The charts showing the true scale of the Magnificent Seven’s fall

9 August 2024

The Magnificent Seven have been knocked off their perch but do their less frothy valuations make them a more attractive prospect?…

By Emma Wallis,

News editor, Trustnet

The savage sell-off in technology stocks has hit the Magnificent Seven hard but now they are no longer priced for perfection, investors may be wondering whether this is a good time to pile back in.

Chris Beauchamp, chief market analyst at IG Group, believes that current market volatility is “a growth scare” and “probably not the beginning of something more dramatic”.

A reset was arguably needed, he continued, and now share prices are more attractive. “If you wanted to be in tech, now is a better time.”

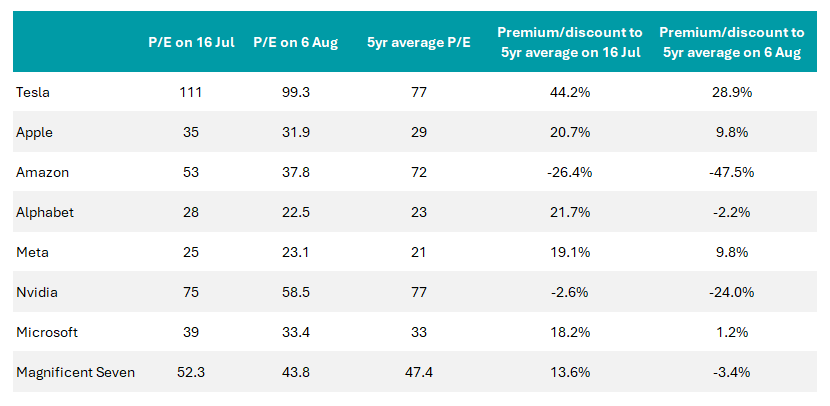

In mid-July, the Magnificent Seven as a group were trading on 52x earnings – a 15% premium to their five-year average. By 6 August, valuations had fallen to a 3% discount versus their five-year average price-to-earnings (P/E) multiples, as the table below shows.

Magnificent Seven P/E ratios vs 5yr average

Sources: IG Group, Reuters Eikon

Amazon’s P/E ratio has slumped to almost half (47.5%) of its five-year average, while Nvidia’s P/E of 58.5x represents a 24% discount compared to its five-year average of 77x.

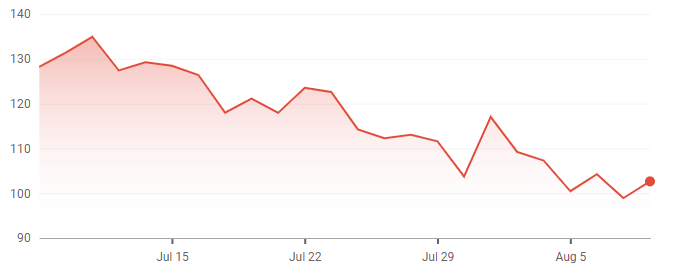

After months of gravity-defying gains, Nvidia’s share price slid from $134.91 on 10 July to $98.91 on 7 August – a $36 or 27% fall.

If he had told an investor two months ago that they would soon be able to buy Nvidia at today’s prices, they would have “bitten my arm off”, Beauchamp said.

Share price performance of Nvidia over 1 month

Source: Google Finance

Looking at the US stock market more broadly, Beauchamp thinks the recent falls should not cause panic. The less liquid summer months are usually a tricky period for markets and volatility is part and parcel of investing.

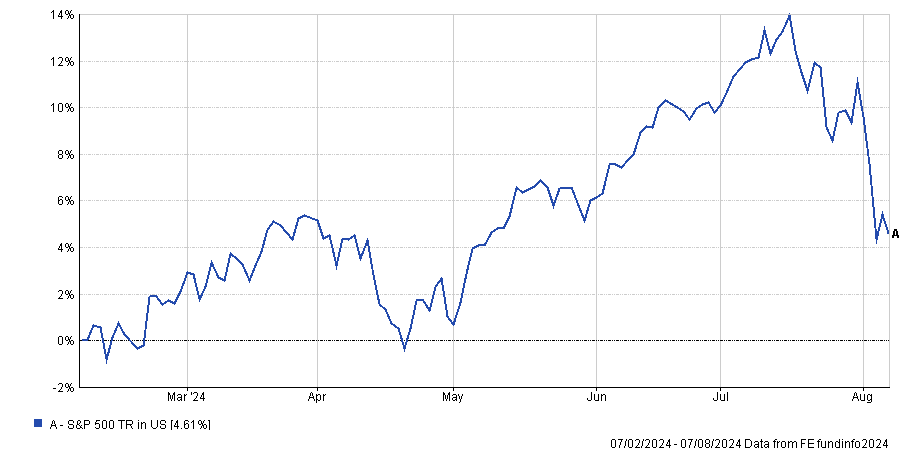

The S&P 500 has retreated to its May 2024 levels, wiping out a couple of months of gains which is “not cataclysmic” and perhaps volatility is “the price you pay” for the exponential returns earlier this year, he said. “We’ve been riding so far ahead of an average year, so there had to be a reckoning.”

Performance of S&P 500 over 6 months in dollar terms

Source: FE Analytics

Beauchamp thinks the US equity market to end the year above its current level but “we should expect the ride to be choppy from here.”

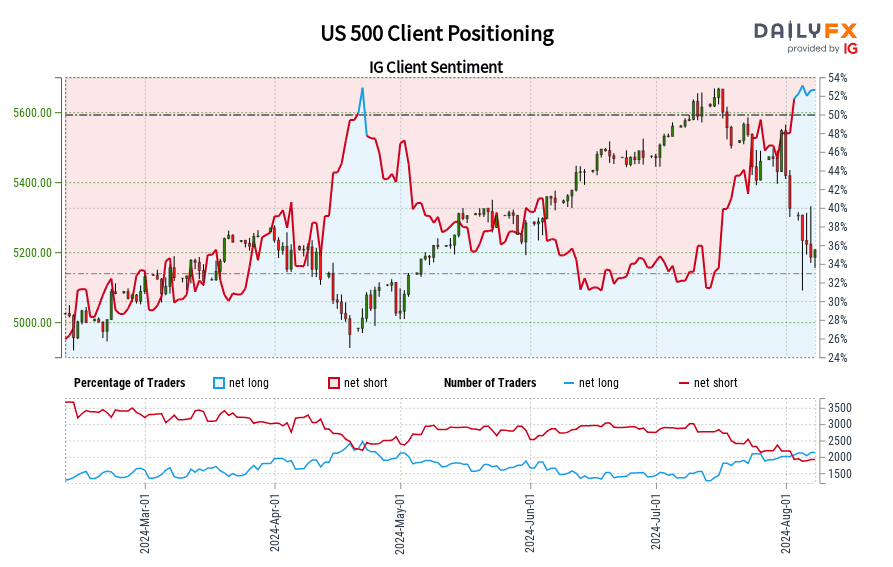

Judging by their trading activity, IG Group’s clients were net short US equities at the market’s mid-July peak but have been buying during the sell-off, he added.

IG Group clients’ exposure to the S&P 500

Source: IG Group

For Simon Webber, head of global equities at Schroders, the correction also came as no surprise. “We have been anticipating increased equity market volatility given the disconnect between buoyant consensus expectations, mixed economic data and an apparent mispricing of risk.”

He agreed with Beauchamp that equities have become a more attractive prospect following the sell-off. “The bottom line is that equity markets were vulnerable to a correction but company fundamentals are decent and heightened volatility is an opportunity for repositioning where dislocations occur,” he said.

“A soft landing for the economy remains our central scenario and we still expect equity markets to be well-supported in the medium term by modest growth in corporate earnings.”

Conversely, Franklin Templeton’s chief market strategist Stephen Dover warned that “the market moves may not yet have run their course”.

“Opportunity will eventually present itself, but we think it is too early for all but the most long-term investors to seek value,” he cautioned.

Timing the market is notoriously difficult, especially as the best days often come hot on the heels of the worst. As such, most stick with the tried and tested mantras of diversification and drip feeding, even – and perhaps especially – during volatile periods.

Rob Morgan, chief investment analyst at Charles Stanley, said: “At these times it is usually best to keep calm, stick to your investing plan and keep focused on the fact that sharp short-term moves should pale into insignificance over multiple years and decades. It’s rather like avoiding seasickness by keeping your eyes on the horizon rather than the rolling waves below.”

For anyone with cash on the sidelines who is thinking about investing but might be nervous about current market conditions, making regular contributions, perhaps at monthly intervals, is “one way to counter market ups and downs, as well as take some of the stress out of investing”, he said.

“The advantage of dripping money into the market is that you don’t need to worry about market timing. The strategy can even turn market volatility to your advantage as you average down if prices fall further.”

Please Note:

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please note the above article was first published by Trust Net and should not be regarded as individual investment advice on whether to buy, sell or hold any of the investments mentioned. Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

As we aim not to use commission paying funds (where applicable), we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investment costs.

Socially Responsible Investing – Ethical Business Standards