Morningstar European sustainable fund flows reach record levels in 2019

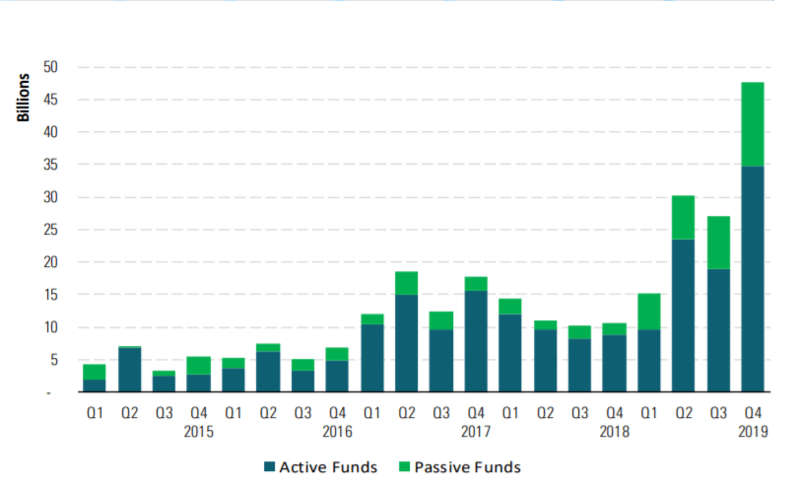

Morningstar’s sustainable funds universe attracted record inflows of €120bn last year, with almost 40% of these coming in during the final quarter alone.

Overall, assets held in European sustainable funds by the end of the year amounted to €668bn – a 56% increase from 2018. This can partially be attributed to the fact 360 new sustainable funds were launched last year – 50 of which had specific climate-oriented mandates – with 105 of these new funds coming to market during Q4. This means the total number of sustainable funds domiciled in Europe stands at 2,405. Some 21% of

European sustainable funds are now passive offerings; sustainable index funds and ETFs garnered approximately €13bn in inflows during the final quarter of last year, accounting for 27% of total quarterly flows. Hortense Bioy, director of passive strategies and sustainability research, manager research, Europe, said:

“2019 was a big year for sustainable investing. Equally, it was a record-shattering year for European sustainable funds, driven by increasing investor interest in ESG issues and a favourable regulatory environment.”As more investors look for ways to mitigate ESG risks—particularly climate risk—and align their investment portfolios with their values and sustainability preferences, we can expect the universe of sustainable funds and the money flowing into it to continue growing.”