Sustainable Ethical Allocation Portfolios – December Update

We finished 2020 on a high…!!!

Well, we nearly did…… the last 2 trading days of the year were negative for the majority of equity markets and as a result, all 3 Sustainable Ethical Allocation portfolios did slip a little to end the year just off their all-time highest levels.

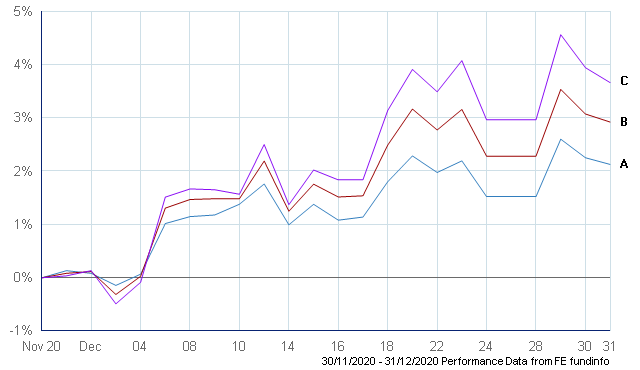

However, the positive momentum from last month did continue for most of December, even though trading volume was low due to the Christmas & New Year holiday period.

The 3 Sustainable Ethical Allocation portfolios once again delivered a positive monthly result with the Growth Allocation +3.7%, Balanced Allocation +2.9% and the Cautious +2.1% for the month of December.

A. Cautious Allocation – 2.1%

B. Balanced Allocation – 2.9%

C. Growth Allocation – 3.7%

This monthly performance was in-line to slightly above that of their relevant benchmarks. The FTSE All Share index, which has been one of the worst performing share indexes for 2020 was also positive for the second month in a row, up 3.7% for December.

All of the underlying funds held in the portfolios had a positive monthly performance to round out the year. The main contributors for the month was the exposure to Emerging Markets (+ 5.6%) as well as a +5% return for the Rathbone Global Sustainability, with 1 of our UK equity funds benefiting from the strong finish of the year in the UK, being up +6.6% for December.

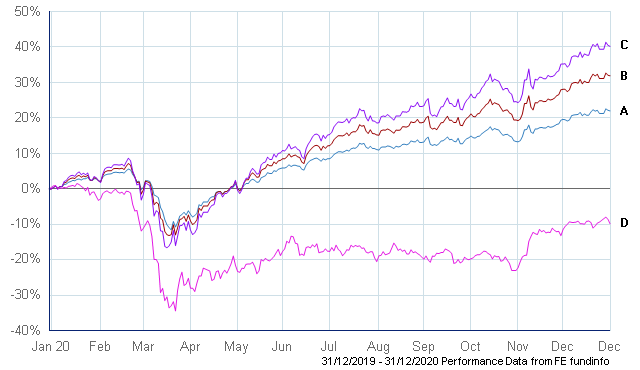

2020 Performance

After such a dismal year in regards to economic lockdowns, travel restrictions, mass unemployment and most of all, illness due to the covid19 outbreak, I am actually very pleased to state that the Sustainable Ethical Allocation portfolios all performed positively, significantly outperforming their benchmarks for 2020.

We will be posting a separate article in the coming days, detailing the annual performance of the Sustainable portfolios and how they have compared to their benchmarks, as well as other diversified strategy funds. But a quick preview, each & every fund that was included in the Sustainable portfolios, recorded a positive return for 2020…… and that includes the funds directly exposed to the UK.

2020 Year to date performance v’s FTSE All Share

A. Cautious Allocation

B. Balanced Allocation

C. Growth Allocation

D. FTSE All Share

Strategy Going Forward

This may seem like I am repeating myself, and I make no apologies for doing so. As I continue to believe that this is a good medium to longer term strategy.

We are still going to maintain our diversified approach with our portfolios, once again with a strong focus on businesses that have a strong, sustainable business models. The obvious question is why not chase the recovery in the other sectors which potentially could provide greater, short term returns…… while that may be the case, the fundamentals for maintaining a longer term focus utilising a diversified portfolio of quality businesses, is as strong as ever…… if not even greater now at these unprecedented times.

NEED TO REMEMBER that this same strategy not only was beneficial during the darkest days of the covid19 crisis, but was also beneficial PRIOR to the covid19 outbreak…….. once again, quality of assets and fund management are very important.

So we are maintaining our current fund manager allocation for the Sustainable Ethical portfolios.

As part of our ongoing client management, we stress the importance of ensuring that investors maintain sufficient cash (or very low risk, liquid assets) that can be called upon to cover their short-term income and / or capital purchase requirements. I strongly believe that this is even more imperative now due to the extremely uncertain and unprecedented economic and market conditions we are experiencing.

The other area that we encourage investors to look at is that of diversification…….. the Sustainable Allocation Portfolios are well diversified with not only asset type (equities, bonds, cash) but ensuring that there is also diversification of geographical region.

The Importance of Investment Timeframe

The underlying Fund Managers (Baillie Gifford, Royal London, Rathbones, Vanguard for example) will also take a different approach and style to their investment strategies and by blending these different managers and investments styles & strategies, potentially will result in lower volatility and more consistent overall portfolio returns.

Investors can also further diversify their portfolios through the use of Structured Notes. While Structured Notes are not our core investment offerings (we prefer the use of liquid, daily traded funds, ETF’s and direct shares), they can provide an opportunity to reduce short term volatility while receiving a pre-determined (conditional) investment return. But it must be stressed that Structured Notes are generally regarded as longer term investments so timeframe and whether access to capital is required needs to be seriously considered.

If you would like to receive further information on the Sustainable Ethical Allocation Portfolios or on the underlying individual Managed Funds, please click REQUEST MORE INFORMATION.