Five funds for income investors to consider in 2023

With inflation elevated around the globe, many investors are looking more at income strategies in a bid to make their money work harder.

Below, Trustnet highlights five income funds that the experts think look well placed as we start the new year.

By Gary Jackson,

Head of editorial, FE fundinfo

Jupiter Asian Income

While many income investors look to the UK market, thanks to its strong dividend culture and international revenues, AJ Bell head of investment research Alena Kosava said they shouldn’t overlook attractive opportunities in other markets.

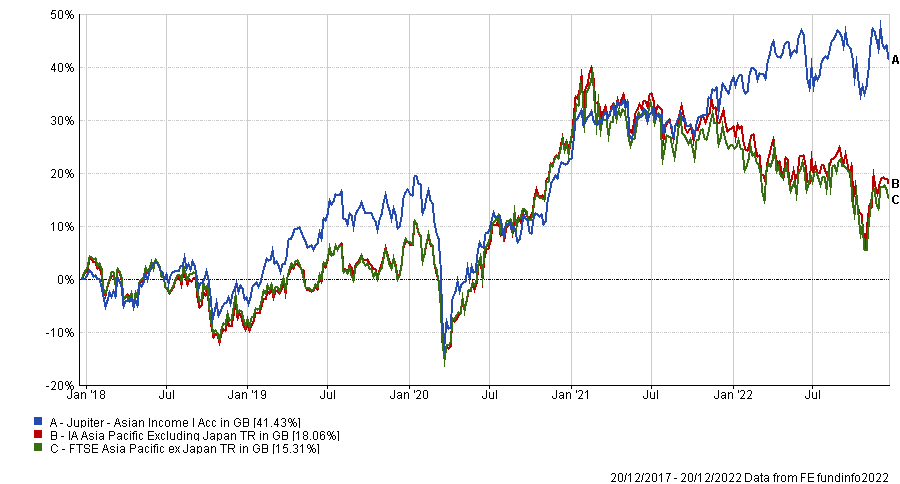

Performance of fund vs sector and index over 5yrs

Source: FE Analytics. Total return in sterling over five years to 20 Dec 2022

“In Asia, dividends have long played a key role in shareholder returns and the Jupiter Asian Income fund looks to capitalise on this. Asian companies continue to be relatively well managed with low debts, helping to support the dividend which currently sits at circa 4.7% from a concentrated portfolio of 28 names,” she said.

“Manager Jason Pidcock is a cautious investor, seeking out high quality companies that have strong management and governance, as well as a clear focus on the shareholder to ensure dividends are a key part of the company strategy.”

This cautious approach – which has involved dropping its exposure to China to zero because of its common prosperity policies (which include regulatory crackdowns) – has served the fund well. Jupiter Asian Income was in the top quartile of the IA Asia Pacific Excluding Japan sector for 2022 (up to 20 December), as well as over three and five years.

Artemis Global Income

Charles Younes, head of manager selection at FE Invest, also backs a fund that looks outside of the UK: Artemis Global Income, which is managed by Jacob de Tusch-Lec and James Davidson.

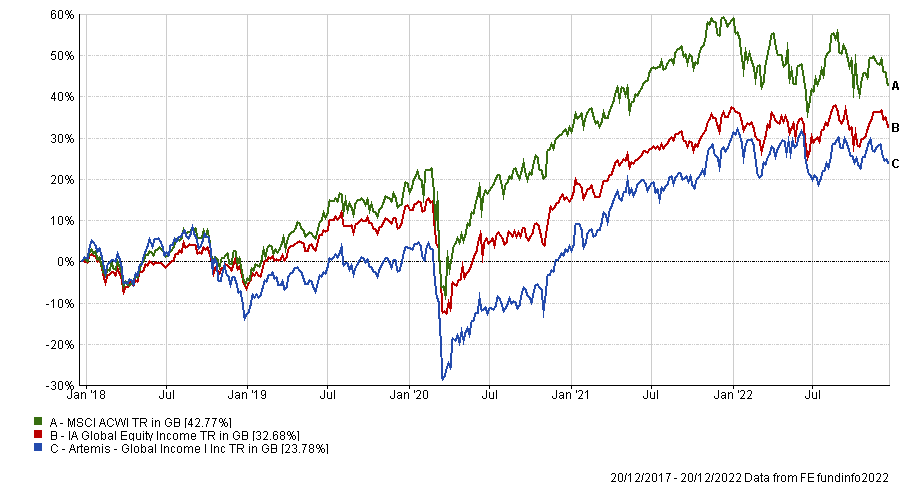

Performance of fund vs sector and index over 5yrs

Source: FE Analytics. Total return in sterling over five years to 20 Dec 2022

Younes likes the “dynamic approach” taken by Tusch-Lec and Davidson, which sees them act more flexibly than the typical equity income fund to deal with changeable markets – something that may prove beneficial in the current uncertain climate.

“The managers invest in companies with high and growing dividends but in contrast to other funds it also takes macro conditions into account when deciding when and where to invest,” he added.

“As this is a global fund it can invest across different regions, including emerging markets, and so is able to take advantage of the relative differences in regional or country-specific conditions to search for higher yields.”

Vanguard Global Credit Bond

Rob Morgan, chief analyst at Charles Stanley Direct, looked to corporate bonds for his 2023 income pick. While corporate bonds suffered a “perfect storm” of rising interest rates and concerns over deteriorating credit quality last year, both concerns look overdone and Morgan said investors can now lock an attractive level of return from investment grade debt without taking the greater risk that comes with high yield bonds.

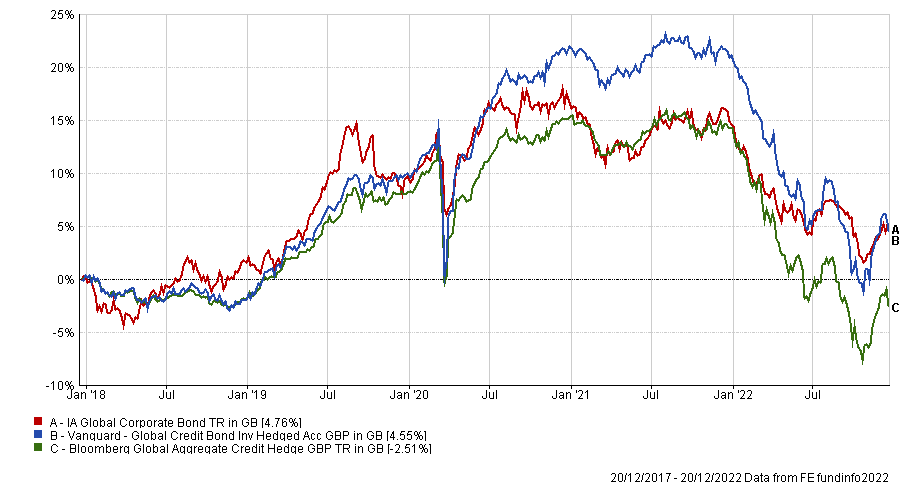

Performance of fund vs sector and index over 5yrs

Source: FE Analytics. Total return in sterling over five years to 20 Dec 2022

“For those seeking broad, ‘core’ exposure we believe Vanguard Global Credit Bond is worth considering. It seeks to provide a moderate level of income through investing in a diversified portfolio of corporate bonds on a global basis. The average yield to maturity of around 5% within the portfolio is typical of the substantial level of income available on corporate bonds presently,” he added.

“The fund could be a helpful building block for investors who prefer straightforward exposure to the asset class, rather than a strategic, flexible or global bond manager that aims to move around the fixed interest spectrum more aggressively in search of outperformance. It’s also a compelling alternative to the narrower and generally more expensive products in the Sterling Corporate Bond sector; it is more diversified and overseas currency exposure is hedged back to sterling.”

Vanguard Global Credit Bond, which is managed by Vanguard’s global fixed income team, made a fourth-quartile total return in 2022 but was in the IA Global Corporate Bond sector’s top quartile in both 2019 and 2020. Over five years, the fund has made a third-quartile return.

Artemis Short Dated Global High Yield Bond

Andy Merricks, manager of the EF 8AM Focused fund, is more optimistic on the opportunities that could be presented high yield bonds following their hefty losses in 2022 – the Bloomberg Global High Yield index, for example, shed around 12% in US dollars.

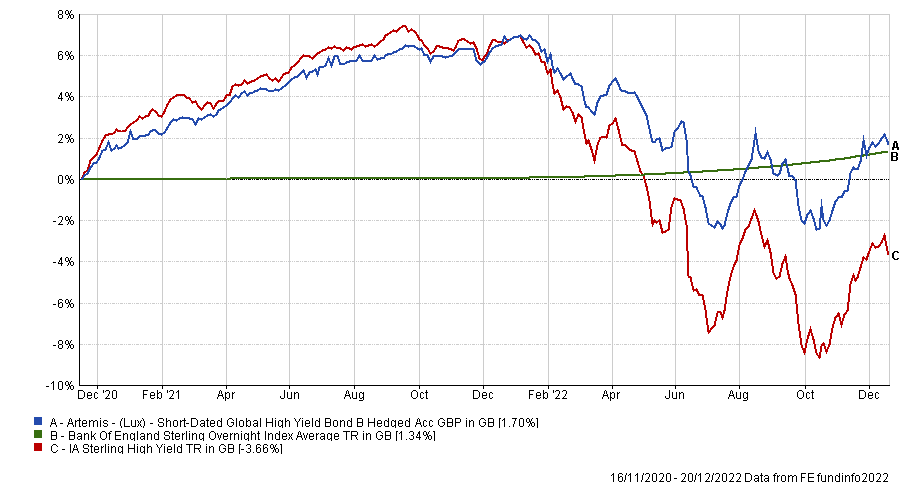

Performance of fund vs sector and index since launch

Source: FE Analytics. Total return in sterling over five years to 20 Dec 2022

“I remember excellent returns being achieved in 2009-10 from investing in high yield bond funds whose yields had mushroomed following the global financial crisis in 2008. The reason was a perceived increase in default rates that generally failed to materialise (default rates rose, but not to the extent that were projected) and yields fell significantly as markets realised that the fears had been overblown,” he said.

“Remember, a bond can do one of two things: default or not default. If the latter, it continues to pay its coupon. The fact that even an actively managed short dated bond fund such as this is yielding around 8% suggests to me that fear has perhaps outweighed reality and it looks like an attractive level to try to tap into.”

For exposure to this asset class, Merricks tipped the Artemis Short Dated Global High Yield Bond fund, which is managed by David Ennett, Stephen Baines and Jack Holmes. It is a relatively young fund, launching at the end of 2020, but has made a top-quartile return in 2022.

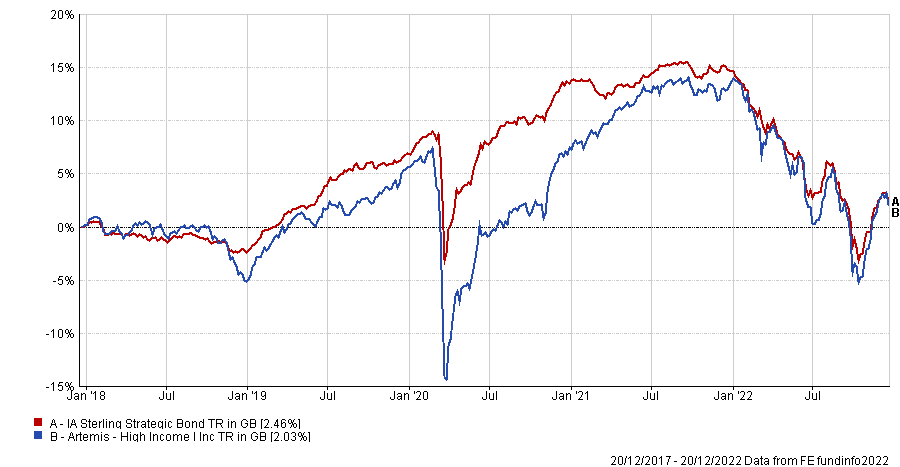

Artemis High Income

Finally, Merricks offered a fund that can hold stocks as well as bonds for investors to consider. Artemis High Income, which is managed by Ennett, Holmes and Ed Legget, resides in the IA Sterling Strategic Bond sector and, as such, can allocate up to 20% of its portfolio in equities (the current exposure is around 15%).

Performance of fund vs sector over 5yrs

Source: FE Analytics. Total return in sterling over five years to 20 Dec 2022

“It is not restricted to shorter duration high yield bonds as the fund above within its bond portfolio and so potentially offers a bit more scope for capital appreciation as well as an attractive income at this entry point,” the EF 8AM Focused manager said.

Artemis High Income has made a five-year return that is broadly in-line with its average peer but as the chart above suggests, it has performed very differently to the sector at time. It was in the second quartile in 2022 but was either at the top of its peers or the bottom before this – making top-quartile returns in 2017, 2019 and 2021 but bottom-quartile numbers in 2018 and 2020.

However, Merricks cautioned that investors need to be aware that today’s volatile markets mean his two Artemis picks could fall further before they recover – advice that applies to any of the investing ideas presented in this article.

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please note the above article was first published by Trust Net and should not be regarded as individual investment advice on whether to buy, sell or hold any of the funds mentioned. Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

At Ethical Offshore Investments, we can access the funds mentioned in this article on the various offshore investment platforms we offer. We do NOT CHARGE any additional entry and/or exit fees to purchase these funds for our clients.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investments costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards