Global Exposure for a Fraction of the Cost…..

Global Exposure for a Fraction of the Cost

Investment Charges – How much is it really costing you & your future.

Our solution keeps more of the investment growth in your pockets.

At Ethical Offshore Investments, we have been strong advocates of helping clients reduce their ongoing costs. And we believe that our Global Index Investing option will not only provide clients access to investing in the world’s greatest companies, but doing so at a fraction of the costs.

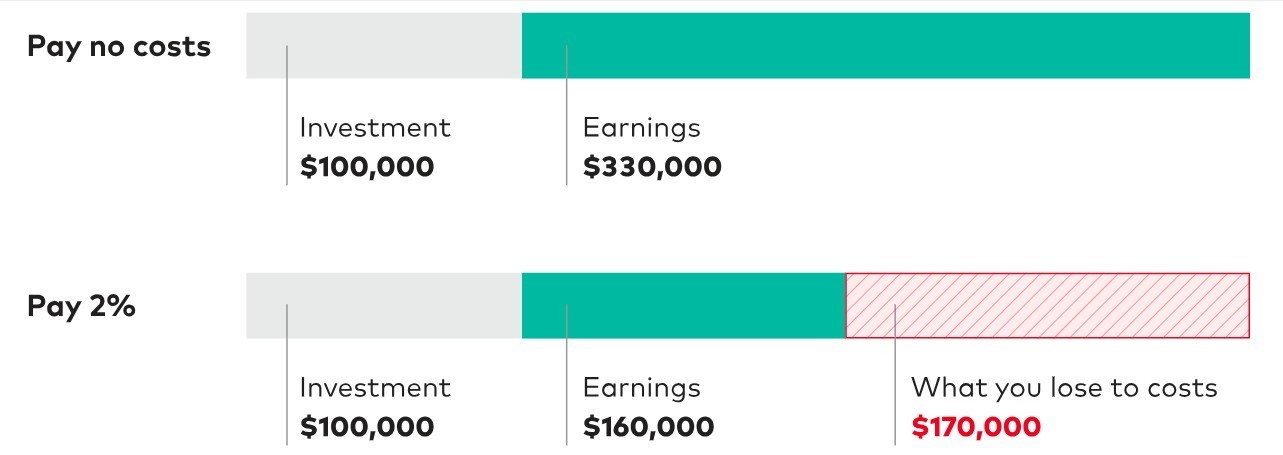

Before we show you how low the total charges are if you become a client of Ethical Offshore, below is an illustration of why reducing your costs is so important.

Don’t let high costs eat away your returns

There is the common saying that you have to spend money to make money…. But the money you spend to invest has a big effect on what you have left in your own pocket.

Points to know

- All investments have costs

- Money you pay for costs compounds (rises exponentially) over time

- Because some investments with higher costs have to overcome these expenses, their performance tends to suffer vs. lower-cost investments.

Understand what you are paying

At Ethical Offshore Investments, we have always strongly suggested that you ask your adviser or investment consultant, for a breakdown of all of the costs associated with holding an investment portfolio (don’t stop there….. ask your financial consultant what service or benefit is being provided for that specific fee / charge).

Every investment has a cost, even if you don’t realise that you are paying it

There are many different kinds of costs, but they all have one thing in common: if the money is going somewhere else, it is not going to you.

Why do costs matter

Investment costs might not seem like a big deal, but they add up, compounding along with your investment returns. In other words, you don’t just lose the tiny amounts of fees you pay – you also lose the growth that money might have had for years into the future.

For example: you invest $ 100,000 and the underlying investments generated a gross 6% each year for the next 25 years and had NO costs or fees, you would end up with an investment value of $ 429,190.

If on the other hand you had paid a combined 2% a year in investment costs & charges, after 25 years, you would have an investment value of only $ 266,580

That’s correct: the 2% of total charges you paid every year would reduce your investment value by nearly 38%……. that 2% doesn’t sound so small anymore, does it..??

Costs can eat away at your investments

The above example & image is provided by Vanguard Ltd

What can you do to control your costs..??

Because all investments have some form of costs, it might seem like a waste of time to worry about them. Or maybe you assume that a high cost means that you are getting higher quality investments & better total returns.

Unfortunately, nothing could be further from the truth. Research on mutual / managed funds has shown that in most cases that the higher-cost funds generally underperform lower-cost funds. That is because the fund managers charging these higher costs may struggle to add enough value to overcome the additional expense (in addition to this, they may have to take a slightly higher risk, more volatile approach to achieve the higher returns).

A Diversified Global Exposure for less than 1%pa

Actually, our global equity allocation total costs is 0.80%pa – that includes the fund manager charges, the offshore holding platform charges and the costs for having your dedicated, Private Manager at Ethical Offshore Investments who will continue to provide guidance and is your direct contact if you have any queries or concerns.

For clients that would like to invest in a dedicated US equity or a UK equity portfolio, the total cost is even lower at 0.75%pa

This is done through a selection of high quality Exchange Traded Funds (ETF’s) from the likes of Legal & General (L&G), iShares (Blackrock) and Vanguard.

Our Global Allocation will result in exposure to over 1,600 of the worlds biggest and most successful companies, which includes Apple, Microsoft, Amazon, Nvidia, Alphabet (Google) and Tesla. This can be invested in a range of different currencies.

Clients can also choose to have dedicated Ethical and Socially Responsible Investment index ETF which will only include the highest quality, screened ESG companies….. and all still for less than a total all up cost of 1%pa.

Finally, we can also offer a risk adjusted, diversified approach (using the expertise of Vanguard Ltd) where you can select a diversified asset portfolio of Bonds and Equities in-line with your preferred risk tolerance and investment objectives.

- Vanguard LifeStrategy 100% Equity

- Vanguard LifeStrategy 80% Equity (20% Fixed Interest / bonds)

- Vanguard LifeStrategy 60% Equity (40% Fixed Interest / bonds)

- Vanguard LifeStrategy 40% Equity (60% Fixed Interest / bonds)

- Vanguard LifeStrategy 20% Equity (80% Fixed Interest / bonds)

The above funds are invested across a range of 10 different Vanguard index funds or ETF’s, which will result in portfolios having allocations across the different geographical locations, economies (both developed and emerging) and business sectors.

The total maximum cost with utilising the Vanguard LifeStrategy range of funds, along with the platform and client servicing costs would be 0.92%pa

What is the benefit to you…… the investor.

Well let’s go back to the previously mentioned $ 100,000 being invested, but instead of 2%pa ongoing charges, it is the 0.80%pa of total charges being deducted (& don’t forget, you still will have your own dedicated Ethical Offshore consultant to assist you with queries & guidance).

That cost saving would result in a portfolio value after 25 years of $ 355,140…….. that is $ 88,560 more in YOUR POCKET…!!!

For clients that have a personal offshore pension (QROPS or a UK SIPP), the investment cost savings are even more important. In addition to the platform, fund management and client management costs, Pension portfolios are also subject to Trustee fees as well as their own administration costs. While we will always try and use the more cost effective pension schemes and trustees, there will unfortunately continue to be trustee costs associated with offshore pensions….. so the more you can save on the portfolio costs, this will help negate the additional trustee charges.

At Ethical Offshore Investments, we are determined to show how clients can invest in a global portfolio of quality companies, but ethically through low cost, flexible investment structures.

If you would like to learn more on how you can invest in a quality global portfolio with minimal costs, please click on the More Information button below and our senior consultant will contact you personally.

Ethical Offshore Investments also provides guidance on portfolios that have an ESG (Environmental & Social Governance) bias and an SRI (Socially Responsible Investing) focus. By avoiding high charging, commission paying funds, this results in lower portfolio costs, so more of the growth staying in the pockets of our clients.

If you would like to get more information on the Sustainable Ethical Allocation portfolios, or enquire on the vast array of Sustainable and Ethical style funds available, please click on More Information.