Warning: These are the 3 most common crypto scams

Cryptocurrencies have now hit mainstream investing, but it’s still a wild world out there and everyone needs to be careful.

Published January 6 2022 – Motley Fool Australia

The last 12 months have seen cryptocurrencies creep increasingly into the domain of mainstream investing.

But amid the hype, it’s easy to forget that the industry is still largely unregulated. The whole concept of cryptocurrency was born out of a desire to circumvent centralised banking, so this shouldn’t be entirely surprising.

As such, there are nefarious types that prey on investors looking to make a quick buck.

Australian crypto exchange platform Coinjar recently listed 3 of the most common scam mechanisms out there.

“The best thing you can do is approach everything involving your crypto with a healthy degree of scepticism,” the Coinjar team said in a memo to clients.

That’s a crypto platform saying this, folks.

Take a look at these scams — and be careful out there:

Rug pulls

A ‘rug pull’ is perhaps the most blatant rip-off in the crypto world.

A new currency is created, promising the world. Investors put their hard-earned into buying the tokens, hoping they will make lots of money from being early adopters.

Then the development team becomes silent. Sometimes even, the crypto’s website is taken down overnight.

“Rug pulls occur when the developers behind a crypto project disappear, taking with them the millions of dollars worth of crypto that investors have given them to buy unreleased tokens or as contributions to token liquidity pools,” stated the Coinjar memo.

“These projects will often have white papers, development timelines and slick-looking websites to make them seem legit.”

In the short term, the currency value may rise spectacularly.

“However, if you scrape the surface there are usually warning signs,” read the Coinjar memo.

“They’ll typically be meme-based tokens, capitalising on market FOMO or pop culture frenzies. They’ll often have anonymous development teams, staffed by people with no LinkedIn profiles or professional history.”

Another huge warning sign is that currency holders cannot sell their tokens.

A recent example of a rug pull is the Squid token, which jumped from 1 cent to US$2,856 almost overnight on the back of the popularity of the Netflix series Squid Game.

The developers then ran off with an estimated US$3.38 million, according to Gizmodo.

Celebrity investment schemes

If a famous wealthy person invests in something then it must be fine, right?

Scammers have exploited this logic for time immemorial, and it continues in the age of cryptocurrencies.

“You’ve probably all seen the ads or emails about high-profile celebrities – Hugh Jackman! Nicole Kidman! – promoting Bitcoin investment platforms that promise guaranteed 1,000% profits,” read the Coinjar memo.

“Click through and you’ll be taken to a legitimate seeming website and asked to register your interest.”

Once they have your details, there will be high-pressure tactics applied to entice you to “invest”. The scammers will then have a fake online portal showing how your money is supposedly growing in real-time.

“The number will keep on going up and up, until you try and withdraw your newfound gains and discover that they were only ever numbers on a screen,” the memo read.

“Investment schemes have long been the biggest single part of the scam landscape and cryptocurrencies are driving it to new heights – almost $100 million has been lost to investment-based scams so far this year.”

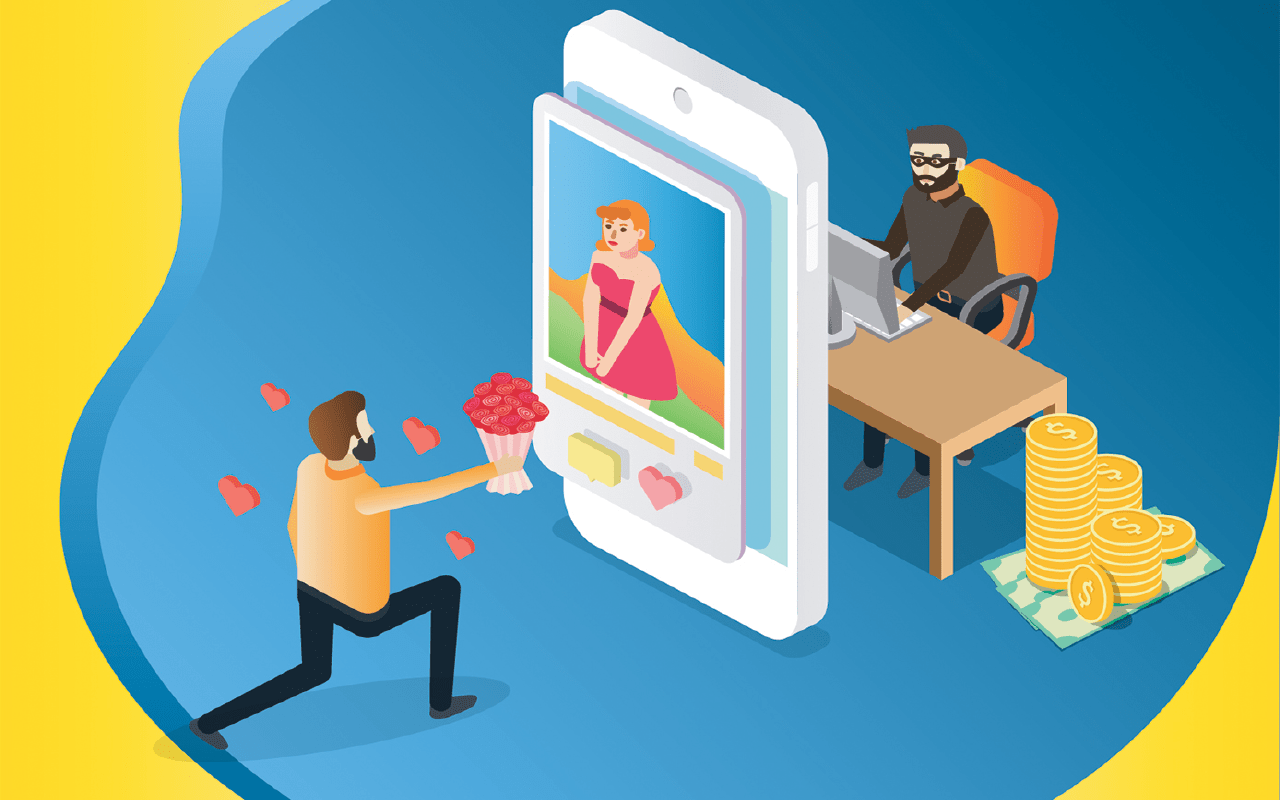

Romance scams

The universal desire for companionship has been exploited online by criminal enterprises for decades now.

The scammers generally find their victims on social media or on dating platforms.

“Once an initial connection is made, the scammer will lavish you with attention and compliments. Victims often report chatting to their scammers online for hours each day, developing a relationship that feels profound and real,” read the Coinjar memo.

“Some planned to marry – as soon as they were able to meet face-to-face.”

After months of an online relationship that feels very real, the scammer will suddenly request crypto.

“‘I need money to get back to Australia to be with you’; ‘My mother is sick and we can’t pay her hospital bills’; ‘I’ll pay you back as soon as I get this job’,” the Coinjar team cited as some examples.

“Usually a small amount first, but over time the requests can build to tens of thousands of dollars. And then, at the first trace of suspicion, they disappear.”

Important information

This communication appeared and was first published through the Motley Fool Australia (www.fool.com.au) and is for information purposes only.

At Ethical Offshore Investments, we only invest in regulated investments, which means we do not provide advice or guidance on Crypto currency assets. However, there are a range of regulated managed funds and ETF’s that invest in companies directly associated with the technology involved with the Crypto market.

This includes companies directly involved in the Blockchain technology, currency storage and Cyber Security.

When investing into these types of fund, we will always get access to the lowest charging version of this fund available on the relevant platform, which ensures that more of the growth stays in our clients pockets.

If you would like to learn more about the wide range of quality funds that are available to investors, click the More Information button below and we will contact you personally.

Sustainable Investing – Ethical Business Standards