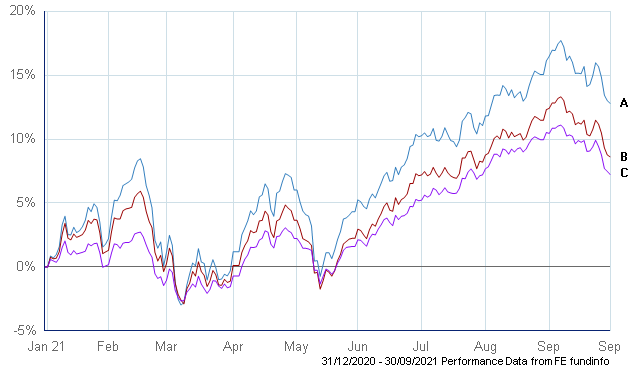

The fund is still +17% year to date so while the end of the month performance is disappointing, the return year to date is still very impressive.

Royal London Sustainable World Trust, which is also held across all 3 portfolio allocations, returned a respectable 4.6% for the third quarter and has performed +11% year to date.

- A – Baillie Gifford Positive Change

- B – Royal London Sustainable World Trust

So what caused the issues late in the quarter..??

Continued concerns on the negative impact of inflation and rising interest rates did put a dampener on the future recovery sentiment for markets and economies. There was also rising oil & energy prices as well as supply chain disruptions, which some market analysts were predicting could derail the covid19 vaccine ‘inspired’ recovery.

There was also the US where urgent action was needed to increase their ‘debt ceiling’ to ensure that the Government would not default on its financial obligations.

And talking about defaults, there was the Chinese property developer, Evergrande, with its $300 billion in debt which they were struggling to service, leading to the default of some interest payments.

We can confirm that the underlying funds that we use for the Sustainable Ethical Allocation portfolios and the ones within the personal bespoke portfolios, do not have any direct exposure to Evergrande or any Chinese property developers.

While this may seem like a company specific problem, the risk is the contagion effect that a default or worse, a collapse will have on other companies globally (suppliers, contractors, banks, insurance companies)……… some media analysts have likened this situation to the Bear Stearns collapse that triggered the Global Financial Crisis in 2008. However, many other analysts have also come out to state that they believe that the Chinese Government, while reluctant, will not allow Evergrande to collapse as that would impact the wealth of millions & millions of Chinese nationals.

Our view is that there will be a Chinese government lead re-structure of the company’s debt to minimise the negative impact for local Chinese investors…… but it may not be such a good outcome for global investors in the company as there are reports that they may only get back 25 cents in the dollar.

While we have no direct exposure to Evergrande stock or debt and will therefore not feel the full brunt of any debt default, there will be some companies that our funds invest in that will be negatively affected. However, as long as this is controlled, we feel that our portfolios will be fairly well insulated from any fallout as this is a sector that generally doesn’t meet our ethical and sustainable investment objectives and as such, would only have nominal exposure to.

Portfolio Performance for 2021 Year to Date

- A – Sustainable Ethical GROWTH Allocation

- B – Sustainable Ethical BALANCED Allocation

- C – Sustainable Ethical CAUTIOUS Allocation

As can be seen on the above graph, we have experienced 3 fairly significant pullbacks with performance this year (on 2 occasions actually putting performance negative YTD), but we are pleased that we are still in positive territory………. and above the performance objectives for the different fund risk strategies.

Going Forward…

I always seem to be concerned in the short term, as there always seems to be a current event(s) that could disrupt the markets…….. but realistically, that has been true for ever and a day. There is always the potential for a current event to cause chaos in one way or another.

However, as history has also shown us, investing in a diversified portfolio of quality real assets with an appropriate timeframe will also come out of any short-term turmoil generally in a better, stronger situation for investors.

So, while I am concerned in the short term (as I always am), I do still have a positive outlook for the types of investments we get exposure to over the medium to longer term……… BUT………. It is also very important that investors also maintain a cash reserve to cover any short-term income / capital expenditure requirements.

I admit that holding cash at present is a losing investment (if you do happen to get interest on cash, the effects of inflation soon take care of that), but it does provide a bit of insurance against having to draw out of an investment during a period of market weakness. You only need to look at February and March last year with the negative effects of Covid19 on the equity markets.

However, our clients that were drawing an income or were due to take money out at that period, had holdings in cash, so they were drawing from an allocation that was NOT affected by the downturn. Over the following 12 months, the markets recovered (an even greater recovery within the sectors we have a bias towards) which allows some profits to be taken & allocated to cash to fund the next round of income / capital requirements.

This is why it is so important to have regular contact with your adviser so that planning strategies can be put in place, and more importantly, monitored, reviewed and adjusted accordingly.

While some regions have been disappointing of late (our Asian and Emerging market exposure), I am still very comfortable with the underlying funds included in the Sustainable Ethical Allocation portfolios in providing a solid core range of quality assets.

For clients that wish to have an increased exposure to specialist sectors, our bespoke portfolio management service can provide guidance on very high-quality managed funds and ETF’s for areas such as:

For clients that wish to have an increased exposure to specialist sectors, our bespoke portfolio management service can provide guidance on very high-quality managed funds and ETF’s for areas such as:

- Alternative fuels

- Solar Energy

- Battery Technology

- Artificial Intelligence & Robotics

- Cyber Security

- Blockchain Innovation

As with all funds / ETF’s that we propose for clients, we will only deal with Fund Managers that are regulated, fully transparent with their holdings and/or investment strategy and will avoid high charging versions of the fund.

If you would like to receive further information on the Sustainable Ethical Allocation Portfolios or on the underlying individual Managed Funds, please click REQUEST MORE INFORMATION.