Is a bitcoin allocation a diversification ‘cheat code’?

The following article is from the Portfolio Adviser publication from 15 August

A 1% allocation to bitcoin in a 60/40 portfolio could have added an annualised 0.67% to returns over the last 11 years

Photo by Art Rachen on Unsplash

15 August 2024 – Christian Mayes

Digital assets continue to work their way into the professional investment space despite caution from regulators and misconceptions around the asset class, according to industry commentators.

While the Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA) have both taken a cautious approach to crypto, regulation introduced over the course of the year so far has seen spot bitcoin ETFs approved in the US while UK asset managers are now able to offer physically backed products to professional investors.

Despite increased interest from asset managers, however, we are still in the very early phases of adoption of the asset class. According to Syz Capital’s head of liquid alternatives Richard Byworth, less than 4% of the global population have any exposure, while far less understand the “core value” of a “highly portable, and absolutely scarce, asset”.

What should a bitcoin allocation look like?

The positive correlation between equities and bonds in recent years has left investors considering alternatives to further diversify their portfolios.

John Plassard, Mirabaud Group senior investment specialist, says that digital assets can provide this due to their low correlation with traditional assets.

“They offer high growth potential as emerging technologies with significant upside if widely adopted, making them attractive to risk-tolerant investors,” he says. “Cryptocurrencies are also seen by some as a hedge against inflation, due to their limited supply and decentralised nature.

“However, their high volatility poses substantial risks, suggesting they should only comprise a small portion of a portfolio, typically 1% to 5%. Additionally, the evolving regulatory environment and security concerns introduce further risks that investors must consider.”

He believes the adoption of bitcoin and ethereum ETFs has given a “new dimension” to the asset, as the products have made it easier to integrate crypto into a diversified investment strategy, while the increased accessibility also lowers the barriers to entry for investors who were previously reluctant to gain direct exposure due to perceived risks or technical complexity.

According to research from WisdomTree — who are among the asset managers to embrace digital assets — looking at the 11-year period between 31 December 2013 to 30 April 2024, adding a 1% allocation to bitcoin to a 60/40 portfolio (60% MSCI All Country World, 40% Bloomberg Multiverse) would have increased returns by 0.67% per year, while adding only 0.07% of volatility and 0.5% of maximum drawdown.

According to research from WisdomTree — who are among the asset managers to embrace digital assets — looking at the 11-year period between 31 December 2013 to 30 April 2024, adding a 1% allocation to bitcoin to a 60/40 portfolio (60% MSCI All Country World, 40% Bloomberg Multiverse) would have increased returns by 0.67% per year, while adding only 0.07% of volatility and 0.5% of maximum drawdown.

Pierre Debru, the firm’s head of quantitative research & multi asset solutions, says: “The correlation with equity and fixed income is lower than commonly used assets like commodities, gold, or Reits. The return potential is well above all other often-used asset classes, and the information ratio aligns or betters most active strategies or hedge funds.

“And yet, contrary to retail crypto ownership, institutional investors’ current crypto ownership remains very small, even if it has recently grown thanks to the ‘wake-up call’ that was the approval and launch of spot bitcoin ETFs in the US.”

He likens professional investor sentiment towards crypto to the ‘Pepsi challenge’, in which consumers of Coca-Cola are invited to participate in a blind taste-test of the two brands as part of a marketing stunt. While most people instinctively think they preferred Coca-Cola, a majority chose Pepsi in the challenge.

“In the same way that consumers, while confronted with tangible proof of their preference for Pepsi, stuck with Coca-Cola, institutional investors continue to disregard the new asset class that is crypto, dismissing all the accumulating research on its strong potential as a source of growth and diversification.

“The asset class and bitcoin, in particular, continue to carry the stigma of many disproven and often contradictory misconceptions, such as that it is only useful for criminal activities and, simultaneously, that it has no real-life use case. Those misconceptions are creating a psychological bias for many investors that stops them from recognising what are now hard-to-contradict facts.”

Syz Capital’s Byworth adds that there is huge value in a decentralised and secure network that has proven its antifragility “time and time again” over the last 15 years.

He says the volatility of bitcoin can make it problematic for clients focused on short-term returns and liquidity.

“But for anyone with a time horizon over four years, the asymmetric upside of bitcoin is a cheat code for increasing portfolio performance.”

Key election issue

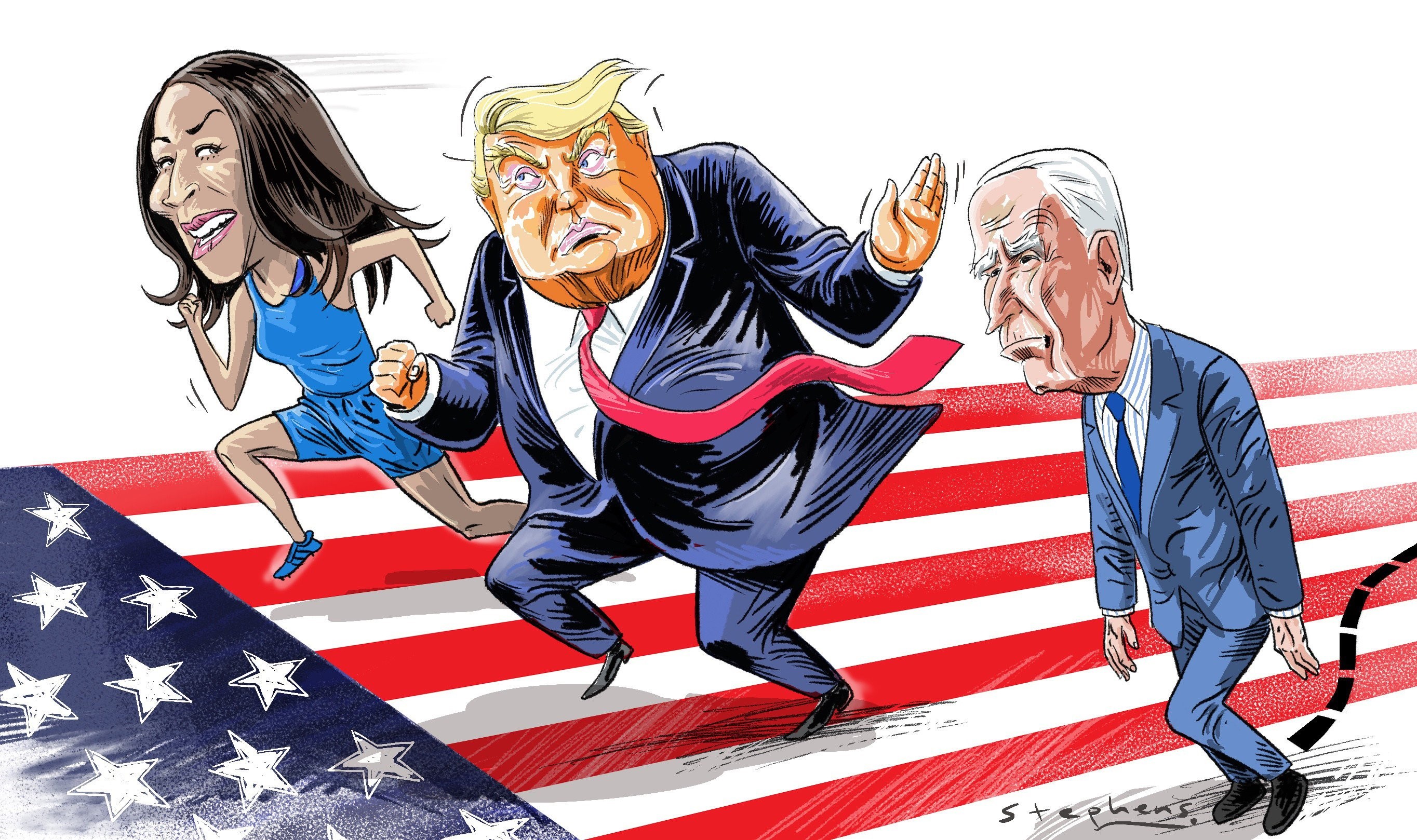

Following Republican nominee Donald Trump’s speech at the bitcoin 2024 conference in July, cryptocurrency has emerged as a new political battleground in the race to the White House.

Among several pro-crypto pledges, Trump said that, if elected, his government would stop selling the bitcoin it currently holds and would transfer it to a strategic reserve.

The US currently holds 213,000 bitcoin, of which 94,000 were seized in connection with criminal activity.

Trump also vowed to make America the “cryptocurrency capital of the world” by developing its crypto industry, while he also pledged to fire SEC chair Gary Gensler and appoint a crypto-currency adviser to “design transparent regulatory guidance” within his first 100 days.

While the Democrats under Joe Biden have taken a cautious stance on crypto, Plassard argues that Kamala Harris may also warm to the asset.

“Kamala Harris may soon recognise that cryptocurrencies are here to stay and propose developing policies accordingly. She could have staff trained on the subject and work with industry players.

“Secondly, Kamala Harris could commit to working with the cryptocurrency industry, appointing regulators who understand and do not look down on the technology. It should be remembered that cryptocurrencies do not fit easily into existing regulations and require an extremely nuanced approach.

“Last but not least, the US industry is crucial to national security and the dominance of the dollar. The Harris camp cannot deny this.

“A more constructive approach from the Vice-President would be a unique — and opportunistic — opportunity to show that Democrats support technological innovation at a critical time before the elections.”

Plassard adds that, from an electoral perspective, crypto and blockchain technologies have an outsized impact in securing victories ahead of and behind the polls.

“Cryptocurrencies are at the heart of voters’ concerns in key swing states, and a balanced approach to cryptocurrencies that drives innovation while protecting consumers is very positive for policymakers and candidates.

“More than 20% of voters in key states have identified crypto as a major issue in the 2024 election, and it’s critical that the Democratic Party makes a compelling case to crypto voters while ensuring that consumers benefit from thoughtful and appropriate regulation.”

Why specifically bitcoin?

Though digital assets incorporate a wide variety of different cryptocurrencies, bitcoin has received the most attention from investors.

“While we do allocate to managers who have demonstrated success in navigating the opportunities within crypto markets, we maintain a cautious approach towards the broader crypto space,” says Syz Capital’s Byworth.

“In our view, bitcoin stands apart due to its unique characteristics, while many other cryptocurrencies face significant challenges, such as limited utility, centralised structures, and weaker network effects. As a result, we believe that a majority of these assets may struggle to maintain value over time.”

“It often requires some time, and willingness to accept that preconceptions may be wrong for an investor to understand the various aspects that make bitcoin such a unique asset,” he adds.

“Perhaps the shortest path to taking a first step is understanding that there is growing demand for bitcoin, that 19.7 million have already been issued, that 21 million will be the limit of that issuance for eternity, and that we are at 4% adoption by humans, less than 1% adoption by corporates, less than 1% adoption by nation states and 0% adoption by AI… and that it will take another 116 years to issue the remaining 1.3 million bitcoins.

“As Satoshi — bitcoin’s creator — once said: ‘it might be worth getting some, in case it catches on’.”

Please Note:

This article is provided for information only.

The above article was published by Portfolio Adviser and should not be regarded as individual investment advice on whether to buy, sell or hold any of the assets mentioned.

The above article was published by Portfolio Adviser and should not be regarded as individual investment advice on whether to buy, sell or hold any of the assets mentioned.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

Interested in having some Bitcoin exposure…??

Speak with Ethical Offshore Investments to learn how you can get exposure to the asset with minimal costs, through our strictly regulated platforms and Exchange Traded Funds (ETF’s)

Socially Responsible Investing – Ethical Business Standards