2nd Year Anniversary – Sustainable Ethical Allocation portfolios

2 years in, so how have our Sustainable Ethical Allocation portfolios performed

It has been 2 years since we established the Sustainable Ethical Allocation Portfolios and it has been suggested that we compare the performance against that of other diversified, multi-manager multi-asset fund strategies over the past 2 years.

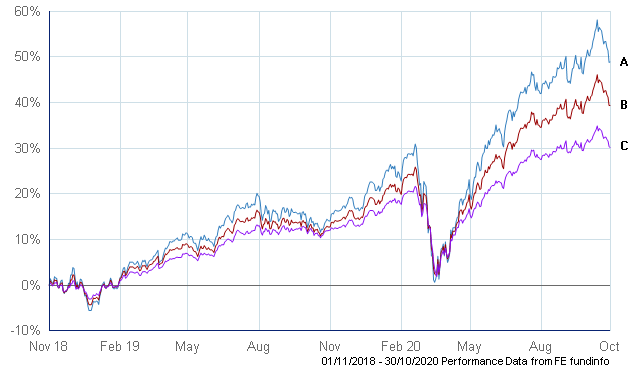

First off, below is the gross performance of the 3 Sustainable model portfolios since the portfolios were established 2 years ago.

- 48.6% – Growth Allocation

- 39.5% – Balanced Allocation

- 29.8% – Cautious Allocation

All 3 Sustainable portfolios have provided performance well above what was forecast with an annualised return of 13.9%pa (Cautious Allocation), 18.1%pa (Balanced Allocation) and 21.9%pa (Growth Allocation).

As has been published on the monthly performance updates, the gross performance has been at or above that of their benchmark over this 2 year period.

But how have they performed against other managed funds that take a diversified, multi-asset multi-manager approach..??

I have prepared this comparison against some of the more well known and reputable multi-manager funds that are frequently used for offshore investors. This includes:

- Canaccord Genuity Wealth Management (CGWM)

- Marlborough Fund Managers

- Tilney Fund Managers

- Momentum Harmony

- Guinness Brewin Dolphin Growth Allocation (the versions of these funds were established at the end of 2018)

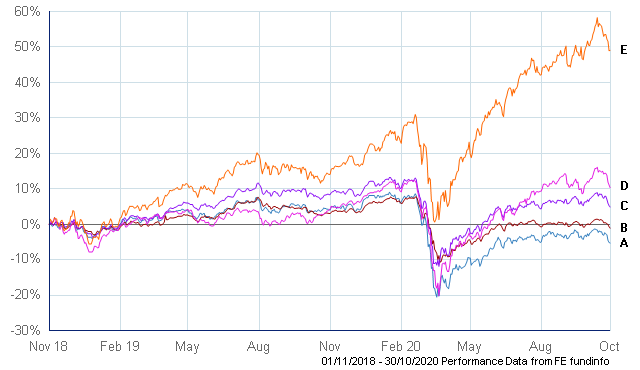

Growth Funds

This compares the Sustainable Ethical Growth Allocation with funds that have a similar growth style allocation. The funds below will generally have a bias towards equity assets which will generally be around 70% – 85% of the asset allocation.

- Momentum Harmony Growth

- Marlborough Growth

- Tilney Growth

- CGWM Affinity

- Sustainable Growth Allocation

Looking back at the month by month performance, the Sustainable Growth Allocation was the outperformer for 12 of the 24 months. The CGWM Affinity was the outperformer for 6 of the months with the Marlborough Growth the top performer for 3 of the months.

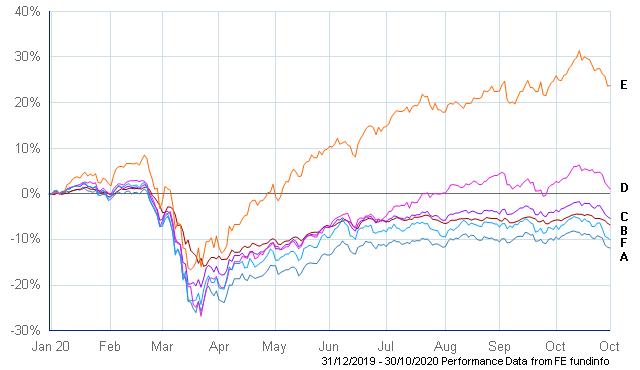

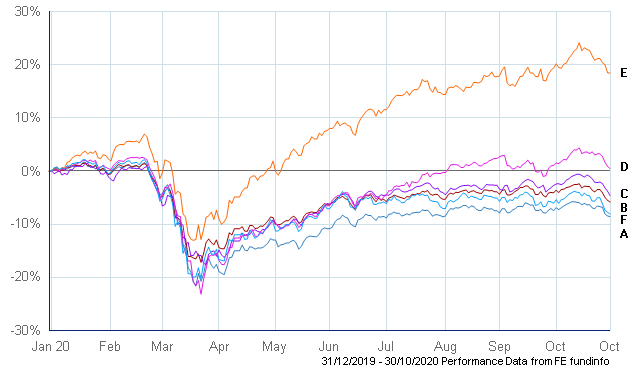

The following graph is 2020 Year to Date (which includes the Guinness Brewin Dolphin Growth Allocation)

- Momentum Harmony Growth

- Marlborough Growth

- Tilney Growth

- CGWM Affinity

- Sustainable Growth Allocation

- Guinness Brewin Dolphin Growth

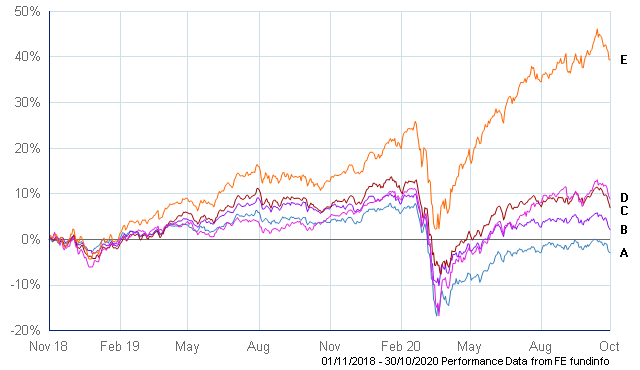

Balanced Funds

This compares the Sustainable Ethical Balanced Allocation with funds that have a similar diversified style allocation. The funds below will generally have a well diversified mix of assets with exposure to equity and growth style assets of between 45% – 65% of the portfolio allocation.

- Momentum Harmony Balanced

- Tilney Balanced

- Marlborough Balanced

- CGWM Diversity

- Sustainable Balanced Allocation

Looking back at the month by month performance, the Sustainable Balanced Allocation was the outperformer for 11 of the 24 months. The CGWM Diversity was the outperformer for 6 of the months with the Marlborough Balanced the top performer for 4 of the months.

The following graph is 2020 Year to Date (which includes the Guinness Brewin Dolphin Growth Allocation)

- Momentum Harmony Balanced

- Tilney Balanced

- Marlborough Balanced

- CGWM Diversity

- Sustainable Balanced Allocation

- Guinness Brewin Dolphin Balanced

It is very pleasing to see that the quality of the underlying managers of the Sustainable Ethical Allocation portfolios, and their subsequent strategy of investing in quality, sustainable businesses, has resulted in very strong performance over the past 2 years.

It is also obviously very pleasing to see how this performance has compared to that of other multi-manager multi-asset diversified funds over this time period. Even more so pleasing as we do hold these other fund managers in high regard.

Whether this outperformance will continue is unknown, but I would like to think that the strategy of investing in a diversified portfolio of highly rated, quality Fund Managers that in turn invest in high quality businesses, will result in superior performance over the medium to longer term…….

For additional information on the Sustainable Ethical Allocation portfolios, please click on the following link ethicaloffshoreinvestments.com/services/#portfolio-management or alternatively click on the request information button below.