Sustainable Ethical Allocation Portfolios – January 2021 Update

One month into the new year……… and it still feels like 2020.

The first 3 weeks of the month of January, we were very pleased with the general market performance and the portfolios mirrored this by continuing their positive momentum from last year.

Then we hear all about some Reddit online forum talking about a battle between an army of amateur investors and multi-billion-dollar hedge fund that has ignited a trading frenzy, sending the share prices of some previously unfancied companies in the US surging while delivering a kicking to the short-selling Hedge Funds who bet against them.

The company that gained most of the media attention was GameStop, a struggling video games retailer that has been hit very hard by the covid19 pandemic.

Institutional investors, including the $13bn hedge fund Melvin Capital have seen this as an opportunity to make a profit from betting against the GameStop share price, commonly known as short selling.

All of this was unremarkable until users on a Reddit forum called ” WallStreetBets” decided to buy into GameStop shares (or options to buy them), initially because they thought it was undervalued, then to send a message to the short-sellers. Acting in unison they pushed up the share price to astronomical levels causing massive losses for short-sellers. The battleground had already shifted to other shares that have been bet against by hedge funds including BlackBerry, cinema chain AMC and American Airlines.

The media frenzy surrounding all of this resulted in headlines that the investment world that we were all familiar with, was about to be completely disrupted by a group of young, on-line trading activists, with their disruptive strategy against the hedge funds and the so called big boys of Wall Street.

What is Short-Selling..?

It’s a way of profiting when the price of an asset – such as gold, oil or a company’s shares – falls. It’s perfectly legal and many experts argue it is an important way to allow markets to determine the “true” price of any asset. It’s also a method of speculation that can increase volatility and reduce stability.

A short seller pays a fee to borrow shares from someone else. Usually this is an institutional investor such as another Investment Fund Manager or a Pension Fund. The short seller then sells the shares at the market rate.

Later on, they will buy the shares back again and return them to their previous owner. If the price has fallen the short-seller pockets the difference between the price they sold the shares at and the price they bought them back at. If the share price is higher, well they then lose money.

One thing with Short Selling is that there is no limit to how much someone can lose. Example, if you buy $5,000 worth of GameStop shares, the most you can lose is $ 5,000 (i.e. the share price goes to zero). But if you decide to short-sell the shares (borrow the shares from someone else and then sell them) and the share price goes the other way and continues to rise, theoretically the potential losses are infinite. Because you still owe that other person the shares and as you have sold them, you will need to buy them back at the current market price.

Me personally, I am not a fan of short selling strategies on individual companies as I don’t agree with benefiting from the pain & suffering of loss from others…… but I do agree with short-selling strategies when it involves broad market indices / indexes as this can be a very successful tool when managing portfolio risk and market volatility. Anyway….. that is my personal ‘ethical’ observation of the subject.

While the above may have resulted in some of the volatility and late month market sell off, there was also updated news on the success (or lack of in some cases) of the covid19 vaccines and future projected affects that this may have with company earnings and economic growth. The media does seem to like to sensationalise situations and the Reddit WallStreetBets was an opportunity to do so…… got to sell that advertising space somehow.

So back to the Sustainable Ethical Allocation portfolios…..

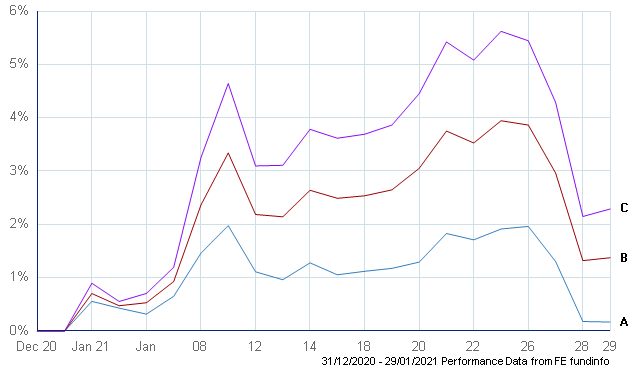

Following the market sentiments early in the month, all 3 Allocation portfolios rose to their all-time highest levels on the 25th (26th for Cautious Allocation) of January, but as stated above, the portfolios were not immune from the significant sell off seen late in the month.

However, even with the market sell off, I am still happy to report that all portfolios ended the month in positive territory.

- + 0.2% – Sustainable Ethical CAUTIOUS Allocation

- + 1.3% – Sustainable Ethical BALANCED Allocation

- + 2.2% – Sustainable Ethical GROWTH Allocation

While I never like to see periods where investment values fall (even though we all know that it is a part of longer-term investing), what was good to observe was that once again, the Sustainable Ethical Portfolios were LESS volatile during these times and as such, did not suffer as bad as their benchmarks.

The main contributor for the monthly performance was once again our exposure to Baillie Gifford Positive Change (which is held across all of our Sustainable portfolios) which was up 7.6% for the month as well as our exposure to Asian & Emerging Market Equities which was +4%. It was a very mixed result for the rest of the underlying funds held as they were all negatively affected in that last week of January.

So are we making any changes….?

At the moment, no. We are continuously monitoring and reviewing all of the funds held in our Sustainable Ethical Allocation portfolios. As has been stated before, we only want to invest in a range of funds that have good stable, high quality management, transparent with their holdings and investment strategy, and have a significant bias towards investing in quality companies that will benefit from a sustainable business model (i.e. consistently profitable during the different market cycles, political changes and what ever pandemics are thrown into the mix).

I am happy with the current allocations for all 3 portfolios as they all meet the above criteria. If there is a significant change in their investment style or management, being daily traded and liquid, we can easily sell out of the effected funds and re-allocate to a new fund…… we do NOT get paid commission from any of the funds held in the Sustainable Ethical Allocation portfolios, so this ensures that we are proposing funds based on merit and future opportunity….. and not financial incentive from the Fund Manager. This is part of the Ethical Business Practices that we preach.

Please click the following link for more information on the Sustainable Ethical Allocation portfolios https://ethicaloffshoreinvestments.com/services/#portfolio-management

As part of our ongoing client management, we stress the importance of ensuring that investors maintain sufficient cash (or very low risk, liquid assets) that can be called upon to cover their short-term income and / or capital purchase requirements. I strongly believe that this is even more imperative now due to the extremely uncertain and unprecedented economic and market conditions we are experiencing.

https://ethicaloffshoreinvestments.com/news/the-importance-of-investment-timeframe/

The other area that we encourage investors to look at is that of diversification…….. the Sustainable Allocation Portfolios are well diversified with not only asset type (equities, bonds, cash) but ensuring that there is also diversification of geographical region.

The underlying Fund Managers (Baillie Gifford, Royal London, Rathbones, Vanguard for example) will also take a different approach and style to their investment strategies and by blending these different managers and investments styles & strategies, potentially will result in lower volatility and more consistent overall portfolio returns.

Investors can also further diversify their portfolios through the use of Structured Notes. While Structured Notes are not our core investment offerings (we prefer the use of liquid, daily traded funds, ETF’s and direct shares), they can provide an opportunity to reduce short term volatility while receiving a pre-determined (conditional) investment return. But it must be stressed that Structured Notes are generally regarded as longer term investments so timeframe and whether access to capital is required needs to be seriously considered.

Please click the below link to get information on the range of Structured Notes currently available via Ethical Offshore Investments.

https://ethicaloffshoreinvestments.com/structured-notes/

If you would like to receive further information on the Sustainable Ethical Allocation Portfolios or on the underlying individual Managed Funds, please click REQUEST MORE INFORMATION.