Trade the Tape – Think About Adding Bonds

Please find below the latest update from Adrian Tout from his regular newsletter, “Trade the Tape”.

Please note that this is for general information only and should not be considered personal financial advice.

The purpose of publishing these newsletters on the Ethical Offshore website is to provide investors some simple, easy to understand technical details on why the US markets are behaving the way they are at the moment, what has occurred to get them where they are, and what actions may influence where they end up in the near future.

The way Adrian Tout explains all this, in simple terms, I believe is good reading for any investor to get a better understanding of what is happening within the financial markets, what risks to be aware of and how to take advantage of these market conditions for your medium to longer term investment journey.

July 9, 2023 – Adrian Tout

Think About Adding Bonds

-

Two bond ETF’s: AGG and EDV

-

Some insurance here could pay longer-term dividends

-

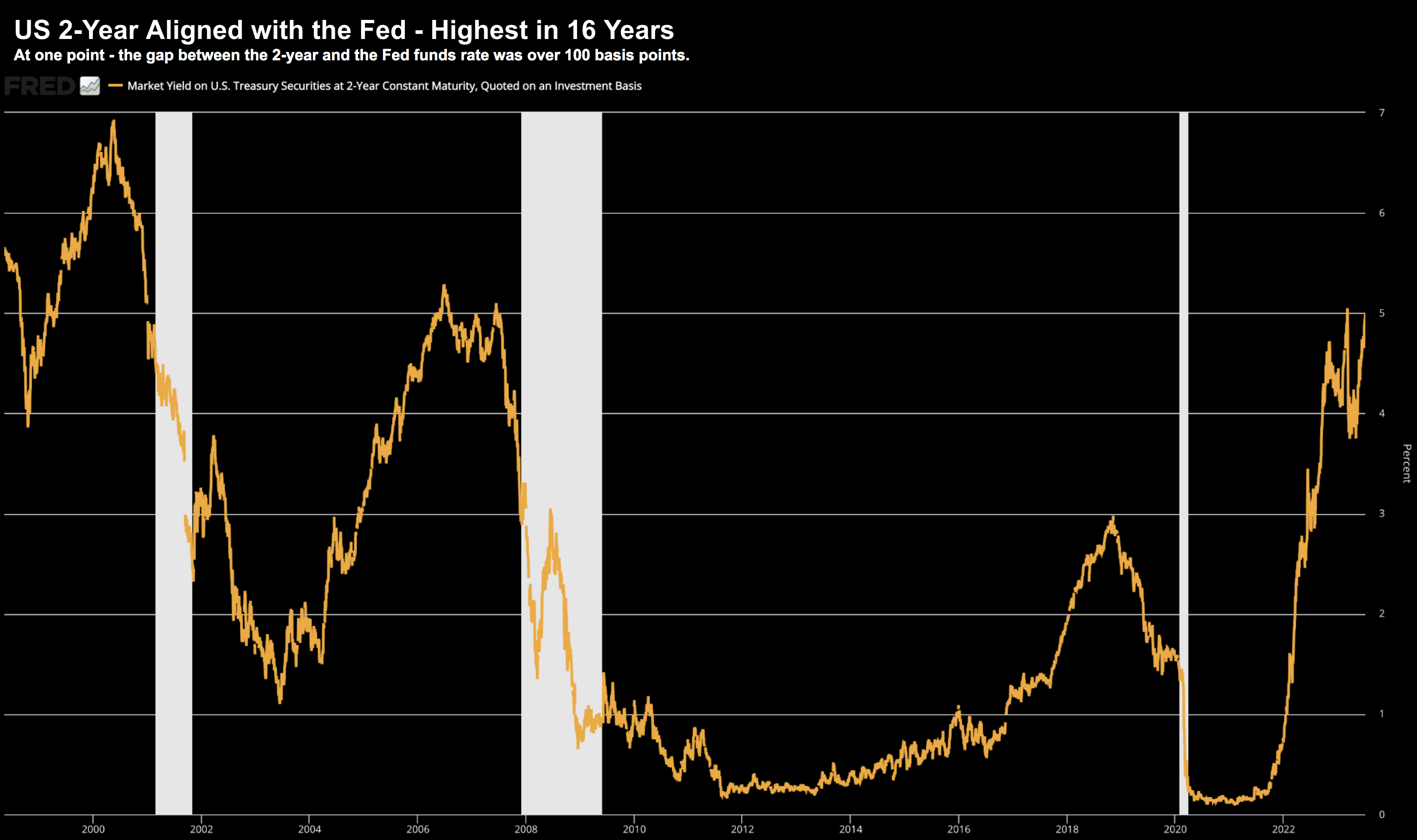

US 2-Year Yield at its highest level in 16 years

For me, 2023 has been a year of repositioning and managing risk.

I lowered my exposure to large-cap tech (down to ~20% portfolio weight) and increased exposure to banks, energy and some industrials (which all trade at reasonable valuations).

In hindsight my move was a little early – as large cap tech added to their recent gains.

However, I don’t trade with the mindset of ‘weeks or months’.

These things are always very difficult to time.

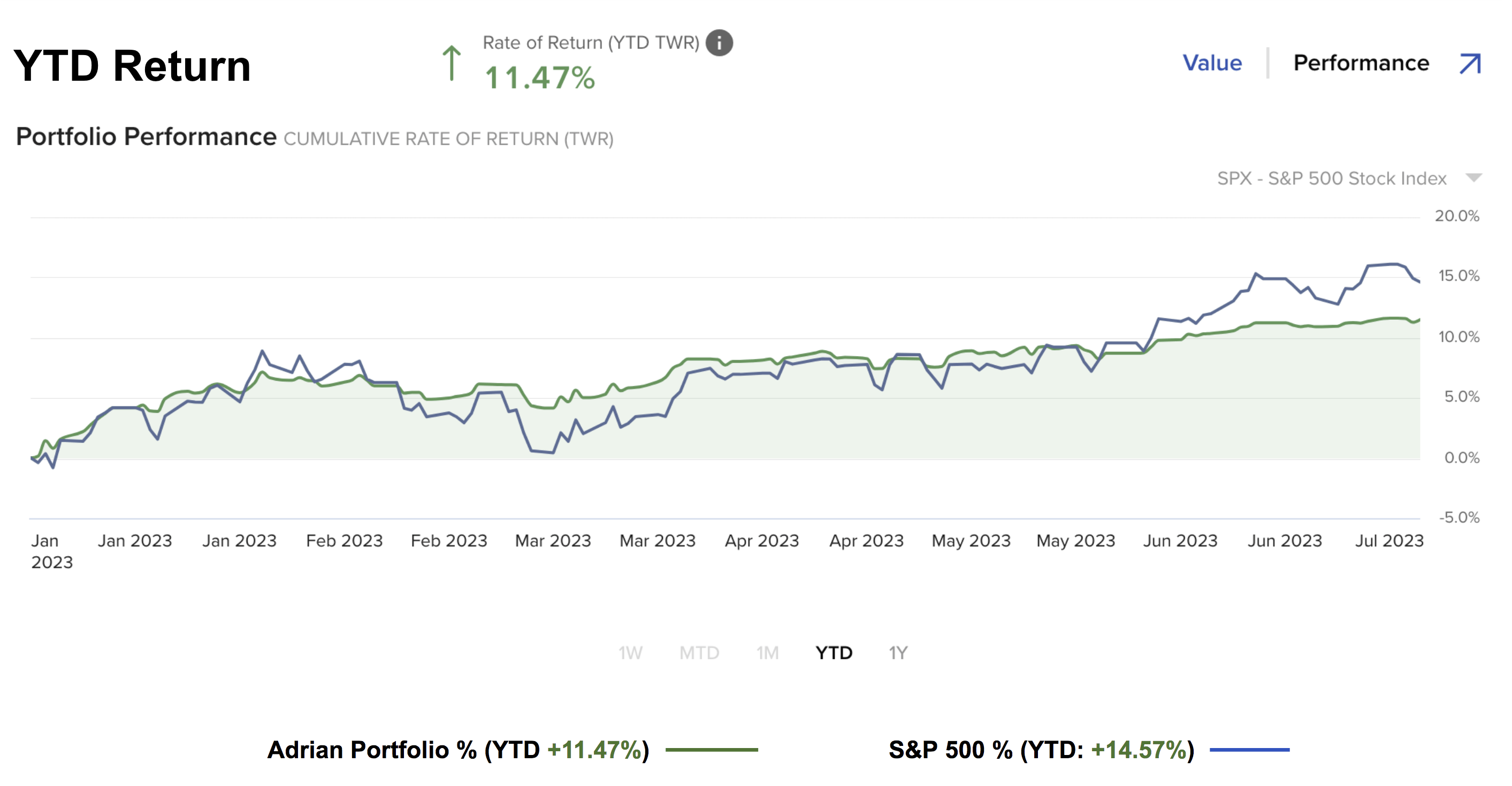

Due to my (mostly) defensive position – my YTD returns are 11.47% (~3% lower than the Index)

July 9 2023

Keeping a large cash position (~35% at the time of writing) can pay dividends in the event of a market downturn (like last year).

However, when the Index surges (as it has done this year) – it will result in underperformance.

As part of my repositioning – I’m adding to fixed income.

For example, with the US 2-year yield now above 5.0% (first time in 16 years); and the 10-year yield above 4.0% – this is attractive.

July 9 2023

Let’s explore why some quality bond exposure deserves a place in your portfolio and vehicles to consider.

But first, some helpful context.

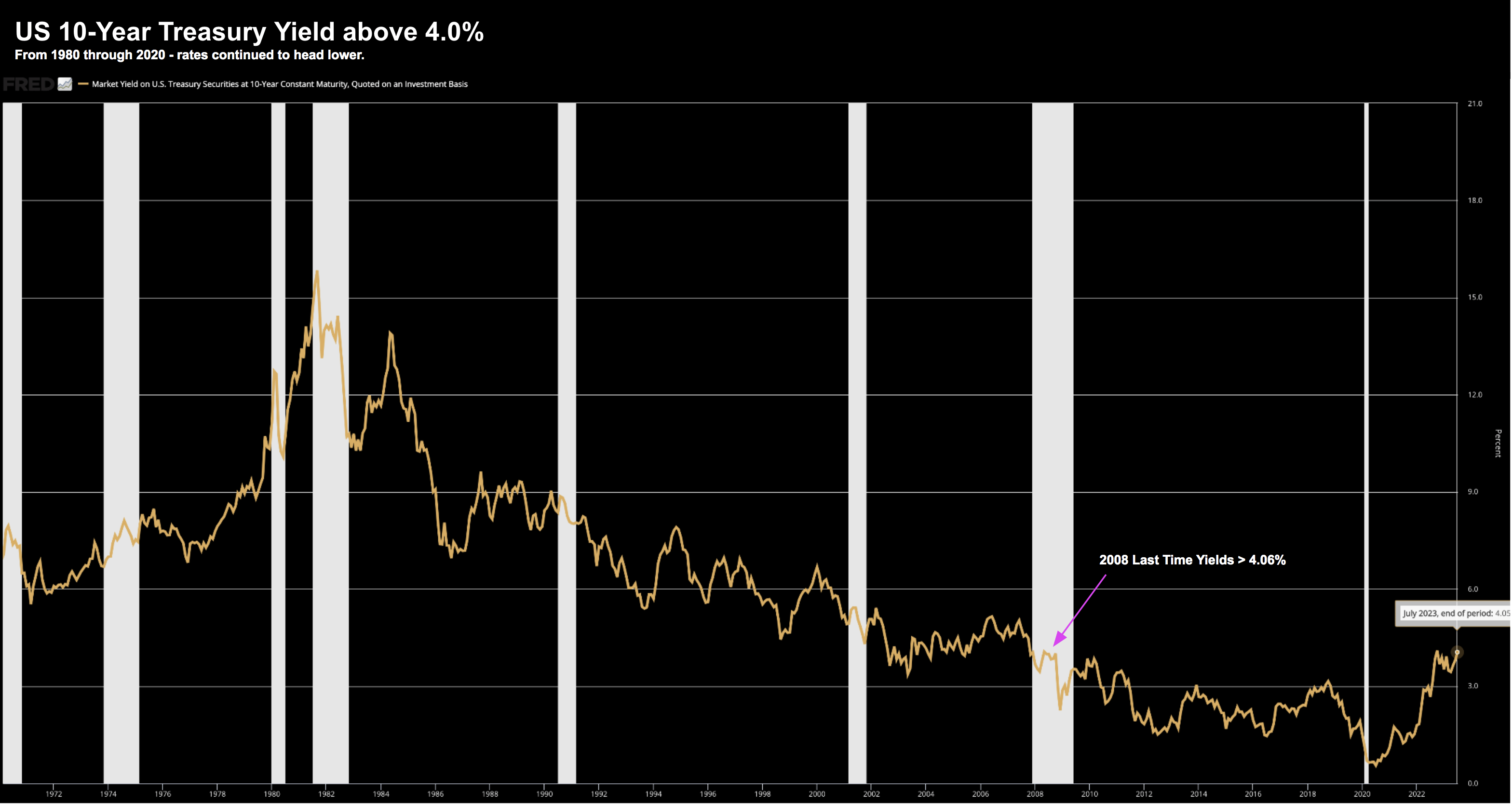

10-Year Yield Back above 4.0%

The US 10-year yield closed at 4.06% on Friday – the highest level since early March.

The last time a rate-hike cycle saw the 10-year yield this high was 2008.

July 9 2023

Obviously with rates artificially low for some 15 years – risks assets boomed (i.e. houses and stocks).

That’s now changed.

The risk/reward for stocks (and houses) now comes at a premium.

What’s more, the market now (finally) appreciates that the Fed is likely to keep rates high.

Inflation is not falling at the velocity many expected (especially stickier forms)

As an aside, we will get an important read on CPI and Core CPI later this week.

Should Core continue to trade with a 5-handle – it will only reinforce the thesis that the Fed is likely to keep rates in restrictive territory.

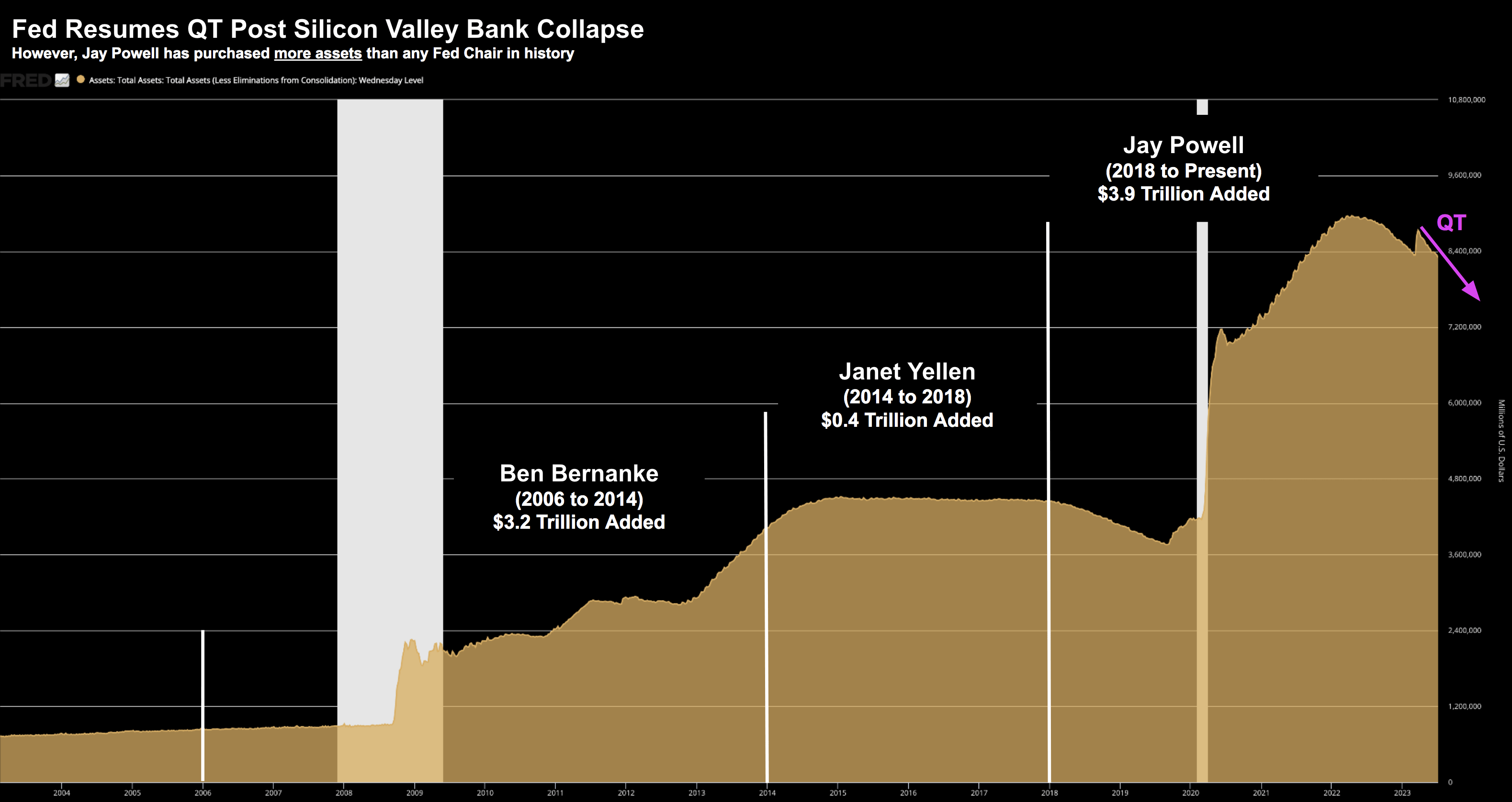

Beyond rates, the Fed can also tighten another way.

For example, they have no intent of participating in the bond market (QE) whilst inflation stays above their 2% target.

With the banking system now stabilized – the Fed has resumed reducing their balance sheet (QT)

With respect to QT – the Fed has reduced their balance sheet by ~$60 billion a month post the SVB collapse.

My view here is they will continue to reduce their balance sheet by as much as $1 Trillion over the next two years (in turn pressuring stocks)

Why Add Bond Exposure?

Over the next 6-9 months – it’s most likely that bond prices continue to drift lower (i.e., yields rise)

And whilst lower bond prices is not a great outcome for bond investors… investors are being compensated with attractive yields

For example, if you are of the view that:

- Inflation will gradually come down over the next 12 months; and

- A recession is likely later this year (or early next)…

… it’s plausible yields fall and bond prices rise.

In this scenario – bond investors will receive both price appreciation and the yield they secure today (vs a lower yield if buying at the time of recession)

Two Bond ETFs to Consider

There are many bond ETFs available for investors (here’s a list)

However all bond ETF funds are not created equal.

Not only do each vary in terms of bond duration and composition of assets held (e.g. short and long term; government vs corporate debt) – they also vary in terms of management fees.

Two bond ETFs you should be aware of:

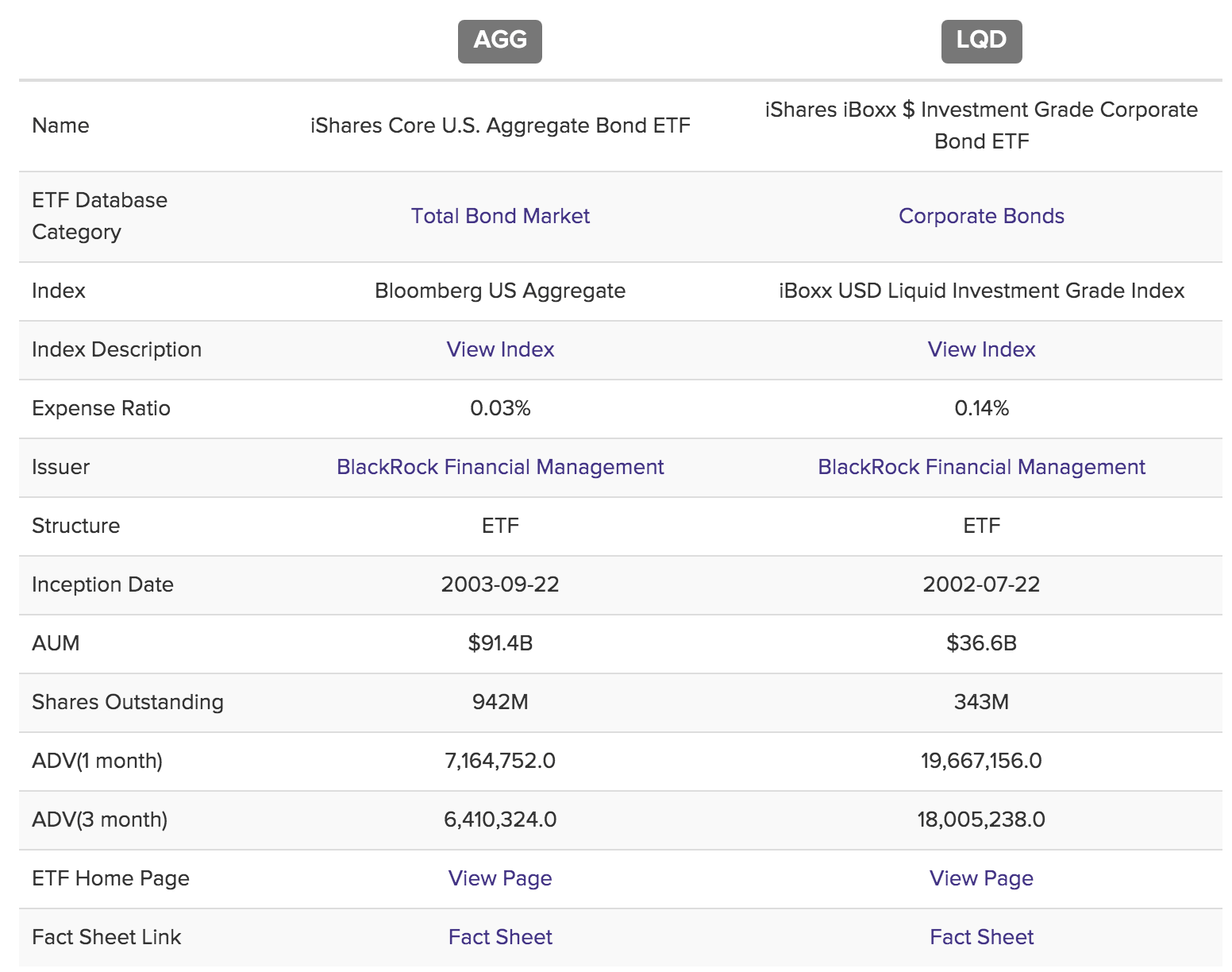

- AGG – iShares Core U.S. Aggregate Bond ETF (note: similar ETF is LQD)

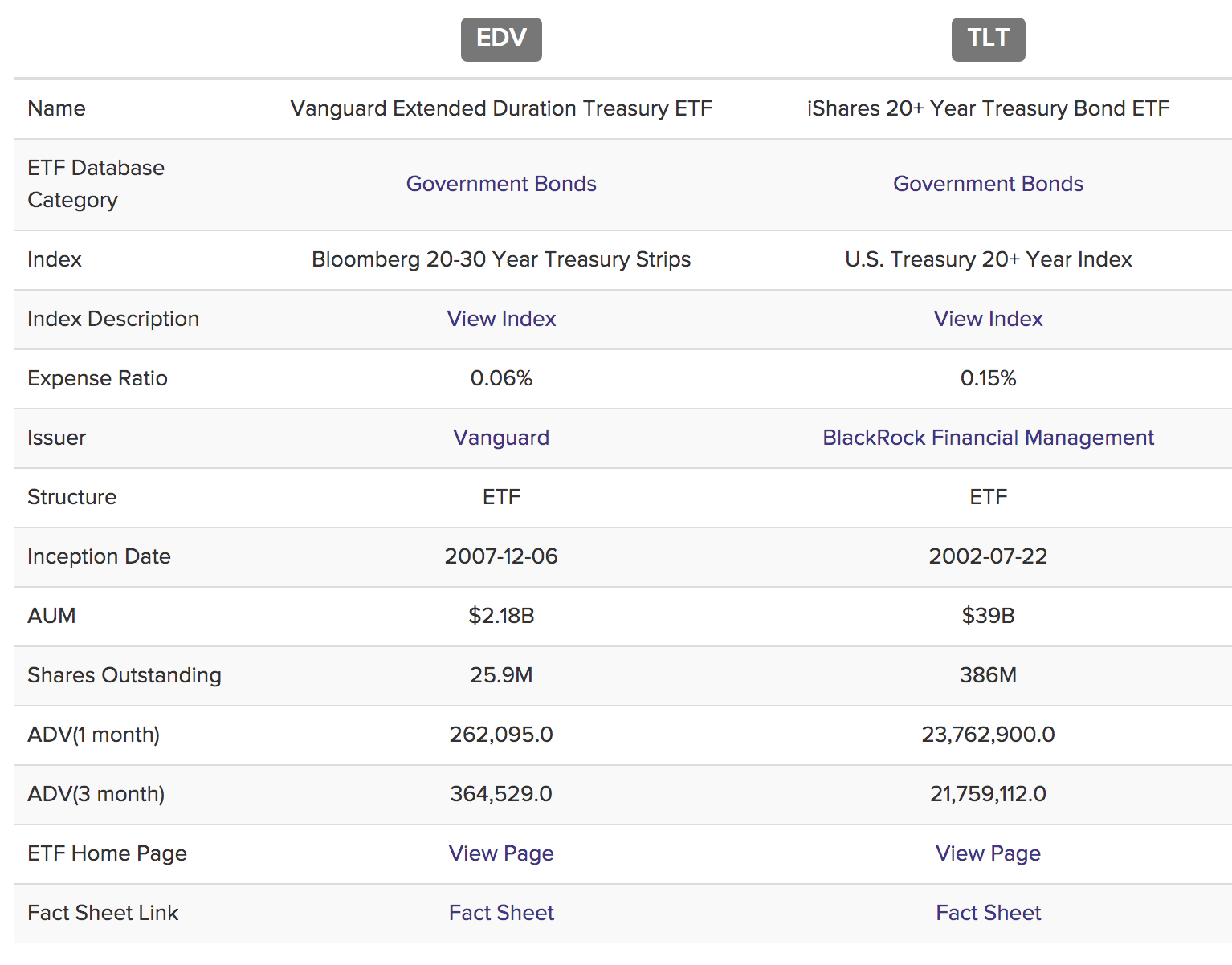

- EDV – Vanguard Extended Duration Treasury ETF (note: similar ETF is TLT)

Let’s take a look.

#1. AGG – iShares Core U.S. Aggregate Bond ETF

AGG boasts an Assets Under Management (AUM) of over $91B.

Similar to many other funds in Blackrock’s iShares stable – they feature very low management fees (only 0.03%).

The ETF is described as an intermediate bond fund, which means it holds a mix of bonds with different maturities with an average effective duration of ~6 years.

There are more than 10,000 investment-grade bonds in the ETF – 72% of which are AAA rated (the highest quality).

That said, it also contains exposure to BBB (14.1%) and A-Rated (11%) bonds which are higher risk.

But overall – this is considered a higher quality corporate bond fund.

At the time of writing, the average yield to maturity for AGG is 4.98%

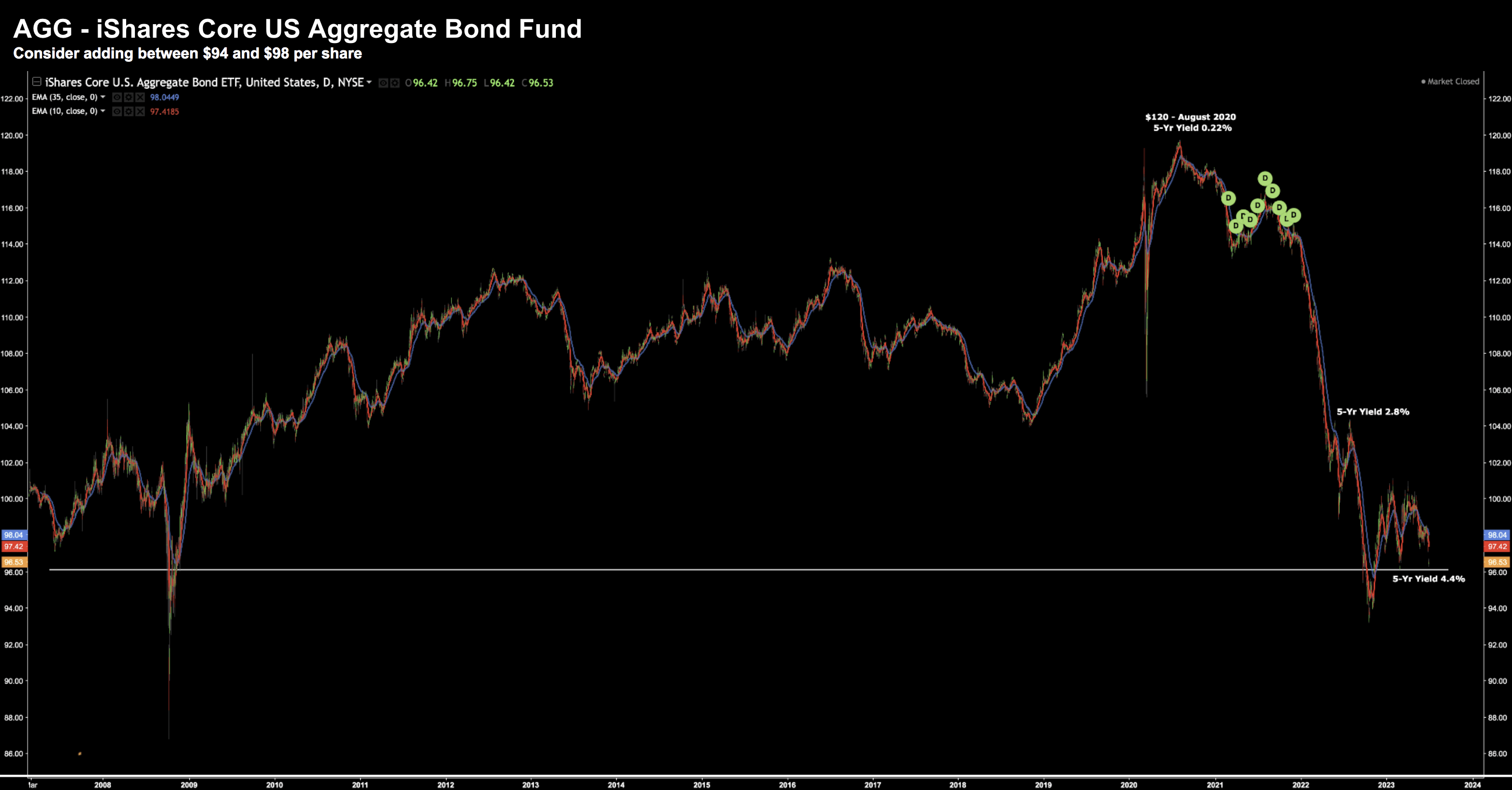

Let’s look at the weekly chart from 2008:

July 9 2023 – AGG 15-Year Chart

The fund is well off its $120 high it hit in August 2020.

At that time, bond yields were close to zero (e.g., the US 5-year was just 0.2%)

Bond prices trade inversely to their yields.

At the time of writing, AGG is trading $96.53 – close to as low as we have seen since 2008.

Again, this is due to the Fed raising rates some 500 bps in 12 months.

Now should interest rates continue to rise (which I expect in the near-term) – then it’s likely we see AGG drift lower.

However, I think the longer-term upside reward meaningfully outweighs the downside risks.

Two things:

- If buying AGG around $96 – you’re securing a yield of ~5.0%

- On the basis rates fall next year (as inflation cools) – this ETF could appreciate 10-15%.

The other consideration is should the economy fall into recession (which I expect) – this will result in fund rotation to fixed income.

As an aside, the ETF AGG is similar to the LQD ETF (comparison below)

#2. EDV -Vanguard Extended Duration Treasury ETF

Unlike AGG – EDV is long-dated US treasury bonds only.

It has AUM of around $2.18B with a management fee of just 0.06% (lower than TLT)

From Vanguard:

- Tracks the performance of the Bloomberg U.S. Treasury STRIPS 20–30 Year Equal Par Bond Index.

- Provides current income with high credit quality.

This ETF is very similar to Blackrock’s TLT – however offers a lower management fee.

Similar to AGG – the fund is designed for investors looking to lock in relatively high bond yields in anticipation of a fall in inflation (and decline in rates).

The fund offers a yield of 4.07% – which is higher than long-term inflation expectations (and expectations for GDP growth).

However, what is most attractive is the hedge EDV (and TLT) offers during times of recession.

And it’s not hard to explain – high quality bonds act as a source of (valuable) portfolio protection during times of economic contraction.

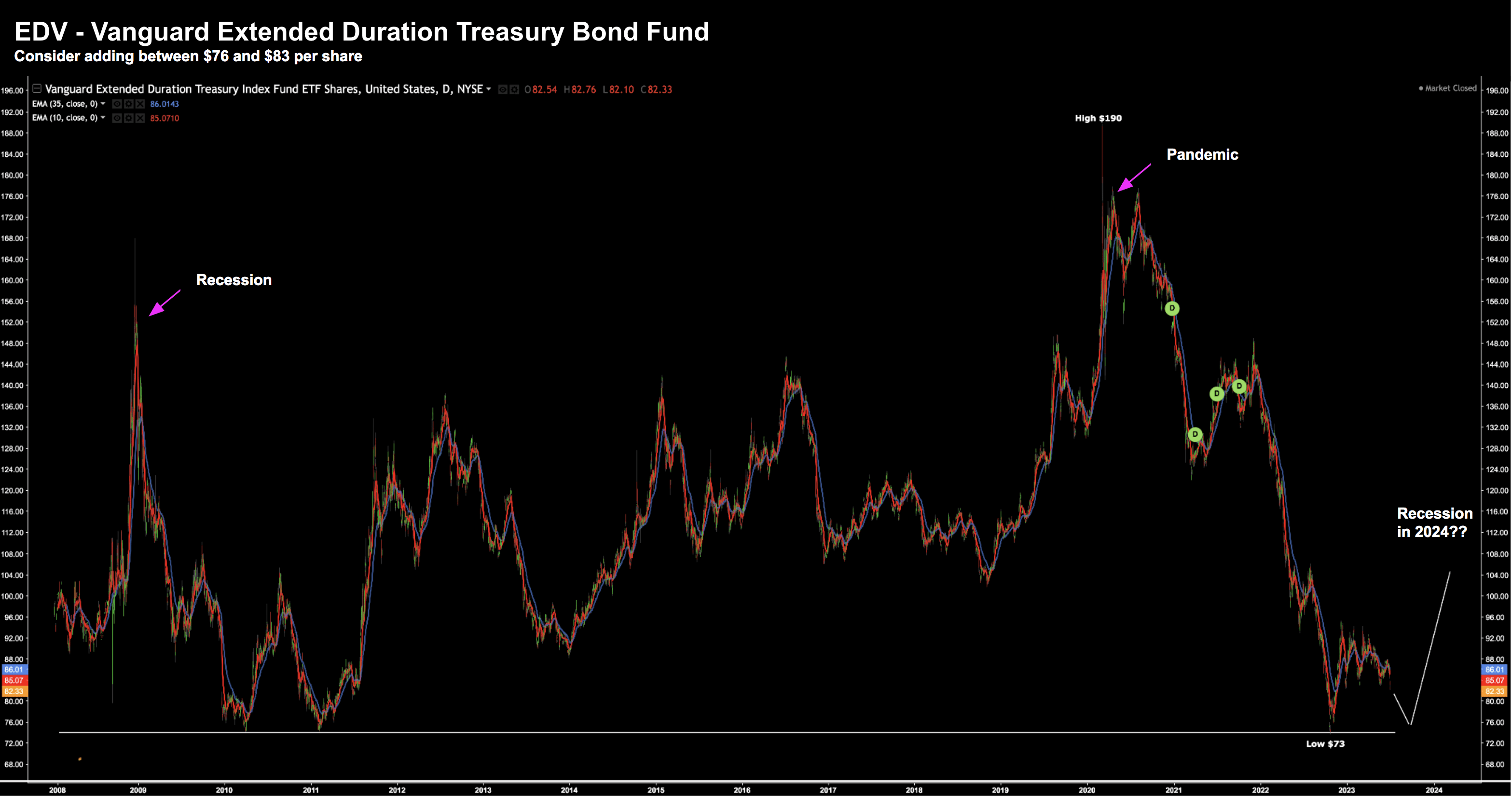

Let’s look at the long-term chart (from 2008)

July 9 2023

Note how EDV is a lot more volatile than AGG – however the direction of the charts are similar.

Similar to AGG – I see the potential for at least 10-15% upside on the basis we see a decline in rates the next 12+ months.

Again, it’s likely this ETF continues to drift lower should the Fed continue to hike.

However, I think the downside move is limited – where you are also compensated by the ~4% yield.

Should we see a recession next year (my base case) – this ETF is likely to move higher.

Below is comparison between EDV and TLT ETFs:

Putting it All Together

Two important questions you need to ask.

What is your outlook for:

- Inflation; and

- Economic growth?

With respect to the former – I see both Core PCE and Core PCI staying higher for longer.

Headline inflation will continue to fall (we will get a read on CPI this week) – however the Fed are more focused on Core PCE.

To that end, with Core PCE trading with a 4-handle – they are likely to raise at least twice more this year.

The bond market has now come to this realization.

What’s more, rates will likely stay high for a sustained period (until Core PCE is closer to their 2% objective)

Given this (and what we see with the depth and duration of the inverted yield curve) – the Fed are likely to cause a recession (later this year or early next).

In the unlikely event we avoid recession – GDP growth will be subdued (as consumers and corporates struggle under the weight of higher rates)

On that basis, the yields offered by both AGG (~5.0%) and EDV (~4.0%) are attractive.

What’s more, these ETFs offer a strong risk-reward in the event of recession.

In closing, you don’t have to rush into these trades.

Higher rates will keep these bond ETFs anchored near their all-time lows.

However, don’t try to get “too cute”.

We never try to pick bottoms (or tops). And if we do – it’s more luck than skill.

Our primary interest lies in whether the long-term upside meaningfully outweighs the downside risks.

I think the probabilities are in our favour here.

Regards

Adrian Tout

The above article is for information only. The views of the author or any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy, sell or hold any specific investment or to adopt a particular investment strategy. However, the knowledge that professional analysts provide can be a valuable additional filter for anyone looking to make their own investment decisions.

Ethical Offshore Investments provides guidance on portfolios that have an ESG (Environmental & Social Governance) bias and an SRI (Socially Responsible Investing) focus. By avoiding high charging, commission paying funds, this results in lower portfolio costs, so more of the growth staying in the pockets of our clients.

Ethical Offshore Investments can also assist clients in getting exposure to the investment markets such as the broad S&P 500 index through very low cost Exchange Traded Funds (ETF’s) as well as investing directly into the individual stocks.

If you would like to get more information on the Sustainable Ethical Allocation portfolios, or enquire on the vast array of Sustainable and Ethical style funds available, please click on More Information.