Sustainable Allocation Portfolios August Update

Portfolio Update for August 2020

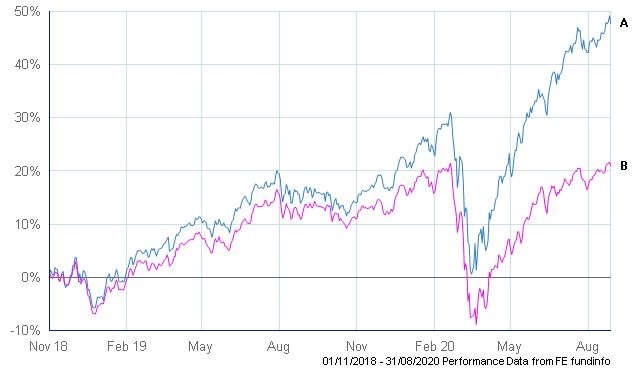

Positive momentum continues to power the performance growth of the Sustainable Ethical Allocation Portfolios

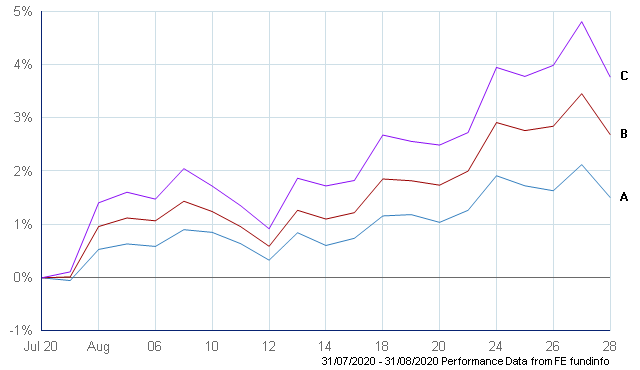

Our Sustainable Ethical Allocation Portfolios maintained their positive momentum, resulting in net gains of 3.8% (Growth Allocation), 2.7% (Balanced Allocation) and 1.5% (Cautious Allocation) for the month of August.

Performance August 2020

A. Cautious Allocation

B. Balanced Allocation

C. Growth Allocation

The equity fund holdings within the Portfolios were predominately higher in August, with our allocation to the Baillie Gifford Positive Change providing a return of 5.6% and the diversified Royal London Sustainable World Trust returning 2.8% for the month (both funds held across all 3 portfolio allocations).

The Rathbones Global Sustainable fund (held in the Balanced and Growth allocation portfolios) also provided a solid 5.6% return for the month of August.

The cautious bond assets in the portfolios were generally flat or slightly negative over this recent period.

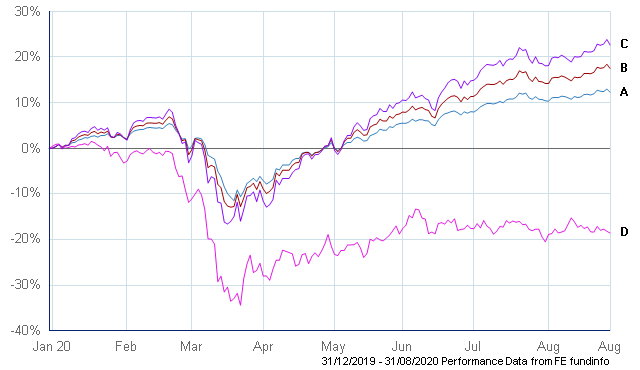

2020 Performance So Far….

While we did see high levels of volatility and significant losses with markets in March, all 3 of the Sustainable Ethical Allocation Portfolios have recovered very well and investors have experienced positive returns for 2020 Year to Date.

21% – Growth Allocation, 16% – Balanced Allocation and 13% – Cautious Allocation. This compares to the FTSE All Share index that is still struggling with a loss of 19% so far in 2020.

A. Cautious Allocation

B. Balanced Allocation

C. Growth Allocation

D. FTSE All Share Index

Strategy Going Forward….

While we are enjoying good solid positive returns with many of our equity funds, we are very mindful that our portfolios need to remain well diversified and that they do not get significantly ‘overweight’ to a specific asset class or sector.

I still hold a very positive medium to longer term view on the funds held in the portfolios and while we should expect to see some short term volatility (which will include periods of negative returns), I do believe that the funds held will result in superior medium to longer term positive returns.

With our rebalancing of the portfolios, we will be adding a new fund manager, Liontrust Fund Partners, to the model portfolios going forward. We feel that the sustainable investment objectives and management style of Liontrust will complement that of the other fund managers held in the Sustainable Ethical Allocation portfolios, potentially providing further upside potential while providing additional diversification.

As part of our ongoing client management, we stress the importance of ensuring that investors maintain sufficient cash (or very low risk, liquid assets) that can be called upon to cover their short-term income and / or capital purchase requirements. I strongly believe that this is even more imperative now due to the extremely uncertain and unprecedented economic and market conditions we are experiencing.

https://ethicaloffshoreinvestments.com/news/the-importance-of-investment-timeframe/

The other area that we encourage investors to look at is that of diversification…….. the Sustainable Allocation Portfolios are well diversified with not only asset type (equities, bonds, cash) but ensuring that there is also diversification of geographical region.

The underlying Fund Managers (Baillie Gifford, Royal London, Rathbones, Vanguard for example) will also take a different approach and style to their investment strategies and by blending these different managers and investments styles & strategies, potentially will result in lower volatility and more consistent overall portfolio returns.

Investors can also further diversify their portfolios through the use of Structured Notes. While Structured Notes are not our core investment offerings (we prefer the use of liquid, daily traded funds, ETF’s and direct shares), they can provide an opportunity to reduce short term volatility while receiving a pre-determined (conditional) investment return. But it must be stressed that Structured Notes are generally regarded as longer term investments so timeframe and whether access to capital is required needs to be seriously considered.

Please click the below link to get information on the range of Structured Notes currently available via Ethical Offshore Investments. https://ethicaloffshoreinvestments.com/structured-notes/

If you would like to receive further information on the Sustainable Ethical Allocation Portfolios or on the underlying individual Managed Funds, please click REQUEST INFORMATION.

So how have the Sustainable Model Portfolios held up in 2020…..

Sustainable Ethical Allocation Portfolios

The Sustainable Allocation portfolios are currently invested in 10 – 12 different managed funds, utlising the expertise of the following Fund Managers.

![]()

![]()

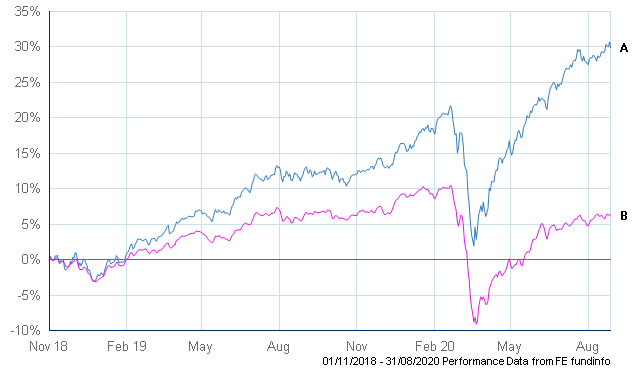

Cautious Allocation

The SUSTAINABLE ETHICAL CAUTIOUS ALLOCATION PORTFOLIO will generally have approx. 65% of the assets invested in various bond, fixed interest and cash type assets that are regarded as lower risk type assets. The remaining will be allocated in growth style of equities and infrastructure type assets.

The objective of this allocation is to achieve a net return of 5%-6%PA but with lower levels of short term volatility.

- A. Sustainable Ethical Cautious Allocation

- B. IA Mixed Investment 20-60% Share Index

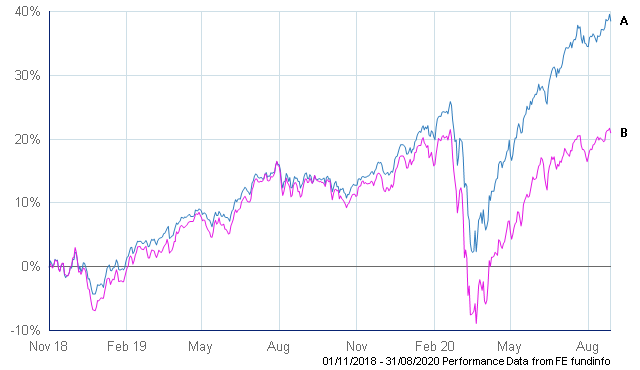

Balanced Allocation

The SUSTAINABLE ETHICAL BALANCED ALLOCATION PORTFOLIO will have approx. 65% of the allocation invested in growth type assets such as equities and infrastructure with the remaining allocated to more cautious type assets such bonds, fixed interest and cash type assets.

The objective of this portfolio is to achieve similar type returns associated with direct equity investing, while experiencing lower levels of short term volatility, especially during negative market periods.

- A. Sustainable Ethical Balanced Allocation

- B. IA Global Index

Growth Allocation

The SUSTAINABLE ETHICAL GROWTH ALLOCATION PORTFOLIO will invest in a range of equity and growth style funds and is designed for the longer term investor that can accept higher levels of short term volatility.

The objective of this allocation is to achieve a net annual return of 10% – 12%pa but clients need to be aware and accept that there will be higher levels of short term volatility and periods of negative returns.

- A. Sustainable Ethical Growth Allocation

- B. IA Global Index