Trade the Tape – Have Jobs Slowed Enough for the Fed to Pause?

Please find below the latest update from Adrian Tout from his regular newsletter, “Trade the Tape”.

Please note that this is for general information only and should not be considered personal financial advice.

The purpose of publishing these newsletters on the Ethical Offshore website is to provide investors some simple, easy to understand technical details on why the US markets are behaving the way they are at the moment, what has occurred to get them where they are, and what actions may influence where they end up in the near future.

The way Adrian Tout explains all this, in simple terms, I believe is good reading for any investor to get a better understanding of what is happening within the financial markets, what risks to be aware of and how to take advantage of these market conditions for your medium to longer term investment journey.

September 2, 2023 – Adrian Tout

Have Jobs Slowed Enough for the Fed to Pause?

-

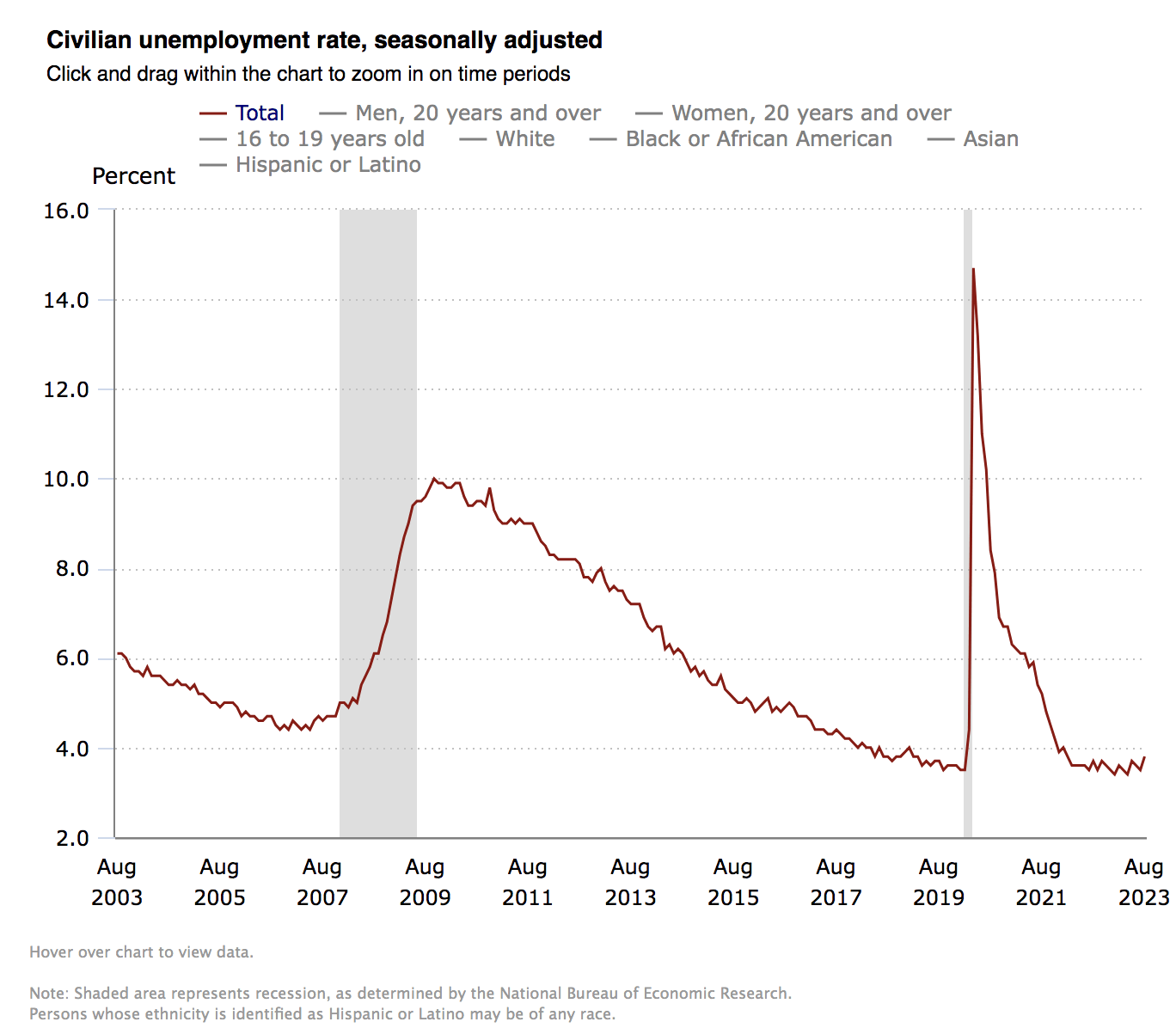

Unemployment rate moves up to 3.8%

-

Job picture is slowing – but enough for the Ted to pause..??

-

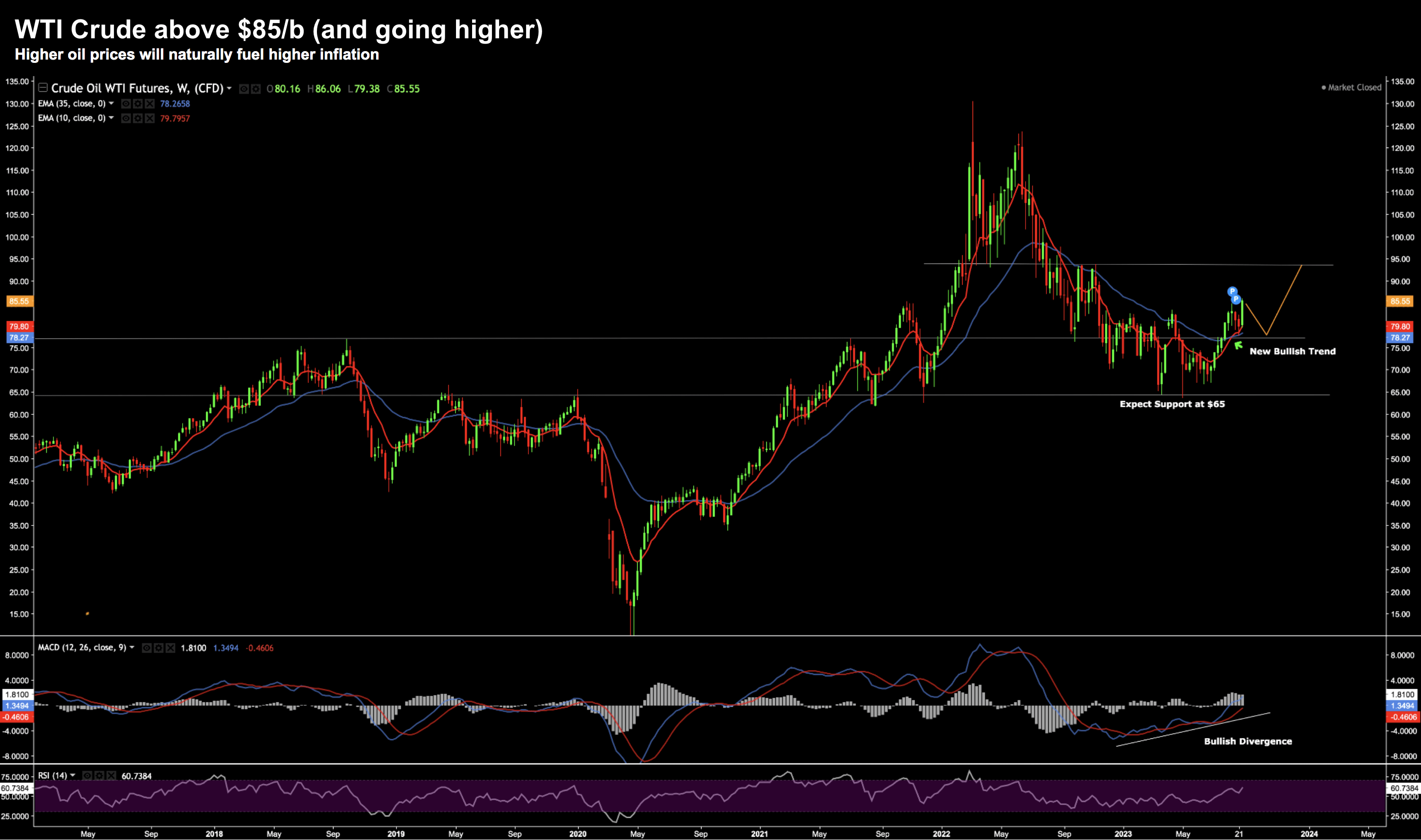

Oil prices above $85/b – how does that bring down inflation..??

Another August is now in the Trader’s Almanac.

Its reputation as a negative month lived up to its name – with the market giving back ground.

That said, we’re not too far off the highs, with the S&P 500 only retracing around 1%

September however boasts the worst record of all the calendar months – so don’t be surprised to see volatility pick up.

Last week offered plenty of macro data for traders (and the Fed) to consider.

For example:

-

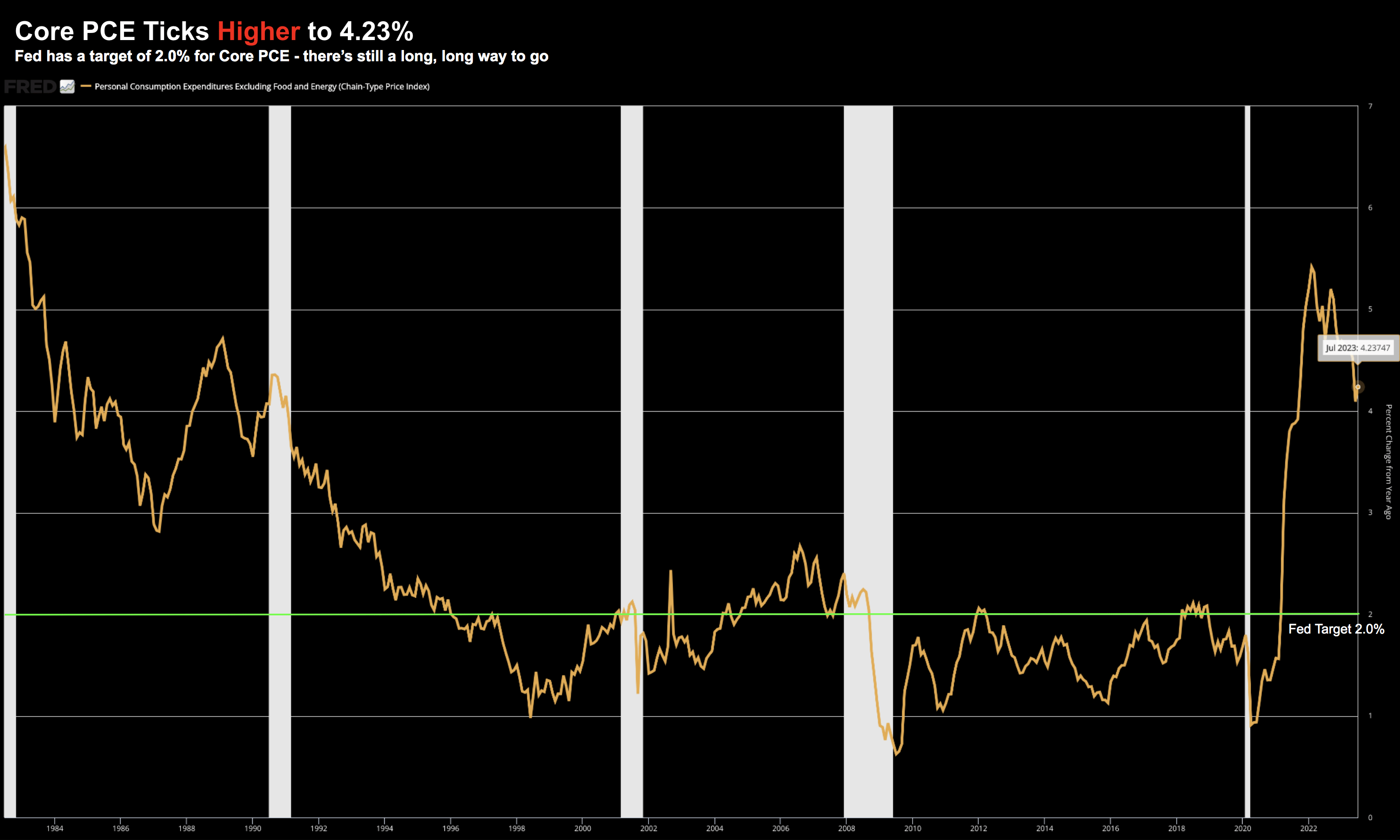

Core PCE at 4.2% YoY – higher than June’s 4.1%

-

ADP private sector payrolls report shows gains of 177K – much less than expected

-

The BLS monthly payrolls (for all jobs) showed gains of 187K – also less than expected (where previous months were also revised lower)

-

The total unemployment rate ticked higher to 3.8% (up from 3.5%)

With the unemployment rate at 3.8% (mostly due to higher participation in the work force) – this has some believing the Fed is done.

But can we make that call?

I don’t think so… not yet

Fed Still Has Grounds to Raise

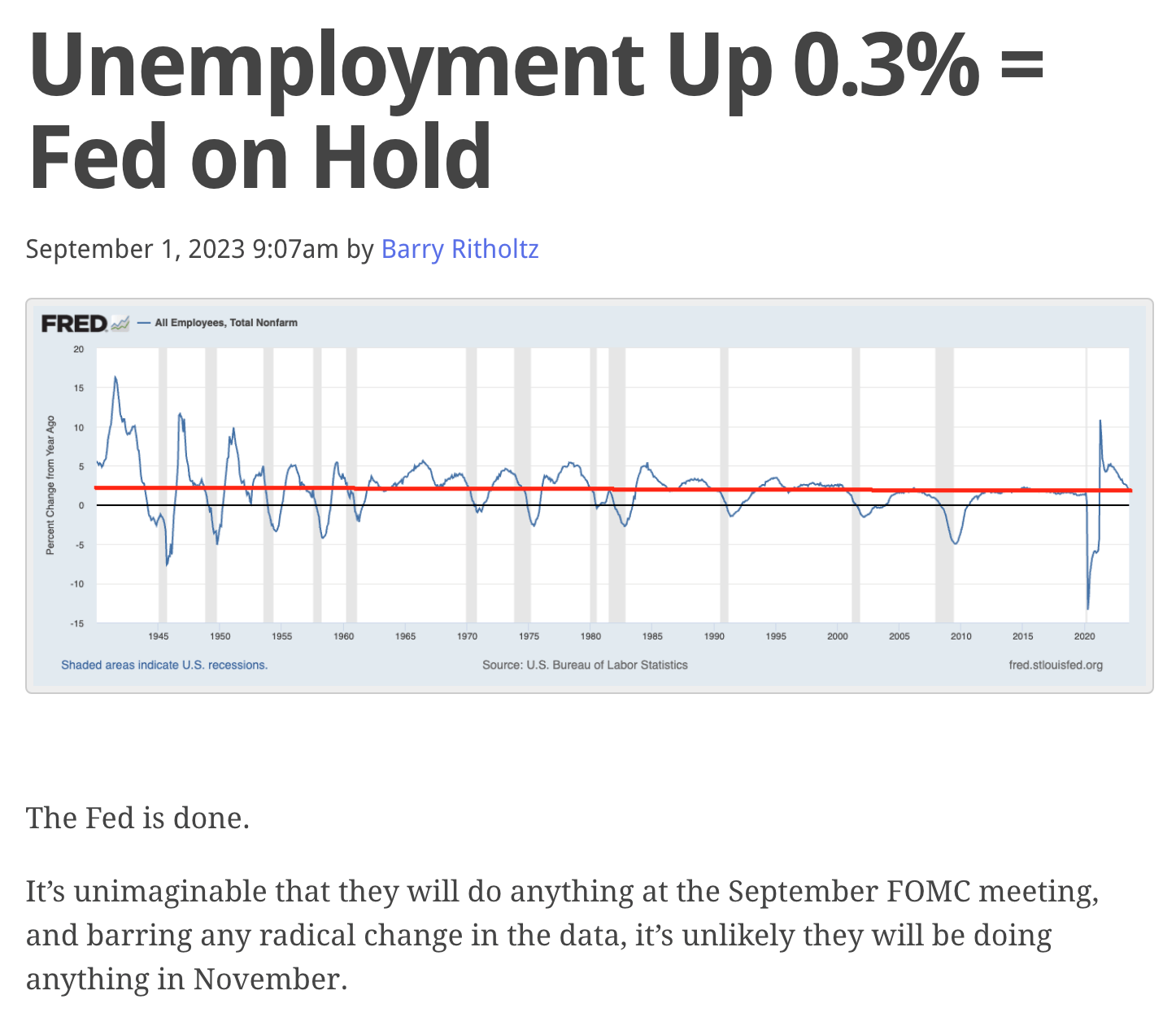

Popular opinion on Wall Street is the Fed is now finished raising rates.

For them, the labor report this week sealed the deal.

Take widely followed blogger Barry Ritholz…

It’s “unimaginable” the Fed will raise rates says Barry…

Really? Why?

Below I will offer a few reasons why I think it’s more than imaginable.

But it requires a bit of grey matter being put to use…

To start…

A total unemployment rate of 3.8% is essentially full employment.

And whilst it’s up from last month’s 3.5% – it’s still exceptionally strong (which can be inflationary).

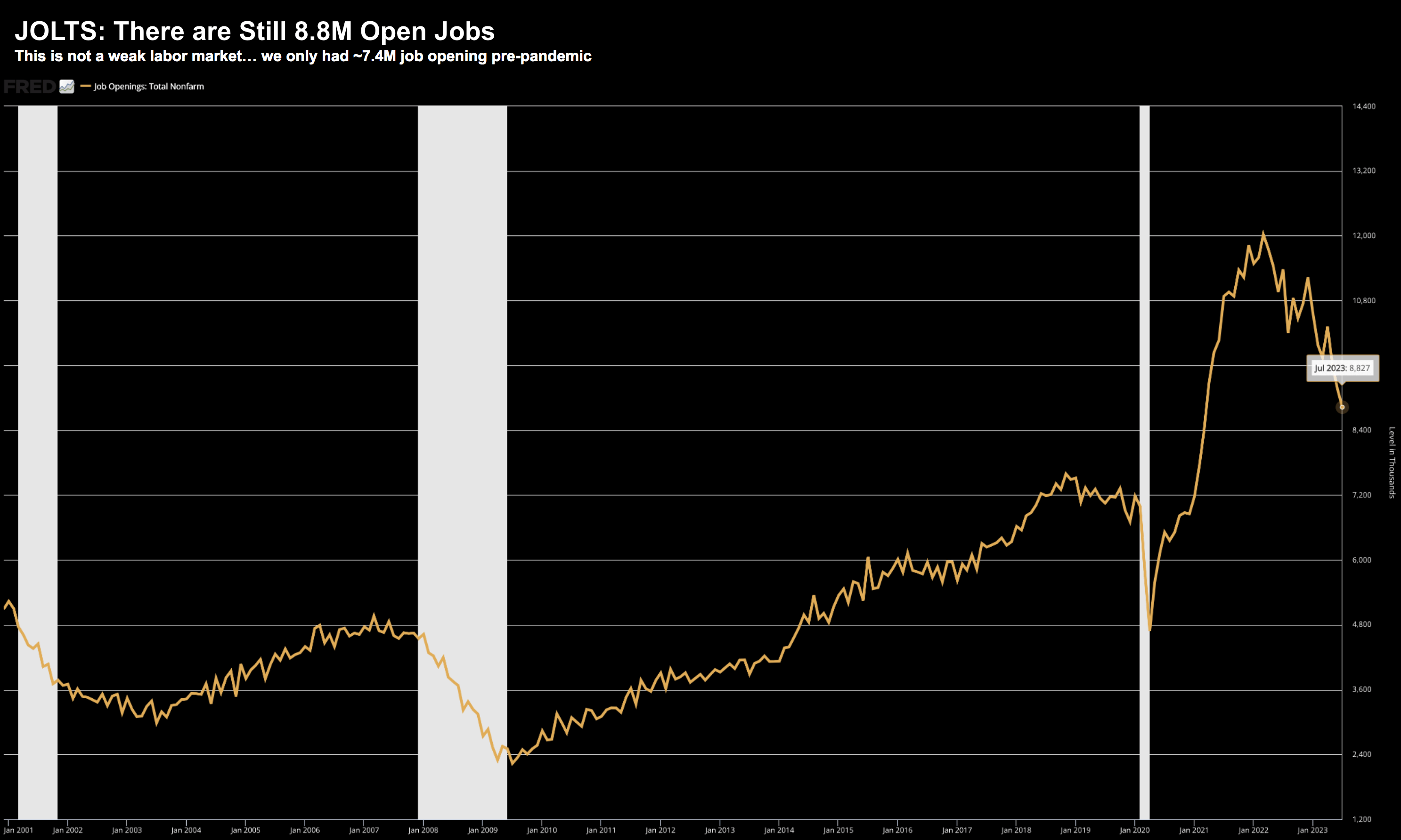

Second – consider JOLTS (Job Openings and Labor Turnover)

The popular narrative is because this dropped to ~8.8M openings from a high of 12M a year ago – the job market has gone “cold”

But is it?

Below is the 20 year trend:

Sept 2 2023

Prior to the pandemic JOLTS were just above 7M.

And that was considered very strong.

We are still above that level but off the post-pandemic high (which is to be expected).

But this is not a weak labor market – not with over 8.8M unfilled job openings.

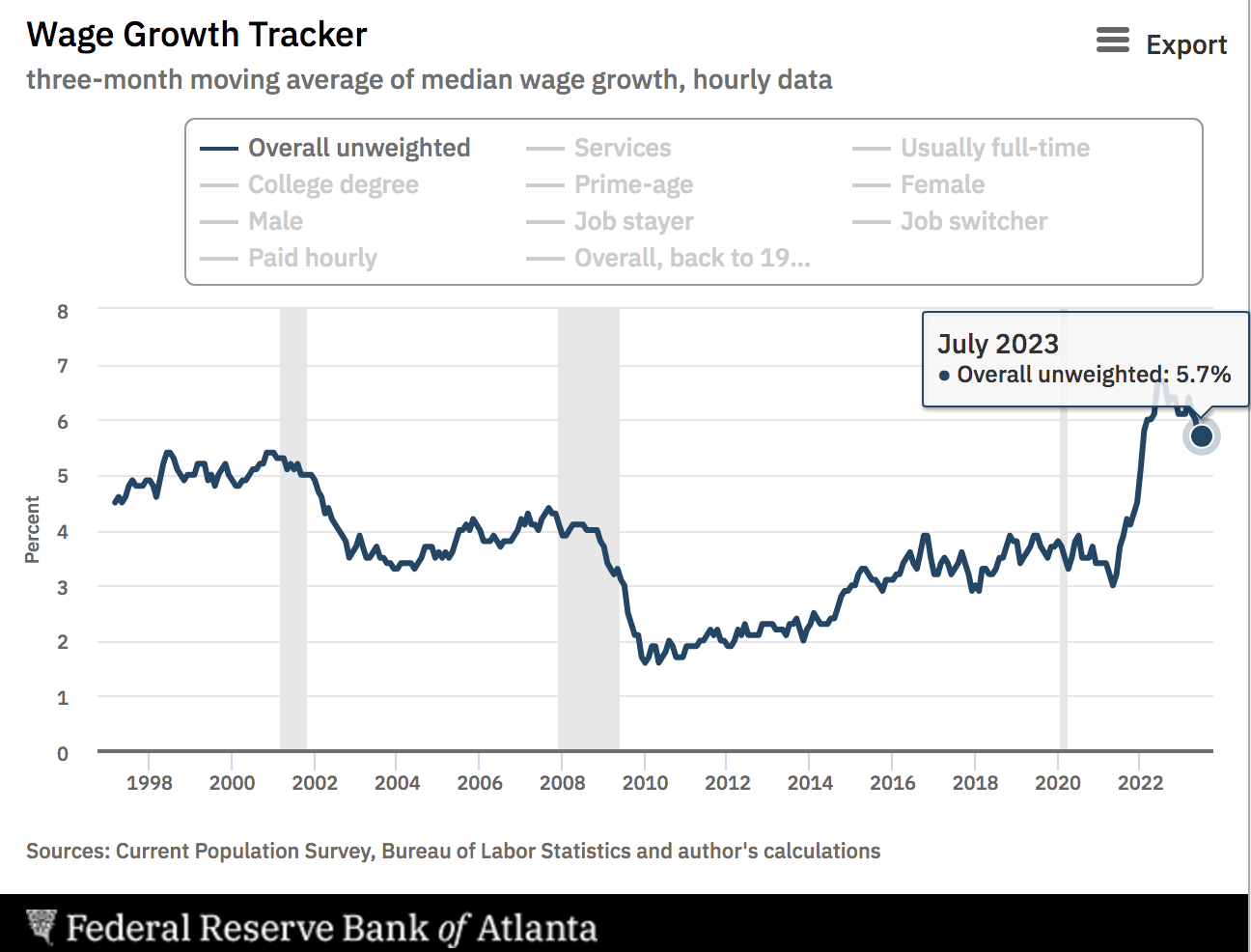

Finally, consider wage growth.

Based on the Atlanta’s Feds wage growth tracker, the three-month moving average of median wage growth is still above 5%

The good news is it’s below the 6.7% average pace of one year ago…

So yes – wages are gradually coming down.

But similar to what we find with JOLTS – wage growth is still historically very high.

Powell has said he would like to see this at levels closer to 3.0%

If I put these three things together:

- Total unemployment at 3.8% (anything below 4.0% is considered full employment)

- JOLTS at 8.8M (still well above the pre-pandemic peak); and

- Wage growth above 5.0% (three month average)

What (if anything) suggests these are where the Fed needs them to be?

Sure, these trends might continue but at what velocity?

Core PCE Ticks Higher

For now let’s assume folks like (not limited to) “Barry Ritholz” are correct with their thesis that employment has cooled enough for the Fed to quit hiking rates.

And that might be right…

However, we still have a situation where the Core PCE rate sits at 4.2% – higher than last month’s print

Sept 2 2023

From mine, this is problematic.

Prior to the Core PCE print this week – my guess was this was still likely to come in with a 4-handle – more than enough to cause concern for the Fed.

But there’s something else we should be mindful of…

And that’s what we see with energy.

Take a look at the price of WTI Crude of late – it’s now back above $85/b

Sept 2 2023

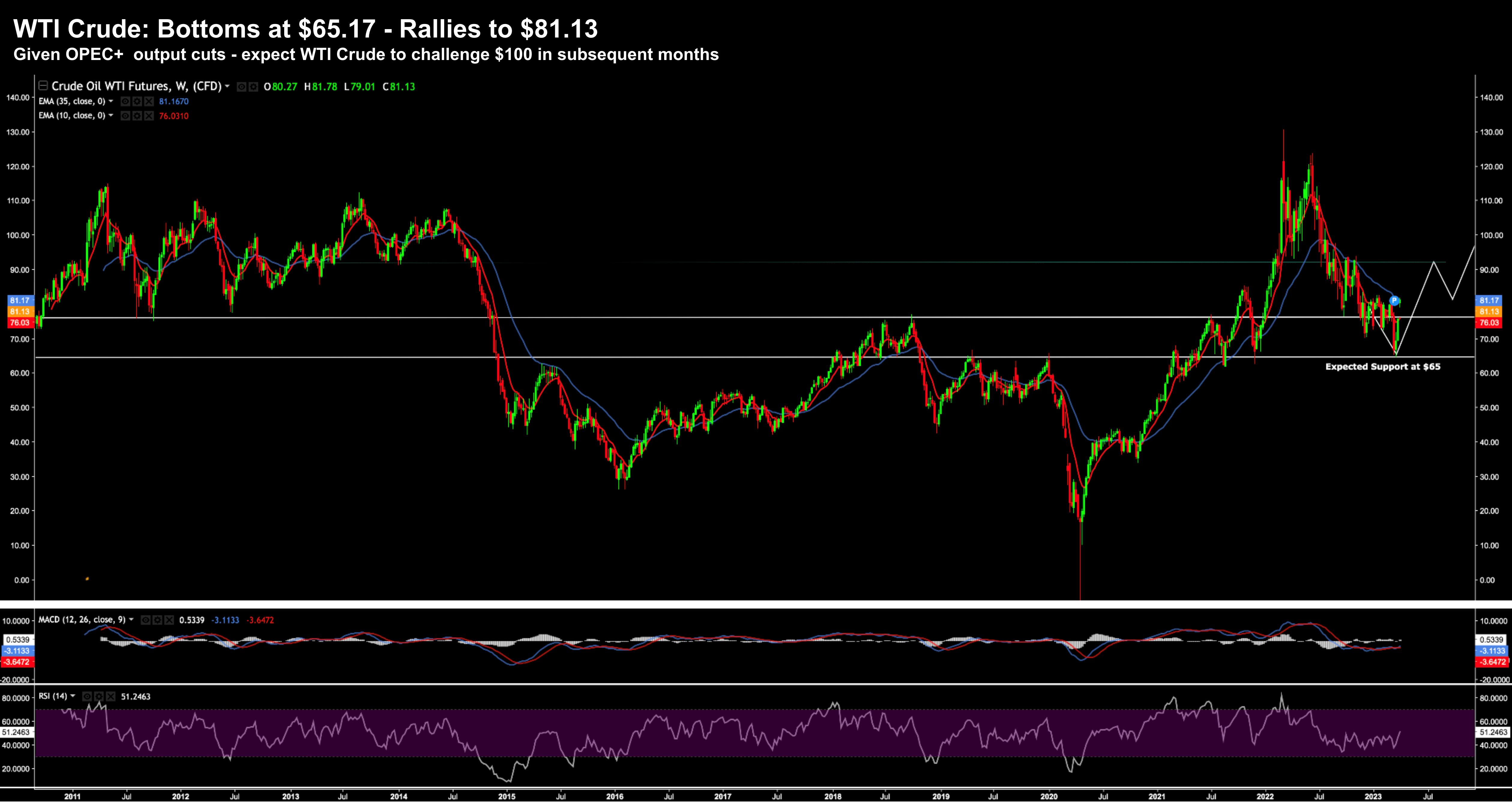

Now before I explain why this will feed into higher inflation – take a look at this post from April earlier this year.

I argued that there was a good chance that WTI crude would find support around $65 and rally back towards $100 a barrel.

Here’s the chart I offered:

April 4 2023

My logic was simply enough – we were more likely to experience a supply shock (given the policies of the current administration on fossil fuels)

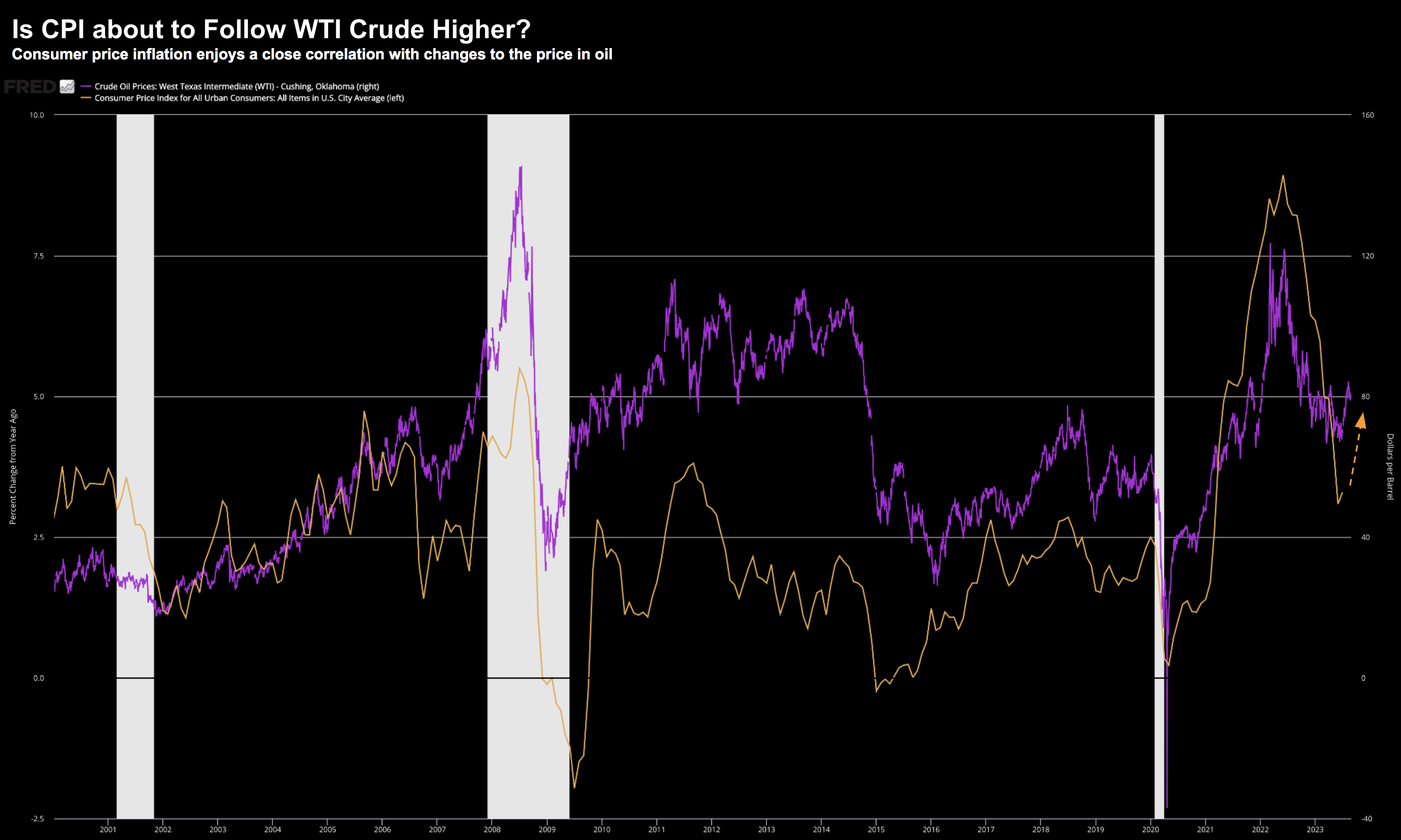

But here’s the chart that matters for Powell (and rates)

Sept 2 2023

The purple line shows the price action for WTI Crude (right axis)

The orange line shows the year-on-year change for consumer price inflation (left axis)

Since the last CPI print – the price of crude has moved from well below US$70/b to over $85/b.

This is yet to show in the rear-view CPI numbers.

So what happens if we also see another bounce in CPI?

As anside, the gas price in California (San Francisco) is back above US$6.00 for 1 gallon (where there are ~3.8 litres p/gallon).

With the Aussie dollar trading ~64.5c against the USD – that’s the equivalent of ~AU$2.45 p/litre (similar to the pump prices in Sydney)

Now whilst Core PCE excludes food and energy – the price of energy permeates through to everything that’s in the Core PCE calculation.

Essentially Core PCE is what you pay for goods and services.

And as we know, almost everything we consume requires energy to manufacture (specifically crude).

In summary, if we continue to see WTI Crude trade well above US$70/b (which appears likely due to supply constraints) – this does not bode well for inflation.

S&P 500 Recovers the 10-week EMA

Whilst the month ended lower – stocks made up some lost ground on the perceived ‘softer’ labor print.

Echoing Ritholz etc – the perception is 3.8% unemployment equals “no more Fed”

Maybe. But I’m less convinced.

However, this perception was enough to also drive yields lower – in turn giving a boost to stocks.

Again, this all comes back to bond yields.

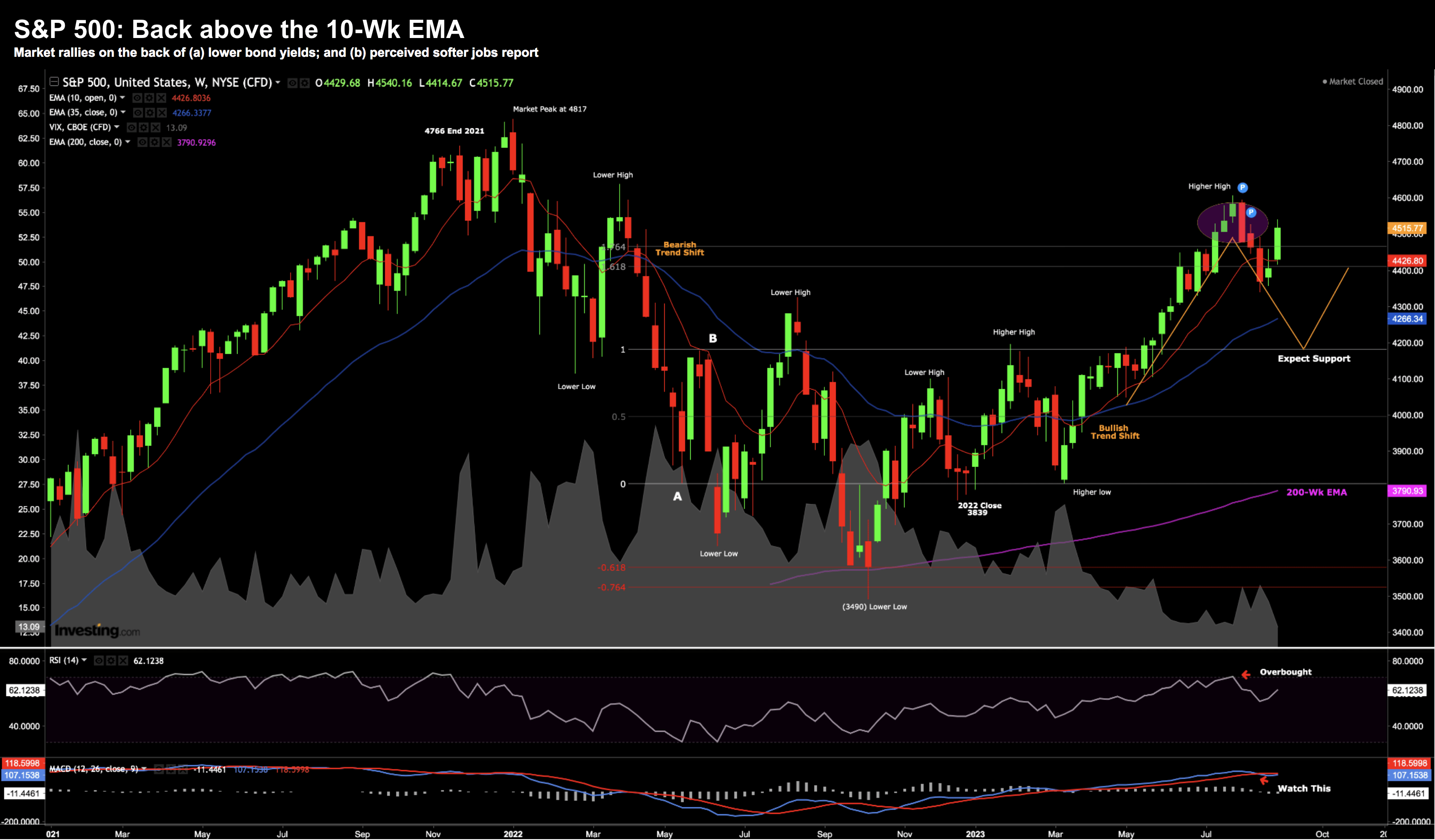

Let’s take a look using the weekly chart:

Sep 2 2023

Technically it was a good win for the bulls this week by reclaiming the 10-week EMA (red-line)

The close below this moving average last week looked ominous.

Looking at the chart, I think there’s every possibility that the market now continues to grind higher.

For example, we could challenge the 4600 made late July.

And this is why you should maintain some exposure to the market.

I personally think it’s a mistake to be either:

- overly long the market; and equally

- hold onto too much cash (e.g., more than 50%).

For me, my exposure is 65% long with no short positions (or long puts).

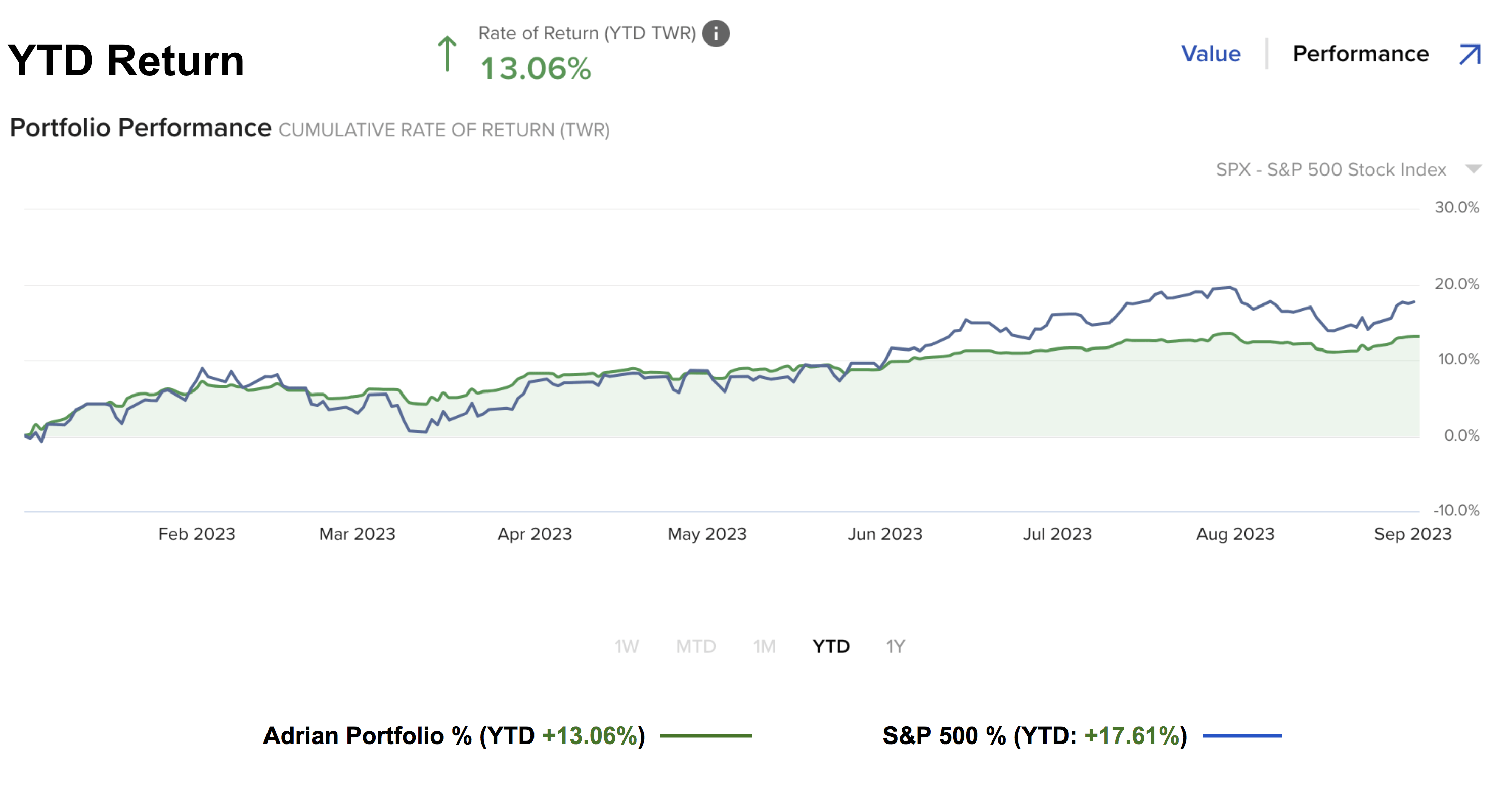

My year-to-date performance is ~13.1%

I’ve underperformed the S&P 500 YTD due to sitting in ~35% cash.

That said, this was also the reason I outperformed last year by ~19%

For example, when the market dropped sharply the past few weeks – my downside was limited by comparison.

And as I’ve shared recently – I think the risks to the downside still meaningfully outweigh any potential upside gains.

Therefore, at this stage I’m not putting any new cash to work.

And if I did – it would be more in value (lower PE names) – which have trailed the market.

Putting it All Together

For me the economic data was certainly mixed.

My assumption is the lower JOLTS number (to “only” 8.8M openings) was a catalyst for lower bond yields.

Lower bond yields typically translate into stocks (especially tech) catching a bid.

Add to that a softer than expected nonfarm payrolls report and away we went.

But I ask the question of whether this is really a soft labor market that will bring down inflation?

3.8% unemployment is full employment. And 8.8M job openings exceed that of pre-pandemic levels.

However for me the big number is Core PCE at 4.2%

That’s still a long way above the Fed’s target of 2.0%.

And with oil prices rising of late – I think this will only add to any inflationary pressure.

Therefore, I can’t follow the likes of Ritholz (and most others) making a call of “3.8% unemployment equals Fed on hold” – it’s premature.

Irrespective – if the Fed were to hold rates here – I expect them to stay high for many months ahead (e.g., well into 2024).

And with inflation slowly falling – that means real rates are going up.

That will hinder both growth and earnings.

Regards

Adrian Tout

The above article is for information only. The views of the author or any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy, sell or hold any specific investment or to adopt a particular investment strategy. However, the knowledge that professional analysts provide can be a valuable additional filter for anyone looking to make their own investment decisions.

Ethical Offshore Investments provides guidance on portfolios that have an ESG (Environmental & Social Governance) bias and an SRI (Socially Responsible Investing) focus. By avoiding high charging, commission paying funds, this results in lower portfolio costs, so more of the growth staying in the pockets of our clients.

Ethical Offshore Investments can also assist clients in getting exposure to the investment markets such as the broad S&P 500 index through very low cost Exchange Traded Funds (ETF’s) as well as investing directly into the individual stocks.

If you would like to get more information on the Sustainable Ethical Allocation portfolios, or enquire on the vast array of Sustainable and Ethical style funds available, please click on More Information.