Guinness Sustainable Energy Report – Building efficiency: critical to the energy transition

This is a marketing communication. Please refer to the prospectus and KID/KIID for the Fund, which contain detailed information on its characteristics and objectives, before making any final investment decisions.

Building efficiency: critical to the energy transition

August 2023

Executive Summary

Buildings are responsible for around 40% of global carbon emissions: 30% from their operational emissions and 10% from materials and construction. Space heating, water heating, space cooling and lighting are key drivers of operational emissions and are collectively responsible for two-thirds of the final energy use of buildings. Decarbonising buildings means tackling each of these areas by investing meaningfully in heat pumps, insulation, lighting, and efficient cooling.

This month’s manager’s comments explore building efficiency, focusing on these four key areas.

Clean energy investment

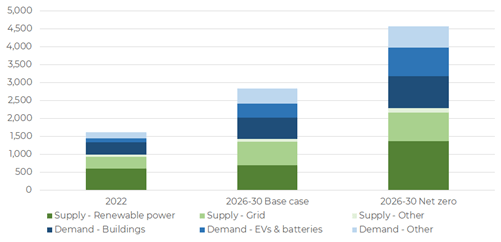

In 2022, global clean energy investment reached $1.6 trillion. Of this, roughly 60% is spent on decarbonising energy supply (renewable power, grids, other), while the remaining 40% is spent on the efficiency and electrification of energy demand (mainly building efficiency, EVs & batteries). The Guinness Sustainable Energy investment universe broadly mirrors this, with 60% of names exposed the installation and generation of sustainable energy and 40% of names exposed to the electrification and efficiency of energy demand.

We expect overall clean energy spending to increase by around 75%, averaging $2.8 trillion p.a. in the second half of the decade. We also expect the mix within clean energy to shift towards an equal split – i.e. 50% towards energy supply and 50% towards energy demand/efficiency. To be clear, though, spending of $2.6trn does not put the world on a ‘net zero’ path. For the world to achieve 1.5 degrees and hit net zero emissions by 2050, spending in the short term needs to nearly triple, averaging $4.6 trillion pa from 2026-30.

Annual investment in clean energy ($’bn pa)

Source: IEA, Guinness Global Investors estimates, as of 31.07.2023

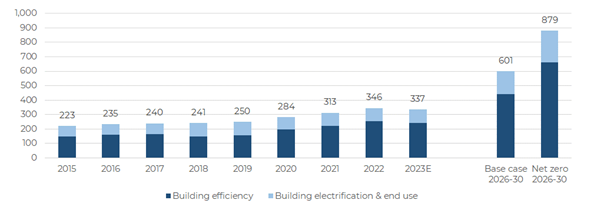

Building efficiency spending

Despite the operation of buildings accounting for around 30% of global emissions, only 20% ($340bn) of global clean energy spending was allocated to buildings in 2022. Space heating (33%), water heating (19%) and space cooling (7%) and lighting (5%) are collectively responsible for 60% of the final energy use of buildings. Decarbonising buildings will require investment in heat pumps to electrify space and water heating; insulation to improve thermal efficiency; and LED lighting and efficient cooling to reduce the energy consumption of key end-use devices and appliances.

We see total building efficiency and electrification spending growing by around 75%, averaging $600bn pa from 2026-30.

Global building efficiency-related investment by scenario ($’bn)

Source: IEA, Guinness Global Investors estimates, as of 31.07.2023

Heat pumps

Space and water heating, used to keep homes warm in winter and provide hot water for washing and cleaning, accounts for half of all global energy use in buildings. Over one?sixth of global natural gas demand is for heating in buildings – in the European Union, this number is one?third. Heat pumps are a vital tool for decarbonising heat and reducing reliance on natural gas imports.

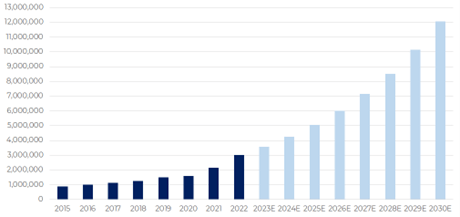

Global heat pump sales grew by 11% in 2022 after growing at 13% in 2021. Despite strong growth in recent years, heat pumps still only meet around 10% of global heating needs in buildings. We see installation growing at 11% pa out to 2030, resulting in the global installed stock more than doubling to meet 18% of global heating needs. However, to get on track with a net zero trajectory, sales need to grow at closer to 20% pa, with the global installed stock almost tripling to 600 million units, meeting 24% of global heating needs by 2030. Future growth is supported by financial incentives in over 30 countries and bans / phase outs on fossil fuel heating systems in 20 countries.

Europe has outpaced global sales in recent years, growing at 35% and 39% in 2021 and 2022 respectively, bringing the region’s heat pump sales to over 3 million units. This expansion was primarily driven by high gas prices and increased policy support as a result of Russia’s invasion of Ukraine. Heat pumps remain a vital tool to secure Europe’s energy independence from Russia. The EU’s target to install 60 million additional heat pumps between 2023-30 is expected to reduce the bloc’s household gas demand by 40% and would require installations to grow at around 20% pa over the period.

In 2023, the EU made further recommendations to introduce a ban on gas boilers from 2028 in new buildings and phase out the use of fossil fuel heating systems in all buildings by 2035.

European heat pump sales 2015-2030E (units)

Source: IEA, Guinness Global Investors estimates, as of 31.07.2023.

Insulation

The second law of thermodynamics states that heat moves away from hotter objects into cooler objects. Insulation can improve the thermal efficiency of a building’s envelope (e.g. exterior walls, roof), helping to prevent outside heat from entering the home in hotter climates and preventing indoor heat from leaking outside in colder climates. For the lowest rated building stock across Energy Performance Certificates (EPC), proper insulation can reduce energy consumption from space heating and cooling by 40% compared to uninsulated homes, with loft insulation offering to pay for itself in as little as 1-3 years.

We estimate the global insulation market has grown at around 6.5% pa from 2012-22, driven by government incentives, energy efficiency requirements, stricter building codes, and higher energy costs. The sector broadly follows the building construction market but has historically seen structurally higher growth of 3-7% pa on average. Going forwards, we expect global insulation industry revenues to grow at 5-7% pa out to 2030 driven by policy and economics. Thanks to a reasonably consolidated industry (the top 9 companies account for >70% of market share) and regulatory hurdles creating a barrier to new entrants, we expect this revenue growth to translate into earnings growth of 10-15% pa.

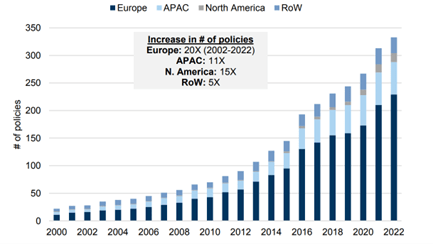

Over the past 20 years, most regions have seen a 10x increase in policies targeting building energy efficiency, including via increased insulation usage, jumping in 2016 after the adoption of the Paris Agreement. To date, markets representing over 50% of global emissions have pledged to target Building Insulation and Green Buildings solutions to meet their 2030 decarbonization targets.

This is only set to grow further, as even in developed economies such as the EU and US, 75% and 90% of all homes are still found to be under-insulated or energy inefficient.

Global policies targeting building insulation, envelope technologies and eco-design

Source: IEA, Goldman Sachs, to 31.12.2022

For instance, the European Commission launched the Renovation Wave strategy in 2020, aiming to double the current renovation rate from 1% pa to 2% pa, retrofitting 35m buildings by 2030. To achieve this, it is estimated that energy renovation spending would need to triple to €275bn pa. In March 2023, this was taken one step further. The EU ratcheted up its energy efficiency target, aiming to reduce final energy consumption by at least 11.7% in 2030 (up from 9%) and required member states to renovate at least 3% of the total floor area of public buildings each year.

If the renovation rate of the building stock in Europe increases by 2-3x, Goldman Sachs estimates that the region’s total addressable market for insulation could double over the next 10 years, equating to growth of 7% pa.

Efficient cooling

Space cooling is the fastest growing building-end use with cooling-related energy consumption having more than tripled since 1990. As the planet warms, ensuring access to energy efficient cooling is of primary importance. According to the IEA, between 2019-2021, the average number of heat-related deaths among people aged 65 years or older reached at least 300,000 deaths.

The number of air conditioning units in operation globally has increase by 2.5x in the past 20 years to 2 million units and is set to grow by a further 50% by 2030 to 3 million units. Thanks to industry consolidation (the top 6 players in any market hold 90% share) and a fragmented customer base (relatively few manufacturers selling to a larger number of distributors), the heating, ventilation and air conditioning (HVAC) OEMs enjoy strong pricing power.

Price increases of 1-3% pa has allowed them to grow their revenues at 6% pa, outpacing unit sales of 4% pa over the past decade. At the same time, improving operating leverage has seen profits grow at 10-12% pa. We expect a similar pattern to continue out to 2030, with installations growing at 4.5% pa and price increases of 1-3% pa resulting in sales growth of 6-7% pa and earnings growth of 10-11% pa.

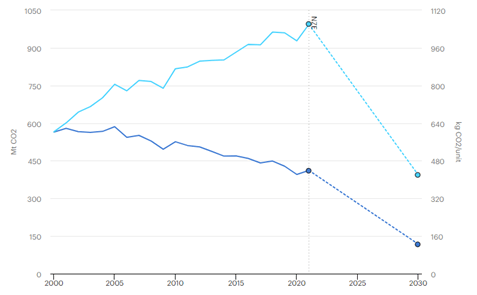

CO2 emissions from and emissions intensity of air conditioning

Source: IEA, as of 30.06.2023

While highly efficient HVAC units are available, most efficiency standards have efficiencies well below best-in-class models. Without a move towards high efficiency cooling and improvements in the thermal efficiency of the buildings in which they operate, electricity demand for space cooling in could increase by as much as 40% globally by 2030. Despite the expected growth in demand for air conditioning, to achieve net zero emissions, final energy consumption from cooling must stay flat and emissions intensity of air conditioning must fall by 70% by 2030.

For this reason, more than 90 countries covering >86% of global residential space cooling energy consumption already have Minimum Energy Performance Standards (MEPS) and labelling policies in place for air conditioners.

For example, 2022 saw China update its minimum Energy Performance Standards for room air conditioners (ACs) allows for a transition from fixed-speed ACs to the more efficient variable-speed models. So far in 2023, we have seen further updates from the United States and India covering air conditioners and fans. These standards are only set to become more demanding and expansive over time. As a result of tightening standards, we believe an outsized share of future growth will be captured by OEMs offering more energy efficient models.

We believe the Guinness Sustainable Energy Fund is well positioned to benefit from increased investment in building efficiency in the coming decades through its exposure to Nibe, a leader in European heat pumps; Installed Building Products, the second largest insulation installer in the US; and Trane Technologies, a specialist in efficient residential and commercial cooling in North America. The Fund is also positioned to capture increased investment in electrical end-use efficiency and building automation through its ownership of low- and medium-voltage leaders Hubbell, Eaton, Legrand, and Schneider Electric.

To read the full commentary report, please follow the link below

|

|

The Managers

Will Riley – Portfolio Manager

Will joined Guinness in 2007 and has been managing energy funds since 2010.

Johnathon Waghorn – Portfolio Manager

Jonathan joined Guinness in 2013 and has been managing energy funds since 2008.

The value of this investment and any income arising from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you invested. Past performance does not predict future returns.

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we can access the fund mentioned in this article on the various offshore investment platforms we offer. We do NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investment costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards