Don’t Try and Pick ‘Tops or Bottoms’

Please find below the latest update from Adrian Tout from his regular newsletter, “Trade the Tape”.

Please note that this is for general information only and should not be considered personal financial advice.

The purpose of publishing these newsletters on the Ethical Offshore website is to provide investors some simple, easy to understand technical details on why the US markets are behaving the way they are at the moment, what has occurred to get them where they are, and what actions may influence where they end up in the near future.

The way Adrian Tout explains all this, in simple terms, I believe is good reading for any investor to get a better understanding of what is happening within the financial markets, what risks to be aware of and how to take advantage of these market conditions for your medium to longer term investment journey.

Lesson: Don’t Try and Pick ‘Tops or Bottoms’

-

Two lessons on what not to do from TV’s most famous stock picker

-

Did Buffett just ring the bell on Apple at 32x forward earnings..?

-

A Framework to help assess whether buying (or selling) is a

Yesterday’s post talked about how I don’t try and pick a top or bottom in a stock. I don’t believe it’s something you can do consistently well.

Now and again it happens – however I attribute that to luck more than skill.

When I sold the bulk of my large-cap tech holdings a few months ago – it was not the top in these names. Most of them continued to add further gains.

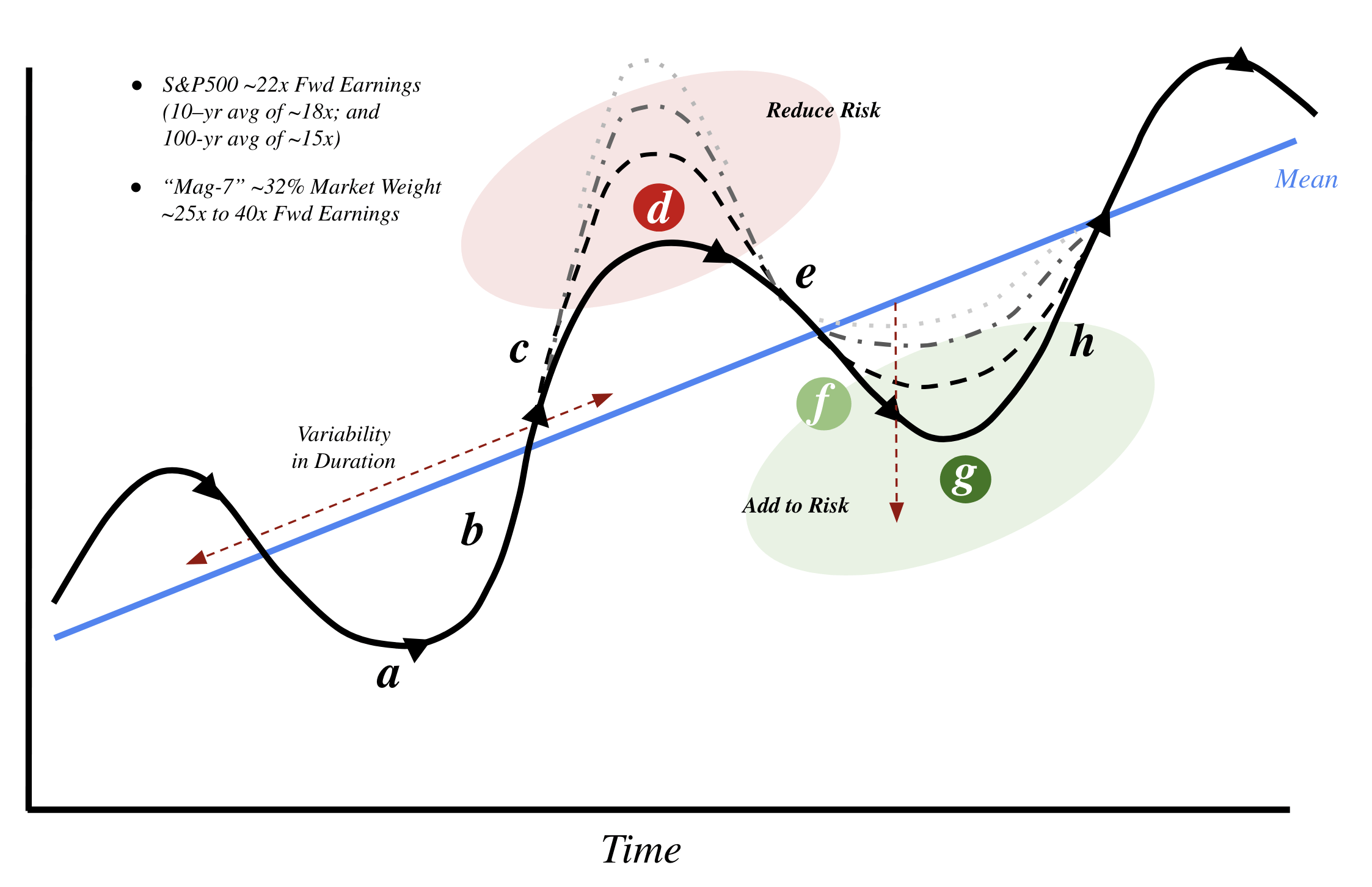

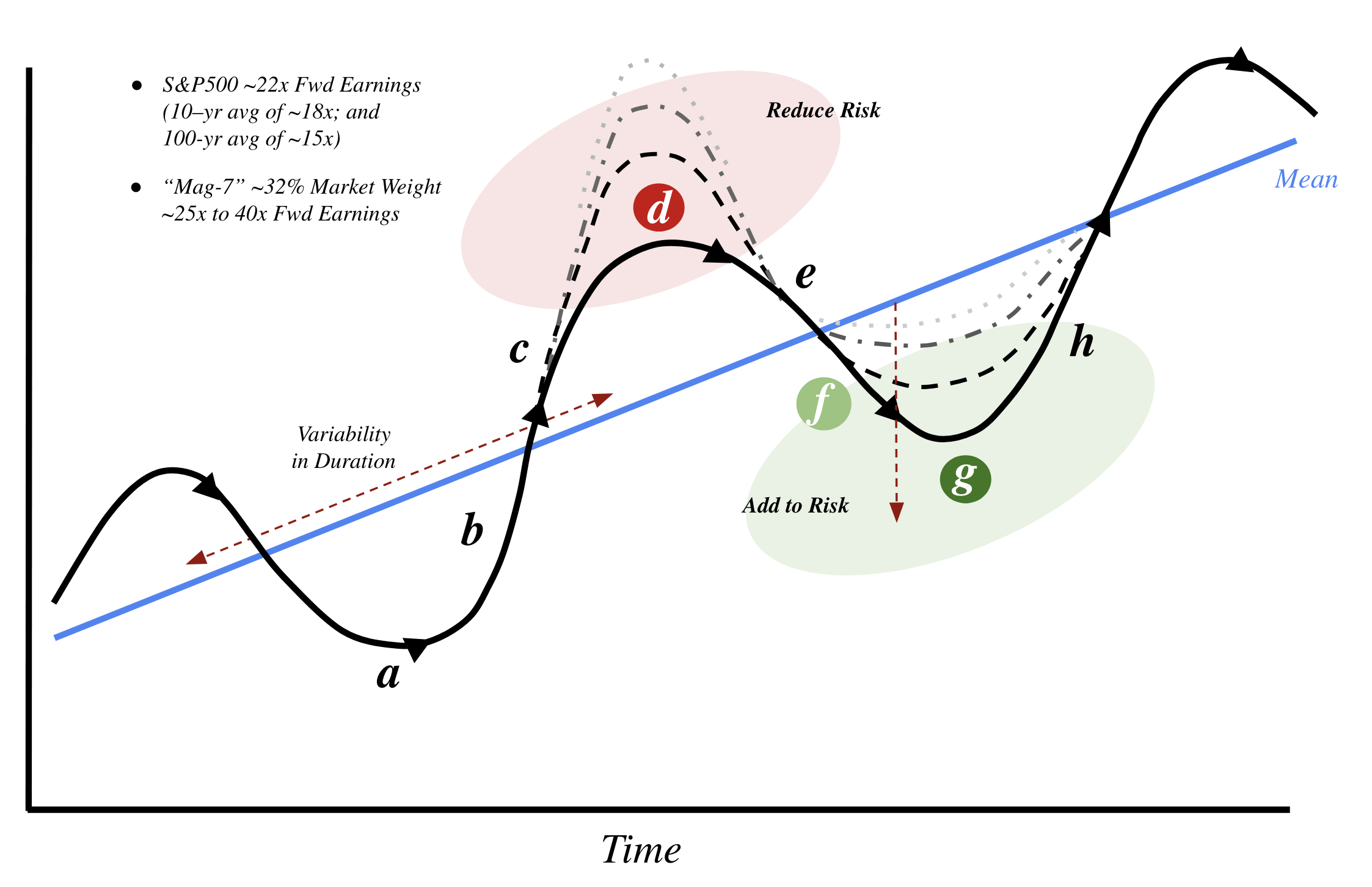

However, when I sold, I felt were trading at the “greed” point in the cycle below (“d”)

On the other side of the coin – when there is outright fear (“g”) – I don’t pretend to know where the bottom might be. Therefore, my approach is to wade into a stock in halves.

For example, my first half position is typically around “f” – when I sense valuations are below the mean (blue line).

Quite often the stock won’t plummet to oversold levels … where it finds a base and continues to rally.

For example, stocks spend most of their time just either side of the mean between “not too bad” and “not terrible” (i.e., points b, c, e and f)

However, when there is genuine fear in the market – I will often look to establish a full position.

For clarity, in my case, a full position will vary anywhere from 2% of my total investable capital (for a more speculative position); and as much as 20% (not more than) for a very high quality stock.

For example, earlier this year Google constituted ~16% of my total holdings (it’s less now)

But on average – my full positions are typically in the realm of 4-5% of my total investable capital.

This is what works for me and how I manage risk – it may not work for you.

Today I want to share two examples from a ‘market expert’ on the dangers of:

• Calling a bottom in a stock; and

• Capitulating when fear is greatest (when you should be buying)

And in my conclusion – I’ll share a timely example of what one of the greatest investors of all time did with his Apple position last quarter.

Spoiler alert: “be fearful when others are greedy; and be greedy when they are fearful”

To our first lesson…

Lesson #1: Calling a Bottom (or Top)

Bottoms are always very easy to see in hindsight. A stock eventually finds the lowest level someone is willing to sell – it proceeds to catch a bid – and from there it rallies.

We look back and say “well that was the bottom”.

Hindsight Capital Inc. always produces astounding returns!

As investors, we don’t have the luxury of knowing what the future holds. All we have are probabilities.

In most cases, the price will go lower than what you paid for it; and/or continue to rally after you sold it.

That’s the case for me at least.

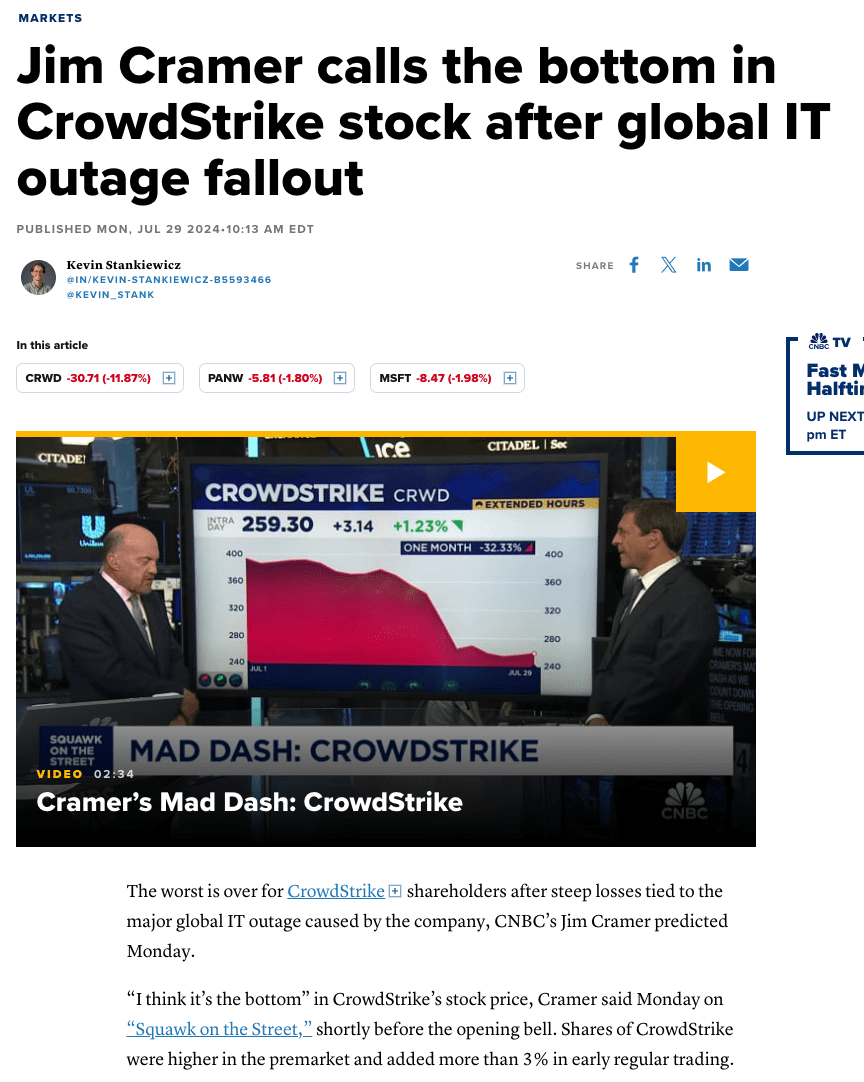

And this is precisely what happened to financial media personality Jim Cramer this week.

But a quick preface before I continue…

Cramer is an entertainer first and foremost. He hosts a program on CNBC’s known as “Mad Money”. His job is two-fold:

• Deliver entertaining (financial) content to lure eyeballs; and

• Enable his employer – UniversalNBC – to sell more advertising.

Part of Jim’s entertainment are regular stock tips.

But a word of caution… he’s an entertainer first and a stock picker second (as I will demonstrate)

Therefore, if you are acting on a Cramer tip – be sure to do a lot of independent work.

Earlier this week (Monday – July 29) Cramer “called the bottom” for popular cybersecurity company CrowdStrike (CRWD)

After a 35% plunge in the stock’s price following the largest IT outage in history – Cramer felt this was enough.

Whilst not the focus of this post (but to demonstrate the severity) – Delta estimate they lost in the realm of $350M to $500M – forcing them to deal with 176,000 refunds after cancelling some 7,000 flights as a result of CrowdStrike’s negligence.

If Delta are successful with their lawsuit (and I don’t see why they won’t be) – one wonders at what precedent this could set?

More on questions like this shortly…

Let’s review Cramer’s bottom call using a three-fold framework:

1. Technical areas of possible support (and the trend);

2. Fundamental valuations; i.e., is there deep intrinsic value after a ~35% sell off? and

3. Has this event caused a material change to the company’s prospects (revenue, earnings, market share, cash position)?

For those who read yesterday’s missive – this is the same framework I applied with Amazon and Nvidia (post their large sell-offs).

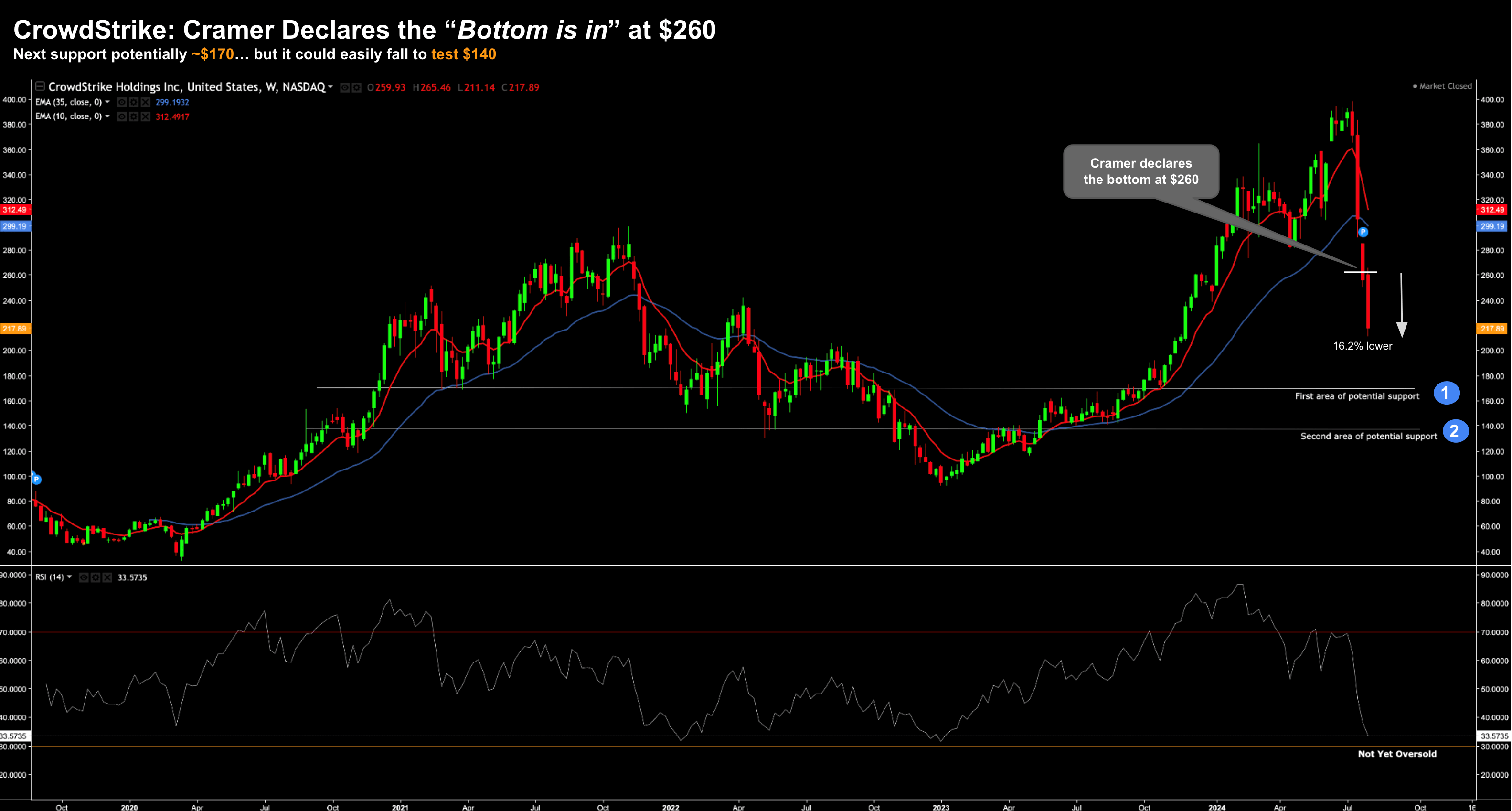

Let’s begin with weekly chart:

Aug 2 2024

CRWD closed this week at $217.89 per share – about 16.2% lower than Cramer’s “bottom” at $260.

It’s only been one week – but Cramer’s call has already caused pain for some investors.

And it may not be the end…

But let’s start by assessing potential areas where the stock could find some support.

Labelled are two areas:

1. The zone of ~$170 – where it saw resistance and support through 2023 (not that long ago); and

2. A lot lower around ~$140 – which was major support through 2022 and 2023

This is where I think the stock could go without too much resistance.

The other observation is the stock is not yet oversold.

For example, if I look at the weekly RSI, it trades at 33.6.

Quite often we will see this indicator trade in the mid-20s – where we could make the argument things might be overdone.

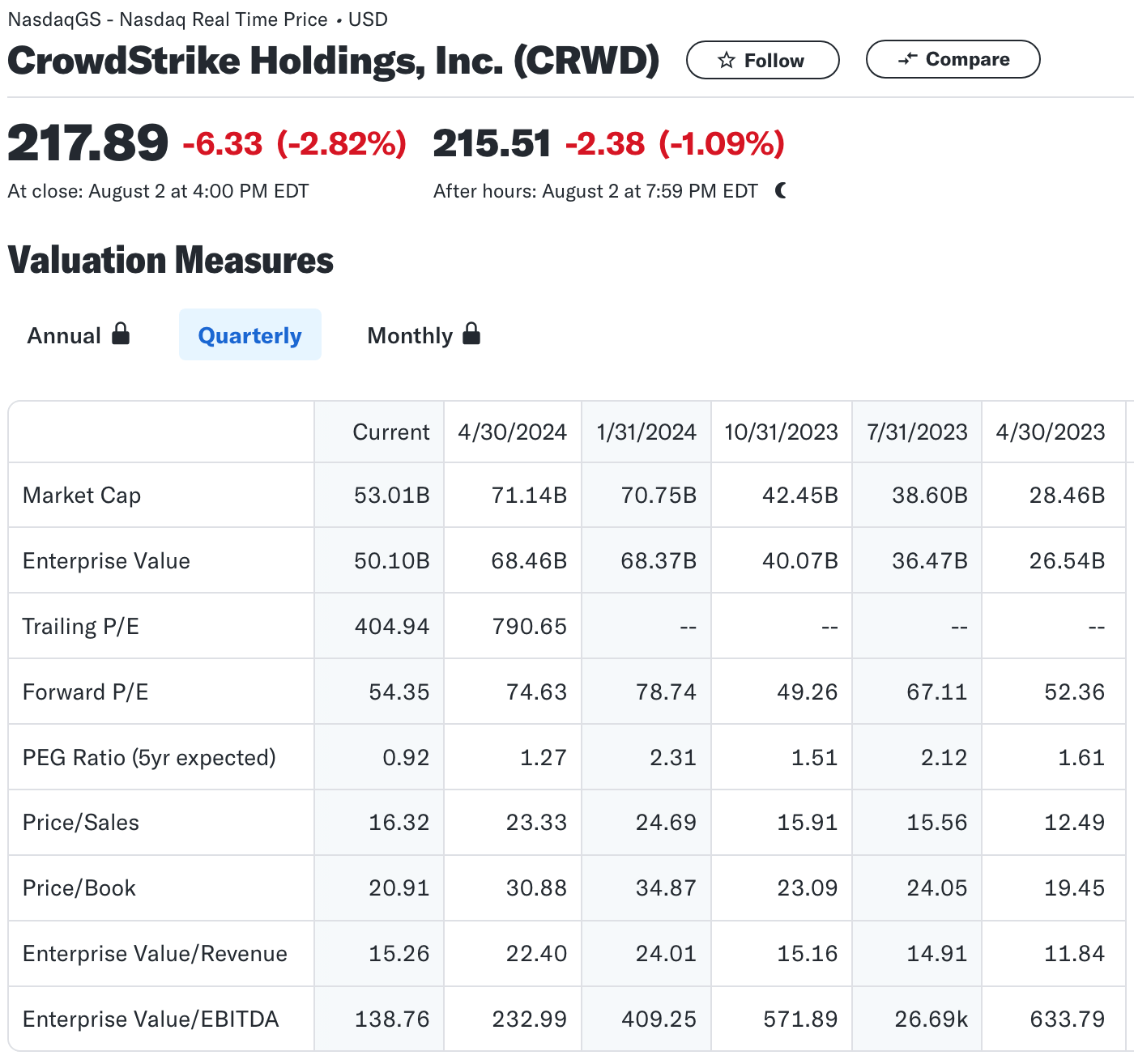

Next question is whether there is intrinsic value after the 35% decline?

At ~$217 – the answer is no.

Consider these valuation metrics from Yahoo!Finance –

Investors are being asked to pay a forward PE of 54x

However, I would argue that 54x multiple could be meaningfully higher pending their liabilities as a result of this outage.

The counter argument to a 54x multiple is the company will “grow into it”

And they might.

In addition to a high PE – you are also paying more than 16x sales – which is no discount.

I don’t see compelling intrinsic value at these prices.

And these metrics are considerably worse at Cramer’s ‘bottom’ price of $260. Essentially you’re making a (risky) bet that the stock’s hyper-growth will continue for several years.

Again they might…. it’s one of the hottest growth areas in computing.

Finally, to the third component of our framework; i.e., does this catastrophic event challenge these assumptions?

For example – can we easily answer the following (and this list of questions is not exhaustive):

• Can we put a limit on the amount of damages to result from ‘thousands’ of lawsuits?

• What reputational (and trust) damage will this do to their brand?

• How will that impact sales and market share?

• What will this do to customer churn – how many clients will they lose?

• What’s the near-term opportunity cost as a result? and

• What business model changes will they need to make (e.g., a shift to agentless computing)?

For a company with only ~$3.7B cash on-hand – generating ~$171M of net income – these are consequential questions.

However, they are very hard to dimension accurately. It’s simply too early.

Sure, at some point the stock may be worth looking at… but that could be a lot lower from here.

The lesson:

Be very careful thinking the bottom is in for a stock (or index).

If a stock has suffered a material move lower you should do three things:

• Assess any areas of potential technical support;

• Check what intrinsic value there is on offer (e.g. forward PE ratios; price-to-sales; free cash flow); and finally

• Is there a material change to the earnings story?

From mine, CrowdStrike is 0 for 3.

Lesson #2: Selling During Peak Fear

Our second lesson also comes courtesy of Cramer… And it overlaps with the importance of cycles – specifically the role fear and greed when making investment decisions.

For this lesson – we need to scroll back to 2022.

To set the scene – there was peak fear in technology stocks. The sector was down ~35% from the highs of late 2021 – where valuations were extremely high.

Repeating our diagram – we were at “g” in the cycle (vs “d” today)

This stage in the cycle is characterized by feelings of despair and attitude that nothing will ever get better. Talking heads (like Jim etc) will tell you to “sell your stock now – I’ve lost faith”

But inevitably – things slowly start to recover – people feel less bad – and we trend back towards the midpoint.

The mean (blue line) acts like a gravitational pull. We move from “g” to “h” etc.

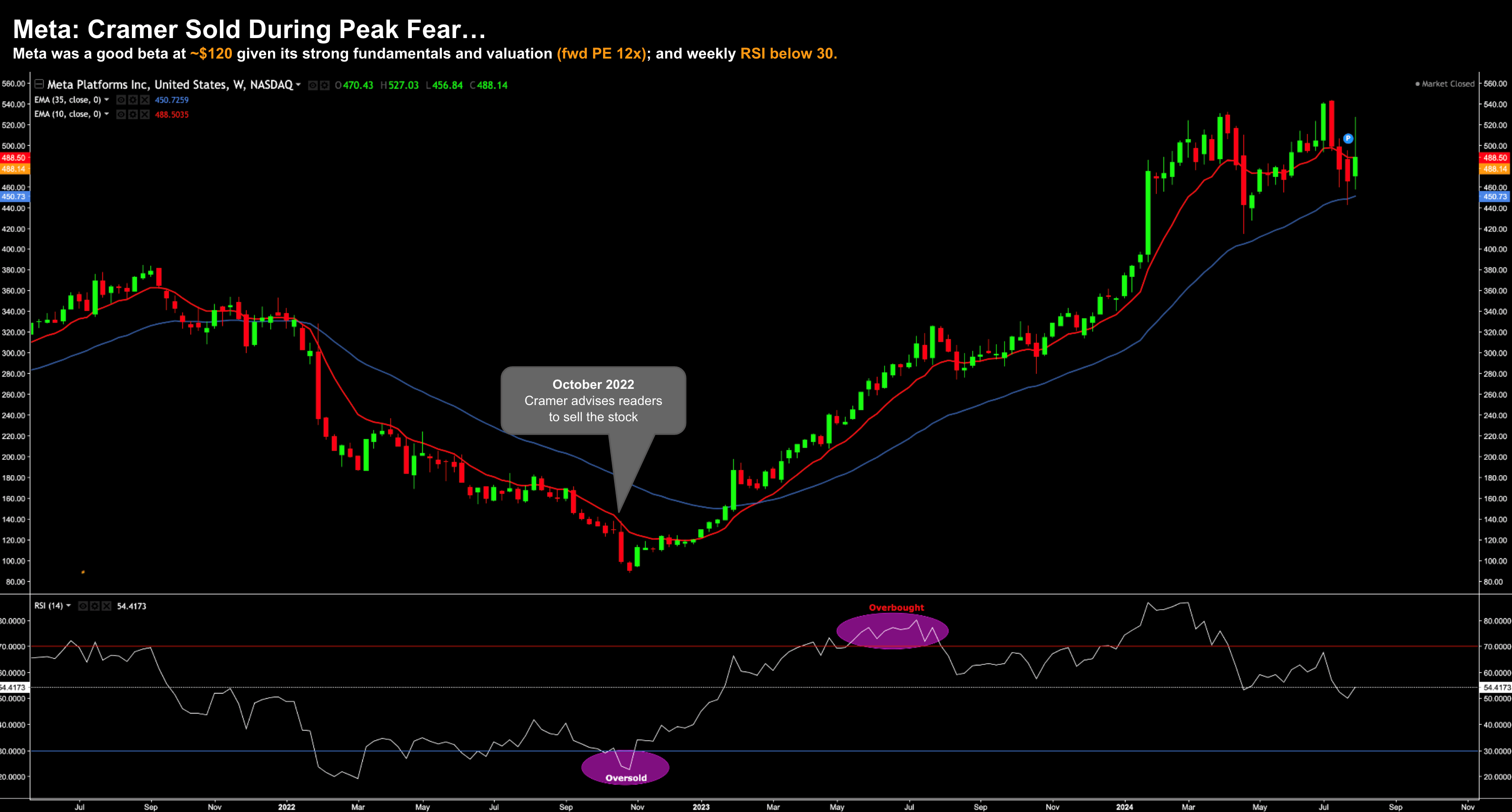

At the time (October 2022) – Cramer told followers to sell the stock Meta.

He issued a heartfelt apology:

“I made a mistake here. I was wrong. I trusted this management team. That was ill-advised.”

After riding it all the way down through the year…. Cramer pulled the pin almost at its bottom.

Aug 2 2023

The irony of course in this case – he almost did pick the bottom – he just chose the wrong course of action.

Now during Q4 2021 and early 2022 – I was removing risk. Valuations were not unlike what saw around July 10th of this year – with weekly RSI’s overbought.

The decision to de-risk saw me avoid most of the downside (enabling 20% outperformance during 2022)

However, when Meta had plunged from $385 to $120, it was worth looking at. We had moved from “peak greed” to “peak fear”.

As shown on our chart above in the lower window – our weekly RSI showed an oversold condition.

And whilst that is not an indication the stock has bottomed (stocks will often show an oversold RSI and continue lower) – it told me sentiment was very negative.

But did the stock offer intrinsic value?

Fundamentally Meta traded at forward PE of ~12-13x

During 2022 Meta earned $8.59 per share (a current year PE of 14x)

Therefore, if it could grow earnings by 10% (via reduced capex) – that could see earnings at $9.44 for a forward PE of 12.7x

In turns out – they grew earnings to $14.87 in 2023 (exceeding all expectations)

Zuckerberg slashed his ~$10B per year on the “Metaverse cash furnace” by half (he could have done more!) – however also saw an improved advertising market. (As an aside, Q1 2023, we also saw quarterly Real PCE and Real Wages rise – which tells us profits were set to improve)

With respect to Meta – five metrics deserved attention:

• $16B+ in cash (giving Meta optionality)

• Very strong free cash flow of $19B per year (with room to improve via reduced capex);

• Clear market leadership with social media advertising (challenged only by TikTok);

• 3B MAUs across surfaces such as Instagram, WhatsApp and Facebook; and

• A forward PE ratio of 12-13x – with every opportunity to grow.

Put another way – this is a very different set up to a stock like CrowdStrike. From mine, establishing an initial position at ~$120 offered solid positive convexity risk.

In other words, there was a greater chance of (long-term) upside vs downside risk.

I took a half-sized position around that level.

And whilst the stock dropped to ~$90 per share briefly – the fundamentals remained intact.

That bet paid off in 2023 – as Zuckerberg showed enough hubris to get the company “lean and mean”

It was Meta’s year of “operational efficiency” – which saw their cash hoard surge to $43B the next year.

The lesson:

When sentiment is at its worst – and the fundamentals are largely intact – that’s the time to sharpen your pencil.

It’s unlikely you will pick the bottom. And if you do – it’s luck.

Being early could see you wear a further “20% or more” of downside in the near-term.

And you will likely feel “wrong” for a bit… that’s something you need to be comfortable with.

However, if the intrinsic value is there, it’s time to think about creating a full position and settle in for up to the next 3+ years.

Cramer may have been swept up in the emotion of it all – I don’t know.

Whatever the case, he was selling when the astute investor was keeping their head.

Somewhat related – I talked about this here: “The Three Stages of Bull Market”

Buying Meta around $120 was the first stage – where a few perceptive investors departed from the crowd.

Putting it All Together

As I was wrapping up this post – a timely alert from CNBC hit my inbox.

“Warren Buffett’s Berkshire Hathaway sold nearly half its stake in Apple”

“The Omaha-based conglomerate disclosed in its earnings filing that its holding in the iPhone maker was valued at $84.2 billion at the end of the second quarter, suggesting that the Oracle of Omaha offloaded a little more than 49% of the tech stake. Even after the selling Apple remains the largest stock stake by far for Berkshire”

Buffett initiated his Apple stake in 2016 – with the stock trading at less than 12x forward earnings.

At the time of his sale – Apple was trading closer to 32x earnings.

And whilst he still has a half position in one of the world’s best companies – his decision to hedge is wise.

That’s money he is not giving back.

And pending who wins the election – he may be paying a lot lower tax rate on the capital gains (on the basis Democrats will most likely raise taxes)

Buffett is known for saying “be fearful when others are greedy; and be greedy when others are fearful”

This is how he successfully traded Apple.

As for me, it appears I made the tough decision to sell my (prized) Apple shares around the same time as Buffett.

I wasn’t doing it for tax reasons (they will be long term gains) – I just thought the stock was too expensive.

Time will tell if I made the right decision.

In closing, when stocks have moved materially in either direction, it’s time to pause and re-assess the following:

• Have investor emotions driven peak greed or fear in the cycle?

• What do the intrinsics tell us? Are you selling when it’s expensive; or buying when it’s at a discount? and

• Has the fundamental earnings story of the company changed (as we could see with CrowdStrike)?

If the story remains intact – and it appears investors are over-reacting – then it’s time to consider taking the opposite side of the trade.

Regards

Adrian Tout

The above article is for information only. The views of the author or any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy, sell or hold any specific investment or to adopt a particular investment strategy. However, the knowledge that professional analysts provide can be a valuable additional filter for anyone looking to make their own investment decisions.

Ethical Offshore Investments provides guidance on portfolios that have an ESG (Environmental & Social Governance) bias and an SRI (Socially Responsible Investing) focus. By avoiding high charging, commission paying funds, this results in lower portfolio costs, so more of the growth staying in the pockets of our clients.

Ethical Offshore Investments can also assist clients in getting exposure to the investment markets such as the broad S&P 500 index through very low cost Exchange Traded Funds (ETF’s) as well as investing directly into the individual stocks.

If you would like to get more information on the Sustainable Ethical Allocation portfolios, or enquire on the vast array of Sustainable and Ethical style funds available, please click on More Information.