Fund Insight – Baillie Gifford Positive Change

If you were offered a net return of 95% for the past 5 years, I am sure most investors would have been happy to take that…….. however, the road to this return has been anything but smooth.

This article provides information on the Baillie Gifford Positive Change Fund which has held a position in our Sustainable Ethical Allocation portfolios since inception (1st November 2018).

Overview

The Positive Change Fund aims to outperform (after deduction of costs) the MSCI ACWI Index (as stated in Sterling), by at least 2% per annum over rolling five-year periods. It also aims to contribute to a more sustainable and inclusive world through investing in companies whose products and/or services contribute to impact themes addressing critical social and/or environmental challenges, measured over at least a five-year period.

Please note – There is no guarantee that this performance objective will be achieved over any time period and actual investment returns may differ from this objective, particularly over shorter time periods.

Past performance is no guarantee of future returns.

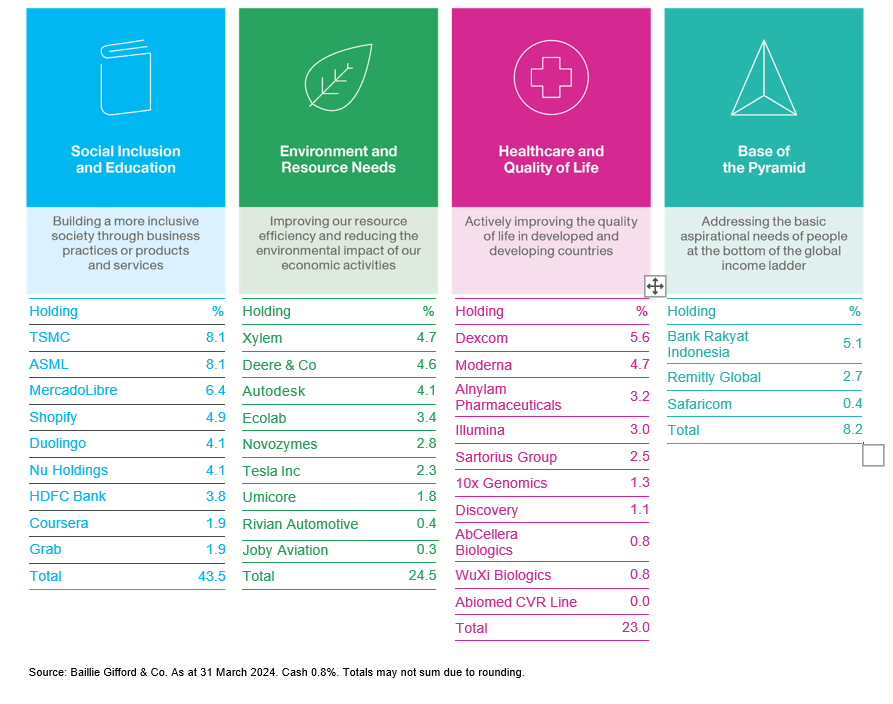

The Baillie Gifford Positive Change Fund is an actively managed portfolio of 25 – 50 global high quality growth companies which can deliver positive change in one of four current areas:

Social Inclusion and Education, Environment and Resources Needs, Healthcare and Quality of Life; and Base of the Pyramid (addressing the needs of the world’s poorest populations).

The Positive Change Decision Makers generate ideas from a diverse range of sources. With a focus on fundamental in-house research, the team complete a two stage analysis of all holdings, looking at both the financial and positive change aspects case for each stock using a consistent framework.

At present, the fund currently holds the following 31 stocks:

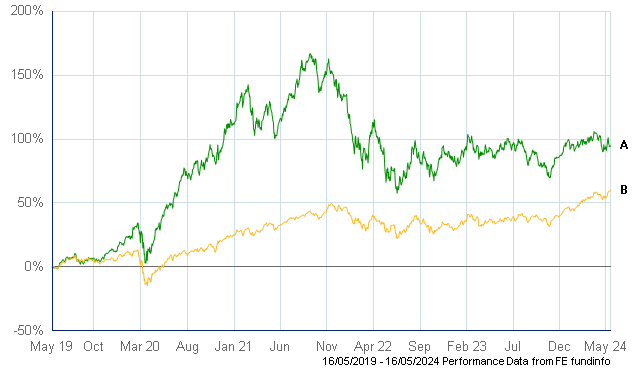

Over the past 5 years, the fund has significantly outperformed most of its peers as well as outperforming the benchmark. But as the graph below indicates, a lot of this out-performance was achieved during the covid impacted times of 2020 through to 2021.

- Baillie Gifford Positive Change B Acc (95.0%)

- IA Global Index (60.2%)

The latest quarterly market commentary for this fund can be found HERE

As I stated at the start of this article, if 5 years ago you were offered a net return of 95% (that is 14.3%pa) for the next 5 years, I am quite sure most investors would have said that they would have been very happy to receive that return on investment.

But what the performance of the Baillie Gifford has shown is the importance of not relying on just one specialist investment, as the short term volatility can be quite extreme…… while it is still +95% over the past 5 years, it is down nearly 27% from its highest level recorded in early September 2021.

So what should investors do…??

Anyone that is invested in the Baillie Gifford Positive Change fund needs to have a longer term investment focus, and can accept that there will be very high levels of volatility in the short term.

While the strategy of this type of specialist fund has been ‘out of favour’ in recent times (high inflation, rising interest rates making smaller, developing & emerging companies less attractive), we still hold a high regard for the management team within the fund, and comfortable that they will continue to meet their long term objective (net performance +2%pa above the MSCI All World Index over a rolling 5 year period).

The current holdings are a very good example of the types of companies that can achieve significant business growth.

BUT……… I would be suggesting that investors consider to look at diversifying their specialist equity holdings.

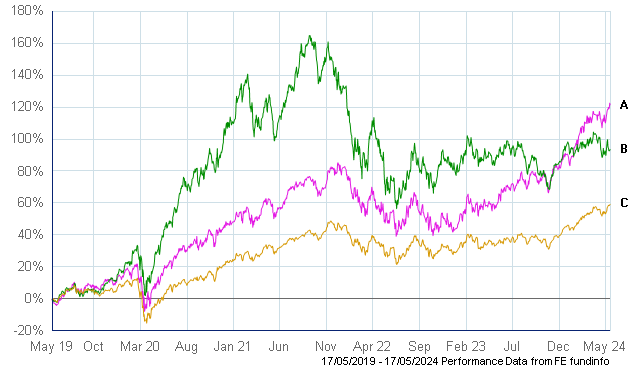

Combing another long term favourite specialist equity fund of ours, the Guinness Global Innovators offers the potential for superior returns over the longer term….. but also, with short term volatility.

Past 5 years net performance:

- Guinness Global Innovators Y Acc (121.4%)

- Baillie Gifford Positive Change B Acc (95.0%)

- IA Global Index (60.2%)

The Guinness Global Innovators fund has also outperformed the majority its peers and the IA Global Index and while it did lag against the Baillie Gifford Positive Change fund, its recent performance has actually now put it ahead of Positive Change over the past 5 years.

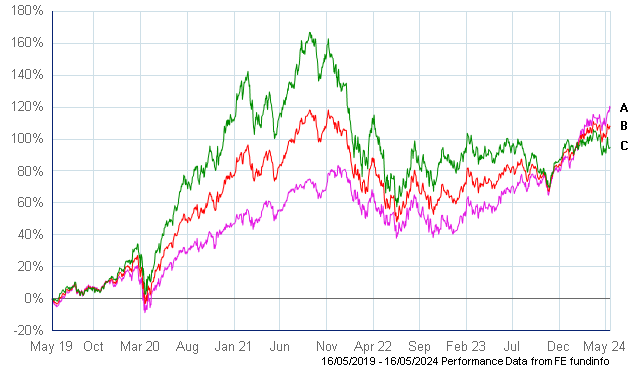

So what would have been the result of the past 5 years if we had combined an investment into the 2 funds..??

- Guinness Global Innovators Y Acc (121.4%)

- Combined Positive Change & Global Innovators (108.2%)

- Baillie Gifford Positive Change B Acc (95.0%)

This would have resulted in once again market beating performance, but with a reduced level of short term volatility.

Both of these funds (in my opinion) have high quality management and an investment into either fund, has the potential to reward investors with superior returns over the longer term…. all be it with high levels of volatility.

But by combining an investment into both funds, will still have the same potential superior growth return to investors, but due to the different investment styles, potentially with lower levels of short term volatility.

And remember, clients of Ethical Offshore Investments get allocated to the lowest charging version of these funds with no additional entry or exit fees applicable.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we can access the funds mentioned in this article on the various offshore investment platforms we offer. We do NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

As we aim not to use commission paying funds (where applicable), we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to see how you can save on your investments costs

Socially Responsible Investing – Ethical Business Standards