Our ethical management approach ensures lower fees… resulting in more performance staying in your pocket.

Can you hold the same investments but with lower costs?

Can you hold the same investments, but with lower costs?

- The answer to this question in many situations is yes….

- Lower Charges = More of the investment return staying in your pocket

Most of the managed / mutual funds that are available have multiple ‘share’ classes of the same fund strategy, designed for the specific end clients (general retail client via an adviser, investment banks, other fund management groups, charities).

All Managed Funds are subject to a management charge which is generally deducted from the funds unit price and in turn, comes from the gross performance of the underlying fund. The difference in the annual management fee charged by the Fund Manager for the various share classes can be significant and in some cases, well over a 1%pa difference.

In general, a normal retail investor would be invested in a retail or standard share class of the fund which in most cases would be the most expensive. From the annual management fee, the Fund Manager would then pay an amount to maybe a platform provider and/or to a financial adviser as a Trail Commission.

As different funds will have a various % rate of incentive / trail commission being paid out, our personal view is that could potentially result in advisers only recommending or allocating to funds where they receive a higher commissions and as such, maybe the client is not being provided the best advice and not being allocated towards the better performing or more appropriate funds or ETF’s

However, most regulated Fund Managers now offer commission free share classes (commonly known as Clean Class or Institutional Class). As the Fund Manager is not paying commission incentives to advisers, banks, platforms etc from this version of the funds, this results in a lower Management Charge being deducted from the gross fund performance. As less charges are being deducted, this results in a greater net return….. resulting in more of the investment growth being retained by the investor.

I have provided examples of 3 different funds and how investors can benefit from the lower charging versions of the funds. Please note at Ethical Offshore Investments, we will always allocate to the lowest charging version of the fund that is available on that particular platform.

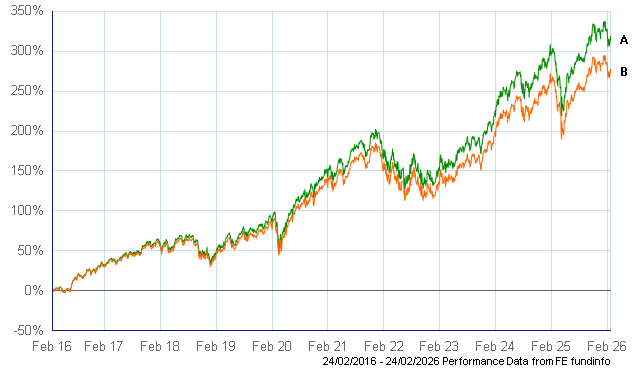

The first example of this benefit is with the Guinness Global Innovators Fund, which is a popular fund held in many offshore portfolios and is a recommended long term holding equity fund by Ethical Offshore.

For this example, we are comparing the C Class version of the fund (which seems to be the version more widely held for offshore portfolios and savings plans) against the Y Class version. The C Class has a current Annual Management Charge (AMC) of 1.83%pa…. compare that to the Y Class version of the same fund strategy that we use at Ethical Offshore with an AMC of just 0.79%pa

- A. Guinness AM Global Innovators Y Class – (10 year net performance 314.0%)

- B. Guinness AM Global Innovators C Class – (10 year net performance 273.4%)

An investment of £ 10,000 into each of the versions of the fund, over the same 10 year period, experiencing the same gross investment returns and volatility, but by investing in the Y Class, our investors would have an extra £ 4,060 of value. That is an extra 40.6% (or 1.2%pa) of return on the initial investment.

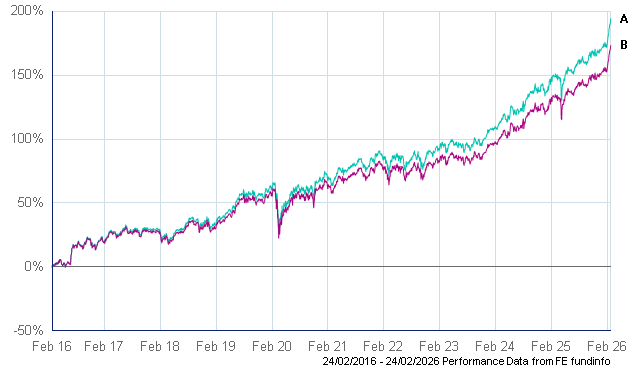

For this example, we are using the UK listed First Sentier Global Listed Infrastructure strategy.

The A Class version of this fund has a current AMC of 1.61%pa………… compared to the B Class that we would access which has a current AMC of 0.80%pa.

- A. First Sentier Global Listed Infrastructure B Class – (10 year net performance 144.8%)

- B. First Sentier Global Listed Infrastructure A Class – (10 year net performance 126.5%)

So once again, an investment of £ 10,000 into each of the versions of the fund, over the same 10 year period, experiencing the same gross investment returns and volatility, but by investing in the B Class, our investors would have an extra £ 1,830 of value. So an extra 18.3% (or 0.92%pa) of return on the initial investment.

Finally our last example, is comparing the Fidelity Global Dividend fund. Fidelity is a very well known global Fund Management group and their funds are regularly found in offshore portfolios and regular savings plans.

We have compared the performance difference of the W Class which has a current AMC of 0.75%pa and is the version of the fund that we would use for clients of Ethical Offshore, and the A Class which has a current AMC of 1.66%pa.

- A. Fidelity Global Dividend W Class (10 year net performance 194.1%)

- B. Fidelity Global Dividend A Class (10 year performance 173.1%)

Once again, the same £ 10,000 amount invested into each of the 2 versions of the fund, over the same period, investors in the W Class would have generated an additional £ 2,100 of value (an additional 21.0% (or 0.80%pa) of return on the initial investment).

This extra growth from the cost savings could be the difference from being able to retire….. to being able to retire comfortably.

WHY ARE WE DIFFERENT?

We are not driven towards ‘commission paying’ funds, as our revenue is generated from the charging of a transparent client management fee. This ensures that we are providing guidance on Fund Managers and investment strategies for our individual clients, based on the actual needs and financial objectives of these individual clients.

We are therefore not influenced by financial incentives from fund groups and as such, we can provide our guidance based solely on fund manager merit, quality and the projection to meet & exceed the investment requirements and objectives of our individual clients.

However, we have an incentive of generating superior returns as the greater return we generate for our clients, we also benefit. So if we can identify a way to reduce clients costs, it not only benefits the clients by them keeping more of the funds performance in their pockets…… it also benefits us.

And that is why we will always use the lowest charging structure version of the fund available with the various Life Companies and Direct Platforms.

If you would like to see if there are lower cost versions of the managed funds that you are holding (Same Investments but with Lower Costs), press Compare Fund Management Costs.

Example of the Fund Managers we use:

Royal London

fundsmith

Lindsell Train

Baillie Gifford

Polar-Capital

Liontrust

Evenlode

Guinness Asset Management

Federated Hermes

AXA Framlington

Schroders

JP Morgan

IShares by BlackRock

BlackRock

Fidelity International

Franklin Templeton Investments

Ninety One

Morgan Stanley

Canaccord Genuity