Why World Water Day Matters…

Past performance does not predict future returns. You may get back less than you originally invested. Reference to specific securities is not intended as a recommendation to purchase or sell any investment.

21 March 2024

Today marks World Water Day. In this article fund manager Simon Clements of the Sustainable Future Investment team discusses just how vital it is for life and why improving the management of water is a key investment theme for the team.

A building block of life

Water is essential for life, and a pillar in the modern economy as a key input to many industries aside from agriculture. It is also unique – unlike energy, it cannot easily be transported from an area of abundance to that of scarcity. Furthermore, it is viewed as a human right, and therefore pricing is heavily regulated, causing it to be under-priced and thus overused.

As well as being a unique commodity, water also has a core input into the way our economy functions. We consume over four trillion cubic metres of water annually across the globe, but access is very unevenly distributed – around two billion people globally do not have access to safe drinking water, with a further 1.6 billion lacking waters for sanitation

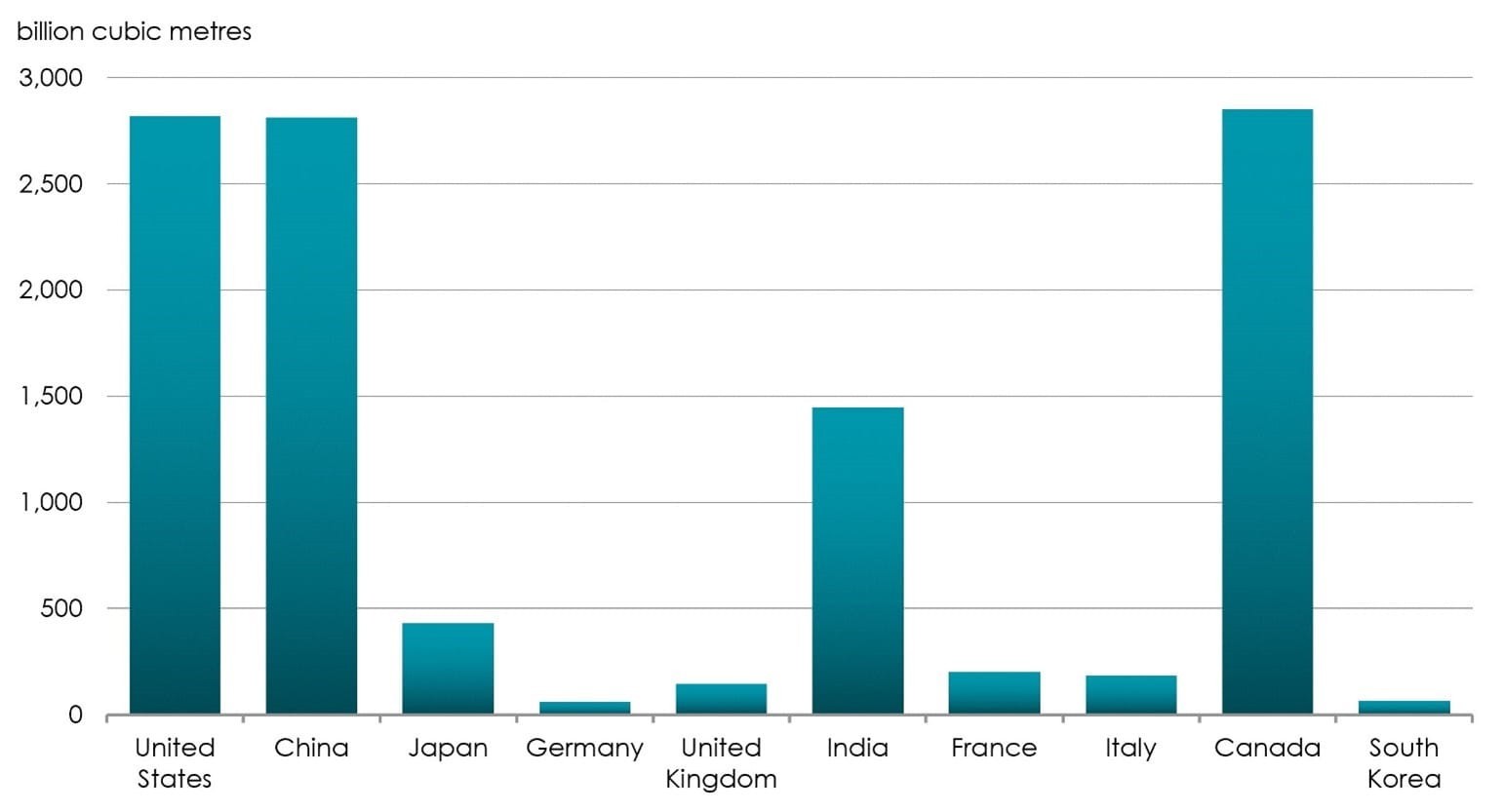

Fig 1: Renewable internal freshwater resources, per capita of top 10 largest economies (2020)

Source: World Bank, Morgan Stanley Research, March 2024

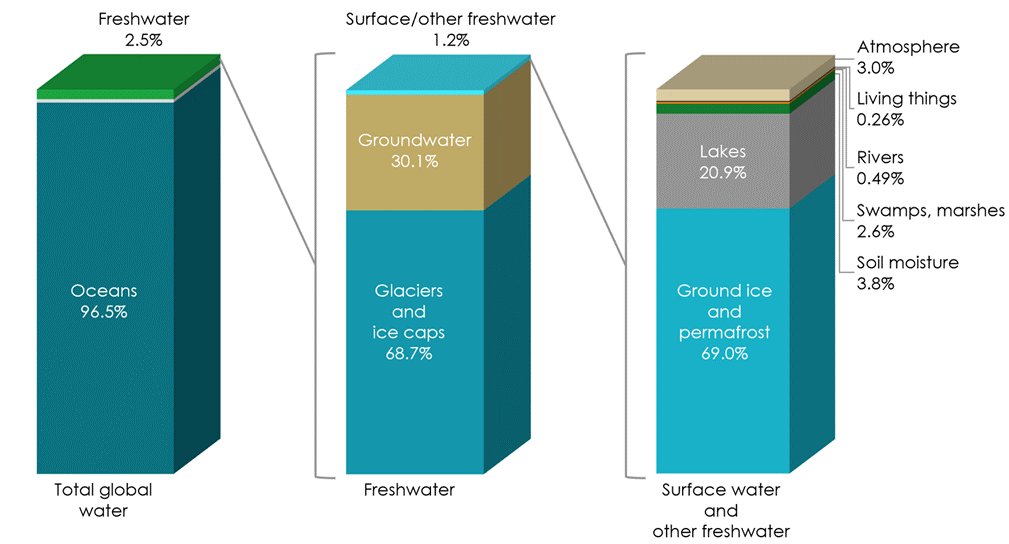

Of all the water in the world, less than 3% is freshwater, and more than half of this is locked in glaciers or icecaps (which will melt into the ocean unless we decide cutting pieces off and towing them to shore is a viable idea).

Fig 2: The distribution of water on, in and above the Earth – Where is Earth’s water?

Source: U.S. Geological Survey, Water Science School. “World fresh water resources” in Peter H. Gleick (editor), 1993, Water in Crisis: A Guide to the World’s Fresh Water Resources. Figures subject to rounding.

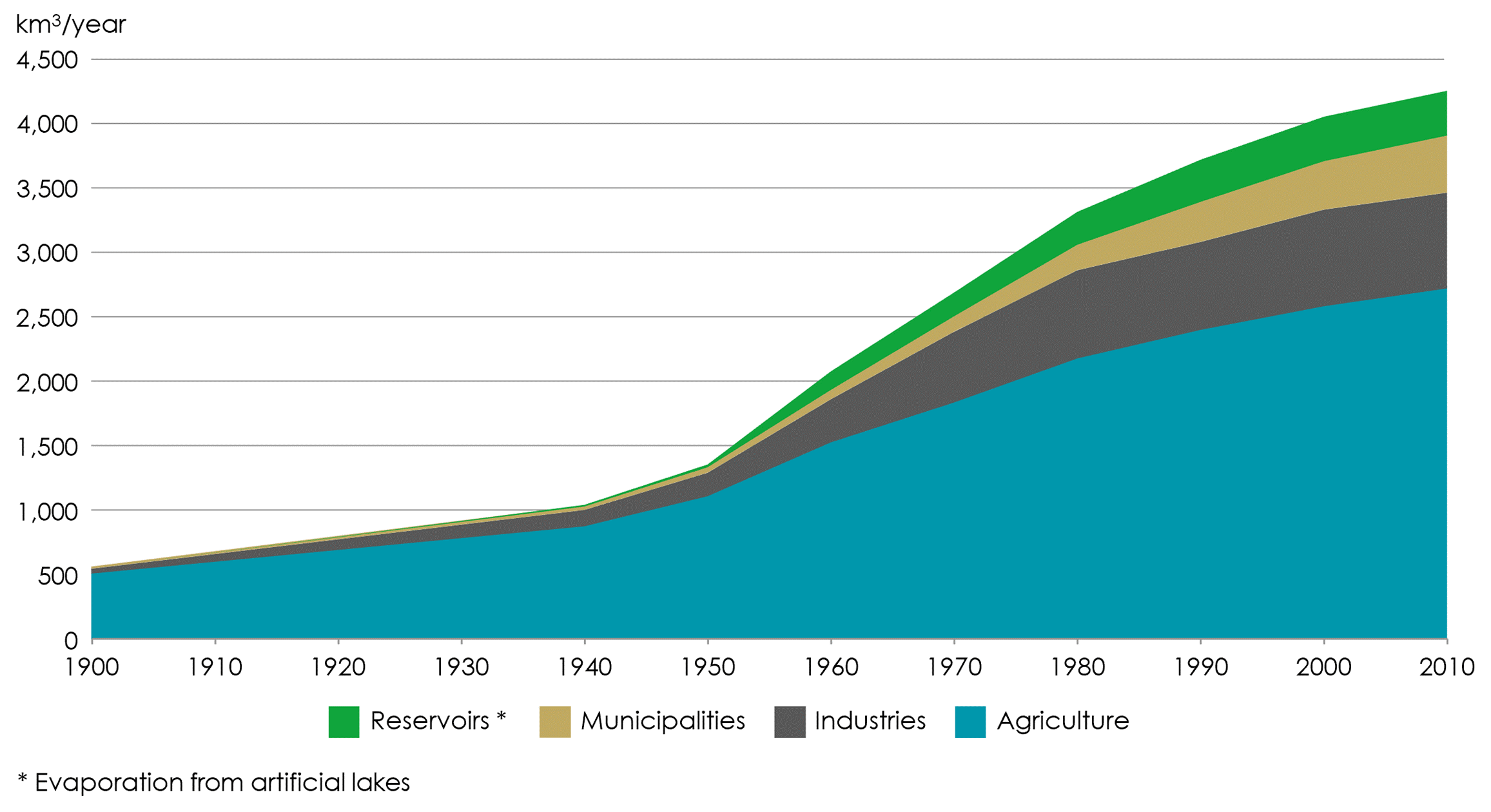

Broken down by use, we can see that 70% of freshwater withdrawals come from agriculture globally. Industry is also the fastest growing area of water demand too. Municipal water is for domestic uses like cooking, cleaning, drinking, and washing.

Fig 3: Global water withdrawal

Source: Global Information System on Water and Agriculture

Demand for water has risen sixfold over the past century, and this is only due to increase as populations and incomes continue to rise, with estimates of growth of 30% over the next 30 years. The majority of growth is coming from non-OECD (Organisation for Economic Co-operation and Development) countries, namely the BRICS (Brazil, Russia, India, China, and South Africa). This rising demand, coupled with water scarcity in economically significant regions, amounts to an estimated 40% gap between demand and renewable supply of water in 2030 according to the United Nations (UN).

Climate change has a detrimental effect on water availability primarily through changes to the water cycle. Events like droughts and floods are due to increase in intensity and frequency as rainfall becomes more variable. The Intergovernmental Panel on Climate Change estimates that 4.8 billion people will be at risk due to water stress if business as usual continues on emissions, which includes areas where half of global grain production occurs. In turn, water scarcity is a factor driving biodiversity loss, and is already beginning to have geopolitical consequences over control of water sources.

Due to being a human necessity, utilities companies are highly regulated and have not historically charged for the true cost of water. As a result, there has historically been chronic underinvestment in water services, resulting in aging infrastructure.

While agriculture looks like a huge opportunity, there are significant barriers preventing investment in water efficiency. The primary issue is that we do not pay enough for water, and hence there is less incentive to reduce the cost of its usage. Approximately 85% of utilities companies worldwide do not cover their costs, instead relying on subsidies. Because of this, prices are heavily regulated.

Ultimately, water usage needs to behave more like a market. Australia has been active in trying to create this environment, creating a regional trade in the commodity so that water can be shifted towards high value uses at times of scarcity. This enabled agricultural production to fall by only 29% during the millennium drought that saw water availability drop by 53%. Similar systems globally, with accommodations for basic human consumption, are needed to create incentives for water usage to become less intensive and more efficient.

The Sustainable Future process invests behind 20 sustainable investment themes, and one of those is Improving the management of water. We target companies that help to solve the challenges we’ve discussed, from industrial water use to municipal use and even into the agricultural sector. Companies such as Veralto, Ecolab, Agilent and Advanced Drainage systems all address these key issues, and the management of water is becoming increasingly important as an investment opportunity within our portfolios.

The key to managing water effectively is ensuring markets begin to assign some sort of fair value to the resource. This basic market mechanism is at the root of the chronic misuse of the world’s most crucial resource. As water availability becomes more scarce, governments and markets will be forced to assign a more appropriate value to water, which will incentivise businesses to better manage water usage.

We believe this process is already underway, and the companies which we invest in behind the theme of Improving the management of water are set to benefit from this shift. The change that needs to take place will involve conserving water, and our investment in Ecolab benefits from this shift. Ecolab manages one trillion gallons of water a year, and its goal by 2030 is to help its customers conserve 300 billion gallons of water.

As well as conservation, reusing and recycling fresh water is also a key part of better water management. To do this we need companies such as Veralto and Agilent, whose water testing technology ensures reused water is safe.

We remain confident that the theme of ‘Improving the management of water’ can deliver companies which deliver strong performance, while ensuring the transition to a more sustainable economy stays on course. The theme also ensures we are collectively more responsible collectively with the planet’s most important resource.

Simon Clements

Simon Clements is a fund manager who joined Liontrust in April 2017 as part of the acquisition of Alliance Trust Investments (ATI), where he had managed funds for five years. Prior to this, Simon spent 12 years at Aviva Investors (previously Morley Fund Management) where, most recently, he was Head of Global Equities. In his early career, Simon worked as a Portfolio Accountant and Risk and Performance Analyst before joining Aviva Investors in 2000 to help develop its global equity and SRI propositions. Simon holds a Bachelor of Economics from the University of Newcastle, Australia, and a graduate diploma in Applied Finance & Investment from Securities Institute of Australia. Simon is a CFA Charterholder.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we can access the funds mentioned in this article on the various offshore investment platforms we offer. We do NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investments costs

Socially Responsible Investing – Ethical Business Standards