Guinness Sustainable Energy Report – 2024 Outlook for Sustainable Energy

This is a marketing communication. Please refer to the prospectus and KID/KIID for the Fund, which contain detailed information on its characteristics and objectives, before making any final investment decisions.

Building efficiency: critical to the energy transition

January 2024

Executive Summary

Energy efficiency, energy security and access to critical material supply chains were the key drivers of the energy transition in 2023. A rapid increase in interest rates together with sluggish inflation negatively impacted the energy transition economics, but 2023 activity in solar, electric vehicles, batteries and energy efficiency all came in ahead of our expectations.

Some clarity was provided around key policy initiatives, but we expect more to come in 2024, spurring further growth in investment and activity. With renewable energy generation continuing to be relatively more economic than fossil fuels, we see the sector representing an attractive long-term growth opportunity.

Our portfolio, which offers broad exposure to companies that are well placed to benefit from the energy transition, now trades at a discount to the MSCI World Index despite offering more than double the earnings growth potential.

This month’s manager’s comments explore building efficiency, focusing on these four key areas.

|

|

After a year of highly accommodative fiscal policy in 2022, the dominant driver for 2023 became tightening monetary policy. A rapid rise in interest rates together with pockets of sluggish inflation led the economics of renewable projects to suffer relative to competing fossil fuel alternatives but, post these factors, we find that renewable energy generation continues to be relatively more economic than fossil fuels. Better relative economics as well as security of supply considerations will help to sustain strong demand for sustainable energy activities during 2024 and will keep the long-term driver of renewables adoption intact.

Much of the key policy support for the energy transition in 2023 was enacted with a focus on improved energy efficiency, energy security and access to critical material supply chains, including the following:

- Further details were provided in Europe about how the EU will localise clean technology manufacturing and supply chains, in order to reduce its reliance on China, as part of its goal to achieve carbon neutrality by 2050. The EU plans include a 55% cut to emissions, 13% lower final energy consumption and 45% renewables in the energy mix by 2030.

- In the United States there was a meaningful surge in activity thanks to the Inflation Reduction Act (IRA), with $369bn of tax breaks morphing into $1.6 trillion of capital being mobilised towards achieving net zero aims. According to the World Economic Forum, this will create over 170,000 jobs and more than 9 million jobs over the next decade. Importantly, with 2024 being an election year, 80-90% of these new jobs are within Republican states.

- From a global perspective, 123 countries signed up to the Global Renewables and Energy Efficiency Pledge at COP28, committing to deep emissions reductions by 2030, requiring a tripling of global installed renewable energy capacity and a doubling of the rate of annual energy efficiency improvements.

Around 520 GW of new renewable generation capacity was installed in 2023, 100GW higher than the record installations seen in 2022 and well over double the 194GW installed pre-COVID in 2019. Solar was dominant (at just over 400 GW) with wind in second place (around 100 GW) followed by hydropower, then bioenergy.

Renewable electricity generation in 2023 increased by around 2.5%, reaching over 9,200TWh, and outpacing global electricity demand (estimated 1% growth in 2023).

Electric vehicles saw continued adoption in 2023, albeit at a slower pace than seen in recent years. After growing at over 100% and over 50% in 2021 and 2022, sales of plug-in vehicles grew by around 35% in 2023 to around 14 million units, representing an 18% penetration rate. After increasing in 2022, lithium-ion battery pack costs fell by 14% in 2023 to $139/kWh, driven by lithium and nickel prices that fell by 80% and 40% respectively.

The solar industry grew rapidly in 2023, with installations likely to have exceeded 400 GW for the full year (up tenfold over the last decade and 65% higher than 2022). This is materially ahead of our prior 2023 expectation of 310 GW and will represent the fastest annual growth rate since 2010 (following several years of 20%+ annual growth).

The wind industry returned to growth and is likely to have delivered record installations in excess of 100 GW, despite high-profile company profitability and growth concerns.

The onshore wind sector is likely to have delivered 91GW, with China accounting for 60% of the total and nearly 90% of the year-on-year growth. Offshore wind installations are likely to have reached 12GW (also led heavily by China) with clear policy support for the struggling industry at the end of the year.

Against this backdrop, the Guinness Sustainable Energy Fund delivered a total return (USD) of -0.4% in 2023 vs its benchmark the MSCI World Index (net return) of 23.8%. For comparison, the MSCI Alternative Energy Index was down by 25.2%. The underperformance of the Fund resulted almost entirely from multiple compression rather than earnings downgrades, with the Fund trading at a one year forward price/earnings (P/E) discount of 6% to the MSCI World Index at the end of the year. Since repositioning five years ago, the Fund has delivered a return in excess of its investment universe, based on an equal weighted average calculation.

Looking ahead to 2024 and beyond, we expect further acceleration of the transition:

Renewable power generation is expected to grow at around 7-8%, displacing some coal and gas power, which would result in the electricity sector’s CO2 emissions declining. Grid investment will increase to support the growth, growing at twice its historic rate from $300bn in 2022 to over $800bn per annum (pa) in the 2040s.

Building efficiency and electrification will see sharply greater investment, increasing from $340bn in 2022 to $600bn pa from 2026-30 (10% pa growth versus a historic rate of 5%pa) driven by energy security, economics and tightening building standards.

EV sales should exceed 16 million in 2024, representing around 20% of total passenger vehicle sales and coming in one year earlier than our long-held target of 20% EV penetration by 2025. Improved economics (lower lithium-ion battery prices in 2024) as well as better range and quicker charging times are the key drivers of improved EV sales. We expect the EV/ICE economic parity benchmark for EVs versus internal combustion engine vehicles (ICEs) of $100/kWh battery prices to come in 2027.

Solar remains the cheapest form of new electricity supply. We expect record low module prices at the end of 2023 to spur growth in all major geographies, with full-year global installations likely topping 500GW in 2024. China will still represent more than half of all installations with European and US solar demand set to rise to 70GW and 38GW respectively.

Global wind installations will grow in 2024 to a new record of 115GW, driven by policy support in China, Europe and the US. Beyond 2025 many of the current bottlenecks will dissipate, allowing installations to grow to around 170GW, a growth rate of 7% pa. Offshore installations are set to grow to 40GW by 2030, a 20% pa growth rate.

The outlook we summarise here is broadly consistent with current government activity and observable investment plans.

To be clear, however, the growth described falls well short of the energy transition activity needed to achieve a net zero / 1.5 degree scenario in 2050, as targeted by the IPCC and reiterated at COP28. In a net zero scenario, the deployment of renewable generation capacity, penetration of EVs and battery storage, use of alternative fuels and implementation of energy efficiency measures will need to accelerate markedly.

At 31 December 2023, the Guinness Sustainable Energy Fund traded on a one year forward (2024) P/E ratio of 16.6x, around 13% lower than one year ago. Over the year, the fund’s one-year forward P/E fell from a premium to the MSCI World of 35% to a discount of 13% in October (the largest discount since March 2020) before closing the year at a discount of 6%.

The consensus earnings per share growth outlook for the Fund remains strong at 19.1% pa, forecast between 2023-2026, relative to the MSCI World at 8.4% pa – a premium of over 10% pa. Each sub sector within the Fund is also forecast to see growth in excess of the MSCI World Index.

Current valuation multiples appear, therefore, to discount an earnings outcome that is far worse than that implied by current interest rates and inflationary conditions. Looking longer-term, we believe that the portfolio is likely to deliver normalised earnings growth of around 14% pa, well ahead of EPS growth in the MSCI World Index, that will bring the fund P/E ratio down from the current 16.6x for 2024E to around 10.6x in 2027E.

We expect further positive catalysts in the year ahead. The sector would be a beneficiary of looser monetary policy and lower inflation, while higher fossil fuel prices would further improve the relative economics of renewable technologies.

In terms of policy, further clarity around IRA tax credits and actions related to the EU Net Zero Industrial Act will help to bring greater investment into the sector. We expect investor interest in sustainable energy equities to recover in 2024, reflecting these catalysts, and that the current attractive valuation level will act as a further catalyst. Beyond these, the continuing importance of energy security and the increased individual, social and government pressures for consumers to become more energy efficient and for producers to increase their share of sustainable energy generation will support further growth in the sector.

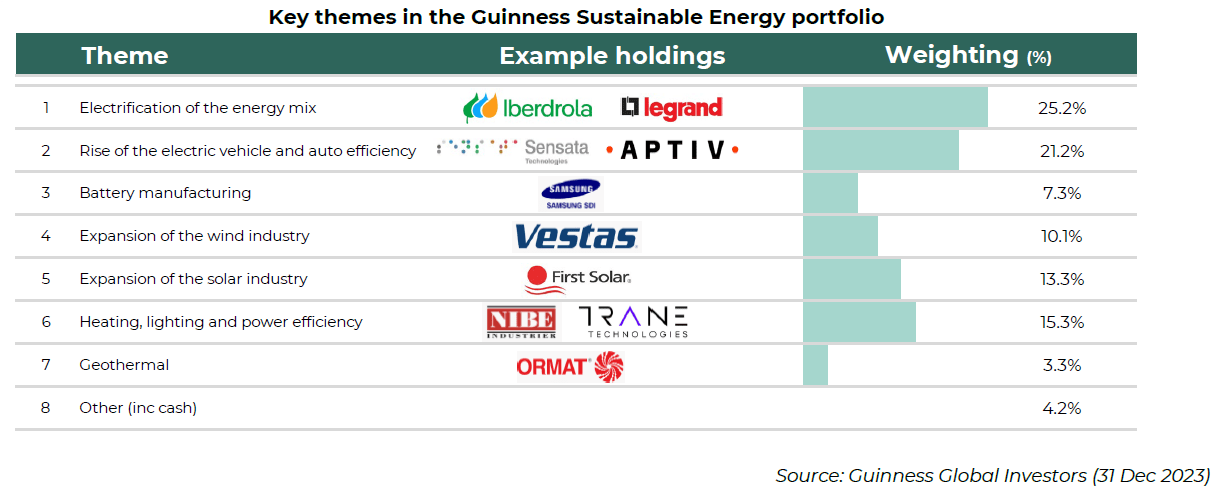

We believe that the Guinness Sustainable Energy portfolio of 30 broadly equally weighted positions, chosen from our universe of around 250 companies, provides concentrated exposure to the theme at attractive valuation levels that are particularly attractive relative to consensus earnings growth expectation

|

|

The Managers

Will Riley – Portfolio Manager

Will joined Guinness in 2007 and has been managing energy funds since 2010.

Johnathon Waghorn – Portfolio Manager

Jonathan joined Guinness in 2013 and has been managing energy funds since 2008.

The value of this investment and any income arising from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested. Past performance does not predict future returns.

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we can access the fund mentioned in this article on the various offshore investment platforms we offer. We do NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investment costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards