What’s Hot: Is Oil Headed for $100 or returning to $75?

Director, Research

15 Sep 2023

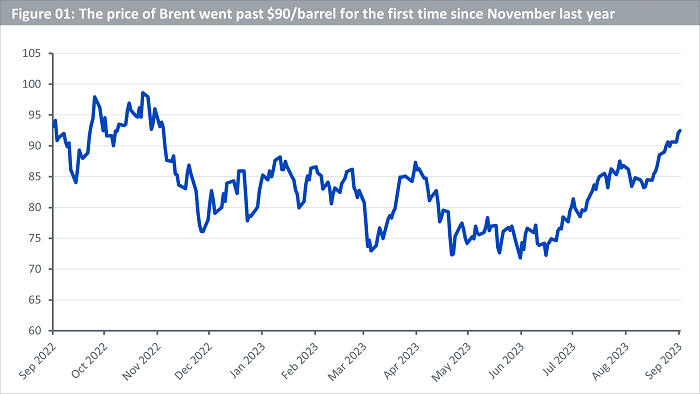

Oil prices have reached their highest level since November of last year. Brent recently broke through the $90/barrel mark, following a sustained rally that began at the end of June. While oil’s behaviour in the first half of this year was largely characterized as ‘rangebound,’ recent price action is prompting a debate about whether oil is in a bull market.

The appreciation in oil prices carries profound implications for the hottest topic in financial markets over the last two years: inflation. Rising energy prices have been cited as the reason for an increase in the US headline inflation rate, which rose to 3.7% in August from 3.2% in July1.

So, is oil in a bull market, or is it still rangebound despite briefly surpassing the upper limit of the range? Is the next step for oil $100/barrel, or will it return to $75? In this article, we outline arguments being made by both the bulls and the bears.

Source: Bloomberg, data as of 13 September 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

What the bulls say

The recent boost to oil’s rally followed the September 5th announcement from Saudi Arabia and Russia that they would extend their additional voluntary production cuts until the end of the year. Originally, these voluntary cuts, amounting to 1 million barrels per day (mb/d) from Saudi Arabia and 300,000 b/d from Russia, were set to conclude in August. However, they will now continue through December, subject to a monthly review.

The influence of OPEC+2 has been evident throughout the year, but this latest announcement has prompted the markets to take the group’s commitment to tightening oil markets more seriously. Bulls argue that there is no sign of a pivot from the group, which has maintained all year that the demand for oil is weak and, therefore, the cuts are warranted.

The International Energy Agency (IEA) continues to provide a contrasting view of oil market dynamics. In its September Oil Market Report, the IEA states that global oil demand is on track to grow by 2.2 mb/d in 2023, reaching 101.8 mb/d. The agency has consistently pointed to strong Chinese consumption as the primary driver in its monthly reports throughout the year. The latest report comments on the extension of output cuts from Saudi Arabia and Russia, suggesting that this move will maintain a substantial market deficit throughout the fourth quarter of the year. So, if the IEA’s outlook is correct and OPEC+ is wrong in its assessment of weakening oil demand, the bullish narrative could continue to find support.

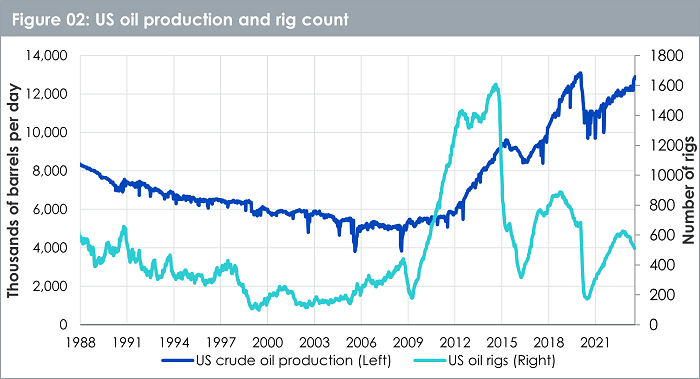

The IEA acknowledges that additional oil supply from non-OPEC producers has partly offset the tightness created by Saudi Arabia and Russia. According to the agency, OPEC+ output has declined by 2 mb/d this year, while non-OPEC+ supply (led by the US and Brazil) has increased by 1.9 mb/d. Bulls will also argue that the US’s ability to further increase supply is limited, given the recent decline in rig counts (see figure 02 below).

Source: Bloomberg, data as of 13 September 2023.

Currently, markets are predominantly leaning towards the bullish case, and the backwardation3 in oil futures has increased over the past month4. This indicates that the market’s perception of tightness in the oil market has intensified.

The bear case

The bears remind us that even for OPEC+, an ever-increasing oil price is not the goal, as it can result in demand destruction. $90/barrel may be the sweet spot that OPEC+ is comfortable with. If the price exceeds $100, Saudi Arabia and Russia may reconsider their stance on additional voluntary cuts during one of the upcoming monthly reviews.

Bears also reflect on the last time oil exceeded $100 and point out the differences. Oil prices rallied in Q1 2022 when the Russia-Ukraine war began, and markets immediately began to factor in significant disruptions in supply. In the following months, the European Union banned the import of Russian oil. All of this was happening as global demand was swiftly recovering post-Covid.

Now, markets are aware that Russian oil is still finding its way into markets worldwide, and the global economy is showing signs of slowing down. Bears will also highlight that Chinese manufacturing has yet to demonstrate clear and sustained acceleration. If data from China disappoints again, markets may fear that China’s robust oil demand this year could take a hit.

Conclusion

There is also a third scenario in which oil neither reaches $100 nor drops to $75 in the immediate future but instead hovers around $90, a level Saudi Arabia might not object to. A stable oil price is possible, albeit relatively unusual, especially given the forces that are pulling it in either direction.

Sources

1 Trading Economics, 13 September 2023

2 The Organization of the Petroleum Exporting Countries and its partners

3 Higher spot prices than futures prices

4 Observed using Bloomberg data as of 13 September 2023

Related products

+ WisdomTree Brent Crude Oil (BRNT)

+ WisdomTree Brent Crude Oil 3x Daily Leveraged (3BRL)

+ WisdomTree Brent Crude Oil 3x DailyShort (3BRS)

About the Contributor

Director, Research

Mobeen is a member of WisdomTree’s research team where he focuses on a wide range of asset classes to offer strategic and tactical insights to our clients on global markets and investment products.

Before joining WisdomTree in December 2018, Mobeen worked at Willis Towers Watson as an investment consultant advising institutional clients as well as their in-house fund business on asset allocation and portfolio construction with his research focus being equity and multi-asset smart beta.

Mobeen has a BSc (Hons) in Accounting and Financial Management from Loughborough University and an MSc in Accounting and Finance from the London School of Economics and Political Science. He is also a CFA Charterholder.

Please Note:

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please note the above article was first published by Wisdom Tree and should not be regarded as individual investment advice on whether to buy, sell or hold any of the funds mentioned. Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

Clients of Ethical Offshore can access the Wisdom Tree products mentioned in the article with with no additional commission…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to see how you can save on your investment costs.

Socially Responsible Investing – Ethical Business Standards