The chart showing why you should keep calm and carry on investing

There are plenty of logical reasons why investors might want to shift out of stocks but the data tells us not to

By: Jonathan Jones,

Editor, Trustnet

‘Time in the market is better than timing the market’ is an old adage used by financial experts and one that is typically thought to be the best way for new investors to think about how to put their money to work.

The idea of staying invested came up again this week in a blog post from Aberdeen Asset Management, in which its Asia Pacific team highlighted the below chart.

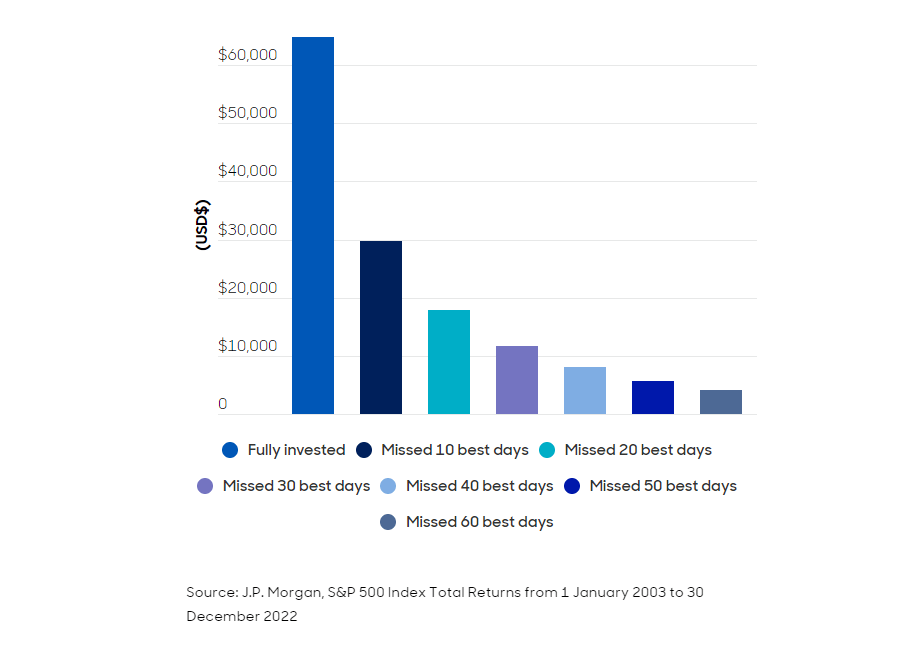

It shows how much an investor would have made if they had put $10,000 in the S&P 500 back in 2003 and left it fully invested for 20 years.

By comparison, the chart also shows the returns that same investor would have experienced if he or she had missed the 10 best days in the market or fared even worse.

How much an investor would have made with $10,000 over 20yrs

This phenomenon of lowering returns when missing out the best days is particularly compounded for income investors, the research noted, as investors will miss out on dividends throughout any periods their money is not being put to work.

It sounds simple: stay invested throughout and reap the rewards. But there will undoubtedly be some that believe they can do even better – why not try to miss the worst days and still reap the rewards of the best?

The reason this is so difficult to do in practice, however, is because quite often these best days come shortly, or even immediately, after the worst days – making it incredibly hard to time.

Yet it would not come as a surprise if investors have in fact been making changes to their portfolios during the past couple of tumultuous years. Indeed, there are plenty of logical reasons why they might want to consider pulling their money out of stocks.

First, cash and bonds now offer compelling yields for the first time in more than a decade, giving investors the chance to move down the risk scale and still achieve steady returns.

This has been compounded by several big events including Covid-19, war in Europe and the Middle East and – new to 2024 – an array of elections in countries around the world including the UK, US and India. All of these have at times posed significant risks to markets.

Then there are the macroeconomic pressures. Inflation has dropped but the final push to central banks’ 2% target is proving difficult to achieve, leaving interest rates in limbo at present and causing more concern that rates may stay higher for longer – something markets are not favourable on.

Lastly, turning to markets themselves, it is easy to come up with arguments as to why now may be a good time to take profits from expensive US stocks such as Nvidia and the other ‘Magnificent Seven’ names that have dominated for the past 18 months, or the ‘Granolas’ in Europe, which have rocketed in recent years.

An investor looking at any or all of these factors could be forgiven for making changes to their portfolios and shifting exposures, taking profits or selling out entirely.

Despite plenty of reasons to move your money elsewhere, whether it be to take on less risk through bonds and cash options, or to move outside of expensive areas such as the US, the data always reminds us that the best course of action is to stay the course and remain invested.

Please Note:

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please note the above article was first published by Trust Net and should not be regarded as individual investment advice on whether to buy, sell or hold any of the funds mentioned. Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investment costs via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards