Sustainable Allocation Portfolios continue their positive moves higher (Mid Year Update)

Mid Year Portfolio Update

2020 – A Year to forget….. or is it..??

The word Unprecedented seems to be the buzz word when it comes to describing the financial markets for 2020

And yes, I too have been regularly using that word to describe how I have viewed what has occurred so far in 2020.

There is no point me going into detail as to what has been the catalyst for this years ‘unprecedented’ market activity, because unless you have been lucky enough to live with absolutely no media access this year, you are all well aware that it is the economic effects being caused by the covid19 Corona Virus. I don’t think that there are many people on this planet that have not been somehow negatively affected by covid19.

As has been reported in our previous client updates, the sectors that have been hit the hardest this year have been Airlines, Cruise Companies, Travel & Tourism Operators. Plus we had the unprecedented (…there is that word again…) price action of Crude Oil when it went into a negative price situation…… that is correct…. traders were actually paying for others to take delivery of their oil contracts that they had previously purchased. So as expected, oil exploration and producers have also been hit very hard this year.

With the first 3 months of the year, we saw significant falls in equity markets and volatility not seen since the darkest days of the Global Financial Crisis, but markets in the second quarter staged a very strong rebound. Helped by the easing of Covid19 lockdowns and early signs of an economic recovery, saw risk appetite return in Q2, supporting equity and credit markets.

So how have the Sustainable Model Portfolios held up in 2020…..

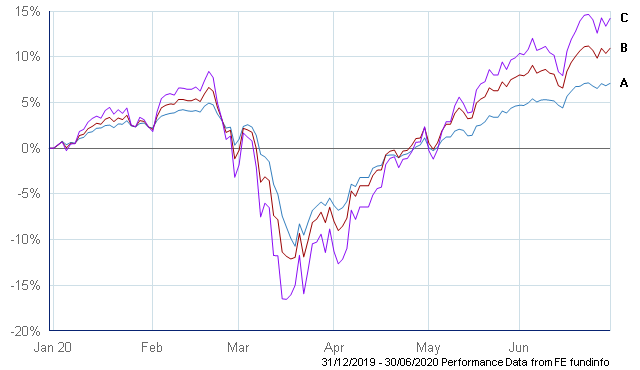

Sustainable Ethical Allocation Portfolios

We have been very pleased with the performance of the model portfolios so far this year, considering the significant (unprecedented..??) market conditions experienced in 2020.

- A. Sustainable Ethical Cautious Allocation +7.1% YTD

- B. Sustainable Ethical Balanced Allocation +10.7% YTD

- C. Sustainable Ethical Growth Allocation +14.3% YTD

The investment style of the portfolios resulted in a lower level of volatility in the first quarter, especially during the extreme negative market conditions in March. This helped to reduce the negative impact compared to that of the general market.

While the portfolios, like most assets struggled in the first quarter of 2020, the allocation to what we regard as very highly reputable fund managers investing in quality, sustainable type businesses, resulted in a very strong rebound for the second quarter. The quarterly performance for the portfolios was 28.4% Growth Allocation, 20.7% Balanced Allocation and 14.4% Cautious Allocation.

Performance 2020 year to date is:

- + 7.1% Cautious Allocation

- +10.8% Balanced Allocation

- +14.3% Growth Allocation

This compares to the FTSE 100 in the UK which is down 18.2% year to date. The Eurostoxx50 is down 13.65% in 2020 (after +16.15% this last quarter) and even the Dow Jones Index and S&P500 in the US are down 9.5% and 4% respectively this year. The only bright light has been the technology biased NASDAQ in the US that is actually +12.1% so far in 2020.

So what has been driving the performance of the Sustainable Ethical Allocation Portfolios……

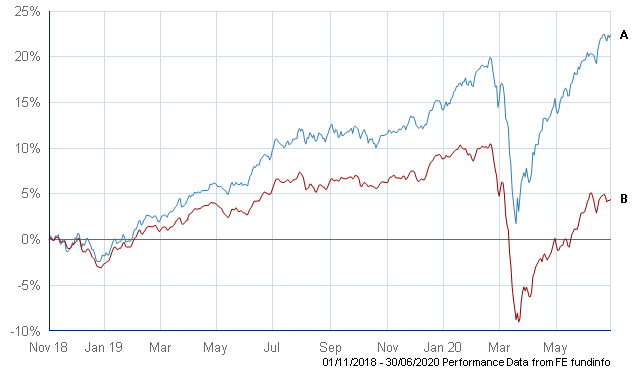

Since the inception of the Sustainable Allocation Portfolios back in November 2018, we have maintained a bias towards fund managers that we think will offer superior risk adjusted performance through their investment into good quality companies with strong balance sheets, low levels of debt, a long term sustainable business/revenue model, while operating with an ethical business practice.

While we were expecting the portfolios to outperform over the medium to longer term, we are very pleasantly surprised at how well they have rebounded and their level of out-performance so far this year.

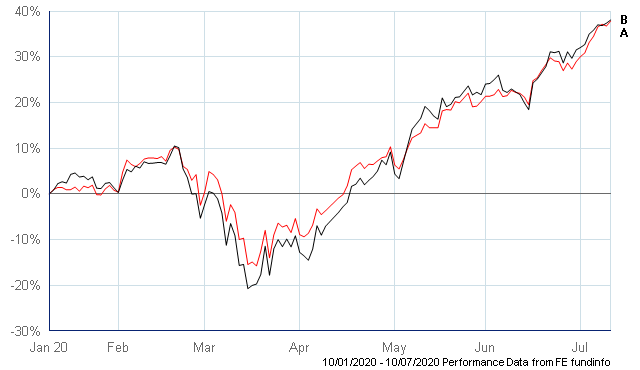

Our exposure to Baillie Gifford Global Discovery and their Positive Change fund has no doubt been the standout performers. I did post an article on 6th April https://ethicaloffshoreinvestments.com/news/within-this-turmoil-is-there-opportunity/

at the time when the fund had just dropped 30% from its February 2020 levels and questioned whether this was actually a time for opportunity with this fund. I then posted a follow up article on the 25th June

https://ethicaloffshoreinvestments.com/top-features/turmoil-and-opportunity/

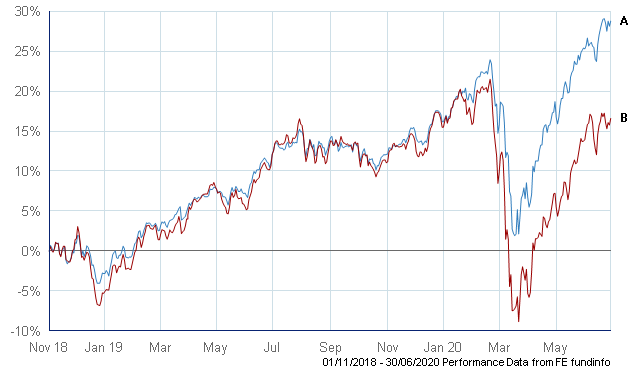

- A. Baillie Gifford Positive Change

- B. Baillie Gifford Global Discovery

All 3 of the Sustainable Allocation Portfolios have some exposure to the Baillie Gifford Positive Change fund, with the Balanced Allocation and Growth Allocation also having some exposure to the Baillie Gifford Global Discovery. If you would like further information on the Baillie Gifford funds, please contact me and I will provide the latest Fund Manager update.

The portfolios exposure to the technology, biotechnology sector as well as healthcare were the main benefactors for their performance so far in 2020, plus a geographical bias towards the US. The portfolios had no direct investments in the airlines, cruise ships and the Crude Oil sector, so was able to avoid the significant falls those sectors experienced.

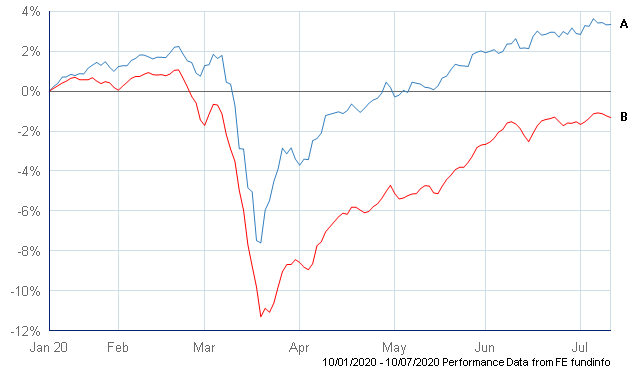

What helped the Cautious and Balanced Allocations during the highly volatile, negative period during March and early April was our exposure to the very diversified Vanguard LifeStrategy fund. While the fund could not avoid losses during this period, the fact that this fund is so well diversified and the asset allocation is re-balanced daily, resulted in much lower levels of volatility and reduced the negative impact on the portfolios.

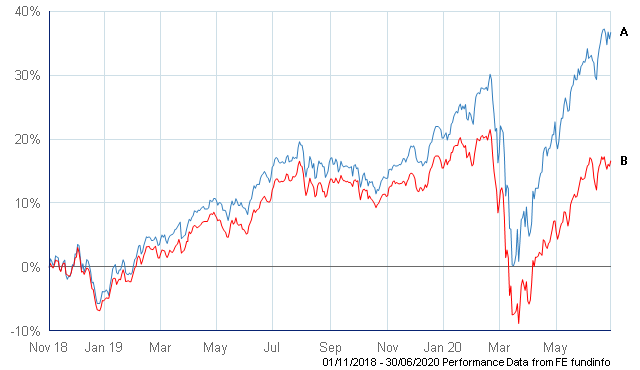

Vanguard LifeStrategy 20% Equity – 2020 Performance YTD v’s IA Mixed Investment 0%-35% shares

- A. Vanguard LifeStrategy 20% Equity

- B. IA Mixed Investment 0-35% Shares

The Sustainable Ethical Allocation Portfolios continue to be well diversified in not only asset type (shares, infrastructure, bonds, fixed interest) but of business sector and geographical location. We continue to utlilise a range of different quality fund managers which include Baillie Gifford, Royal London and Vanguard that also provides diversification of investment style. The different investment approach and styles will complement each other with the potential to provide a more consistent overall portfolio return with lower levels of volatility.

We will continue to have bias towards investments into higher quality assets, with good management, strong balance sheets and a sustainable business model.

Strategy Going Forward…..

I think what is important now more than ever is that of liquidity and ensuring that you have sufficient assets in ultra low risk (i.e. cash) assets to cover any short term income and or capital requirements.

What happened in March & April is a prime example of why I continue to harp on about having the next 6 – 12 months worth of income sitting in cash. No one likes to see their portfolio going down in value, but if you are relying on it for your income or a lump sum payment in the short term, it can result in even greater short term pain. As you are then drawing out of an asset during a falling market.

Investors that maintained their short term income requirements in the cash accounts of their portfolios ensured that those particular assets were protected from the negative markets…… therefore not affecting their upcoming income payments. The rest of the proceeds continue to be invested in the growth component of the portfolios, but by ensuring that short term needs are taken care of with the cash account, when we do see a negative situation with the markets like we did in March & April, it gives the quality assets time to recover before they will be needed.

In regards to portfolios themselves, we are happy with the underlying managed funds that are held in the Sustainable Ethical Allocation Portfolios as they have consistently provided top quartile performance against their peers. We will continue to re-balance the portfolios back to around their default asset levels to ensure that the portfolios maintain their very diversified nature.

We are concerned in the short term with so much uncertainty surrounding covid19 and what the actual true negative impact has been on economies and what is a realistic timeframe for getting back to some form of normal…… obviously a covid19 vaccine would provide a boost to economic confidence going forward.

However, while we are concerned in the short term, we do hold a lot of confidence with the sustainable strategy and that of the quality fund managers that make up the Portfolio Allocations.

As we have stated in the past, all of the managed funds held are strictly regulated, transparent with their holdings and/or their strategy but most importantly, their assets are liquid and can be traded on a daily basis. So if there is a significant change with the financial markets, we can relatively easily switch in or out of investment or move to a holding in cash.

Summary

We are obviously very happy with the performance of the 3 Sustainable Allocation Portfolios to not only limit the negativity downside in the first quarter, but to also show substantial recovery in the second quarter which has resulted in strong positive returns year to date.

If you have any queries with your portfolio or would like to get additional information on the underlying investments, please click on the Request Information.

Sustainable Ethical Allocation Portfolios

The Sustainable Allocation portfolios are currently invested in 10 – 12 different managed funds, utlising the expertise of the following Fund Managers.

![]()

![]()

Cautious Allocation

The SUSTAINABLE ETHICAL CAUTIOUS ALLOCATION PORTFOLIO will generally have approx. 65% of the assets invested in various bond, fixed interest and cash type assets that are regarded as lower risk type assets. The remaining will be allocated in growth style of equities and infrastructure type assets.

The objective of this allocation is to achieve a net return of 5%-6%PA but with lower levels of short term volatility.

- A. Sustainable Ethical Cautious Allocation

- B. IA Mixed Investment 20-60% Share Index

Balanced Allocation

The SUSTAINABLE ETHICAL BALANCED ALLOCATION PORTFOLIO will have approx. 65% of the allocation invested in growth type assets such as equities and infrastructure with the remaining allocated to more cautious type assets such bonds, fixed interest and cash type assets.

The objective of this portfolio is to achieve similar type returns associated with direct equity investing, while experiencing lower levels of short term volatility, especially during negative market periods.

- A. Sustainable Ethical Balanced Allocation

- B. IA Global Index

Growth Allocation

The SUSTAINABLE ETHICAL GROWTH ALLOCATION PORTFOLIO will invest in a range of equity funds and is designed for the longer term investor that can accept higher levels of short term volatility.

The objective of this allocation is to achieve a net annual return of 10% – 12%pa but clients need to be aware and accept that there will be higher levels of short term volatility and periods of negative returns.

- A. Sustainable Ethical Growth Allocation

- B. IA Global Index