July 2021 Update – Sustainable Ethical Allocation Portfolios

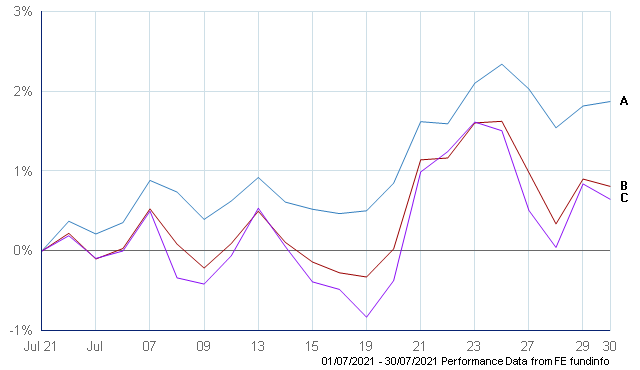

The Sustainable Ethical Allocation Portfolios continue their positive momentum for the month of July.

An unusual month of performance for the Sustainable Ethical Allocation Portfolios where it was the Cautious Allocation (with only approx. 35% allocated to growth type assets) ended the month as the better performing portfolio.

The Cautious Allocation achieved a return of +1.9% for the month, Balanced Allocation +0.9% and the Growth Allocation +0.7%

- A – Sustainable Ethical CAUTIOUS Allocation

- B – Sustainable Ethical BALANCED Allocation

- C – Sustainable Ethical GROWTH Allocation

The fixed interest / bond exposure of the portfolio was positive for the month with returns in the range of 1% – 2%, outperforming some of the growth & equity funds.

The Cautious Allocation Portfolio also benefitted from its minimal exposure to Chinese and Asian markets in general, which was the subject of a significant market sell off late in the month.

The Balanced Allocation Portfolio does have exposure to the Asian and Emerging Market region with the Growth Allocation Portfolio having an increased exposure. The sell-off in the Chinese market had a negative impact on the portfolios Asian and Emerging Market holdings. This cost the portfolios 0.9% (Balanced) and 1.29% (Growth) of performance for the month.

What this does also show is the importance of ensuring that your portfolio is well diversified of not only asset type, but also industry sector and geographical region. While the Asian region showed significant losses for the month (Hong Kong was down circa 15%), the Balanced & Growth portfolios still ended the month on a positive note.

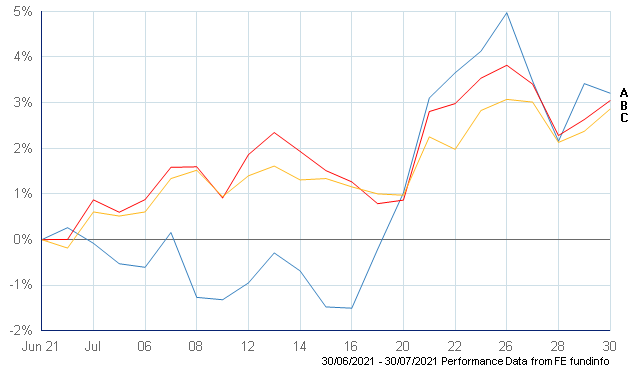

So what drove the portfolios this month…

It was once again our long term favourite Baillie Gifford Positive Change, along with the Rathbone Global Sustainability and Royal London Sustainable World Trust that were the main drivers of the monthly performance with a monthly return of all around 3%.

- A – Baillie Gifford Positive Change

- B – Rathbone Global Sustainability

- C – Royal London Sustainable World Trust

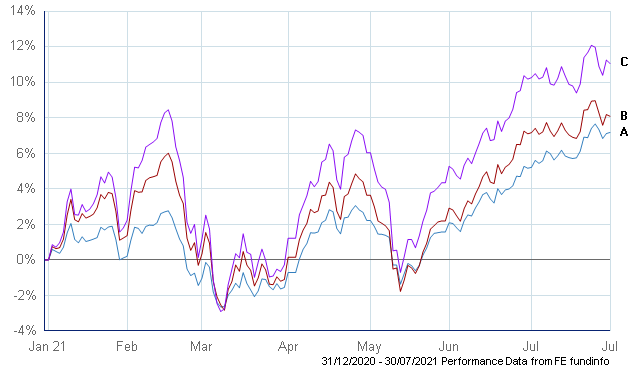

Year to date performance…

It has been a rollercoaster ride for investors in the various Sustainable Ethical Allocation Portfolios, with the ESG (Environmental & Social Governance) & SRI (Socially Responsible Investing) styles of investing seeing both positive & negative momentum sentiment so far this year.

However, we are pleased to declare that all 3 portfolios are well in positive territory so far for 2021.

- A – Sustainable Ethical CAUTIOUS Allocation

- B – Sustainable Ethical BALANCED Allocation

- C – Sustainable Ethical GROWTH Allocation

Changes to the Portfolios

We continue to review the underlying funds held in the various Sustainable Allocation portfolios, and as we are not affiliated with any of the fund management groups, we are free to make any allocation changes that we feel is necessary to improve performance.

At this stage, we are comfortable with the current range of funds held in the portfolios, so we will be maintaining the current fund allocation.

Structured Note Investments

Investors can also further diversify their portfolios through the use of Structured Notes. While Structured Notes are not our core investment offerings (we prefer the use of liquid, daily traded funds, ETF’s and direct shares), they can provide an opportunity to reduce short term volatility while receiving a pre-determined (conditional) investment return.

With interest rates at historical lows, downward pressure on dividends and equity market uncertainty ahead, investors are becoming increasingly attracted to the benefits of structured products.

But it must be stressed that Structured Notes are generally regarded as longer term investments so timeframe and whether access to capital is required needs to be seriously considered.

Please click the below link to get information on the range of Structured Notes currently available via Ethical Offshore Investments.

https://ethicaloffshoreinvestments.com/structured-notes

If you would like to receive further information on the Sustainable Ethical Allocation Portfolios or on the underlying individual Managed Funds, please click REQUEST MORE INFORMATION.