Are Commodities Telling US Something..??

Please find below the latest update from Adrian Tout from his regular newsletter, “Trade the Tape”.

Please note that this is for general information only and should not be considered personal financial advice.

The purpose of publishing these newsletters on the Ethical Offshore website is to provide investors some simple, easy to understand technical details on why the US markets are behaving the way they are at the moment, what has occurred to get them where they are, and what actions may influence where they end up in the near future.

The way Adrian Tout explains all this, in simple terms, I believe is good reading for any investor to get a better understanding of what is happening within the financial markets, what risks to be aware of and how to take advantage of these market conditions for your medium to longer term investment journey.

May 6, 2024 – Adrian Tout

Are Commodities Telling Us Something…??

-

Why I expect lower commodity prices in the second half

-

If true, then expect inflation to fall and the Fed to cut

-

And why the narrative will pivot from inflation risks to the dreaded ‘R” word

Forecasting things like (not limited to) GDP growth, unemployment and inflation is tricky business.

Very few get it consistently right (especially policy makers).

And whilst macro forecasting is generally a fool’s errand – there are things we can observe to improve our probabilities of success (or at least reduce our risk).

Consider inflation…

Whilst not perfect – there are a set of reasonably strong correlations which exist over extended periods.

And it’s these types of correlations we can use to our advantage.

As I will demonstrate shortly – over the past five decades (after the US dollar removed its peg to gold in 1971) – inflation levels have largely correlated to what we see with commodity prices.

And this makes sense – as commodities comprise the input cost of almost everything we consume (e.g. from energy to food to basic materials etc).

It follows that every inflationary spike we’ve seen has come with (short-term) spikes in commodity prices.

Here’s another way of framing it:

We’ve never experienced a surge in inflation without a rise in commodities.

And whilst the financial media (and specifically central planners) appear ‘wrapped around the axle’ on things like “Supercore PCE services” – is this the right metric when looking ahead?

Let’s take a look.

Where You Go… I Go

Let’s start with a long-term chart…

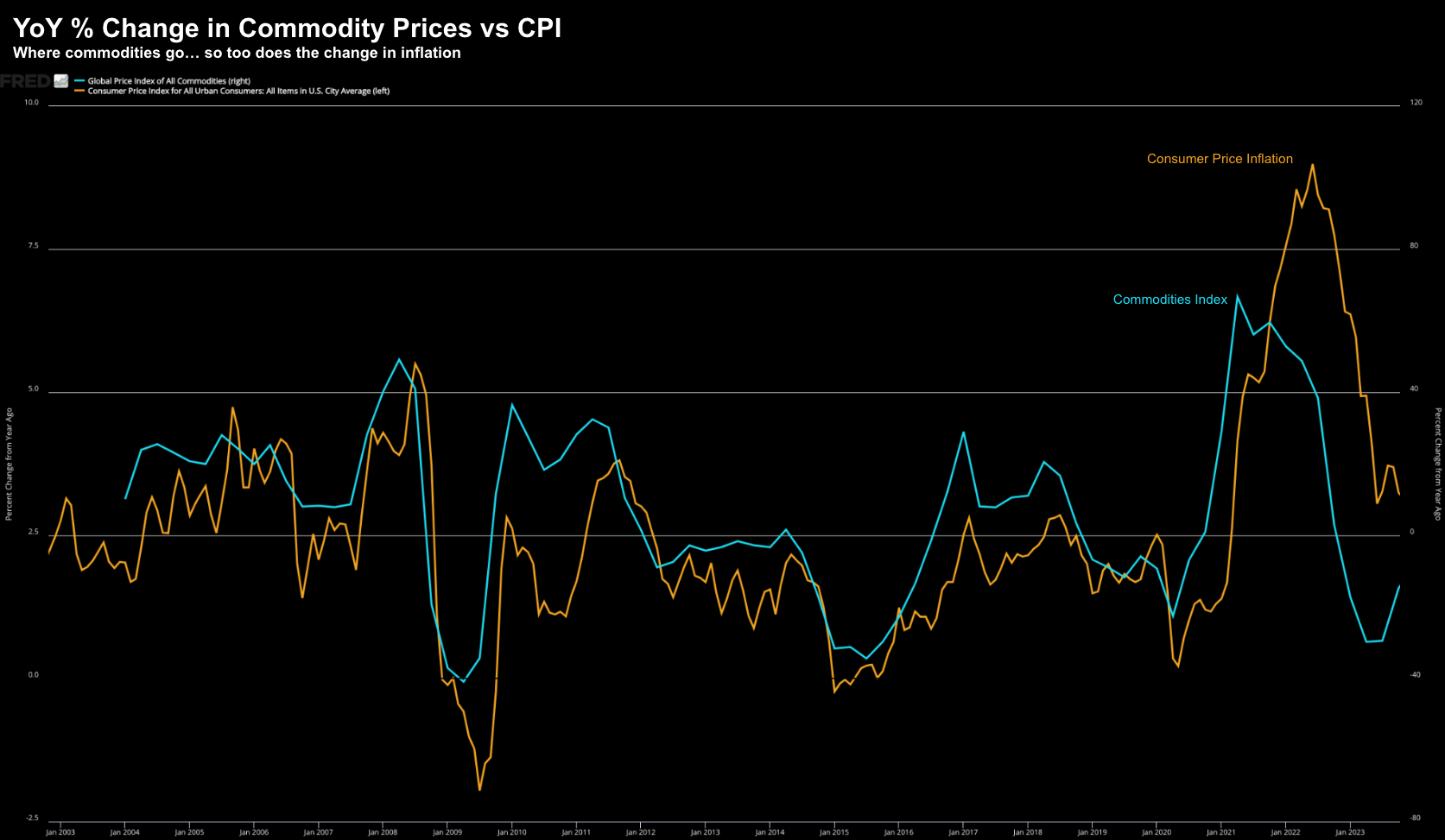

Below is the 20-year correlation between the Global Commodities Price Index vs Consumer Price Inflation (CPI)

May 6 2024

At first glance, we can see that the correlation is not perfect, however more than consistent.

For clarity:

- The orange line is YoY % change with consumer price inflation (CPI) – currently running around 3.5% (as of April 10)

- The light blue line shows what we see with the YoY % change with the global commodities price index.

It’s fair to suggest that commodities represent a “foundational layer” for inflationary events (e.g., note the corresponding peaks and troughs)

But consider what we’ve seen of late…

For the first few months of 2024 0 commodity prices on the whole (especially oil) moved higher.

Naturally, this added to inflation (cited by the Fed).

(n.b., read this post where I called the possible ‘oil problem’ for the Fed in March)

Now compare this to what we saw last year with commodity prices…

Here we saw rapidly declining prices for energy, agricultural and metals products (with inflation following suit)

Therefore, perhaps the right question to ask is where do we think commodity prices are potentially headed?

This is a very difficult question to answer.

But we can take a look at history (and specific ratios) to hazard a guess…

What Can We Learn?

Whilst things like services are adding to inflationary pressures (due to higher wages) – it’s worth asking whether they will continue to be the most impactful driver of higher prices?

My guess is potentially no…. especially if we continue to see the labor market weaken (which I think will be the case)

As an aside, the latest labor report showed more chinks in the employment armor.

From mine, commodities are arguably a more reliable long-term source of inflationary pressure.

And if the Fed are to get back to levels of 2% Core and Headline (PCE and/or CPI) – they will need to see lower commodity prices.

Period.

To that end, much lower commodities will play a major role in determining the Fed’s next step on (possibly easing) monetary policy.

And from there, we can hazard a guess as to what we see with speculative assets (which I will touch on in my conclusion).

Now over the past three years – the Fed has been forced to be restrictive with monetary policy.

Due to artificially suppressing rates well below market – this lead to excess money chasing too few goods (the very definition of inflation)

But what has eluded most investors (for now) has been the “long and variable” impacts of tighter monetary policy.

Look no further than massive amounts of fiscal spending (which I will talk to below).

From my lens, it would appear that the Fed’s restrictive policies could finally be playing catch up (and perhaps why Jay Powell & Co. are so confident in their inflation outlook)

Another chart (and coming back to fiscal spend):

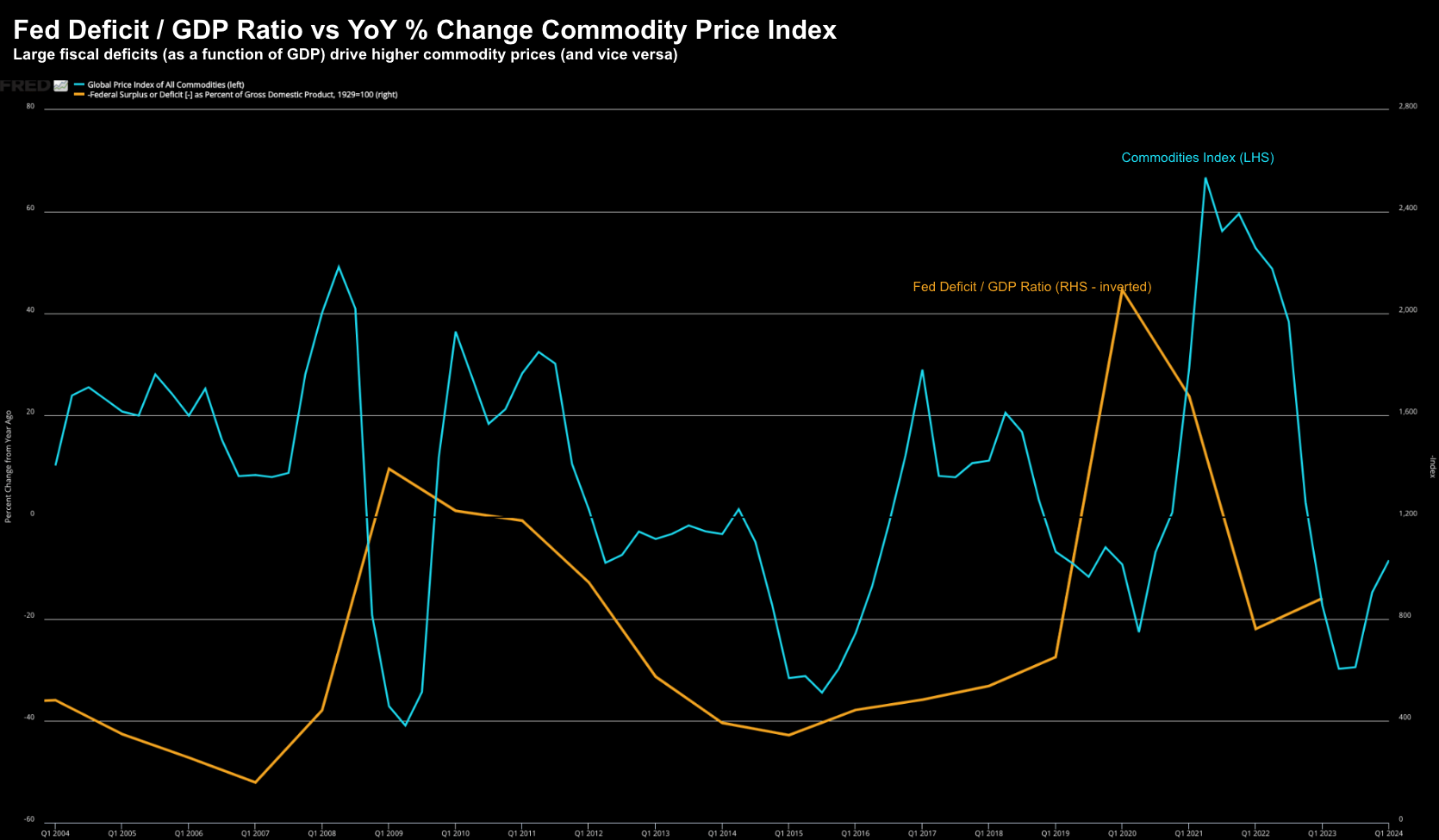

The chart above plots the global commodity price index (blue) vs the fiscal deficit as a function of GDP (orange and inverted).

Again, it’s far from perfect… but it could be helpful with identifying what potentially lies ahead for inflation.

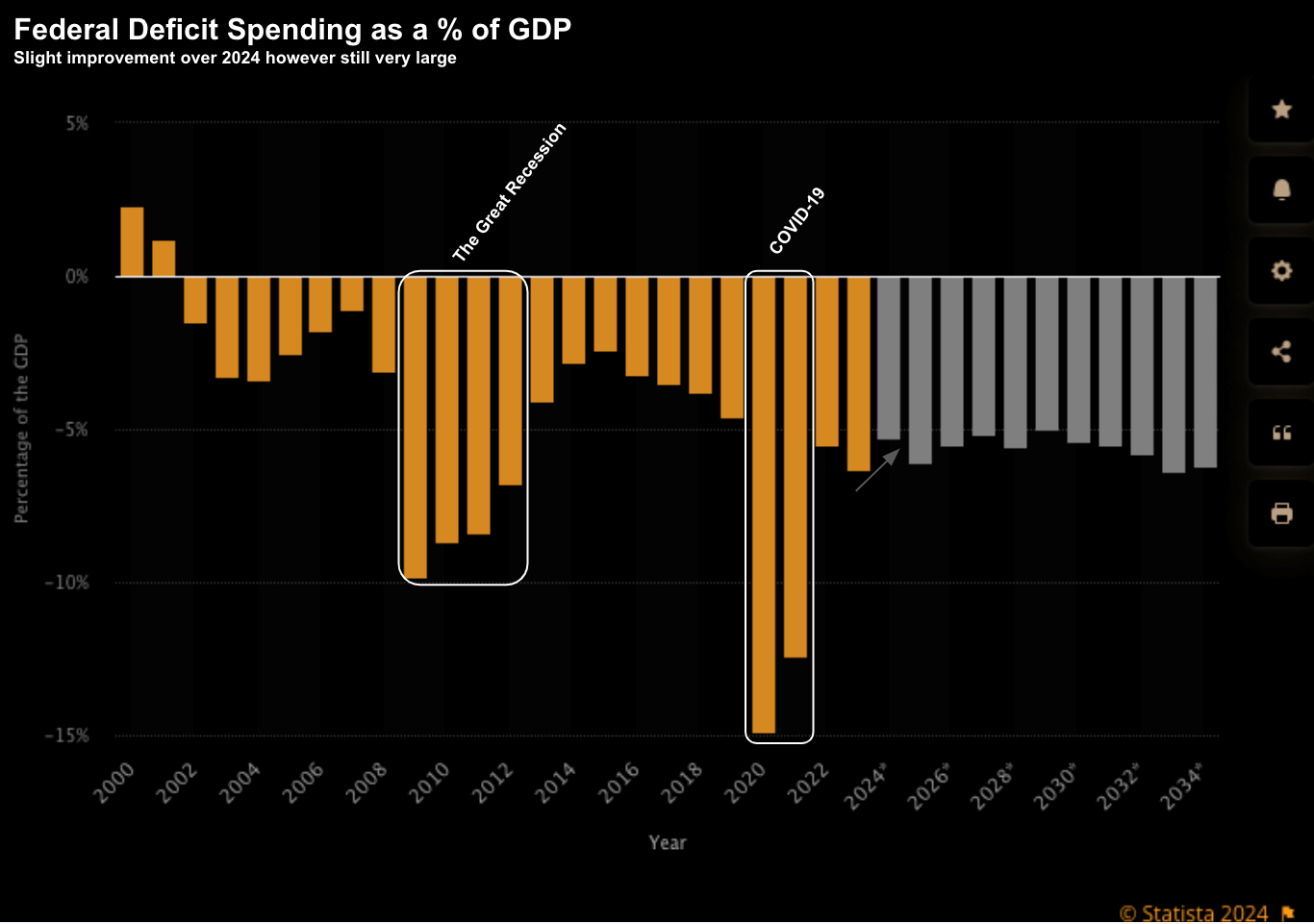

Now when the federal deficit-to-GDP ratio rises, the deficit shrinks, and fiscal stimulus becomes less accommodative.

The opposite also holds true; i.e., when the deficit expands (as we saw recently at a level not seen since WWII), this is both accommodative and inflationary.

For example, looking back, we saw this ratio rise with massive fiscal deficits – sending commodities (and inflation) higher.

To that end, one could argue the government was an opposing force to the Fed in their fight to squash inflation (and hence the delayed impact of monetary ‘long and variable’ lags.

(Note – Powell told us as much in this interview with 60-Minutes early Feb).

The “good news” is the government has started to moderate their post COVID spendathon (slightly)

For example, the federal deficit/GDP ratio has come down about 2.4% since last June (see below)

Now if our earlier correlation holds true (bearing in mind it operates with a lag) – this should result in decline in commodity prices towards year end.

For clarity, this is not to say it will, but all things being equal this is what we should expect (i.e., it’s a higher probability outcome)

So what sort of decline could we expect?

Well for that I will refer to the tape…

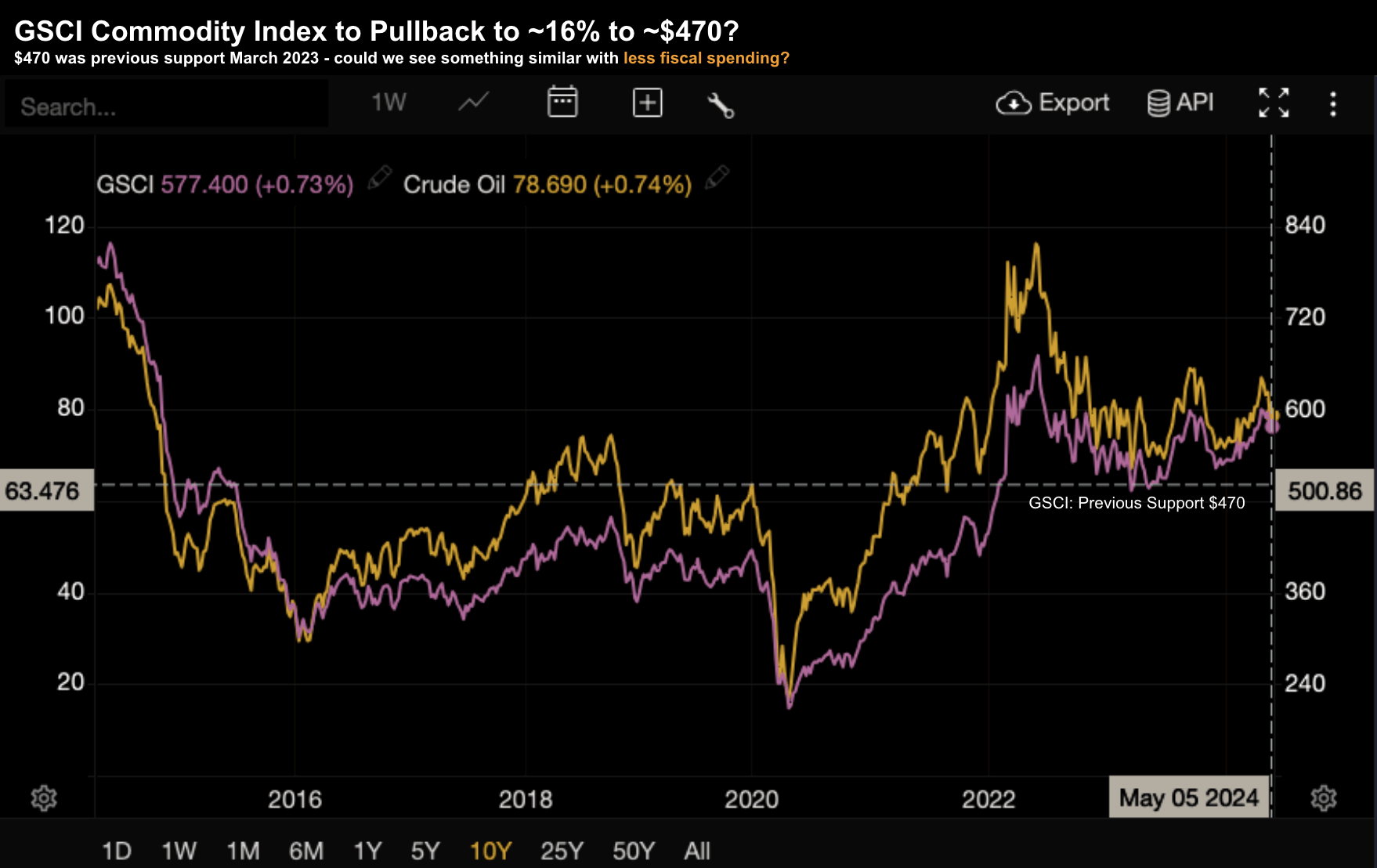

Today the GSCI commodity price index trades around 577 (according to tradingeconomics.com)

The chart below (which also plots the price of Crude Oil) suggests we could see this index ~16% lower by years end (i.e. the previous support level of ~$470)

And if that were to transpire – this would be disinflationary – giving the Fed scope to cut.

Put together, a reduced fiscal deficit as a function of GDP will likely see softer commodity prices.

And if that’s true – it follows that inflation heads lower – given the Fed latitude.

But what about bond yields?

Lower Bond Yields

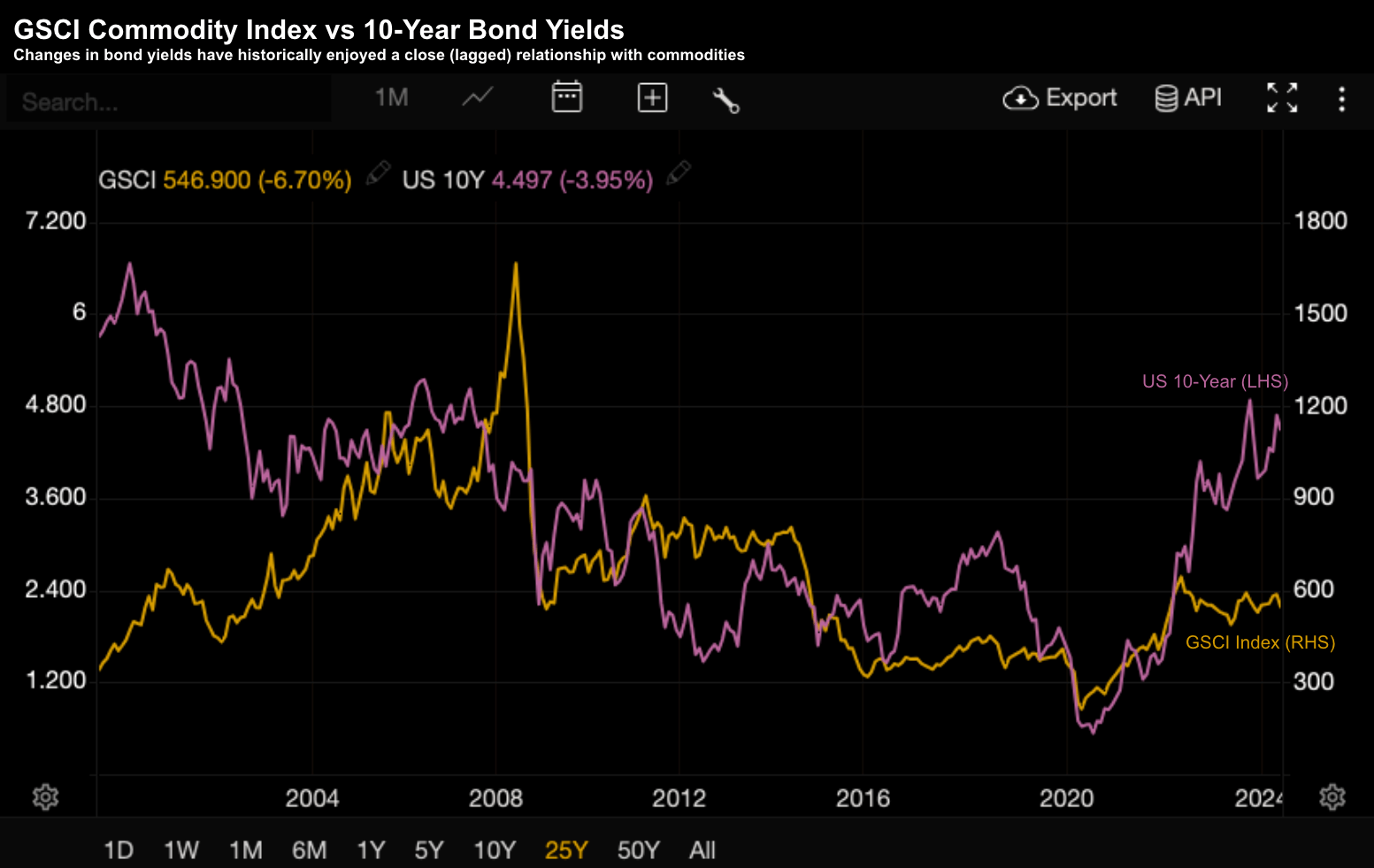

Finally, the correlation between long-term bond yields and commodities is worth observing.

Again, this isn’t perfect, and what’s more suffers an ~2 year lag.

For example, two years ago the 10-year was trading ~3.0% (relatively accommodative)

This is helped push commodities higher…

However, as the 10-year continued to sustain a level well above 4.0% – the rally in commodities stalled.

And it makes sense…

Investment cycles tend to decline as the cost of money increases (e.g., which we saw with private investment in the latest Q1 GDP report)

Now consider the following 20 year chart:

May 6 2024

Commodities are yet to fully react to the 2.0% gain in rates over the past two years.

However, you can see it’s starting to bite. Commodity prices are stalling.

Given the historical two-year lag between the two – it’s my guess commodity prices will soon ease.

And if that happens – the conversation will quickly shift from ‘inflation concerns’ to that of economic growth.

And from there, we usher in Fed rate cuts.

It Starts with Falling Commodities

To help dimension the above shift, from mid-2022 to mid-2023 the GSCI commodity price index plunged 35%.

Given what we now know – the saw CPI decline from 9% to about 3%.

However, the dreaded “R” word also dominated the narrative.

Commodity prices are not only our cue for lower inflation but recessionary fears.

My expectation is commodities will suffer a large drawdown in the second half – giving the Fed more scope to cut.

Will we enter a recession?

That’s very difficult to answer… but it remains something we can’t rule out.

I think the answer to that will depend on what we see with employment.

For example, if we see the unemployment jump to levels of 4.50% over the coming few months, then I would be confident in calling for a recession.

But first, let’s see what happens to commodity prices…

If we see a 10% to 15% fall in the coming 6 months with the GSCI… that’s where the conversation will shift.

And no-one will be talking about unwanted inflation.

Putting it All Together

My argument is Powell has an itchy trigger finger when it comes to rate cuts.

A sharp fall in commodity prices (e.g. to the tune of 15%) would be just the tonic.

What’s more, I also believe Powell wants to ensure he “sticks the so-called landing”

He knows that a sharp decline in commodities will be a leading indicator of slowing demand and growth.

However, cutting rates at that point might be too late.

Meanwhile he has a US President election to contend with….

If Powell is successful in avoiding recession (and he might be with a lot of luck) – then equities will advance during the rate cut cycle.

If not – down they go.

From a risk management perspective, exposure to bonds looks very attractive in a disinflationary environment.

For example, if the 10-year is to fall from today’s 4.50% to levels closer to 3.50%, that will be a boon for anyone buying bonds today.

And in terms of equities – your tilt should be towards defensives over cyclical sectors.

Cyclicals do better during the early cycle… not late cycle (which we are in now).

But there’s a lot of water to pass under the bridge between now and then… keep an eye on commodity prices.

If they continue to decline… expect inflationary pressures to ease.

Regards

Adrian Tout

The above article is for information only. The views of the author or any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy, sell or hold any specific investment or to adopt a particular investment strategy. However, the knowledge that professional analysts provide can be a valuable additional filter for anyone looking to make their own investment decisions.

Ethical Offshore Investments provides guidance on portfolios that have an ESG (Environmental & Social Governance) bias and an SRI (Socially Responsible Investing) focus. By avoiding high charging, commission paying funds, this results in lower portfolio costs, so more of the growth staying in the pockets of our clients.

Ethical Offshore Investments can also assist clients in getting exposure to the investment markets such as the broad S&P 500 index through very low cost Exchange Traded Funds (ETF’s) as well as investing directly into the individual stocks.

If you would like to get more information on the Sustainable Ethical Allocation portfolios, or enquire on the vast array of Sustainable and Ethical style funds available, please click on More Information.