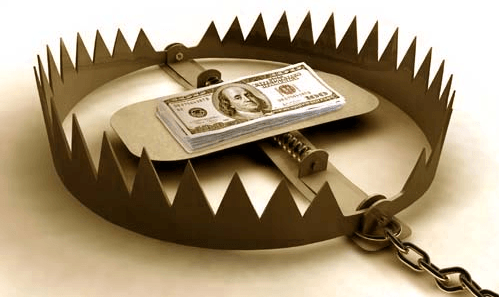

A Regular Savings Plan… or A Savings Trap

This article may save you from locking into a very expensive, inflexible long term savings contract!

Know the facts and your options BEFORE you sign up for a Contractual Savings Plan policy

I have made it no secret in the past that I am not a fan of ‘contractual’ Savings Plans and what we saw with the Covid19 pandemic in 2020 and the impact that it had on so many individuals just reaffirms my attitude towards these types of products.

“Shouldn’t you be encouraging people to invest on a regular basis..?”

This is a question I do get asked when I do make my (negative…. but honest..??) comments about these savings plan products….. but funnily enough, the majority of the time it is from other offshore financial advisers.

The answer though is a resounding yes…

People should be encouraged to invest on a regular basis for their longer term financial future. BUT just because a product has ‘savings plan’ in its name, doesn’t automatically result in it being the best option for your current and future requirements.

Below is a summary of why I personally do not like contractual savings plans, which I will go into more detail later:

- Lack of flexibility (especially in the first 12 – 24 months)

- Restricted Investment options

- Expensive

To be fair, there will be occasions where an Offshore Savings Plan will be the correct product and I have highlighted a few scenarios where this may be the case.

So what are the alternatives..?

I am a strong believer in the flexibility of investment products and where it has been appropriate, I have proposed the use of direct Platforms as this in many cases, provides greater flexibility, increased investment opportunities and potentially is much more cost effective. For more information on the Investment Platform, please click the link below.

But back to my thoughts on contractual Savings Plans

As stated, I do encourage people to invest on a regular basis for their longer term financial future but there is a lot more that needs to be taken into consideration than just putting away an amount each month. And the following are my concerns:

* Lack of Flexibility

Unfortunately, there are some ‘advisers’ in the offshore market that their only analysis of what to do with regular savings is “how much do you earn, how much can you put away each month & when do you want to retire”. Let’s say they have a 38 year old earning good money, who can currently afford to put away $2,000 per month and would like to retire at age 60. So a contractual savings plan of $2,000 per month is set up with a maturity term of 22 years…… sounds pretty straight forward doesn’t it..??

The adviser has provided all of the growth projections based on the above scenario plus all of the promotional material from the Life Company (Bonus Payment on initial payment, Loyalty Bonuses and Enhanced Allocations on monthly contributions) ……. Seems like a GREAT OFFER. The Life Company is going to add to your contributions and the more you invest, the more they add. But not all is what it seems (more on this later).

But here is where the lack of flexibility (in my opinion) can end up being very costly.

Hopefully, the adviser would have confirmed with the client about the Initial Funding Period and that during this period, no changes to the contributions can be made. The length of the Initial Funding Period does depend on the different Life Companies product offerings as well as the term length of the policy. This will range from 4 months (rare) to the more common 18 – 24 months.

Using our example above and the product terms of a very common product promoted in the offshore market (RL360 Savings Plan**), the Initial Period would be 22 months and as such, $2,000 per month needs to be contributed for at least the first 22 months of the policy. So once the $44,000 has been contributed (22 x $2,000) the client does then have the flexibility to reduce or even suspend their regular contributions. But at a cost…..

So what can you do if your personal situation changes during this Initial Funding Period…??

The simple answer is not much if anything at all….!!! If you can not fund the monthly payments within the Initial Funding Period, you potentially would lose a large amount of what you had invested…… if this occurs in the first 12 months, then say goodbye to up to 100% of what you have contributed.

I think the above is absolutely critical for any prospective investor to understand completely, as the Covid19 crisis of 2020 is a prime example of how a personal situation can change considerably……

Start of the year, steady job with regular income…… a few months later, covid19 shuts down many industries & jobs are lost, so no income (& obviously can no longer fund the monthly savings). So not only would the investor feel the negative impact of reduced/no salary income but a significant penalty if they wanted to stop paying into their savings plan………..

While the covid19 was an unprecedented global event (hopefully not to be repeated), I still don’t accept the rationale of a long term contractual savings plan when so many other situations can occur that can affect your capacity to contribute each month. By signing up for a $2,000 per month x 22 year savings plan, that is realistically saying that over the next 22 years, you will always be in a position to contribute $ 2,000 per month to the plan…… I can’t speak for everyone, but there is no way I could with 100% confidence state that I could do that for even the next 5 years, never mind 22 years..!!

This is why I like the flexibility of a direct platform…… you can add to the platform account when ever you want to, with an amount that you are comfortable to invest. If your personal situation changes to where you need to reduce or not pay anything in, you have that flexibility. If you come into a bit of a windfall, maybe a salary increase or bonus, that this can be added to the platform with the knowledge that it is not locked away.

While the account may have been established for the longer term, maybe retirement plans, as the Direct Platform has no lock in periods, or funding periods or set length terms, you can access some or all of your investment and you are NOT penalized for doing so..!!

I am a very strong believer in establishing a regular savings habit….. But it needs to be flexible to meet the personal and individual changes that each person goes through in their working life.

* Restricted Investment Options

While the Life Companies will offer what appears to be a wide range of investment choices for your regular savings plans, investors are still restricted in only having access to the funds on their specific list. To their credit though, the list of funds available is generally quite extensive, but unfortunately doesn’t always results in the better Managed Funds being available. And the funds that they do have access to, very rarely do you see the use of the lower charging version of the fund

Learn how you can hold the same investments but with lower charges

Once again, I prefer to offer clients the option of flexibility of investment choices, whether it is for a regular savings strategy or a lump sum investment

The International Platform provides investors access to well over 80,000 different Managed Funds, as well as Exchange Traded Funds / Commodities (ETF’s / ETC’s) and direct shares. So even someone saving on a monthly basis can invest directly into say Nvidia, Microsoft, Tesla shares, they could also invest directly into the S&P500 index via an ETF or even physical gold via an ETC. Contractual Savings plans do NOT give you that flexibility and diverse investment choice.

Access over 80,000 managed funds, plus ETF’s and direct shares

* How expensive are contractual savings plans..??

Now, this is my personal opinion and I am sure that there are advisers and product providers out there that will disagree with me…… but my opinion is that they are very expensive. Plus, and this really annoys me, the charging structure imposed is very complicated to understand, especially when it comes to a situation where a monthly contribution amount has been changed (or stopped).

If your Financial Adviser can’t understand and explain it in simple terms, how is a client expected to fully understand and accept the terms & conditions.

In most cases, the policy / admin charges are predetermined at the outset, based on the monthly saving contribution and the term of the policy. So using our previous example again, the policy / admin charges would be calculated assuming that the client would be contributing the same $ 2,000 per month, every month (on time) for a full 22 years……. If a client reduces or suspends paying in to the policy for a period of time, it doesn’t affect the Life Company as their policy charges have already been calculated and will continue to be collected. This could be as high as 7.5%pa of the policy value if you were to stop contributing straight after the Initial Funding Period (even higher when you include the management costs).

But what about all of those promotional bonuses from the Life Company that get paid as an incentive…

Good question……… using the previous example of a $2,000 per month x 22 year plan, this particular Life Company would pay:

- $ 9,180 Starter Bonus

- Additional 2% for each monthly contribution (so an extra $40 per contribution)

- Bonus Loyalty Payment of 5.5% of the plan total at the end of the 22 years (this is reduced if you don’t pay all of the monthly contributions)

So that seems to be quite a financial windfall then….. so why then on the illustration report does it state that you still require a growth rate of 1.41% net each year for an investor to get back just the amount that they have invested..?? This is just to cover the policy charges. And don’t forget, that is assuming that you make the $2,000 investment every month for 22 years, otherwise this bonus amount will be reduced (& you will need to achieve an even higher net growth rate just to break even).

If you are considering a new savings plan or already have one set up and would like to know what your actual bonus and/or policy charges are, please press Request Information and provide details of the policy type (do NOT include policy number(s)) and we will come back to you with the information.

And this is all before you take into consideration the individual investment Managed Fund charges. Every fund will have their own internal charges for the operational costs of managing that particular funds strategy. Fixed Interest / bond and passive type funds generally have lower costs with the more specialist equity funds (biotechnology, emerging market economies) being the more expensive due to the higher levels of activity.

There are different versions of each fund, structured for a specific end client. Unfortunately, it does appear that the share class version the savings plan policies use are the higher charging, retail versions of the fund…… maybe the Life Companies get some form of trail commission revenue from the fund managers for making it available on their list of available funds………..

Learn how you can hold the same investments but with lower charges

I am sure that there will be many an offshore adviser that will rubbish what I have stated above…… but at the end of the day, it is my personal opinion based on my 15+ years of working in the offshore investment industry (as well as the 20 years in the Australian financial Industry) and the information that I have gathered over the years.

I am a strong believer in the importance of flexibility, and the Covid19 pandemic in 2020 & 2021 is a perfect example of why it is so important. As an investor, wouldn’t you prefer to have the flexibility to reduce or stop making regular contributions without getting penalized..?? Also, wouldn’t you like to be able to access your money at anytime without penalty..?? I know that I prefer that with my own personal finances.

So when would I use a contractual savings plan?

For smaller regular contribution amounts (less than $1,000 per month) it may be more beneficial for a contractual savings plan due to the fact that you can ‘spread’ that contribution amount across a range of ‘their listed managed funds’. This means that the regular contribution can be invested in up to 10 different specialist funds for each contribution. So there is a definite advantage with asset and fund manager diversification in this situation.

However, you can access a low cost, global diversified index fund that would provide exposure to many different regions (& asset classes) within the 1 fund via a direct platform.

With an investment platform, as you would be investing directly into the relevant fund, there will be at times where a minimum investment amount is required.

Another situation where I would consider including a contractual savings plan as part of a longer term strategy is with Principal Protection savings plans offered through Investors Trust. These policies offer investors the option of investing into the S&P 500 Index or the MSCI World Index (ex US) and participate in the performance of these relevant indexes, while also benefitting from the Principal Protection feature that these products provide in the event that markets were to experience a significant fall when the policy was about to mature.

For example, the Investors Trust policy will provide Principal Protection of 100% for a 10 year term, 140% for a 15 year term and 160% for a 20 year term.

But I must stress that it would only form part of a savings strategy as to qualify for the Principal Protection, there are conditions that need to be met (example, all contributions due to be paid into the plan over the term of the plan, need to have been made) plus it can impact an investors flexibility in the event that their personal situation has changed.

Other Benefits

Being issued by a Life Company, there is the Insurance Tax Wrapper structure around the policy which can provide some tax benefits for certain nationalities / citizens while they hold the policy, and/or when it comes time to cash it in.

There is a definite benefit for Australians that return & become Aussie tax residents again with the 10 year ruling. In summary, if a policy has been held for 10 years or longer, and you have not contributed 25% more to the plan than the year prior, any gains made on the cashing out of the policy would not be subject to Australian tax (correct as at time of writing). If you are an Australian that is planning on repatriating back to Australia (or already have) and would like further information on the tax consequences of an offshore policy, please click Request Information and we will be in contact with you.

Also, as a Life Insurance product, it can be very beneficial when it comes to Estate Planning in that in the event of your death, with a valid beneficiary nomination on file, the proceeds can be paid directly to the beneficiaries without the need to wait for Probate or the Estate to be settled. In addition, as a Life Insurance product, there is an additional 1% of policy value paid out on death which is the insurance element of the policy.

So in summary, yes there can be situations where an offshore contractual savings plan could be the appropriate product…….. But before signing up, please check the terms & conditions, especially the penalties if your situation changes and you need to change the contribution amount or need to access some or all of the policy.

Remember, they have set the pricing on these policies based on you contributing the same amount each month, every month until the maturity date…….. ask yourself this…. “do you think that your situation will not change over that period..?”

Personally……. I would prefer the flexibility.

** The RL360 Savings Plan mentioned in this article is a product that I would propose for a potential client where a contractual savings plan is the appropriate option for the client. I am in no way suggesting that there is anything wrong or unethical with the product….. I just want to ensure that potential clients are provided with the most appropriate option for their personal requirements.