Which Taxes Will Rise in Rachel Reeves’ Autumn Budget?

Markets expect fresh tax hikes in the November Budget as the chancellor grapples with debt and weak growth.

Key Takeaways

- Rachel Reeves’ second Budget next month will likely include more tax rises.

- After a period of uncertainty over the health of the government’s finances, bond yields remain at elevated levels.

- Inflation is rising and economic growth remains weak, limiting the chancellor’s options.

Further tax rises are a near certainty when Chancellor Rachel Reeves delivers her delayed Autumn Budget on Nov. 26, experts say, with a potential VAT increase now in the spotlight after a volatile month of political scandal and growing market disquiet over the achievability of the government’s own fiscal rules.

This event occurs against a more anxious backdrop than in 2024 when the chancellor delivered her first Budget in on Oct. 30.

In the buildup to her second Budget, there has been more speculation than usual about what the government has planned to fill the multi-billion pound gap in the public finances.

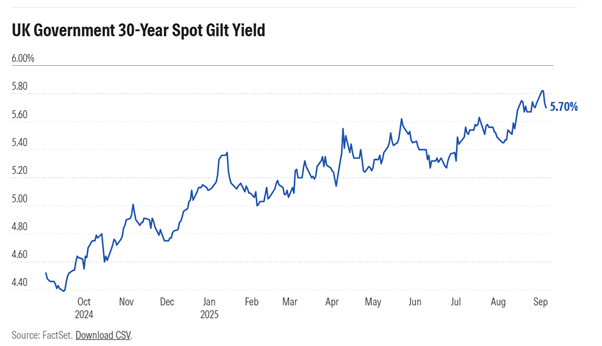

The UK’s restless government bond markets are keen to see evidence that the state has debt under control and jittery about any hint of the opposite. The yield on the 30-year gilt is still elevated at 5.63%, below 2025’s high of 5.72% in September, but still above levels in the autumn 2022 crisis. In this financial year, the UK government is expected to spend more than £100 billion servicing debt interest.

Reeves’ options include cutting public spending, raising direct or indirect taxation or increasing government borrowing, or a combination of all three levers.

Cutting public spending is unlikely to be popular with core voters keen to see improvements in public services.

Raising taxes is always politically dangerous: Taxpayers already face the highest tax burden since the Second World War, and the imperative to achieve a balanced or in-surplus government budget by 2029/30 is unlikely to cheer households struggling with rising food inflation.

Bond markets would prefer to see lower public spending and lower government borrowing, and would likely support tax increases as a way of balancing the books.

But higher taxation will likely worry business leaders, who argue more levies will choke growth at an already-precarious moment for the global economy. And after increases to employer National Insurance contributions kicked in this April.

Rachel Reeves Under Pressure as UK Economy Stalls

UK GDP growth in July was zero, down from 0.4% in June. Inflation has risen to 3.8% and is expected to rise to double the Bank of England’s target. The labor market is weakening. What’s more, formerly fringe party Reform UK would win a general election if called now, polls suggest. A summer of protests has put Downing Street on the back foot.

Though Reeves has hung on, speculation over her future has not dampened. Idle talk of an International Monetary Fund bailout has affected her credibility, even if it is at this stage unlikely. Speculation over her future reached a crescendo in early September, when gilt yields spiked around the time that the deputy prime minister, Angela Rayner, resigned.

“Whether the Autumn Budget is ‘do or die’ for the government remains to be seen, but it’s definitely do or die for Rachel Reeves,” says Morningstar’s chief European market strategist, Michael Field.

“We are at a crucial juncture. Labour has a great opportunity to make strides in fixing the UK’s financial black hole—a precarious, but eminently fixable, problem.

What Tax Changes Have Been Rumored?

- Changes to property taxation, including stamp duty and council tax or imposing CGT on primary residences.

- Lowering of tax-free sums for those accessing private pensions.

- Changes to private pension tax relief.

- Widening the scope of the VAT regime.

- Income tax and/or National Insurance increases, breaking the manifesto pledge.

- Making landlords pay National Insurance contributions on rental income.

- Changes to Cash ISA limits.

- Scrapping certain “gifting” exemptions under inheritance tax.

Will Reeves Raise VAT or Income Tax?

In its 2024 general election manifesto, the Labour Party pledged it would not increase the main rates of income tax, National Insurance and VAT. At the October Budget last year, it got around this constraint by increasing employer contributions on National Insurance rather than employee contributions. The government could now repeat this playbook.

In her speech to the Labour Party’s Annual Conference in Liverpool in late September, Reeves declined to outline how taxes might be increased, but it was clear to onlookers that the chancellor felt the cost of maintaining the government’s debt was unsustainable.

“There is nothing progressive, nothing Labour, about government using one in every £10 of public money it spends on financing debt interest,” Reeves claimed.

“Our economic renewal will rest on stability, to keep taxes, inflation, and interest rates as low as possible.”

The statement has been widely interpreted as a strong indication that the government will once more increase the tax burden.

Gilt Markets Expect Higher Taxes

When Reeves made this statement, there was little reaction from the UK gilt markets, indicating investors still wish to see the government’s plans before projecting any material implications.

“[Gilt] yields will likely remain elevated until we get a clear plan at the Autumn Budget, though given the UK government’s promises not to increase austerity and to keep its fiscal maths in order, the Autumn budget will inevitably bring higher taxes,” says Oliver Faizallah, head of fixed income research at Charles Stanley.

“This isn’t a quick fix, though. Higher taxes may create a fiscal doom loop, where tax increases hurt demand and growth, further lowering tax receipts.”

How Will the Government Raise More Tax?

Several means of increasing government revenue are reportedly under consideration. They include taxes on Cash ISA investments, changes to the capital gains tax treatment of property sales, and a major amendment to inheritance tax to restrict the so-called “gifting” rules.

It’s possible there will be more significant changes to the rules around VAT, a form of indirect taxation. Though Labour has pledged not to increase the headline rate of VAT beyond 20%, Reeves could lower the threshold at which businesses pay the tax.

She could also put VAT on private taxi and ride-sharing platforms online, and even remove the VAT exemption on private healthcare. The last of these policies would echo an earlier decision to remove a VAT exemption on private schools, which came into effect on Jan. 1 this year.

This might seem like an easy target, but VAT increases are typically passed on to consumers in the form of higher prices.

“If the government does increase VAT this could lead to a one-off increase in inflation, at a time when price pressures are already elevated,” says Kathleen Brooks, research director at trading platform XTB.

If tax increases are inevitable, then so too are other difficult decisions.

“Reeves has so far shied away from bold action, but bold action is what is required,” says Morningstar’s Field.

“Failure to do so could certainly result in a reshuffling of her job.”

What Tax Changes Were Announced in the 2024 Budget?

- The rate of National Insurance employer contributions was increased to 15% from April 2025.

- Pensions were brought into the scope of inheritance tax regime from 2027.

- Changes were made to the treatment of family business, including farms.

- Capital gains tax for shares was increased as well as stamp duty on second homes.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Please Note:

This article was first published by Morningstar and is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we focus on reducing investment costs so that more of your investment growth, stays in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investments costs

Socially Responsible Investing – Ethical Business Standards