2021 – year in review for the Sustainable Ethical Allocation Portfolios

2021 was another year impacted by Covid19…… we look back at how the Sustainable Ethical Allocation Portfolios performed during another 12 months of uncertainty.

We have made it through 2021, and with the hope that we had left the curse of Covid19 back in 2020, we were bitterly disappointed that this was not the case…..

In my opinion, 2021 was an even more volatile year of uncertainty for financial markets.

Of course, 2020 had the significant market falls in February & March but when you look back at it, the recovery from these lows, especially with the sustainable type entities that we have a bias towards to, was relatively linear.

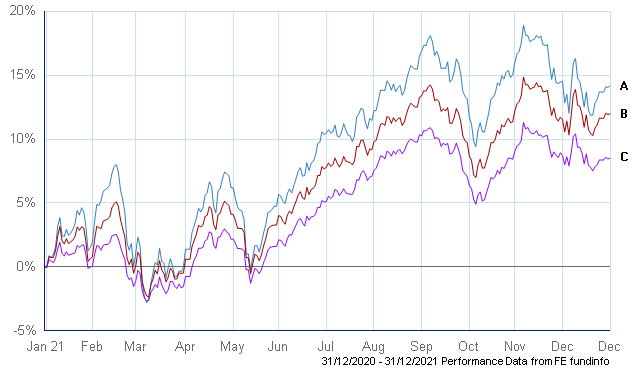

Looking at the performance of the portfolios in 2021, we experienced much greater levels of volatility with the portfolios dipping into negative year to date performance 3 times by mid May. Performance picked up significantly in the third quarter…. only to once again experience more volatility through the fear of rising inflation and the forecast for rising interest rates.

Portfolios recovered again to hit their all time high levels at the start of November….. only to slightly pullback on once again the fear of rising interest rates, inflation and the risk of supply chain shortages.

While we are disappointed with the end of year performance, the portfolios still provided positive returns.

- A – Sustainable Ethical GROWTH Allocation – 13.7%

- B – Sustainable Ethical BALANCED Allocation – 12.2%

- C – Sustainable Ethical CAUTIOUS Allocation – 8.6%

So how did the underlying funds perform….

Unlike 2020 where every fund held in the portfolios provided a positive return, this year we did have some funds that ended the year in negative territory.

Investments in Bonds and Fixed Interest assets were generally down across the board, as the increase in interest rates is actually a negative to existing bond assets. Our strategic ethical type bonds and fixed interest funds ended around 0.5% down for the 2021 year.

We had 2 equity funds, 1 being an Emerging Market equity fund (held in the Balanced and Growth portfolios) and the other a specialist, early stage global small company (held in the Growth portfolio) that suffered losses for the year, at -7.6% and -20.6% respectively. The remaining equity funds in the Sustainable Ethical Allocation Portfolios did end the year positively….. but there was a wide margin between the best performing equity fund (+32.7% – European allocation specialist fund held across all 3 portfolios) and the worst performing equity fund (+8.8% – UK equity allocation fund held in the Growth portfolio only).

With our portfolio updates, we regularly comment about the Baillie Gifford Positive Change fund and the Royal London Sustainable World Trust which are both held in all 3 portfolios. So how did they perform in 2021..??

- A – Royal London Sustainable World Trust – 17.7%

- B – Baillie Gifford Positive Change – 10.8%

The Baillie Gifford Positive Change, as can be seen on the above chart, has been quite volatile over the past 12 months. This should be expected due to the concentrated portfolio (25 – 50 stocks) with holdings towards Healthcare, Biotechnology and Technology companies…..

While it is disappointing to see the downward movement since September, the fund still ended the year + 10.8% and the fund has still provided an average annualised return of over 30%pa over the past 3 years.

The Royal London Sustainable World Trust has a much more diversified holding approach and a such, was a lot less volatile over the past 12 months.

Both funds are still very highly rated and while we expect that there will continue to be volatility and periods of negative returns, especially in the Baillie Gifford fund due to its investment style, we are continuing to maintain our holdings in these funds across all 3 of the Sustainable Ethical Allocation portfolios.

As part of our ongoing reviews and monitoring of the Sustainable Ethical Allocation Portfolios, we also keep an eye on other multi-manager, multi-asset funds to see how they are performing throughout the year, and will compare their month-to-month performance against that of our Sustainable portfolios.

Our goal is to be a consistent top quartile performer amongst our peers through the use of high-quality individual fund managers and investing in higher quality, sustainable business entities.

So how did we perform….??

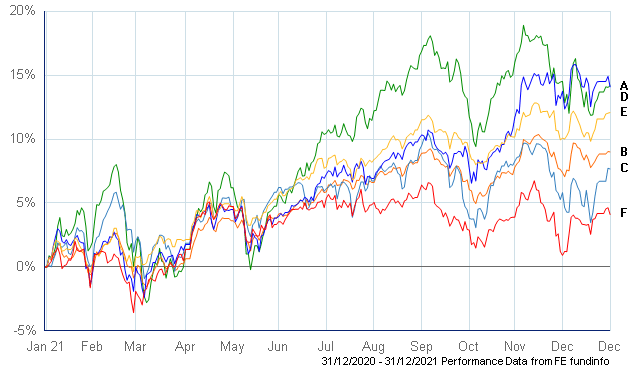

Growth type strategies

- A – Sustainable Ethical GROWTH Allocation

- B – Tilney Growth

- C – Canaccord (CGWM) Opportunity

- D – Guinness Brewin Dolphin Growth

- E – Momentum Harmony Growth

- F – VAM Growth

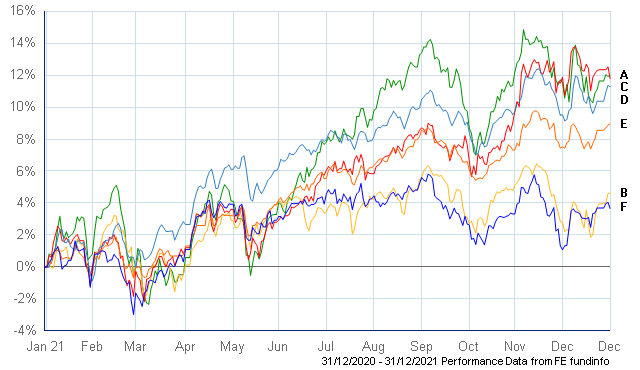

Balanced type strategies

- A – Sustainable Ethical BALANCED Allocation

- B – Canaccord (CGWM) Diversity

- C – Guinness Brewin Dolphin Balanced

- D – Marlborough Balanced

- E – Momentum Harmony Balanced

- F – VAM Balanced

I am pleased to state that once again, the Sustainable Ethical Allocation Portfolios has held up very well compared to other multi-manager, multi-asset fund strategies. Even with the pullback in the sustainable areas that we have a bias towards to (Education, Healthcare, Technology, Sustainable & Renewable Energy) we just pipped the very highly rated Guinness Brewin Dolphin strategies for the year.

Strategy Going Forward

We continue to believe that investing in a diversified range of quality companies that exhibit strong internal management, successful (& sustainable) business models that are not only profitable, but are also contributing to the improvement of the environment and people’s well-being.

We will continue to do this by utilising highly rated Fund Management firms through a range of different managed funds and Investment Trusts, with the various Fund Managers using different investment strategies in achieving their long-term investment objectives.

By using a diversified portfolio with Fund Managers and their different investment styles, the different investment styles will compliment each other which has the potential to provide a more consistent overall portfolio return.

An additional point we would like to make is that of the portfolio charges. All managed funds will have a management fee, but at Ethical Offshore Investments, we will utilise the lowest cost version of the fund that is available on the various platforms / Life Companies. With the current fund allocations, the current combined fund manager Annual Management Charge (AMC) is:

- 0.62%p.a. Cautious Allocation

- 0.68%p.a. Balanced Allocation

- 0.74%p.a. Growth Allocation

If you are a client holding a portfolio that you would like to compare against the Sustainable Ethical Allocation model portfolios, please use the More Information button at the bottom of this page. We will provide a full comparison report which will include:

- Performance comparison (short, medium & longer term)

- Consistency of performance against peers

- Fund manager ratings

- Asset allocation comparison

- Level of diversification

- Ongoing charges

All of the funds that we propose for our clients must be strictly regulated, transparent with their investment holdings and/or investment strategy, liquid and preferably trade on a daily basis. As per above, we will utilise the lowest charging version of that fund that is available on the relevant platform / Life Company.

Whether it is investing via one the Sustainable Ethical Allocation portfolios or through a personalised bespoke portfolio, we will make sure that we only access regulated, and highly rated investment structures for our clients.

Sustainable Investing Strategies – Ethical Business Standards

If you would like to learn more about the portfolios or the underlying investments, please contact us using the more information button and we will respond to your queries.