Sustainable Portfolios continue their Positive Performance (May 2020 Update)

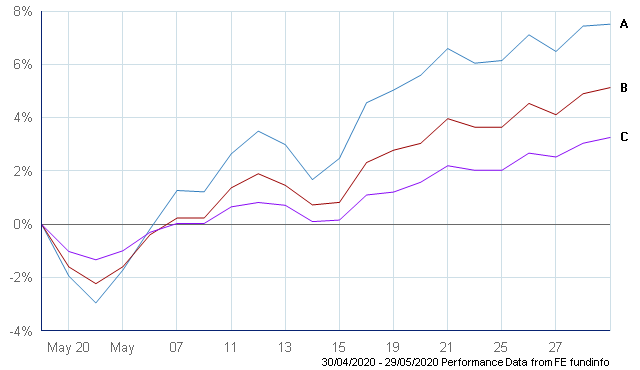

Positive Performance for May 2020…

After a shaky and volatile start to the month of May, and a significant pullback in Europe on the last trading day, the majority of equity markets posted gains for the month……… and so did the Sustainable Ethical Allocation Portfolios.

A. +7.2% Growth Allocation

B. +5.2% Balanced Allocation

C. +3.3% Cautious Allocation

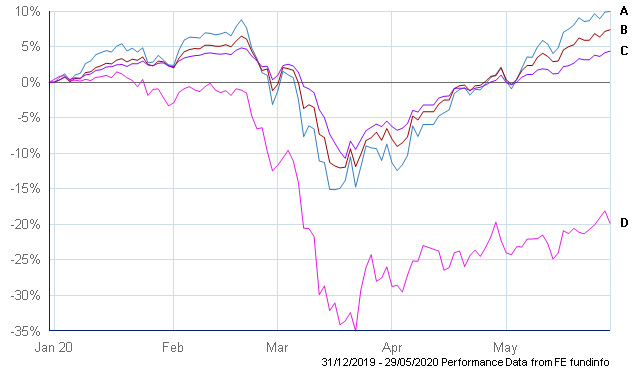

2020 so far…

That has powered the Portfolios well into positive performance for year 2020……. Even after all of the turmoil that was experienced during the panic of late February and through the month of March.

A. Growth Allocation

B. Balanced Allocation

C. Cautious Allocation

D. FTSE All Share

As can be seen in the graph above, all of the Sustainable Ethical Allocation portfolios have provided investors positive performance against a backdrop of negativity across the global markets. The FTSE All Share Index had a positive month (+3.1%) but is still down 19.85% year to date.

So what has driven the Portfolio performance…

Once again, I refer back to previous reports and my comments on the focus of Diversification and Quality. The underlying Fund Managers and their respective funds held in the portfolios have been included because of their individual focus on investing in higher quality, sustainable businesses that should not only come through this current covid19 crisis, but because of their strength of business practices, will come out an even stronger company.

Like all investors, they will not get everyone of their investments perfect and each manager does have their own specific style of investing. This is where the benefit of diversification comes into play by not only ensuring that the portfolio is invested across a range of asset types (equities, infrastructure, fixed interest / bonds, commodities) but across a range of geographical regions, industries as well as individual Fund Manager investment style……….. By blending the different investment styles of the different Fund Managers will potentially provide a more consistent overall portfolio return.

And this has been the case since when I first constructed the portfolio allocations on 1st November 2018.

If you would like to receive further information on the Sustainable Ethical Allocation Portfolios or on the underlying individual Managed Funds, please click REQUEST INFORMATION.

Request more information on the Sustainable Ethical Allocations