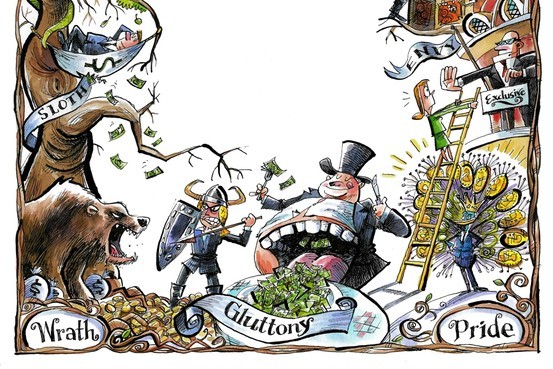

The seven deadly sins of investors: Avoid these common investing mistakes

Bestinvest’s Adrian Lowery warns of seven key investing sins that should be avoided.

By Adrian Lowery,

By Adrian Lowery,

Bestinvest

We are all human when it comes to matters of money and our financial affairs don’t always benefit from the most rational behaviour. And nowhere is this probably more true than in the field of investing, where it is easy to let emotion and impulse get the upper hand. In order to keep a portfolio on the straight and narrow, there are seven key investing sins that should be avoided.

Sin 1 – Lust: Following the latest hot trend

There is always an alluring new investment theme to get excited about and the investment industry is notoriously faddish. During the pandemic crisis it was stay-at-home technology and renewable energy, all accessible by a raft of – in many cases recently established – thematic funds, investment trusts and ETFs.

That’s not to say all of these are poor long-term investments: looking past short-term volatility to see a good long-term case is important. But it’s easy to forget the basics, the steady-Eddie investments that should be the core of a portfolio, and end up with a lot of sparkly, risky and volatile peripheral assets.

Sin 2 – Gluttony: Buying too many funds

Sin 1 leads naturally to sin 2: as the years go by many investors are tempted each year by the latest hot themes and end up with sprawling collections of investments that were once in vogue.

It is easy to pick up dozens of investments this way, which will almost certainly not form a coherent, well-planned investment portfolio that works together. The portfolio will end up being ‘over-diversified’ (i.e., you own everything including all the bad stuff), poorly constructed, difficult to monitor and often too risky.

Any more than 20 funds is probably too many for most private investors, and reasonable diversification can be achieved with around a dozen carefully researched and selected investments.

Sin 3 – Wrath: Reacting to short term events

Impulse and impetuosity are not useful attributes for investing.

Panic selling during market sell-offs is rarely the right thing to do, and can very often result in missing out on subsequent gains when the market recovers. Likewise, when markets are soaring to new highs and valuations are frothy, over-confidence can mean taking too much risk.

If investors find themselves unnerved by short-term market volatility, then they should consider de-risking their portfolio into more stable, defensive assets. Investors can protect against some of the volatility in equity markets this way, but the most important tactic is to take the long-term view. Markets have consistently provided positive returns over the long run.

Sin 4 – Greed: Chasing gains

It can be very tempting to keep ploughing ever more cash into the same, favourite funds in a portfolio that have done particularly well. This is not always a bad thing to do, as long as it is done with consideration and is consistent with a well-balanced and diversified portfolio strategy.

But often that is not the case and the extra investment in the star funds means they can dominate a portfolio, leaving the investor too narrowly exposed to a particular manager and their investment style. In many cases, after stellar gains, the sensible thing to do is to top slice and take some profits, not double down.

As a rule of thumb, it is wise not to hold more than 15% of a portfolio in a single fund.

Sin 5 – Sloth: Not reviewing one’s portfolio

Looking for the next big thing to buy into is a lot more interesting and exciting than reviewing what is already there. Doing a portfolio MOT at least once a year is a good discipline to follow.

This can involve rebalancing the asset allocation so the portfolio remains suitable for the investor’s risk profile; checking whether each fund is performing well against the part of the market it invests in; lifting the bonnet to see whether there have been any changes to the way a fund is being managed; and assessing whether the economic outlook means you need to switch into slightly different investment style.

This is the time to be honest with oneself about mistakes and not to fall into the trap of sin 6…

Sin 6 – Pride: Refusing to sell

It can be difficult to admit one has made a bad decision, or that to recognise that a once sound investment has gone off the boil because of a change in circumstances such as the fund becoming too large, or the appointment of new managers.

Many investors will hang on in there in the hope that a disappointing investment will eventually return to form or are reluctant to sell until it has made up lost ground. Many investors end up with what is known as a ‘long tail’ of funds that have fallen from favour but have not been sold.

Sometimes switching and moving on can be the right move. This is one of the most difficult aspects of investing, realising what is a short-to-medium term patch of disappointing performance, and what is a deeper problem that needs to be acted upon; when to keep faith and hold on in hope of better days ahead, and when to cut one’s losses and exit.

Sin 7 – Envy: Choosing investments on a hot streak

Even the very best funds will go through weaker periods and so it is unrealistic to expect a fund to always be near the top of the performance rankings. It is often a mistake to put too much store by short-term performance tables.

Looking at three- or six-month, or even one-year, returns across the whole investing market will probably throw up many funds that are surpassing anything that’s in your portfolio.

There can be a time and a place for different styles of investing such as backing growth or value stocks, and more active investors may be prepared to adjust a portfolio in favour of different styles over time depending on the market environment. But for many the right approach will be to hold a portfolio that blends different approaches and to hold these over the long term.

Adrian Lowery is an analyst at investing platform Bestinvest.

At Ethical Offshore Investments, we can provide guidance on a range of high quality Fund Managers and Exchange Traded Fund (ETF’s) providers that offer exposure to a wide range of global investment opportunities. As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

We will also NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

If you would like to discuss your investment options, including the low cost opportunities, please press the Contact Us button below and we will contact you personally.

Socially Responsible Investing – Ethical Business Standards