Sustainable Ethical Allocation Portfolios – Quarter 1, 2021 Update

The Sustainable Ethical portfolios have struggled so far this year….. is it time to abandon the quality E.S.G. & Socially Responsible Investing approach that we promote..??

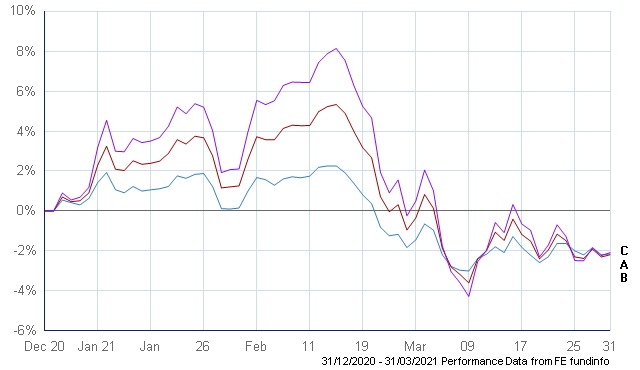

Not going to mince my words here…. I have been disappointed in the recent performance (or more to the point, lack of positive performance) so far this year for the Sustainable Ethical Allocation Portfolios. After a very positive start to the year, we saw a reversal of fortunes in February as the areas that the portfolios have a significant bias towards, such as sustainable & renewable energy, technology and healthcare, experienced a sell off as short-term investors ‘rotated’ towards the areas of the market that were hardest hit during the covid19 pandemic (oil & gas, tourism, airlines).

The 3 Sustainable portfolios unfortunately were all negatively affected and have ended the quarter all suffering losses circa 2%.

- Sustainable Ethical CAUTIOUS Allocation

- Sustainable Ethical BALANCED Allocation

- Sustainable Ethical GROWTH Allocation

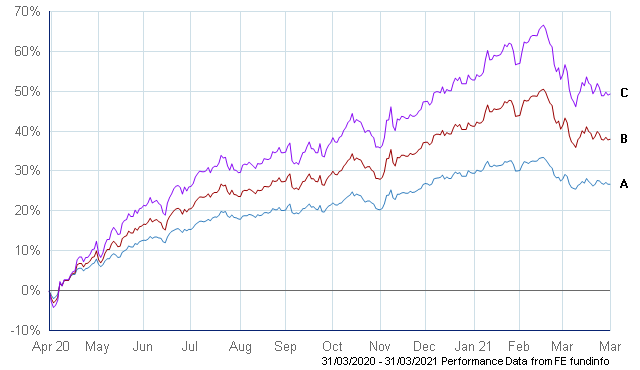

While it is disappointing to experience a portfolio loss over this first quarter of 2021, if we look at the actual performance over the past 12 months, the strategy still has generated solid positive returns for investors.

- Sustainable Ethical CAUTIOUS Allocation

- Sustainable Ethical BALANCED Allocation

- Sustainable Ethical GROWTH Allocation

What caused the pullback with our Sustainable portfolios..??

With the covid19 vaccine rollout, there was some positive sentiment towards the areas of the economy that were hardest hit by the covid19 lockdown, with the prospect that we may get back to some form of normal day to day life. Sectors such as airlines, tourism, oil & gas and discretionary spending saw quite a bit of investor inflow and to do that, investors/traders had to get the proceeds from somewhere with many using the opportunity to sell down some of their winning holdings of 2020. The funds held in the Sustainable portfolios would have had very little if any exposure to those sectors hard hit in 2020……… so while it is part of the reason for the recent underperformance, it is also a significant reason for the longer term outperformance.

Another negative sentiment towards the sectors the portfolios have a bias towards was the forecast that the re-opening of the world’s economies could result in an increase in inflation to above the level that the various Central Banks are comfortable with. To curb inflation, Central Banks will generally increase official interest rates, which in theory would be a negative to companies that have debt, as the cost of servicing that debt would rise, therefore eating into profit.

The above fear of rising interest rates did actually result in price movement in the bond market, with bond yields rising. What needs to be remembered here is that when interest rates rise, this becomes a negative for existing bond holdings as the value (or premium) of the Bond entity will fall. This is also why our fixed interest / bond assets also struggled this quarter (this was across the board, and not just with Ethical or Sustainable type issuers).

So, is it now time to abandon our strategy of investing in E.S.G. (Environmentally & Social Governance) and S.R.I. (Socially Responsible Investing) entities…??

My honest answer to that is a resounding no…..

While we are disappointed with the recent quarterly performance, it must be remembered that all portfolio strategies will experience some periods of underperformance which will include negative returns.

The underlying Fund Managers and the funds that make up the Sustainable Ethical Allocation Portfolios have consistently outperformed their benchmarks and their peers over the medium to longer term……. so this would include periods prior to the Covid19 pandemic and the subsequent recent focus on ESG and Sustainable investing strategies.

The Fund Managers perform in-depth research on their investment holdings, with an emphasis on investing in quality companies that exhibit a business model that will be sustainable (& profitable) over many years and through different market cycles. Unfortunately, like what we witnessed last quarter, is that there will be times when we will see a short-term rotation out of these quality stocks from traders which can put some pressure on the share price of such companies.

Assuming that the medium to longer term outlook of the companies has not changed, this pullback in their share prices can actually provide an opportunity for our Fund Managers as they can top up some of their share holdings at discounted levels. And this seems to have been the case with the Fund Managers held.

An example of this is some recent comments from the lead manager of the SDL UK Buffettology Fund which is held in the Sustainable Growth Allocation:

“The current so-called rotation to value reads like a Who’s Who of everything we don’t invest in, so is giving us a buying opportunity to add businesses to the portfolio which we have had on the watch list, including Quartix and Team17,” said the manager.

“There are also excesses in the US market which might yet create some favourable opportunities if there were to be a meaningful pull back.”

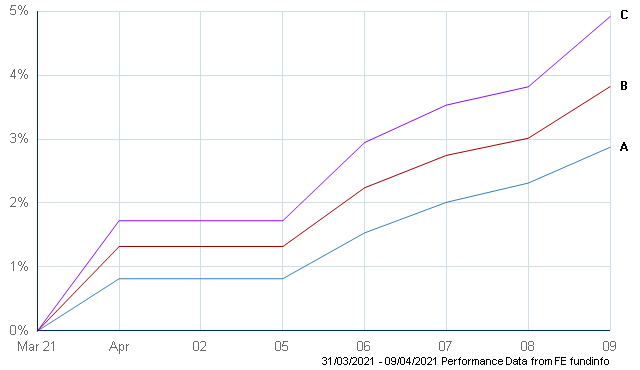

We are only 9 days into April, but the 3 portfolios have benefited considerably so far with the recovery in the sectors that our portfolios have a bias towards. Hopefully this is a sign of performance to come………

- Sustainable Ethical CAUTIOUS Allocation

- Sustainable Ethical BALANCED Allocation

- Sustainable Ethical GROWTH Allocation

Are we making any changes to the underlying funds…??

We are continually monitoring the funds and the Fund Managers in how they are performing in relation to their investment objectives, benchmarks as well as against their peers. As I have stated above (& on many previous occasions), there will be periods where the underlying funds underperform which may include negative returns. This is not the first time and this will no doubt not be the last time.

However, while we will not panic & sell out of a fund just because of short term performance issues, we will monitor the fund to determine if it is in fact just a short performance blip, or if it is something more substantial. We are NOT associated with any of the Fund Managers that form the Sustainable Portfolios and do NOT receive any financial incentive from them…….. therefore any changes that we make would be done so without any bias.

At present, we are maintaining the current holdings for now. If there is a significant change in an investment style or management of one of the underlying funds, being daily traded and liquid, we can easily sell out of the affected funds and re-allocate to a new fund holding(s).

Please click the following link for more information on the Sustainable Ethical Allocation portfolios https://ethicaloffshoreinvestments.com/services/#portfolio-management

As part of our ongoing client management, we stress the importance of ensuring that investors maintain sufficient cash (or very low risk, liquid assets) that can be called upon to cover their short-term income and / or capital purchase requirements. I strongly believe that this is even more imperative now due to the extremely uncertain and unprecedented economic and market conditions we are experiencing.

https://ethicaloffshoreinvestments.com/news/the-importance-of-investment-timeframe/

The other area that we encourage investors to look at is that of diversification…….. the Sustainable Allocation Portfolios are well diversified with not only asset type (equities, bonds, cash) but ensuring that there is also diversification of geographical region.

The underlying Fund Managers (Baillie Gifford, Royal London, Rathbones, Vanguard for example) will also take a different approach and style to their investment strategies and by blending these different managers and investments styles & strategies, potentially will result in lower volatility and more consistent overall portfolio returns.

Investors can also further diversify their portfolios through the use of Structured Notes. While Structured Notes are not our core investment offerings (we prefer the use of liquid, daily traded funds, ETF’s and direct shares), they can provide an opportunity to reduce short term volatility while receiving a pre-determined (conditional) investment return. But it must be stressed that Structured Notes are generally regarded as longer term investments so timeframe and whether access to capital is required needs to be seriously considered.

Please click the below link to get information on the range of Structured Notes currently available via Ethical Offshore Investments.

https://ethicaloffshoreinvestments.com/structured-notes/

If you would like to receive further information on the Sustainable Ethical Allocation Portfolios or on the underlying individual Managed Funds, please click REQUEST MORE INFORMATION.