October 2021 Update – Sustainable Ethical Allocation Portfolios

I get Knocked Down…… but I get Up Again

The Sustainable Ethical Allocation portfolios recover from the recent sell off

The end of October 2021 marked 3 years since from when I first constructed the Sustainable Ethical Allocation portfolios and we will be publishing a separate article on how we have performed over this quite unique time period.

But for now, let us see what happened in the month of October……

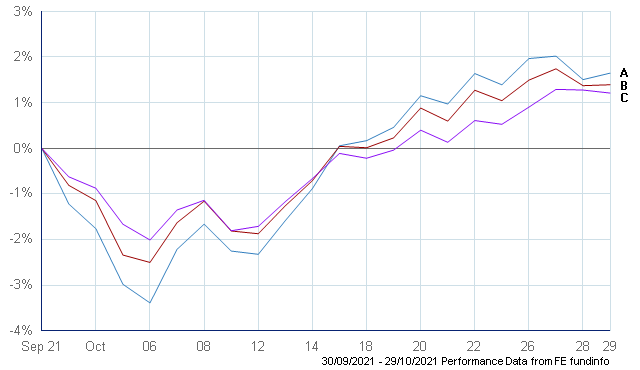

Well, the negative momentum that we witnessed in the last few weeks of September continued into October, and it was once again the growth style ESG (Environmental Social Governance) type entities that we have a significant bias towards, that copped the brunt of the market sell off.

After dropping as much as 3% within the first week of October (Growth Allocation), the portfolios rallied well from these falls, with all portfolios ended the month above +1% for the month.

- A – Sustainable Ethical GROWTH Allocation

- B – Sustainable Ethical BALANCED Allocation

- C – Sustainable Ethical CAUTIOUS Allocation

It was a really mixed basket of individual fund performance over the month, with our UK equity exposure being the hardest hit (down -2.6% to -3.3%) for the month. Yet our European exposure through the global equity funds was much more positive, with our specialist European fund providing a +4.1% for the month.

Fixed Interest / Bond assets once again struggled due to the fear of inflation and rising interest rates, resulting in our Fixed Income / Bond funds suffering small losses of -0.2% to -0.6% for the month.

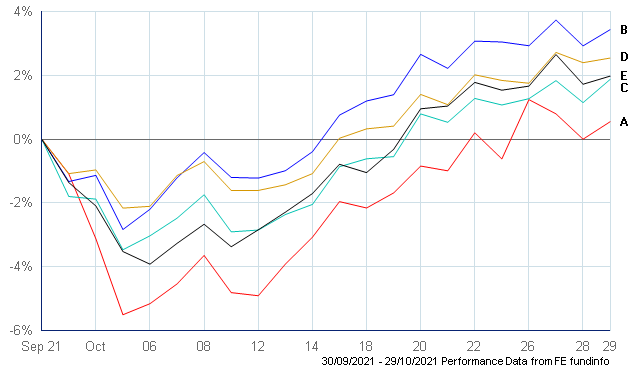

For our diversified global equity funds, they all witnessed similar performance patterns, with losses at the start of the month before recovering well to finish the month well into positive territory.

- A. Baillie Gifford Positive Change

- B. Liontrust Sustainable Future Global Growth

- C. Rathbone Greenbank Global Sustainability

- D. Royal London Sustainable World Trust

- E. Stewart Worldwide Sustainability

Changes to the Portfolios

We continue to review the underlying funds held in the various Sustainable Allocation portfolios, and as we are not affiliated with any of the fund management groups, we are free to make any allocation changes that we feel is necessary to improve performance.

At this stage, once again we are comfortable with the current range of funds held in the portfolios, so we will be maintaining the current fund allocation.

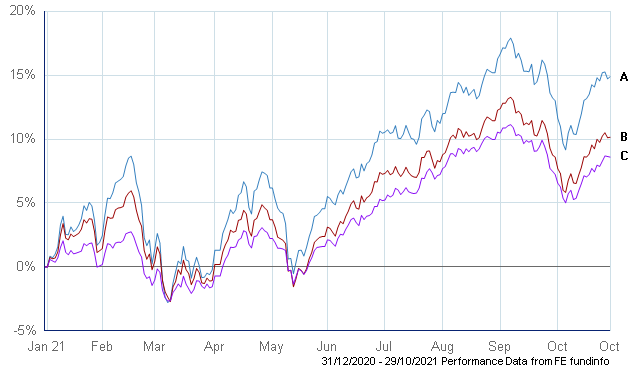

Portfolio Performance for 2021 Year to Date

- A – Sustainable Ethical GROWTH Allocation

- B – Sustainable Ethical BALANCED Allocation

- C – Sustainable Ethical CAUTIOUS Allocation

We are very happy to announce that even with the pullback in September & early October, the recent recovery rally is helping push the gross performance back to near our all-time high levels. And to be completely honest, after the year we had for the covid19 affected 2020, we were not expecting to see such positive levels of growth for this year.

Going Forward…

I always seem to be concerned in the short term, as there always seems to be a current event(s) that could disrupt the markets…….. but realistically, that has been true for ever and a day. There is always the potential for a current event to cause chaos in one way or another.

However, as history has also shown us, investing in a diversified portfolio of quality real assets with an appropriate timeframe will also come out of any short-term turmoil generally in a better, stronger situation for investors.

So, while I am concerned in the short term (as I always am), I do still have a positive outlook for the types of investments we get exposure to over the medium to longer term……… BUT………. It is also very important that investors also maintain a cash reserve to cover any short-term income / capital expenditure requirements.

I admit that holding cash at present is a losing investment (if you do happen to get interest on cash, the effects of inflation soon take care of that), but it does provide a bit of insurance against having to draw out of an investment during a period of market weakness. You only need to look at February and March last year with the negative effects of Covid19 on the equity markets.

Structured Note Investments

Investors can also further diversify their portfolios through the use of Structured Notes. While Structured Notes are not our core investment offerings (we prefer the use of liquid, daily traded funds, ETF’s and direct shares), they can provide an opportunity to reduce short term volatility while receiving a pre-determined (conditional) investment return.

With interest rates at historical lows, downward pressure on dividends and equity market uncertainty ahead, investors are becoming increasingly attracted to the benefits of structured products.

But it must be stressed that Structured Notes are generally regarded as longer term investments so timeframe and whether access to capital is required needs to be seriously considered.

Some examples of the current notes available are:

Credit Agricole Technology Income Note 8.00%pa (underlying assets are Alphabet (Google), Amazon Inc, Apple Inc, Netflix Inc)

Barclays Climate Autocall 8.50%pa – (Solactive Climate Change Europe BTI PR Index)

Goldman Sachs Prime Markets 9.50%pa – (underlying assets FTSE MIB Index, Euro iStoxx 50 Futures Decrement 3% Index, FTSE 100 Custom Synthetic 3.5% Index)

Please click the below link to get information on the range of Structured Notes currently available via Ethical Offshore Investments.

Structured Notes currently available

If you would like to receive further information on the Sustainable Ethical Allocation Portfolios or on the underlying individual Managed Funds, please click REQUEST MORE INFORMATION.