April 2021 Update – Sustainable Ethical Allocation Portfolios

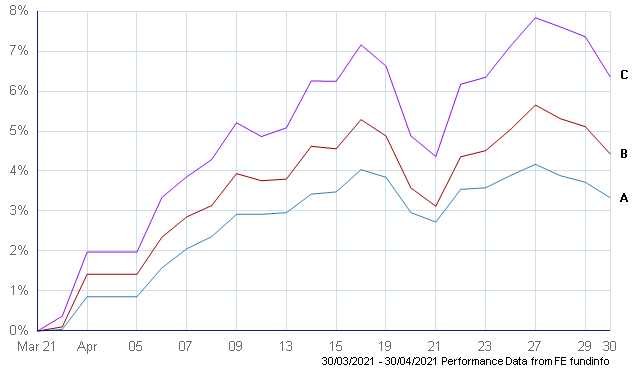

A positive month all round for the Sustainable Ethical Allocation Portfolios.

As stated in our recent end of quarterly update, portfolios that hold a bias towards Sustainable growth and Environmental improving type companies have struggled so far this year, especially after last year’s significant outperformance.

And the question was asked, “is it now time to abandon our strategy of investing in quality E.S.G. (Environmentally & Social Governance) and S.R.I. (Socially Responsible Investing) entities…??

Well 1 month on from this, it was good to see that every underlying fund held in the various Sustainable Ethical Allocation Portfolios had a positive month, which resulted in the portfolios showing growth of 3.3% (Cautious), 4.4% (Balanced) & 6.4% (Growth) for the month of April.

- A – Sustainable Ethical CAUTIOUS Allocation

- B – Sustainable Ethical BALANCED Allocation

- C – Sustainable Ethical GROWTH Allocation

As with every month, there was some volatility and the sell-off in global stocks in the last 2 trading days did dampen the monthly performance…….. with all 3 portfolios beating their respective benchmarks (all be it by a slim 0.1% for the Balanced Allocation).

The main contributor for the monthly performance was the exposure to our long-term favourite Baillie Gifford Positive Change that was +7.8% for April which is held across all 3 of the Sustainable Portfolios. I have provided some further performance information on this fund later in this report.

The Royal London Sustainable World Trust, which is also held across all 3 portfolios was up +5.2% for the Month.

The equity sectors that did struggle this month compared to other areas was that of our Asian and Emerging Market equities, which were +1.3% to +1.8% respectively.

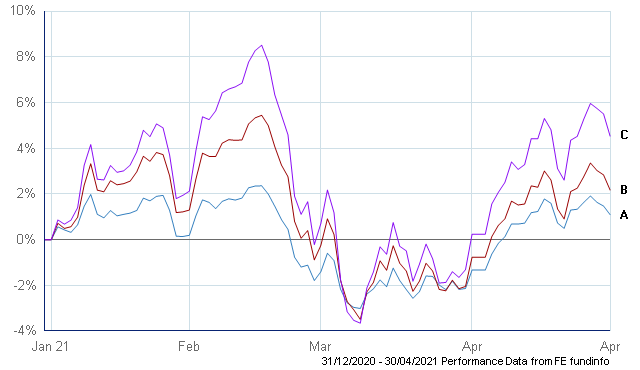

So what has happened so far in 2021……….

- A – Sustainable Ethical CAUTIOUS Allocation

- B – Sustainable Ethical BALANCED Allocation

- C – Sustainable Ethical GROWTH Allocation

All of the underlying Growth style funds are now back in positive territory for 2021 (2 of them only just) with most +4% to +6% Year to Date.

However, it is a different story with the cautious style funds that historically allocate predominately to Bonds, Fixed Interest and Money Market style assets with a low allocation to shares. While we did have a positive month for April, all of the bond type funds are still negative for the year (-0.86% to -2.4%).

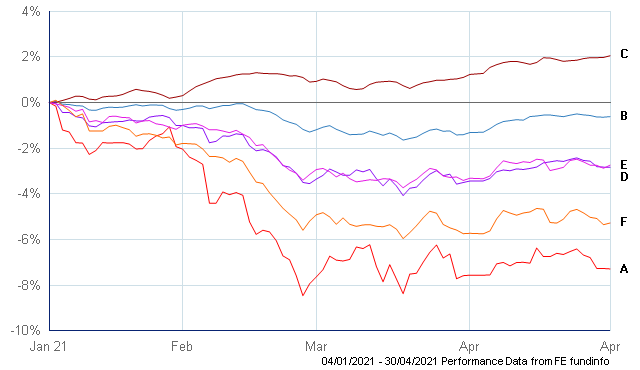

Looking at the Bond / Fixed Interest sector in general, the Year to Date negative returns are across the board with only the High Yield Bond sector being in positive territory. UK Gilts (which we have minimal if any exposure to) are down over 7% for 2021.

- A – IA UK Gilts

- B – IA Sterling Strategic Bond

- C – IA Sterling High Yield Bond

- D – IA Sterling Corporate Bond

- E – IA Global Mixed Bond

- F – IA Global Government Bond

As interest rates are so low globally, there is really only 1 way that interest rates can go and that is up. With the vaccine rollout and the possibility that we may get back to some form of normal day to day living sometime this year, there has been comments from certain Central Banks that this may result in a spike in inflation. So what is the common course of action to curb this..?? They raise interest rates which in theory reduces disposable income & subsequently discretionary spending. Less demand then forces prices down (or reduce the upwards trend).

This can have a negative affect on Interest Rate sensitive assets such as Bonds. In general terms, if interest rates rise, the price (or value) of current bonds will reduce as the ‘interest rate premium’ that they had over new bonds being issued with the current interest rates, has now reduced. They are therefore not as attractive to hold.

What to do…..?? This is not the first time that bond markets have faced such an issue and one thing that I can guarantee is that it will not be the last. The advantage that we have is that all of the cautious type funds held in the portfolios are being managed by very experienced asset managers, who have experienced such issues many times in the past. Bond and fixed interest assets are liquid type assets that can be bought / sold fairly easily on market. The high quality, very experienced Fund Managers that we are using for our cautious allocations (Royal London, Rathbones, Aegon, Liontrust) will be using this as opportunity to re-balance and restructure their underlying Bond portfolio allocations in-line with their current and future interest rate forecasts and projections.

Baillie Gifford Positive Change Fund

Baillie Gifford Positive Change Fund

I will be preparing a more in-depth look at this fund as a separate article, but I just wanted to highlight the performance of this fund, as it is held across all of the Sustainable Ethical Allocation Portfolios and has been the stand out performer since inception of the Sustainable Portfolios.

The Fund invests in an actively managed portfolio of 25-50 global high quality growth companies which can deliver positive change in one of four current themes:

Social Inclusion and Education, Environment and Resource Needs, Healthcare and Quality of Life and addressing the needs of the world’s poorest populations.

The reason why I am bringing focus onto this fund is due to recent performance and to once again stress the importance of having a suitable investment timeframe.

https://ethicaloffshoreinvestments.com/features/the-importance-of-investment-timeframe-april2021/

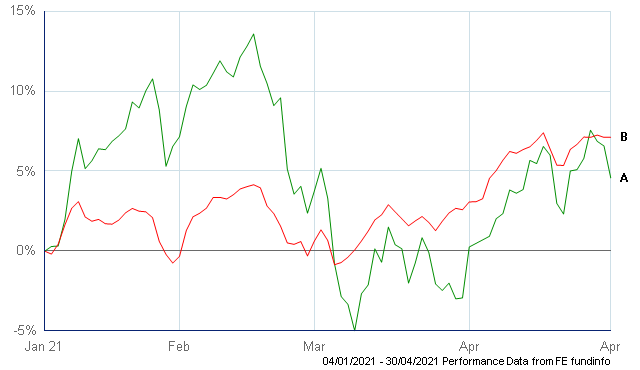

The performance of this fund since inception of the Sustainable Portfolios in November 2018 has been incredible, up by +128% (it is over +260% since the fund launched in January 2017). But as the graph below indicates, it has not just been a 1 way street upwards….. there have been some speedbumps along the way.

- A – Baillie Gifford Positive Change

- B – IA Global Index

Because of the style of investment that the manager (Baillie Gifford) takes plus the type of companies that they will invest in, the fund will experience a higher level of short-term volatility. And this has been evident this year with the fund being one of the bottom performers compared to other Global Equity strategies, especially those that have a ‘value’ bias strategy that have benefited recently with the market rally in the sectors that got hammered last year during the covid19 induced economic closures…….. areas that the Positive Change has minimal, if any exposure to.

Baillie Gifford Positive Change performance 2021 YTD

- A – Baillie Gifford Positive Change

- B – IA Global Index

As I have stated in previous updates, I don’t like it when there is a drop in performance, especially when it results in a period of negative returns……. But unfortunately, it is a situation that investors do need to be aware of and accept if they are to achieve the superior, longer term rewards of investing in such funds.

While this fund is a personal favourite of mine (I personally hold it my own offshore portfolio), I am mindful of ensuring that clients portfolios are well diversified and the overall performance is not reliant on just 1 or 2 funds. For the Cautious Portfolio, this fund makes up 5% of the portfolio allocation, with the Balanced and Growth Portfolios being 8% and 10% of the portfolio allocation respectively (please note that the portfolios do also hold other Baillie Gifford sustainable strategies).

Please click the following link for more information on the Sustainable Ethical Allocation portfolios https://ethicaloffshoreinvestments.com/services/#portfolio-management

Investors can also further diversify their portfolios through the use of Structured Notes. While Structured Notes are not our core investment offerings (we prefer the use of liquid, daily traded funds, ETF’s and direct shares), they can provide an opportunity to reduce short term volatility while receiving a pre-determined (conditional) investment return. But it must be stressed that Structured Notes are generally regarded as longer term investments so timeframe and whether access to capital is required needs to be seriously considered.

Please click the below link to get information on the range of Structured Notes currently available via Ethical Offshore Investments.

https://ethicaloffshoreinvestments.com/structured-notes/

If you would like to receive further information on the Sustainable Ethical Allocation Portfolios or on the underlying individual Managed Funds, please click REQUEST MORE INFORMATION.